Good morning. Zach Kirkhorn, former CFO and “master of coin” at Elon Musk’s Tesla, has a new preoccupation: He is focusing his attention on Jolly, a startup aimed at boosting employee productivity and satisfaction.

Kirkhorn led a $16.5 million Series A fundraise for Jolly, the company announced on Wednesday. The round included participation from angel investors Gokul Rajaram, Julien Codorniou, Steve Luczo, and David Marcus, and institutional support from Bullpen Capital, Dorm Room Fund, and Eigen Ventures, among others.

Along with investing in the startup, Kirkhorn will join its board. Dean Zimberg, founder and CEO of Jolly, who in 2019 was a data science intern in Tesla’s finance org, sees this as a win for the company.

“When I was at Tesla, I saw first-hand how Zach led his team with empathy and aligned a massive workforce with one mission—while building an operationally excellent business,” Zimberg, age 27, told me. “My time at Tesla and Zach’s stewardship has been incredibly formative to the buildout of Jolly. Having him join the team is a dream come true.”

Kirkhorn initially expressed interest in Jolly in late 2024, he said. “Jolly is a tool for CFOs, and particularly for companies that have large frontline workforces,” Zimberg said. “Zach’s professional experience fits squarely in our target customer demographic.” In addition, Kirkhorn’s operating experience and perspective will be “incredibly valuable” to the company as it continues to scale, he said.

Similar to cashback on a credit card or earning miles on airlines, Jolly is a platform that allows employees to earn points by incentivizing actions that are considered value-accretive to the business, like picking up extra shifts. The points can be used on gift cards or other high-value items, according to the company. Jolly has initially targeted frontline workers.

“Frontline employees have labor-intensive jobs, often at difficult hours of the day, and for low pay,” Zimberg said. “As a result, frontline employers are seeing unprecedented employee turnover, prompting executives to actively seek a solution.”

Jolly works by integrating with employers’ existing technology stack to leverage real-time, objective data to systematically distribute rewards, Zimberg explained. The platform automatically issues points for actions on the job considered value-accretive, he said. Among the industries Jolly currently targets are health care services, manufacturing and logistics, trucking, and retail operations.

“Business leaders are under immense pressure to improve financial performance, but it’s also critical to ensure employees see a direct benefit from their hard work,” Kirkhorn said in a statement.

CFO influence

Kirkhorn stepped down from his role at Tesla on Aug. 4, 2023. The company said in an SEC filing that during his tenure, “Tesla has seen tremendous expansion and growth.”

The SEC document didn’t discuss any reasons for Kirkhorn’s departure. And in his LinkedIn post following the announcement, he didn’t give a reason. “Being a part of this company is a special experience and I’m extremely proud of the work we’ve done together since I joined over 13 years ago,” Kirkhorn wrote. He also thanked Musk for his “leadership and optimism, which has inspired so many people.”

However, Kirkhorn recently told the Wall Street Journal that during his time at Tesla, he was under a lot of public scrutiny. He’s now seeking a “return to a world of privacy, to the extent possible,” he said.

His departure in 2023 was a surprise to Wall Street as he was being considered by Tesla’s board as Musk’s successor for the CEO position, according to reports. He joined Tesla in March 2010 as a senior analyst in finance. When he took on the job of CFO in 2019, Tesla was valued at $50 billion, and it was worth $773 billion at the time of his departure, Fortune reported. He amassed a net worth of $590 million during his four years as CFO.

Kirkhorn was succeeded by Vaibhav Taneja as CFO, who was previously the chief accounting officer. Recently, at a time when sentiment in Tesla stock is at its most vulnerable in months, Taneja is one of the company’s insiders opting to cash in more of his shares.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Mark Ortiz, CFO of dLocal (Nasdaq: DLO), a cross-border payments platform, will step down from his role due to an unforeseen health issue that requires attention. The transition will take effect once the company has filed its annual report on Form 20-F including the 2024 annual audited financial statements (and in any event, no later than May 1). The board of directors has appointed Jeffrey Brown, who currently serves as VP of finance, to act as interim CFO while it conducts a search for a permanent successor.

Intekhab Nazeer was named CFO of Lineaje, a software supply chain security company. Nazeer brings over 20 years of leadership experience. Before joining Lineaje, he served as CFO at Weka.IO, a data platform for AI workloads, where he helped raise over $300 million in funding and grew annual recurring revenue from $2 million to over $100 million. Nazeer also previously was responsible for operational efficiency and finance automation at Unifi Software, Platfora, Appcelerator, Greenplum, and HCL Group.

Big Deal

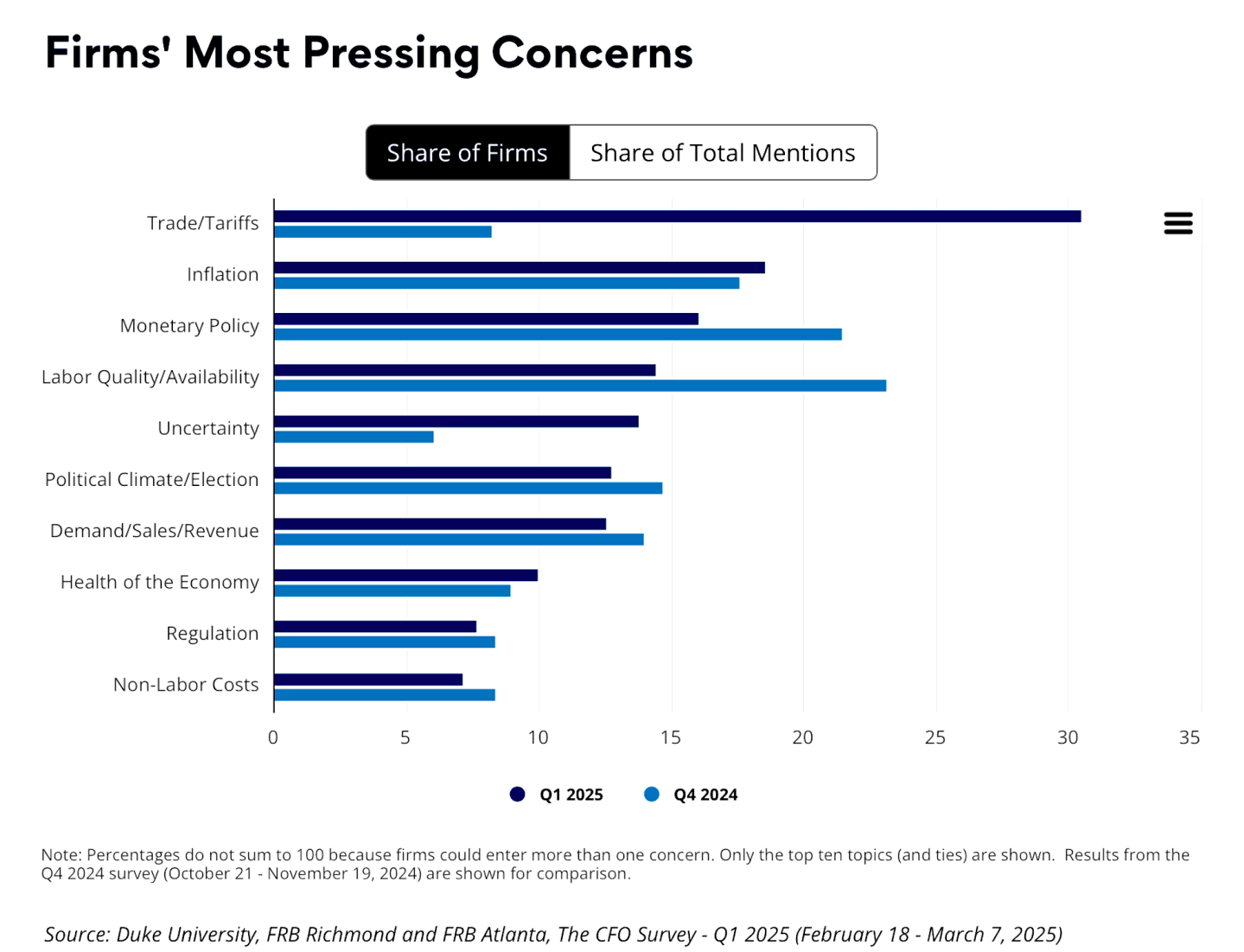

Amid concerns about tariffs and broader economic uncertainty, economic optimism among CFOs dropped in the first quarter of 2025, according to the CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta.

The economic optimism index fell from 66.0 in the fourth quarter of 2024 to 62.1 in the first quarter of 2025, “almost erasing gains from a post-election jump,” according to the report. CFOs’ optimism about their own firm’s financial prospects fell from 71.3 to 68.4, not nearly as much as economic optimism.

“Not only did almost one-third of respondents report concerns about tariffs, but those respondents had notably lower optimism, lower expectations for GDP growth, lower expectations for revenue and employment growth, and higher expectations for price growth in 2025,” Sonya Ravindranath Waddell, VP and economist with the Federal Reserve Bank of Richmond said in a statement.

About a quarter of firms reported that changes to trade policy would negatively impact their hiring and their capital spending plans in 2025. Some CFOs plan to take action. On the sourcing side, almost 30% of firms planned to diversify supply chains, 20% moved up purchases, and there were some reports of finding new domestic or foreign suppliers, according to the findings.

Employment growth expectations dipped. However, expectations for revenue, unit cost, wage, and price growth were relatively steady from last quarter, the researchers found.

The findings are based on a survey of 400 firms conducted from Feb. 18 to March 7.

The firms range from small operations to Fortune 500 companies across all major industries.

Going deeper

“Trump sets auto tariffs at 25%, drawing swift backlash. ‘The tariffs announced today will harm—not help,’ says world’s largest business association,” is a new Fortune report by Amanda Gerut. President Trump announced from the Oval Office on Wednesday that he will proceed with new tariffs on foreign-made cars and light trucks of 25%. The new tariffs will launch on April 2 “and we’ll start collecting on April 3,” said Trump, adding the levies would not hit cars built in the U.S.

Overheard

“When I took my first job in the Army—you walk in, you’re a brand-new lieutenant—everybody knows more about everything than you do. You figure out really quickly that it’s really not about you at all, it’s actually about making the team better.”

—Debra Crew, CEO of Diageo, told Nicolai Tangen, CEO of Norway’s sovereign wealth fund, in an interview on his podcast, In Good Company, released Wednesday. Crew credits her time as a military intelligence officer with influencing how she leads the 30,000-strong drinks company behind Guinness and Johnnie Walker, Fortune reported.