- The price of gold hit a new record high—something that normally happens when investors are fearful and seeking a safe haven. But the stock markets also hit a new record high—normally a signal of optimism. The reason? Investors are both bullish and afraid, according to Deutsche Bank.

The price of gold hit another record high today, which Deutsche Bank noted is incongruous with the optimistic tone of markets more widely. Gold does, after all, usually act as a safe haven in periods of economic unease.

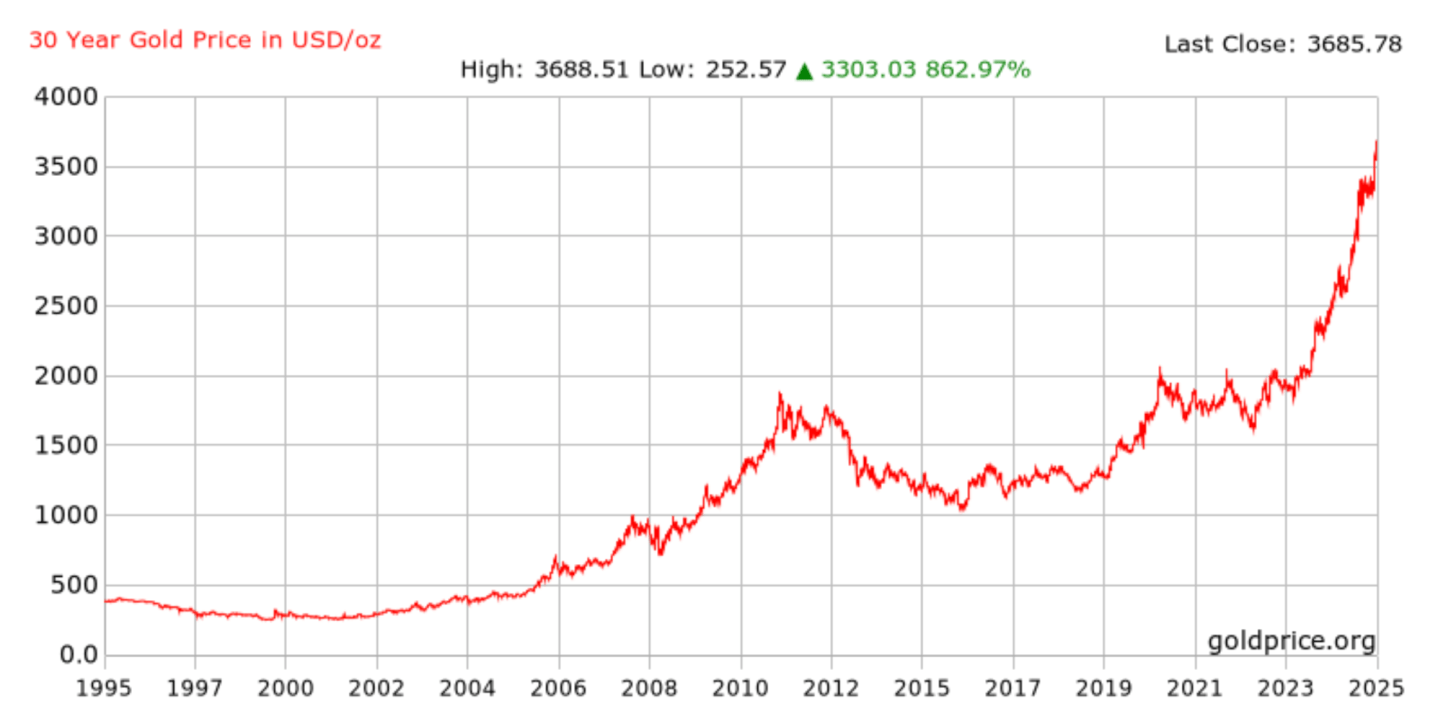

The COMEX gold futures contract hit $3,757.60 per ounce, while the S&P 500 closed up 0.49% on Friday, hitting a new all-time high at 6,664.36. S&P futures are down 0.22% this morning, premarket. The price of gold has been on the rise for the past month, after hitting a record high earlier in the year, due to a recent interest rate cut by the Federal Reserve and expectations of further policy easing.

Investors are both bullish on equities as well as being afraid that there are major downside risks, Deutsche’s Henry Allen said in a note to clients reviewed by Fortune.

“Whilst gold prices have many drivers, one is the perception that it operates as a haven that investors buy in times of fear. After all, it doesn’t pay a dividend or a coupon, and over the very long term, it’s struggled to compete with other asset returns. This September, gold prices exceeded their previous inflation-adjusted peak from January 1980. That was a time when the U.S. was heading into recession, driven by a huge monetary tightening by the Fed under Paul Volcker, aiming to get inflation down. So historically, high gold prices haven’t exactly been associated with rampant optimism,” Allen told clients.

So what are investors afraid of?

“U.S. inflation is priced to linger above target in the next few years, which is far from ‘perfect,’” Allen wrote. “That links up with lingering tariff fears, with reviews still due into sectors like pharmaceuticals and semiconductors. Prediction markets think a U.S. government shutdown at the end of the month is increasingly likely. And markets are clearly worried about the payrolls slowdown too, hence rapid rate cuts are priced in. So the reality is there are lots of downside risks priced in, offering plenty of scope for events to resolve on the upside from a market perspective.”

JPMorgan’s Fabio Bassi and his team are also long on gold, according to a separate note seen by Fortune.

There is also a lot of chat about AI stocks being in a bubble, akin to the 1999-2000 dot-com boom. Prior to that bubble bursting, the price of gold sank because investors were notoriously over-optimistic about tech stocks.

“A key difference with that period is gold prices were then around multi-decade lows in real terms. That would be more consistent with an environment of high exuberance, where people want to own assets with stronger returns, rather than gold, which doesn’t pay a dividend,” Allen said.

Here’s a snapshot of the markets globally this morning:

- S&P 500 futures were down 0.19% this morning. The index closed up 0.49% in its last session, hitting a new all-time high at 6,664.36.

- STOXX Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was flat in early trading.

- Japan’s Nikkei 225 was up 0.99%.

- China’s CSI 300 was up 0.46%.

- The South Korea KOSPI was up 0.68%.

- India’s Nifty 50 was down 0.21% before the end of the session.

- Bitcoin fell to $112.7K.