Albert Edwards, the long-standing strategist at Société Générale known for offering the “alternative view” within the institution, believes the recent political success of figures like Zohran Mamdani signal the corporate sector’s self-inflicted backlash against “greedflation.” Edwards, whose career in finance dates back to 1982 and who hasn’t been aligned with the “house view” of his investment bank for many years now, has gained a sort of cult following for his skeptical approach to market narratives, once famously writing a note about how appalled he was by “greedflation,” or record profit margins against the backdrop of post-pandemic inflation. He described it as the “end of capitalism” in 2023, and in conversation with Fortune, absolutely stood by his point.

At that time, Edwards said, inflation was generally being blamed on raw material prices because of the Ukraine war, as well as the labor market, with very few people saying there was profit-driven inflation, but he took a different view: “This is unprecedented,” he noted, pointing out, “when unit costs rise, always, unit margins fall, always, in history.” He said that shouldn’t have happened, and the reason it did was because of so much stimulus from the government that “companies could get away with doing it, using [inflation as] cover.”

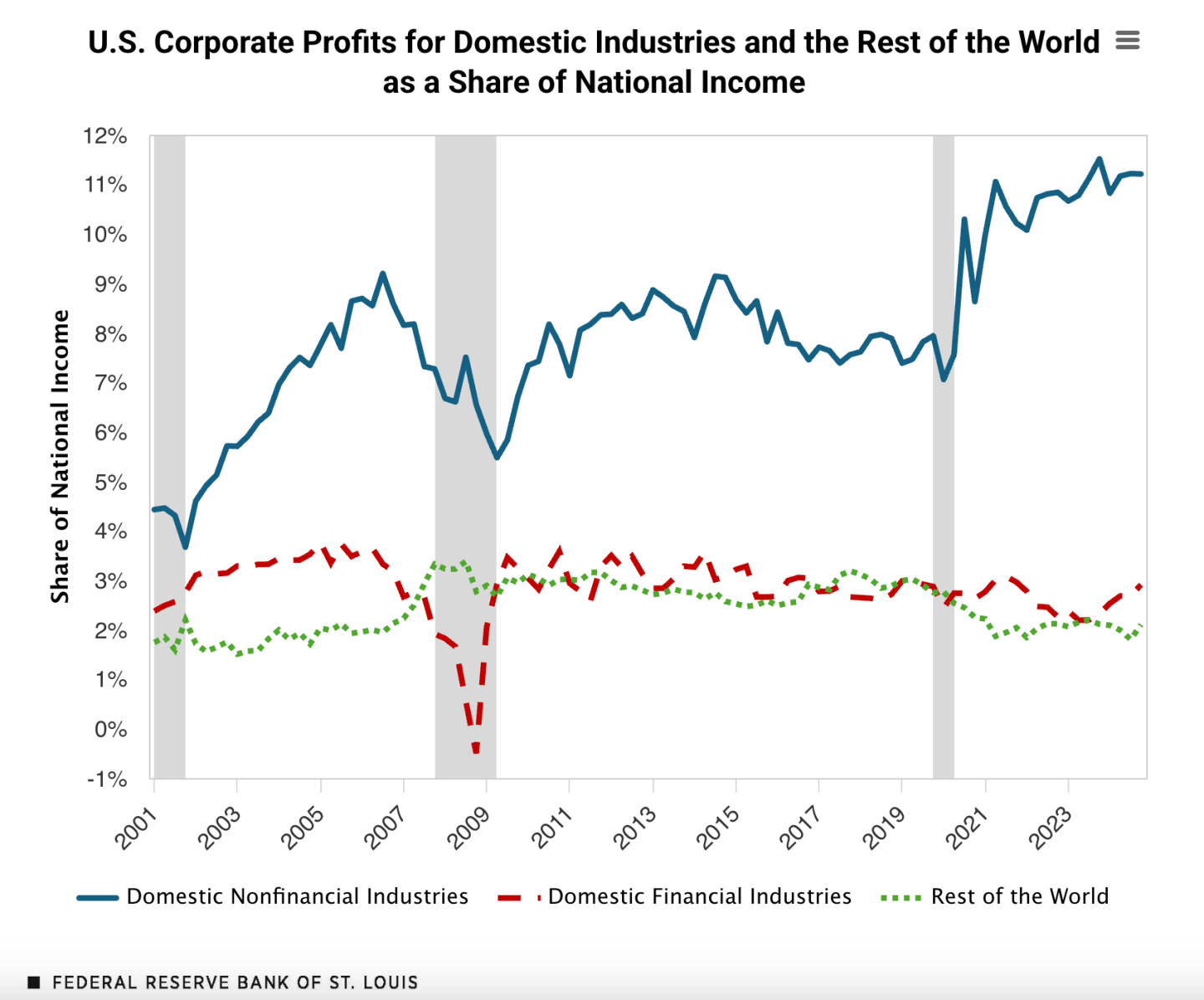

The consequence of this money printing and fiscal expenditure was a “bonanza for the corporate sector,” resulting in corporate profit margins soaring “off to infinity” after the pandemic. Edwards noted specific sectors benefited enormously, recalling a St. Louis Fed study that showed corporate profits as a share of national income surging since the inflation spike, a total outlier compared with the rest of the world.

This period of corporate excess laid the groundwork for severe political instability and public outrage, Edwards argued. Just look at the election in New York, he said, which was all about the cost of living. Zohran Mamdani’s election is “an indication that this still is a big issue.” Edwards agreed “affordability” is a major topic of the moment, along with the U.S. housing market: “It stands out as, like, ‘What’s going on?’”

This latest twist in the populist turn isn’t necessarily something to celebrate, Edwards said. As an economist, he said he considers Mamdani’s policies, deriving from his democratic socialist background, such as rent control and price controls, to be “lunacy,” having experienced them himself in the 1970s. Still, dysfunction in capitalism means that society will “come back full circle to this.” The increasing intergenerational strife, driven by young people being shut out of the housing market and out of wealth concentration, has created a primal sense of betrayal, especially among Americans who no longer feel they are better off than their parents.

Edwards was speaking as the first-time homebuyer hit an average age of 40 years old, a stark symbol of how the largely youthful voter base that elected Mamdani is shut out of the market. Sean Dobson, CEO of the Amherst Group, one of America’s largest institutional landlords, recently estimated the same post-COVID economic landscape that so outraged Edwards meant “we’ve probably made housing unaffordable for a whole generation of Americans.”

‘You reap what you sow’

Coming back to his critique of capitalism, Edwards argued Mamdani’s election is “part of the consequence … The corporates, by being excessively greedy, hence ‘greedflation,’ have laid the seeds for their own destruction—and backlash.” Edwards added that “more and more people are identifying corporate excess.”

Speaking about what he called “intergenerational strife,” Edwards said he thinks this is “the first generation where people are not seeing themselves as better off than their parents were.” Everywhere you look in modern capitalism, “young people can’t get on the housing ladder, they see wealth extremely concentrated … It takes the incentivization out of the economy if young people don’t feel they’re participating.”

Edwards’s argument here has some strange bedfellows, as none other than Peter Thiel has been warning about this incentivization problem for years. Mamdani’s election seemed to send a shiver through Silicon Valley’s right-wing contingent, as Chamath Palihapitiya shared Peter Thiel’s 2020 email to Mark Zuckerberg and Marc Andreessen, warning of a “broken generational compact” and reasoning, “if one has no stake in the capitalist system, then one may well turn against it.” In a follow-up interview days later, Thiel told The Free Press, “if you proletarianize the young people, you shouldn’t be surprised if they eventually become communist.”

On the left wing of legal thought, Columbia Law School professor Tim Wu recently told Fortune that he wrote his new book, The Age of Extraction, about a similar feeling. “My understanding of America is that it’s the place where things are supposed to get better,” Wu said, but instead we’re living through a time with “an economy-wide problem” where “everything kind of just creeps. It’s that weird feeling of something you like becoming worse.” He added that American politics right now are “very angry” and marked by “economic resentment” but also a general feeling that “we let things go a little too far” and we “just kind of lost touch with the tradition of broad-based wealth that was the American way.”

On the subject of greedflation, Edwards was philosophical but insisted that what happened in 2023 was a mistake. “Okay, I can understand this is capitalism, this is how it works,” he said about pursuit of the profit motive, “but if the government doesn’t step in” then a backlash is bound to happen. Edwards declined to say whether this was a particularly Democratic or Republican issue, but, he noted, “there’s a reluctance” in American culture to dictate to the corporate sector. At any rate, the consequence of it is “there’s a day of reckoning coming in,” he said.

Edwards, who is also convinced artificial intelligence is in a bubble, said he views his role in this often overly optimistic market as similar to “Caesar’s slave,” referring to the story from antiquity about the Roman emperor ordering someone to follow him around and always whisper in one ear: “You are mortal.” (This is also commonly referred to by the Latin phrase “memento mori.”) Edwards warns while the macro-level excesses might not be visible in aggregate, drilling down reveals “things are pretty crappy under the surface.” The political reaction embodied by Mamdani’s focus on affordability is a clear sign that the economic consequences of corporate greed are now driving mainstream political change.

Edwards concluded there’s a fitting phrase for the dysfunctions of capitalism in the 2020s: “You reap what you sow.”