Nvidia’s blockbuster quarterly earnings last week came with a big dose of negative news: A $4.5 billion write down on chips originally destined for customers in China that will ultimately go undelivered.

The company had developed the so-called H20 chips, which are less powerful than its top-of-the-line semiconductors, to comply with Biden Administration regulations against sending technology to foreign adversaries that could help their AI efforts. The Trump Administration, however, went a step further in early April and banned exports of even second-tier chips.

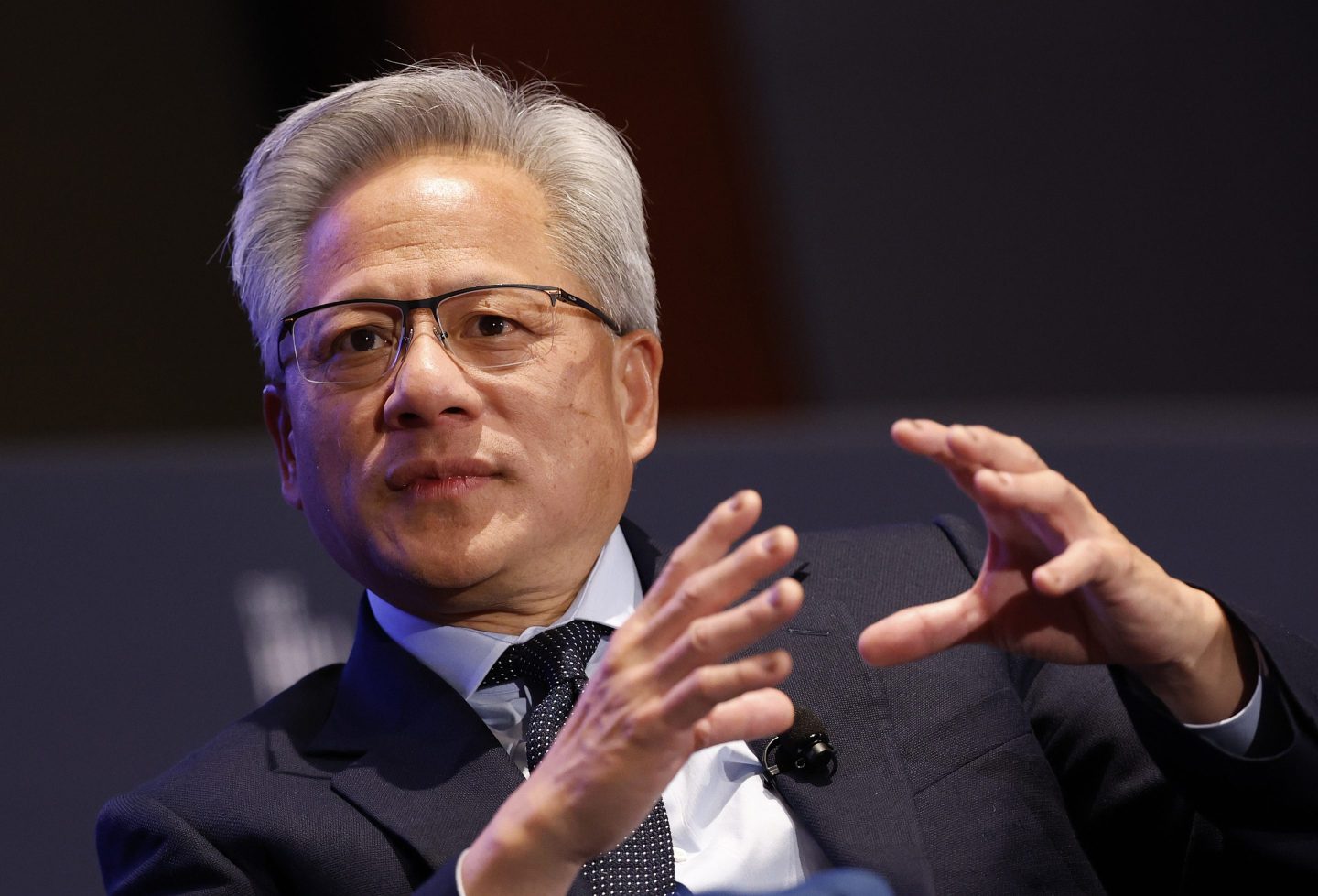

“We are taking a multibillion dollar write off on inventory that cannot be sold or repurposed,” said Nvidia CEO Jensen Huang on a May 28 earnings call.

The details around the decision to write the value of the chips to zero—rather than sell them to other customers—wasn’t explained. The company added, without elaborating, that it’s “exploring limited options” for the unused inventory, a move that would apparently fall short of selling the chips.

The H20 was built specifically for the China market under the old export rules. Because of the chip’s design and limited capabilities, it may be difficult to use in other countries. “It doesn’t really fit anywhere else without a lot of expensive tweaking,” says Arash Azadegan, a professor of supply chain management at Rutgers Business School.

This tweaking could involve additional costs for Nvidia. Furthermore, some of the chips may “not meet the performance needs of customers in other regions” or may be engineered “specific to Chinese customer requests or requirements,” says Chad Autry, a University of Tennessee supply chain professor.

Even if it could sell the chips by cutting their price, Nvidia would risk damaging its image as a seller of top-tier innovation. The company’s new Blackwell GPUs, after all, power cutting-edge AI like OpenAI’s yet-to-be-released GPT-5 model. “Nvidia probably doesn’t want to flood the market with discounted chips—it could mess with their pricing, confuse customers, and distract from their big push into the newer Blackwell lineup,” says Azadegan, referencing Blackwell’s used in new products from Amazon’s AWS, Microsoft Azure, Google Cloud, and Oracle, among others.

Nvidia declined to comment beyond what its executives said during the company’s earnings call last week.

After China-based DeepSeek released its ChatGPT rival in January, major Chinese firms like Alibaba, ByteDance, and Tencent purchased Nvidia’s H20 chips, Reuters reported in February. These companies have likely developed powerful AI capabilities using H20 chips, so there’s little reason to believe that U.S. companies could not do the same if Nvidia sold H20 to them.

But Nvidia and U.S.-based customers probably have no interest in this, says Matthew Bryson, a Wedbush Securities managing director who covers Nvidia. “The reason that these products are going to China is because everyone would choose something better.” Bryson explains that the technology underpinning H20s “would never have been made” if not intentionally engineered to prevent Chinese firms from building models similar to U.S.-made advanced AI applications. And if Nvidia sold the chips at a big discount to reflect their U.S. market value, it could “cannibalize” sales of better products, he says.

Nvidia had initially expected to have to write off $5.5 billion of chip inventory from its balance sheet. But it managed to salvage about $1 billion of H20 inventory by “[reusing] certain materials,” reducing the realized first-quarter writeoff to $4.5 billion, chief financial officer Colette Kress said on last week’s earnings call.

Unsurprisingly, she noted that as a result of the Trump Administration’s new export rule, Nvidia will take a revenue hit from Trump’s China ban in the first half of the year. The company booked a $2.5 billion loss in first quarter revenue and predicted a steeper $8 billion revenue loss in the second one.

The question remains of what happens with this H20 stockpile. Supply chain experts interviewed by Fortune suspect it will be discarded. “These chips will meet the “cool lava lamp” you got from your aunt in a landfill somewhere,” Alan Amling, a professor of supply chain at the University of Tennessee’s Haslam College of Business, wrote to Fortune via email. “With so many other growth opportunities, the opportunity cost of repurposing, retesting and requalifying these chips was obviously too high a bar.”

Because of how quickly the new export rules under Trump took effect, the undeliverable H20 chips are likely sitting in U.S.-friendly places like Taiwan and Hong Kong, said University of Tennessee’s Autry. Taiwan-based TSMC manufactures much of Nvidia’s inventory meant for China-based customers, and Nvidia’s fulfillment partners are in nearby countries.

Writing off the H20 chips had minimal short-term impact on Nvidia’s otherwise booming business. Nvidia reported first quarter revenue of $44.1 billion (up 69% year-over-year) and $18.8 billion in net income, representing a healthy 42.6% net profit margin.

Writing down the full value of the chips provides an immediate tax benefit by reducing the company’s taxable income. Depending on Nvidia’s future sales prospects and costs, this benefit could outweigh or come close to the financial benefit of selling the chips at a steep discount.

“Nvidia is going to be alright; investors of Nvidia are going to be alright,” says Rutgers’ Azadegan. “The real story,” he said, is that Nvidia’s manufacturing partners like TSMC and suppliers, including Samsung and Micron, could be most impacted by the H20 inventory writeoff because they’ve built businesses by serving critical functions in Nvidia’s supply chain. The magnitude of the impact to these partners will be determined in the months and years ahead, notes Azadegan. “It’s never on a dime that we can pivot.”

Nvidia analyst Harsh Kumar of Piper Sandler is hopeful that Trump eventually undoes the blockade on H20 chips to China. If so, Nvidia could finally complete the H20 sales or deliver the chips to new customers in China, assuming the company holds onto the H20 inventory. It’s unclear how realistic this scenario is after the Trump administration appealed a judge-imposed block on his “Liberation Day” tariffs.

Still, Trump’s new export ban prevents Nvidia from delivering chips to China for national security reasons, so it may have little to no correlation with his tariff agenda. “To me, it almost implied that there is a pathway that Jensen [Huang] and Nvidia see for this H20 chip to be sold back into China,” Kumar told Fortune, potentially helping to propel the company’s already high-flying stock to greater heights in the future.