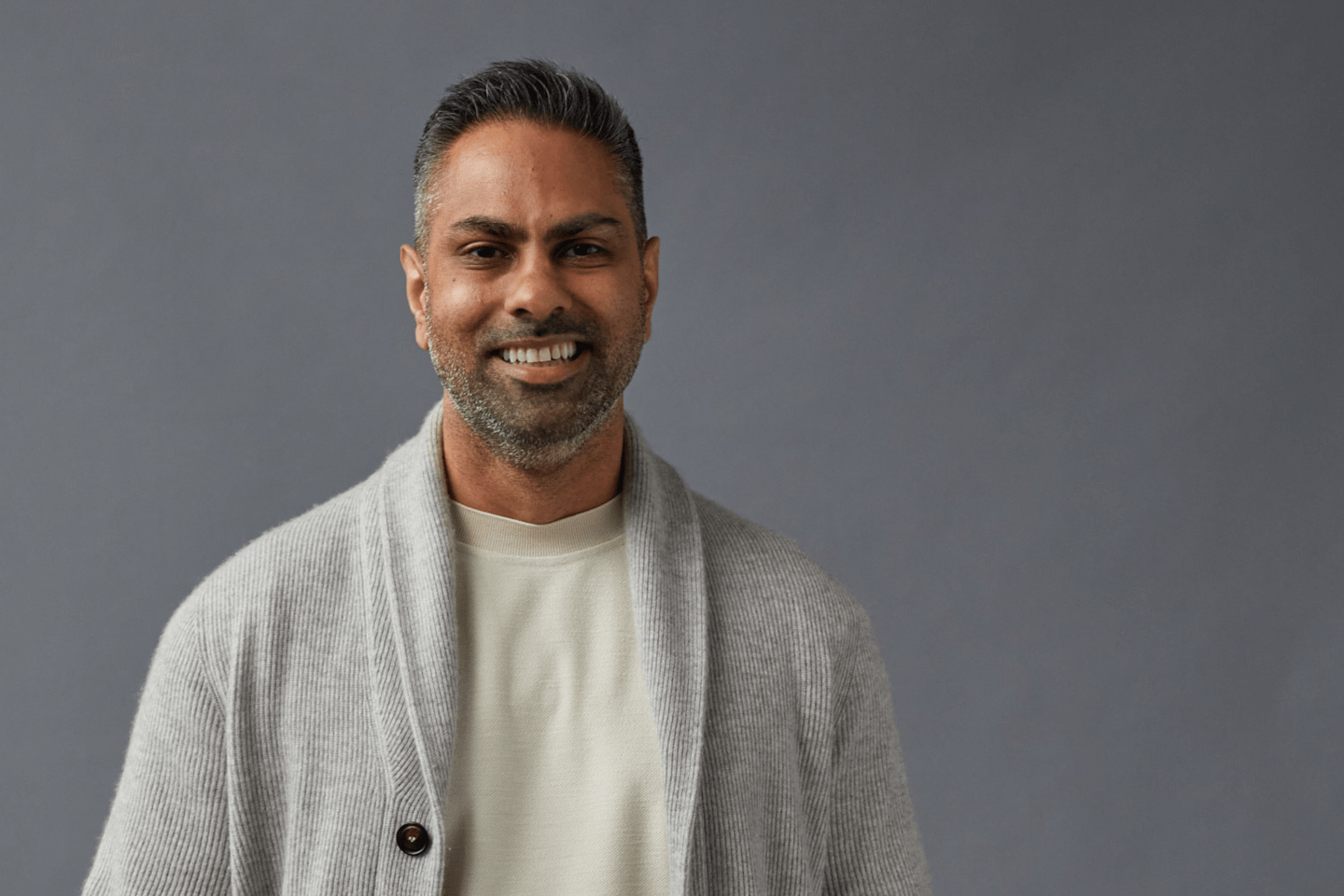

- Netflix’s finance guru Ramit Sethi made millions in his 20s before teaching others how to get rich too with his New York Times best-seller and Netflix show. Contrary to the likes of Dave Ramsey who says he can 100% tell who will stay middle-class by looking at the cars they drive, Sethi says it’s now knowing how much money you have to splash that’s the red flag.

It’s not that brand-new car or even the oft-vilified avocado toast keeping you trapped in the middle class. According to the self-made millionaire Ramit Sethi and star of his own Netflix show, “How to Get Rich”, you can have all those things and more—while still hitting your financial goals.

The real issue? Many have no idea how much they can afford to spend in the first place.

“The fact that so many people go into debt to purchase a luxury blows my mind,” he says—and it’s one of the most common financial red flags he sees among spenders.

Research has consistently echoed that although Gen X has the most debt, Gen Z and young millennials are “doom-spending” themselves into financial trouble. To cope with the high cost of living, tough job market, and negative news cycle, young people are treating themselves to designer goods and lavish holidays—but they’re increasingly using buy-now-pay-later services to pick up the bill.

“One shocking finding that I’ve had on my podcast, “Money for Couples”, is that 50% of people do not know their household income,” Sethi adds.

“It’s almost like we go through life driving, and we can only see 15 feet ahead of us in the fog. But in order to live a rich life, you have to zoom out and be able to see half a mile down the road, a mile five miles down the road—same thing with our money. We need to plan six months ahead, a year, even 20 years ahead. And we can do it. It’s not that hard. We have to get out of the weeds.”

Other financial red flags: Home renos, cars and not running the numbers

Sethi isn’t anti-spending. In fact, he’s all for enjoying the fruits of your labor—as long as you’re clear on your bigger financial picture. Most of the financial red flags he flags come down to one thing: people making money decisions without running any numbers.

Take home renovations. “I’m frankly shocked at how many people in America simply believe that home renovations are totally normal and routine,” the 42-year-old finance guru says. “In fact, many people tell themselves their home renovation is an investment. No, it’s not. Most renovations don’t make you money, they cost you money.”

Sethi’s not saying you shouldn’t upgrade your kitchen. But if you can’t pay for it upfront, it’s likely more of a financial strain than a smart investment.

“If you want to do a renovation, and you acknowledge that it’s a luxury and you don’t go into debt to do it? Great,” Sethi says—and that approach doesn’t just apply to renovations.

“The fact that almost nobody runs a single number before they make the biggest purchase of their life—which is their house—blows my mind,” he adds.

“The fact that most people get their advice about how much they can afford on a car from their neighborhood car dealer, Chet, blows my mind.”

The 4 numbers you should track before splurging

Forget the house, the car, or the luxury holiday—for some ultra-wealthy critics, it’s small daily indulgences that are really keeping you from building wealth—and that circa $950 a year young people spend on their caffeine hit could go towards a home downpayment instead. Shark Tank’s Kevin O’Leary even called people who grab coffee to go every day “idiots”.

Read more from Fortune

But your oat milk flat white isn’t the problem, Sethi says.

“It’s probably time to stop lecturing the middle class about cutting back on their avocado toast,” Sethi tells Fortune, while slamming the “multi-millionaires” who suggest otherwise.

“What we tend to do is we tend to focus on $3 questions. You know, am I spending too much on coffee? Ooh, I’ve been bad. I should be good,” he says.

Before demonizing your spending habits, Sethi recommends breaking down four key aspects of your personal finances:

- Fixed costs (rent, utilities and any other essential monthly bills)

- Savings (Sethi’s currently recommending keeping aside 12 months worth of expenses as an emergency fund)

- Long-term investments (such as your monthly retirement contributions, index funds, etc)

- Guilt-free spending.

By knowing how much you have coming in—and more importantly, going out—each month, you can then work out how much money you can spend guilt free.

“If we know those four numbers, suddenly we’re equipped to really put our money where we want it to go, and that works regardless of if you are in the middle class, upper middle class, wealthy and beyond,” he says.

“If you choose to buy very nice skin care lotion, or if you choose to buy a beautiful coat, or you choose to go out to eat six times a week. That’s totally up to you, as long as it fits in your guilt-free spending number—that’s why I call it guilt-free.”

For Sethi, that looks like splashing out on beautiful hotels: “I’m not wasting my money. I am intentionally choosing to spend extravagantly on the things I love as long as I cut costs mercilessly on the things I don’t.”

“That is a key lesson for Gen Z,” he adds. “You can actually spend more on the things you love. You can spend extravagantly on those things as long as you cut costs mercilessly on the things you don’t.”