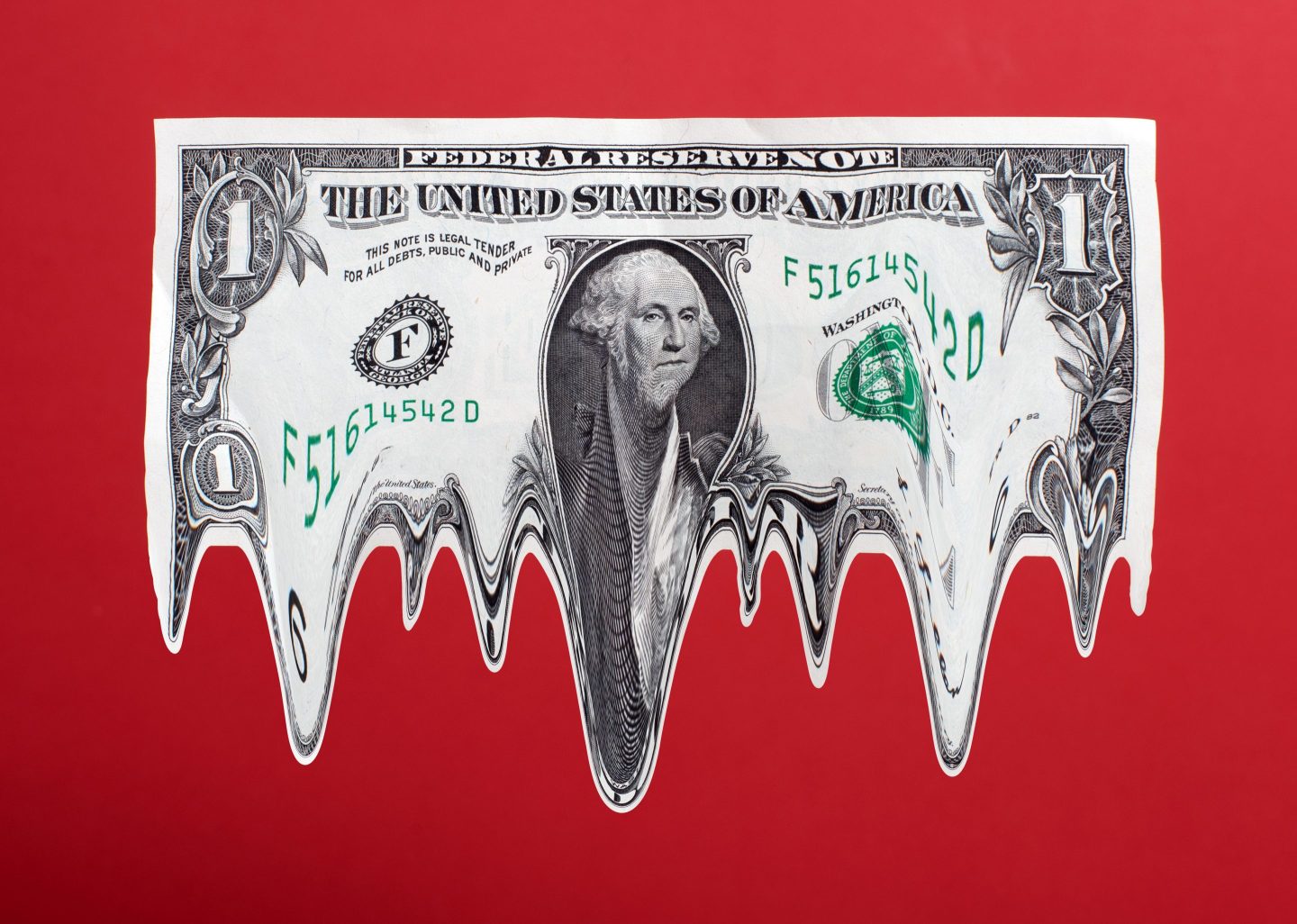

- The dollar’s plunge and gold’s surge this year are signs that financial markets are not pleased with the Trump administration’s policies, according to a former IMF official. Unless there is a major course correction, the U.S. should brace for a financial crisis leading up to congressional midterm elections next year, he warned.

The world is losing faith in the dollar, and the U.S. could suffer a financial crisis next year, according to Desmond Lachman, a former deputy director of the International Monetary Fund’s Policy Development and Review Department.

In a Project Syndicate column on Monday, he noted that the U.S. fiscal situation was already shaky before President Donald Trump began his second term.

But his tax cuts in the megabill that was just signed into law will add trillions to the deficit. Meanwhile, his tariffs and pressure on the Federal Reserve to lower rates have further weakened confidence in the dollar by stoking inflation concerns, Lachman, a senior fellow at the American Enterprise Institute, explained.

“Add to that Trump’s apparent disregard for the rule of law, and markets see little reason to trust the US,” he added.

In his view, that’s why the dollar sank 10% against other top global currencies in the first half of the year, marking the greenback’s worst such performance since 1953.

The plunge came despite the tariffs and the wider premium between U.S. rates and those of other top economies, which would normally boost the dollar.

Gold’s surge of more than 25% this year is another sign of collapsing market confidence in the U.S., as is Treasury yields remaining elevated despite market turbulence, Lachman said.

That all adds up to a very clear vote of no confidence from financial markets in the Trump administration’s economic policies.

“The problem for Trump is that, unlike politicians, markets cannot be pressured or primaried,” he said, referring to the threat of ousting disobedient lawmakers via primary elections. “If he refuses to heed investors’ warnings, as seems likely, the US should brace for a dollar and bond-market crisis in the run-up to next year’s midterm elections. The days of the world letting America live beyond its means are rapidly coming to an end.”

To be sure, many on Wall Street have been sounding alarms about tariffs, inflation, widening deficits, unsustainable debt, the dollar and demand for U.S. Treasuries.

But so far, tariffs have failed to trigger a spike in inflation, while the revenue collected from the duties is on pace to reach $300 billion this year.

And despite warnings that “bond vigilantes” will express displeasure with fiscal policies by demanding higher yields on bonds, that has yet to materialize. In fact, recent Treasury auctions have shown there remains healthy demand for U.S. debt, for now.

In addition, many analysts see the dollar retaining its status as the world’s primary reserve currency despite attempts to push alternatives.

John Queen, fixed income portfolio manager at Capital Group, said in a recent note that bond markets are adapting to higher debt levels, adding that the interest rate market is “incredibly efficient” at pricing in risks.

While he is concerned about the size of the debt and its impact on borrowing costs, it’s unknown when those worries will become reality.

“Many people have predicted that catastrophe is right around the corner and, someday, one of them is going to be right,” Queen wrote. “Unfortunately, they are just guessing, so I am not going to predict that. I am instead going to say that I think the market is good at pricing in those concerns.”