Good morning. In a year defined by uncertainty, CFOs must stay agile and make proactive decisions to navigate a financial landscape where market sentiment can “flip on a dime”.

That was the focus of an interesting conversation I had with Amol Dhargalkar, chairman and managing partner of Chatham Financial, a global financial risk management advisory and technology firm. Dhargalkar shared insights from his discussions with CFOs, highlighting three major issues.

Financing now, not later

“If there’s one big theme I can point to, it’s that when there is an opportunity for financing, CFOs are taking advantage of it,” Dhargalkar said.

He explained that this bias toward immediate action is less about the U.S. Federal Reserve’s moves on interest rates and more about market sentiment, which can shift rapidly due to geopolitical or policy changes. Many CFOs prefer to secure deals now rather than risk adverse developments, such as new tariffs, that could negatively affect their businesses.

Recent data shows a significant amount of issuance in the first half of the year, reflecting this proactive approach, Dhargalkar noted. Even if interest rates might decline modestly in the coming months, the risk of waiting often outweighs the potential benefit for many finance leaders.

Navigating volatile bond yields

“We’ve seen a lot of volatility in government bond yields, which has played into the market in a variety of ways,” Dhargalkar explained. CFOs are closely monitoring these fluctuations, though uncertainty about future movements remains high. While this doesn’t mean investors are abandoning U.S. markets, it is a key area of concern for finance leaders.

Concerns about the potential impact of President Trump’s tax bill rattled bond markets last month, primarily due to fears it would sharply increase the U.S. national debt, Fortune reported.

The dollar’s impact and currency risk

The strength—or weakness—of the U.S. dollar is also top of mind, especially for multinational companies, Dhargalkar said. Many CFOs are asking whether the recent dollar weakness is temporary or a longer-term trend, and how they should manage related currency risks. This environment has prompted some companies to implement or expand foreign exchange hedging programs, particularly those that previously had limited exposure, he explained.

Managing currency risk is more challenging for smaller multinationals, which are less likely to have robust hedging programs in place, Dhargalkar said. For companies with significant overseas earnings, a weaker dollar can be a net positive, as foreign revenues translate into more dollars, he explained. However, the rapid movement of the dollar in either direction typically sparks extensive internal discussions about hedging strategies and financial forecasts.

When I asked Dhargalkar his biggest piece of advice for CFOs, he said: “Rethink their approach to capital structure and financing tools.” As companies move beyond “firefighting mode,” they should consider diversifying their issuance base—such as issuing debt abroad or exploring private credit markets—rather than relying solely on traditional U.S. financing options, he suggested.

Today’s financing tools are more flexible, though often more expensive due to higher rates compared to several years ago. “Don’t feel like you’re stuck with the tools of yesterday,” Dhargalkar said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

James Cook, CFO of Sealy & Company, a real estate investment and services firm, will officially retire after 24 years of service on June 30. James Gilligan will succeed Cook as CFO, effective June 16. Gilligan joined the company in April and brings an executive leadership background centered around real estate investments and private equity. He was previously CFO and treasurer of Farmland Partners, and before that worked at Equity International and Equity Group Investments.

Alice Heathcote was appointed CFO of Origis Energy, a renewable energy and decarbonization solution platform, effective immediately. Most recently, Heathcote served as CFO at Strata Clean Energy. Before that, she spent seven years at ContourGlobal, a global independent power producer. During her tenure, she held several leadership roles, including SVP of financing and acquisitions, where she led ContourGlobal's IPO on the London Stock Exchange. She also served for nearly four years as CFO of the Renewable Division.

Big Deal

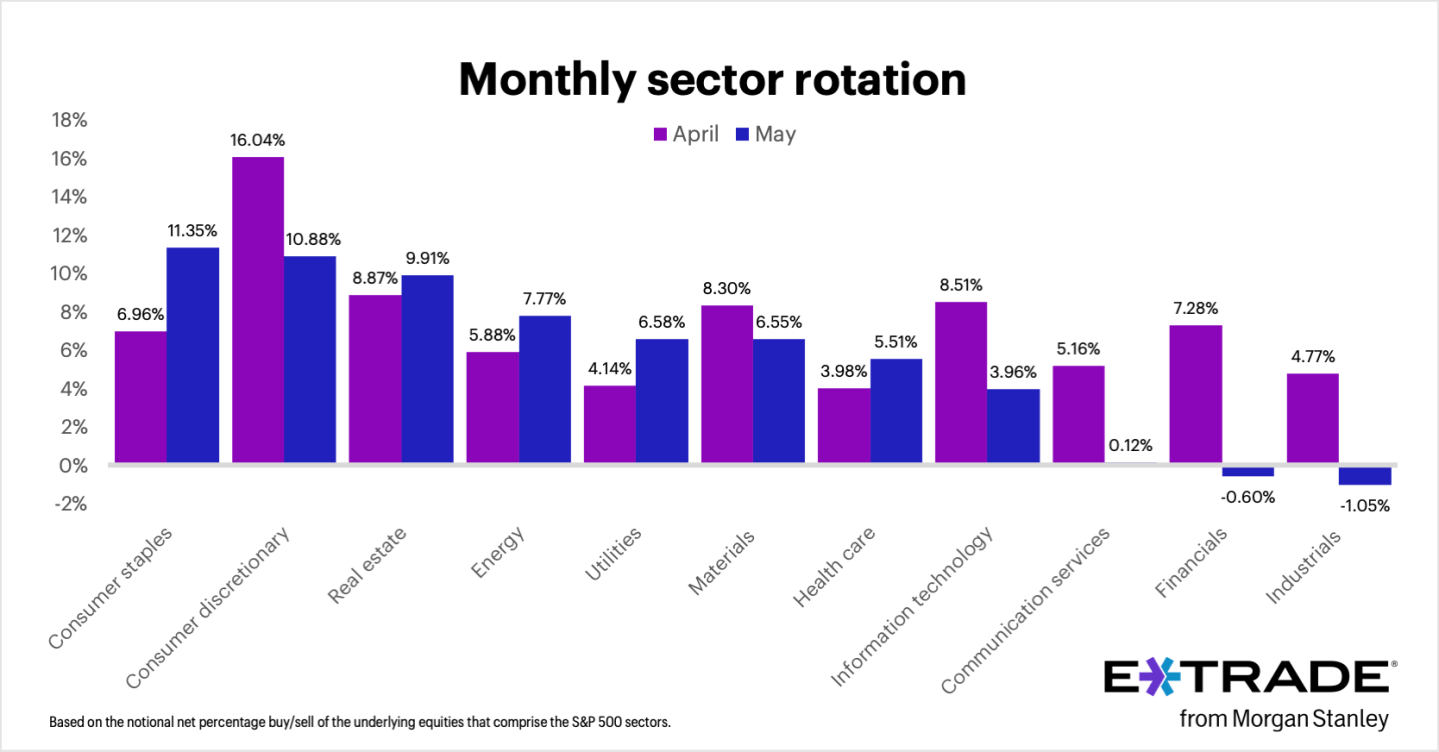

E*TRADE from Morgan Stanley’s monthly analysis finds the three most-bought sectors on the platform in May were consumer staples (+11.35%), consumer discretionary (+10.88 %), and real estate (+9.91 %). The data is based on the net percentage buy/sell behavior of stocks on the platform that comprise the S&P 500 sectors.

In May, E*TRADE from Morgan Stanley clients were net buyers in nine of 11 S&P 500 sectors, Chris Larkin, managing director of trading and investing, said in a statement. “There appeared to be a mix of defensive and ‘risk-on’ activity on the buy side, as clients made the biggest push into consumer staples, followed by consumer discretionary,” Larkin said. Also, for the second month in a row, customers were net buyers of the real estate sector. “Clients were net sellers of industrials and financials, and were only modest net buyers of the two sectors that gained the most in May—tech and communication services,” he said.

Going deeper

The second annual Fortune Southeast Asia 500 list provides insight into a region ready to take advantage of global supply chain shifts and booming industries like mining, EVs, and AI. No. 1 on the list is Trafigura Group, a global commodities trading and logistics company based in Singapore.

The seven countries in last year’s inaugural Southeast Asia 500 list—Indonesia, Thailand, Malaysia, Singapore, Vietnam, the Philippines, and Cambodia—return in 2025 and continue to make their mark on the region’s economy. The Southeast Asia 500 companies are playing an increasingly significant role in global supply chains—capturing manufacturing capacity shifting from China, which is drawing significant capital flows and reshaping global trade dynamics.

Overheard

“Hiring a lot of junior people who are native at building agentic workflows and picking up AI first is just a different way of thinking about building products. We are actually getting a lot of value from bringing in those university dropouts.”

— Canva cofounder Cliff Obrecht said in an interview at the “Viva Technology” event in Paris, Fortune reported. Job-seekers with AI skills may now have an edge over those with university credentials, he said.