Good morning. Research over the years has pointed to how extraordinary leaders can create far more economic value for a company than ineffective leaders. Now, a new case study on Delta Air Lines provides more evidence.

“How Ed Bastian turned Delta into America’s most profitable airline while giving employees billions along the way” is the latest Fortune magazine cover article by my colleague Shawn Tully. The piece provides an in-depth profile of Ed Bastian but also shows how his leadership as CEO has boosted the bottom line of the Fortune 500 company.

“For 15 years, including Bastian’s nine as CEO, Delta has often charted a course in the opposite direction from its rivals,” Tully writes. “When other airlines reckoned that low prices were the biggest lure for customers, Delta bet that fliers would pay a premium for a superior experience. When the pandemic pressured the industry to slash capital investments, Delta kept building.”

Going against the grain has resulted in Delta becoming the largest U.S. air carrier by revenue, and the most profitable—“while earning the kind of customer loyalty that can help it weather catastrophes like a recent frightening, non-fatal crash in Toronto,” according to Tully.

“Its place atop the podium represents a crowning achievement for Bastian, who has led Delta with a rare blend of salesmanship, showmanship, and an accountant’s mastery of return on capital—and who has helped the airline build strong employee-management relations in an industry where those ties are often strained,” he writes.

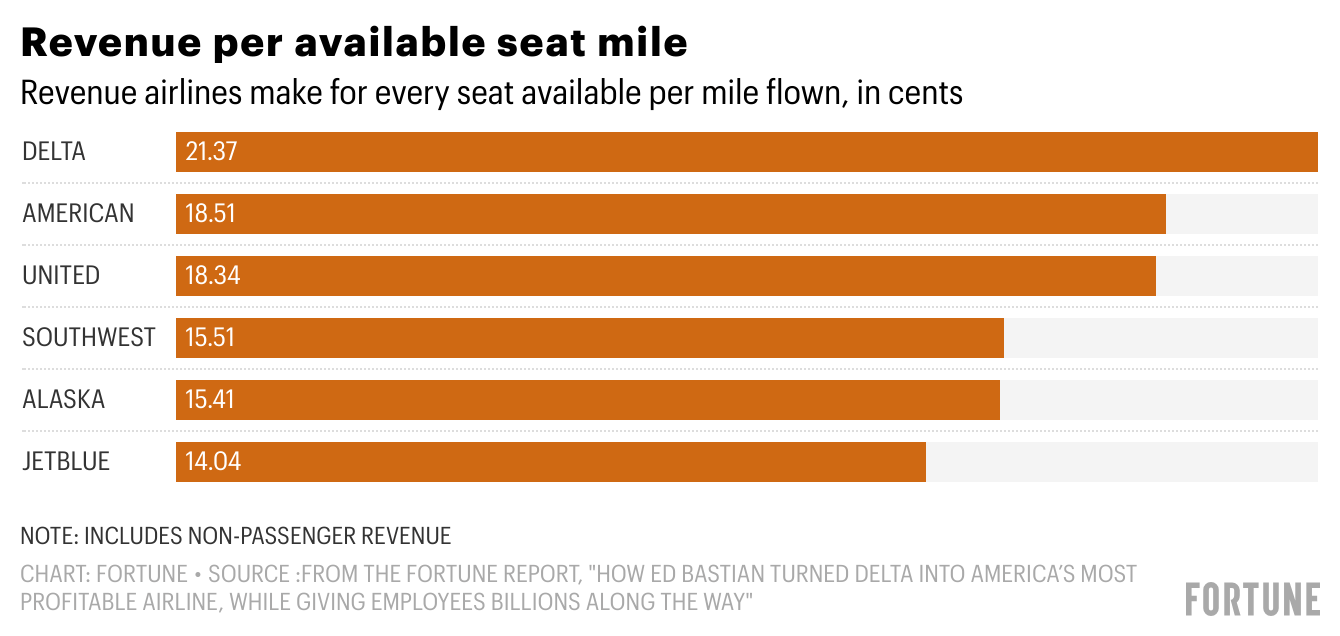

Tully conducted an analysis which found that Delta brings in more money than its competitors for each “seat mile” flown—a standard measure for comparing sales. “Non-passenger” revenue, including fees from its American Express partnership, contributes to Delta’s lead. “But it comes out ahead even with those sales included,” he writes.

Even if U.S. economic uncertainty continues, Tully writes that this CEO has made one thing clear: “He intends to remain at the controls.” You can read Tully’s in-depth profile of Bastian here, which also includes Delta’s strategy to continue outpacing its competitors, why its customer service is a major differentiator, and the company’s generous profit-sharing program for employees.

Bastian understands the link between company culture and financial performance. He joined Delta in 1998 as VP and controller and then became CFO before becoming president and then CEO in 2016. He now leads about 100,000 global professionals.

Bastian’s success comes at a time when more finance chiefs are being considered for chief executive roles. Shawn Cole, president and founding partner of executive search firm Cowen Partners, recently told me that companies are hiring CFOs as CEOs who have operational acumen of the core business and strategy experience. “CFOs have become real strategic partners to CEOs, and I would call them ‘truth-tellers,’” he said.

As the strategic partners of CEOs, finance chiefs recognize their own leadership profile needs attention in 2025, according to Gartner research. An expanded CFO role creates a need to influence across the entire company, raising the bar for CFO leadership effectiveness.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Jim Gibson was appointed CFO of PacBio (Nasdaq: PACB), a developer of sequencing solutions, effective March 31. Gibson joins PacBio from Sequoia, where he served as CFO across four entities. Before Sequoia, Gibson was CFO at Willow Innovations. Additionally, he has held executive roles at GoDaddy, Tesla, Apple, Netflix, and Affymetrix.

Jim Lejeal was appointed CFO of Forter, a software-as-a-service company. Lejeal is a four-time public company CFO with over 20 years of experience leading hyper-growth companies through two IPOs, secondary offerings, acquisitions and international expansion. Before Forter, he served in numerous finance leadership roles, including those at Absolute Software, Rally Software, and Splunk.

Big Deal

The geopolitical landscape has CFOs concerned about their foreign exchange (FX) exposures, according to the MillTechFX Global FX Report 2025. Over the past 12 months, the tech company surveyed 750 corporate finance leaders across Europe, the U.K., and North America to gauge their approach to FX risk management.

Shifts in geopolitics have driven currency volatility and firms have been forced to protect their bottom lines by adjusting their FX hedging strategies, according to the report. This year, 62% of respondents overall said they planned to adjust their strategies, compared with only 8% that plan to decrease hedge length.

Looking specifically at North American corporates, they are among the leaders that place a high value on FX hedging (82%), according to the survey. For respondents overall, of those who do not hedge, over half (52%) said they were now considering hedging due to market conditions. Also for those who do not hedge, U.S. corporates saw the highest losses in unhedged risk (77%), followed by the U.K. (75%) and Europe (72%), the researchers found.

Going deeper

“Should We Compare Bitcoin to Gold? Lessons From the Last Financial Crisis” is a new article in Wharton’s business journal. Wharton’s Rahul Kapoor and Lehigh University’s Natalya Vinokurova explain the risks associated with a common argument for investing in Bitcoin: comparing it to gold.

Overheard

“xAI and X’s futures are intertwined.”

—Elon Musk wrote in a post on X. Musk’s xAI artificial intelligence startup has acquired his X platform at a valuation of $33 billion, which is a surprise twist for the social network formerly known as Twitter.