- Investors are underestimating the inflation risk of President Trump’s tariffs, which will push up import costs, according to Deutsche Bank. One indicator forecasts that U.S. inflation may soon exceed 4%. Consumers are also expecting higher prices. But the inflation swaps market has yet to reflect these risks, analyst Henry Allen says.

One of the central mysteries inside President Trump’s tariff plan: Where is the inflation?

Once all the new levies are in place—the latest is that all imports into the U.S. from India will be subject to a 50% tariff starting today—the effective average tariff rate will be somewhere near 15%. Estimates vary. Pantheon Macroeconomics puts it as high as 19%. Prior to Trump, it was 2.4%.

And yet inflation is currently running at only 2.7%. Although it is heading upward, its momentum isn’t great. Inflation is conspicuous by its absence.

Wall Street analysts have been puzzling over this for a while. Surely, if the government imposes a price increase on a wide range of goods, inflation must follow?

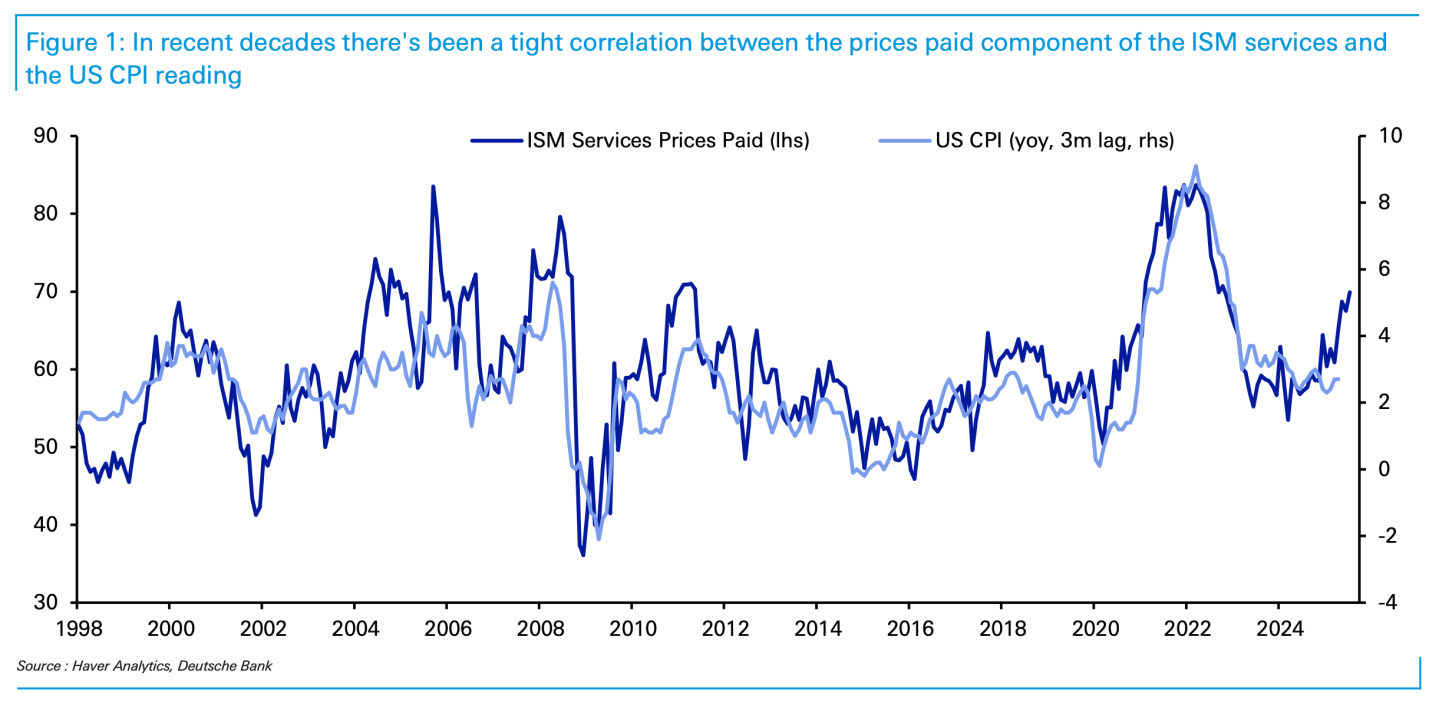

Deutsche Bank’s Henry Allen published a research note yesterday arguing that it is following, and that the market is underestimating its effect. He points to the prices-paid variable in the ISM services indicator. The survey is a relatively narrow one, and it measures what service-economy companies are paying for goods. But the weird thing about it is that the indicator moves in close correlation to the consumer price index, which lags ISM services by three months. The ISM survey thus often predicts where inflation will be three months from now. Right now it implies the number will be above 4%:

“That prices-paid component moved up to 69.9 in July, the highest since October 2022, back when CPI was still above 7% and the Fed were hiking by 75 bps per meeting to get it down again. Given the tight correlation between the two, we can see that a prices-paid component around 70 has often been consistent with CPI inflation going above 4%,” Allen said in a note.

Consumers also think higher inflation is coming. The Conference Board’s most recent inflation expectations consumer survey, which asks people to estimate where they think inflation will be 12 months from now, rose 0.5 percentage points to 6.2%.

In a note seen by Fortune, Daiwa Capital Markets’ Lawrence Werther and Brendan Stuart said: “Uncertainty surrounding the Trump administration’s variable tariff agenda was once again a key concern for survey respondents in August, with Stephanie Guichard, senior economist, global indicators at the Conference Board, noting in the official release: ‘Consumers’ write-in responses showed that references to tariffs increased somewhat and continued to be associated with concerns about higher prices.’”

Deutsche Bank’s Allen argues that investors seem to be ignoring this data. He points to the inflation swaps market, where investors bet on future inflation rates. “Inflation swaps aren’t pricing this at all,” he says, noting that the one-year swap hasn’t moved much since early April, when Trump launched his trade war.

“This is particularly striking when you consider that we know the tariff impact is still filtering through. First, because it takes time for tariffs to be passed into consumer prices. Second, even the data we do have only goes up to July, and several more tariffs were imposed after that in August, like 50% on copper and an increase to 35% on Canada. Third, the administration has said more tariffs are still to come, with reviews into semiconductors, pharmaceuticals, and critical minerals. So it’s surprising that inflation swaps aren’t pricing in more inflation risk,” he wrote.

Here’s a snapshot of the markets prior to the opening bell in New York:

- S&P 500 futures were flat this morning premarket, after the index closed up 0.41% yesterday.

- STOXX Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was up 0.11% in early trading.

- Japan’s Nikkei 225 was up 0.33%.

- China’s CSI 300 was down 1.49%.

- The South Korea KOSPI was up 0.25%.

- India’s Nifty 50 was down 1.02% before the end of the session.

- Bitcoin rose to $110.6K.