In just seven years, Social Security will reach a fiscal cliff that could leave millions of American retirees with drastically reduced benefits, according to a recent analysis by the Committee for a Responsible Federal Budget (CRFB). The think tank’s new report projects that, unless Congress acts, Social Security’s main trust fund will be insolvent by the end of 2032, triggering automatic and painful benefit cuts for everyone relying on the program.

How painful? Around $18,000 less per year for retirees who depend on the program. This is not the first time the CRFB has warned about this, and it’s a common refrain from no less than the Oracle of Omaha himself: famed investor Warren Buffett.

The ticking clock

Social Security and Medicare, the two bedrock programs supporting older Americans, are drawing closer to insolvency than many might realize. The most recent data, compiled from the programs’ own trustees and enhanced by CRFB calculations, forecasts that by late 2032, Social Security’s retirement program will no longer be able to pay out promised benefits in full. At that point, the law dictates that payments must be limited to the amount coming in from payroll taxes—resulting in an immediate, across-the-board benefit reduction.

The scope of the cut: $18,100 shortfall for typical couples

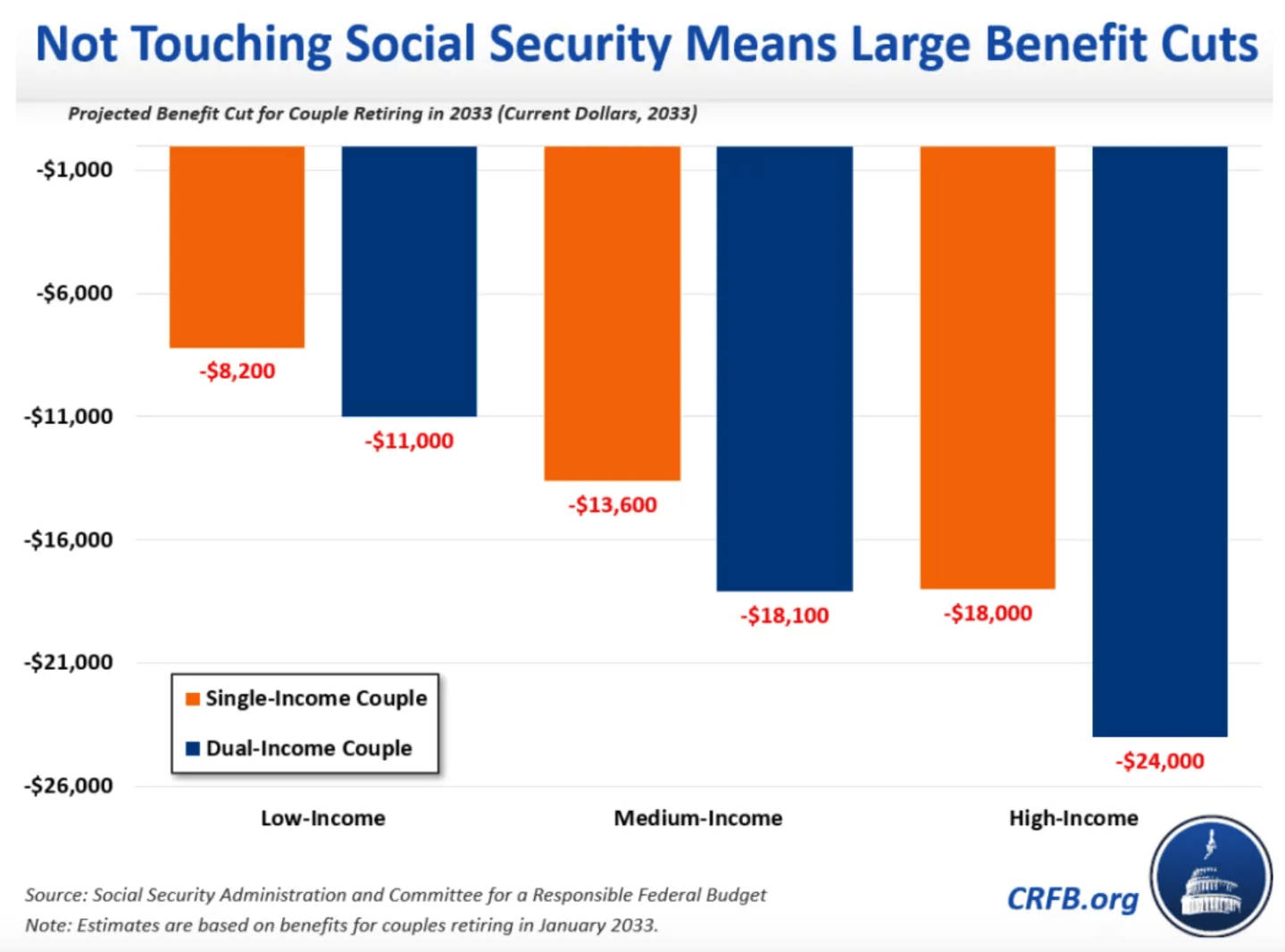

For millions of future retirees, the numbers are stark. CRFB’s estimate reveals that a typical dual-earning couple retiring at the start of 2033 would see their annual Social Security benefit drop by approximately $18,100. The percentage cut is projected to be 24% for that year, instantly slashing retirement incomes for over 62 million Americans who depend on the program.

The pain would be widespread but would vary by income and household type. For example, single-earner couples could see a $13,600 cut, while low-income, dual-earner couples face an $11,000 shortfall. And high-income couples might lose up to $24,000 a year.

While the dollar cut is smaller for lower-income households, the relative burden is even more severe, devouring a larger share of retirement income and past earnings. Also, these cuts are in nominal dollars; adjusted to 2025 dollars, the actual cut would be about 15% less.

What’s causing the crisis?

Social Security is funded by a dedicated payroll tax, but the gap between what goes out in benefits and what comes in through taxes is growing. The newly enacted One Big Beautiful Bill Act (OBBBA) has accelerated the timeline by reducing Social Security’s revenue through tax rate cuts and an expanded senior standard deduction. According to CRFB, these policies increase the necessary benefit reduction by about one percentage point; if the changes become permanent, the benefit cuts would be even deeper.

Over time, the gap is expected to worsen: By the end of the century, CRFB adds, Social Security could face required benefit cuts of over 30%, unless lawmakers shore up the program’s finances. Despite these dire projections, many policymakers have pledged not to alter Social Security, promising to keep benefits untouched. But if nothing changes, the law automatically enforces cuts when the trust fund runs dry.

The CRFB report urges policymakers to be candid about the situation and to work toward bipartisan solutions that secure Social Security’s future. Ideas could include new revenue sources, adjusting benefits, or a combination—anything to avoid the “steep and sudden” cut that looms for tens of millions. Without meaningful congressional action before 2032, the Social Security safety net will be abruptly—and dramatically—shrunk, so Americans approaching retirement will at least want to pay close attention to congressional action on the looming cliff.

Buffett’s bugbear

Warren Buffett has been vocal about the dangers of Social Security insolvency and the looming benefit cuts that millions of retirees could face if action is not taken soon. The retiring Berkshire Hathaway CEO has stated that reducing Social Security payments below their current guaranteed levels would be a grave mistake, and urged prompt congressional action.

Buffett, who has signed the Giving Pledge and has advocated for higher taxes on higher earners, has criticized the cap on income subject to Social Security taxes, arguing that higher earners—including himself—should contribute more. He’s also suggested that Social Security’s finances could partially be eased by raising the retirement age, with the 95-year-old investing legend himself working well beyond the standard end of most careers.

CRFB background

The CRFB is not just any think tank, either. It’s a respected nonpartisan institution that stretches back to 1981. Its board has consistently included former members and directors of key budgetary, fiscal, and policy institutions, such as the Congressional Budget Office, the House and Senate Budget Committees, the Office of Management and Budget, and the Federal Reserve. The CRFB regularly produces analyses of government spending, tax proposals, debt and deficit trends, and trust fund solvency (such as Social Security and Medicare), as well as recommendations and scorecards for major fiscal legislation.

The CRFB has consistently advanced a centrist position on budgetary matters, regularly advocating for reducing federal deficits and controlling the growth of national debt. The organization has often criticized large spending bills that are not offset by reductions elsewhere, as well as tax cuts that are not revenue-neutral.

The think tank favors reforms to federal “entitlement” programs, especially Social Security and Medicare, aiming to make them fiscally sustainable, an emphasis that has drawn criticism from the left. For example, Paul Krugman characterized it as a “deficit scold” when he was still with the New York Times.

In the Social Security sphere, the CRFB has supported or proposed ideas like raising the retirement age, adjusting cost-of-living increases (using the chained CPI), increasing the amount of wages subject to payroll tax, and progressive indexing (in which benefits grow more slowly for higher earners). The CRFB has also weighed proposals for new revenue streams and some means-testing of benefits. On the right wing, the CRFB’s proposed reforms to Social Security have drawn criticism for, as Charles Blahous of the Manhattan Institute put it, creating a structure more like “welfare” than an earned income benefit.

Still, the CRFB is widely respected in policy circles as a knowledgeable, data-driven budget watchdog, with a long track record of analysis and advocacy for sustainable fiscal policy.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.