Asian stocks were down this morning and Europe was flat, but investors in U.S. equities were ignoring all that in renewed hopes that the U.S. Federal Reserve will cut interest rates in December, thus fueling asset markets with a new round of cheaper money. Nasdaq 100 futures were up 0.46% this morning, premarket. S&P 500 futures were up 0.25%, after the index closed up 0.98% on Friday.

Last week, Wall Street seemed to have decided that a December cut was off the table. On Wednesday, the CME Fedwatch futures index placed the probability of a cut at just 30%. JPMorgan published a note predicting a cut in January instead. Markets sold off dramatically. The S&P 500 lost 2% last week. Fears of a bubble in AI didn’t help, either.

Today speculators put the probability of Fed Chairman Jerome Powell delivering a rate cut at 75.5%.

What changed?

On Friday, New York Fed president (and FOMC vice chair) John Williams gave a speech in which he all but called for a cut next month:

“My assessment is that the downside risks to employment have increased as the labor market has cooled, while the upside risks to inflation have lessened somewhat,” he said. “Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral.”

The Fed has two main mandates: supporting employment and controlling inflation. Until Friday, it looked as if the two were almost perfectly balanced against each other, suggesting that the Fed would keep rates on hold in December.

Not anymore.

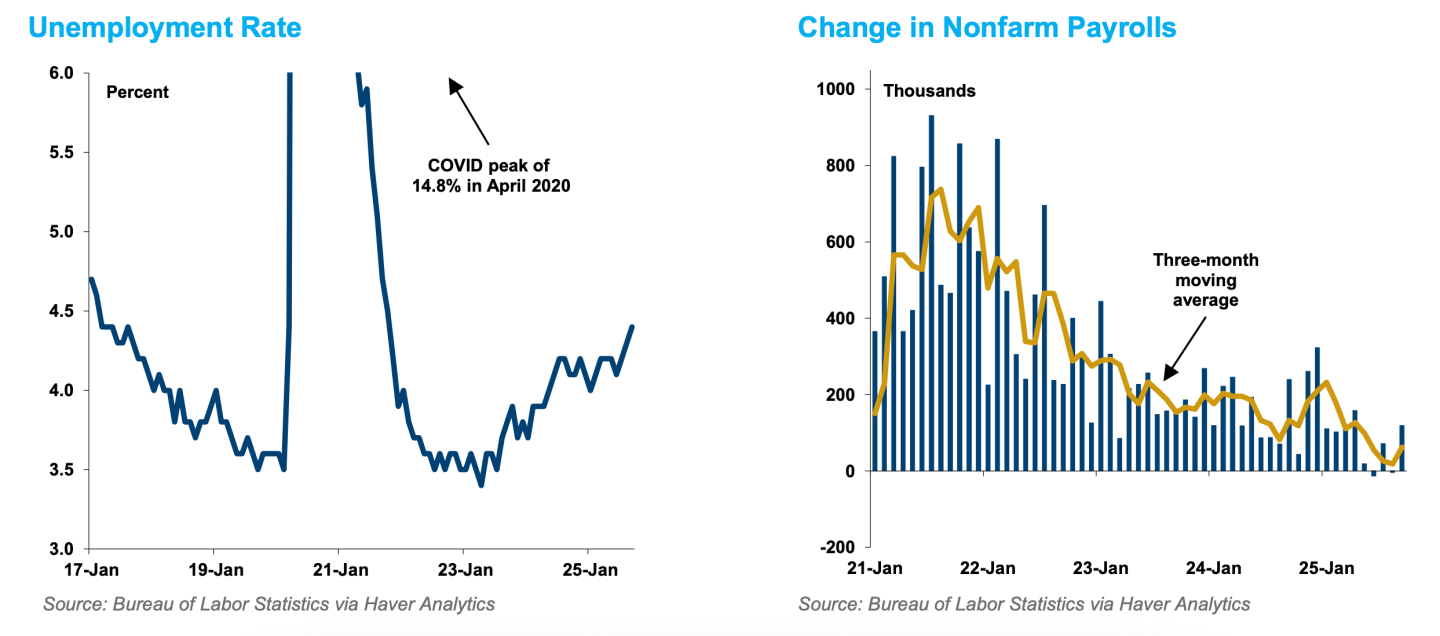

The U.S. government shutdown made employment data harder to come by, but most analysts think the labor market is getting weaker. These charts from Daiwa Capital Markets’ Lawrence Werther and Brendan Stuart say it all. Unemployment is trending up and job creation is trending down:

Goldman Sachs’ Jan Hatzius seized on the issue in a note this morning. “Though badly delayed, the September jobs report may have sealed a 25bp cut at the December 9-10 FOMC meeting,” he told clients. “[Williams’] view is likely consistent with that of Chair Powell—who almost certainly wrote down three cuts in the September dot plot—and a majority of the 12 voting FOMC members, though not necessarily a majority of all 19 FOMC participants.”

Pantheon Macroeconomics analysts Samuel Tombs and Oliver Allen were even more emphatic. They believe Williams has sealed the deal for a cut: “Mr. Williams’ words carry more weight than other FOMC members, as he has always voted with the majority and has never taken an opposing view to the Chair, either during his role as the NY Fed President since 2018 or when he was the President of the San Fran Fed between 2011 and 2018. We doubt Mr. Williams would have implied a December easing was likely without consulting members of the Board of Governors, including Chair Powell,” they told clients this morning.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.25% this morning. The last session closed up 0.98%.

- STOXX Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was up 0.13% in early trading.

- Japan’s markets are closed today.

- China’s CSI 300 was down 0.12%.

- The South Korea KOSPI was down 0.19%.

- India’s NIFTY 50 is down 0.42%.

- Bitcoin was down at $85.8K.