Four former Intel board members have written two opinion pieces for Fortune arguing that the only solution to Intel’s problems is to break the company into two pieces: a design company and a wafer fabrication (foundry) company. I do agree with their position that Intel should not sell its foundry business to TSMC but strongly disagree with their argument that Intel should be broken up.

The board members are well meaning but off target. They are two academics and two former government bureaucrats, just the type of folks you want dictating strategy in the ruggedly competitive semiconductor industry.

Pat Gelsinger, who ran Intel the last three-plus years (he was abruptly fired two months ago) did a great job resuscitating the technology development team, and today the company’s leading technology is on par with TSMC’s 2nm technology. Additionally, Intel has a lead in the newest imaging technology (high NA EUV lithography, where they are currently processing 10,000s wafers) and in backside power delivery to complex chips. Both these accomplishments are key for future generations of silicon technology.

The best technology wins

Intel is back—from a technology point of view. They are still struggling to attract independent chip designers, but they have the technology and manufacturing know-how to compete with the likes of TSMC. So, if Intel is back from a technology standpoint, what is the advantage of splitting up a company with 100,000-plus employees spread over several continents?

The former board members think that because Intel also makes and sells chips, no other chip designers will want to trust Intel to make their products. This thought process ignores the fact that the best technology wins in the semiconductor industry. All the independent designers currently use TSMC because TSMC has the best technology, so they don’t have any process technology advantage over each other. They are all using the same manufacturing technology to compete with each other and to compete with Intel chips. If Intel has equivalent or better technology than TSMC, then the game changes.

Intel failed in its previous efforts in the foundry business for the simple reason it did not have a competitive technology. The best technology wins, as you are at a disadvantage if you use an older version. Of course, Intel has to provide good customer service, fair pricing, guaranteed capacity, and a clear separation of chip designers from their foundry customers, but there is no disputing that the best technology wins. Intel used to lead in technology and chip design. They still struggle in chip design with the move to AI applications, but they are certainly back in manufacturing technology.

So, let’s stop talking about breaking up Intel as the only solution. Instead let’s talk about Intel eating into TSMC’s current high-end foundry business on the basis of Intel’s technology resurgence.

Sure, the government can help by pushing U.S. firms to use a U.S. foundry. The government can also make an investment in Intel like they have done with other struggling institutions critical to the US economy and national security. And the current administration can move much faster than the previous one with support like tariffs. The Biden administration slow-walked the Chip Acts support over a two-year period while the Trump administration has demonstrated instantaneous decision-making and movement.

But, please, stop talking about breaking up a company and dealing with all the complications and distractions therein. The company has gone through several CEOs and boards that did the wrong things.

The next Intel CEO

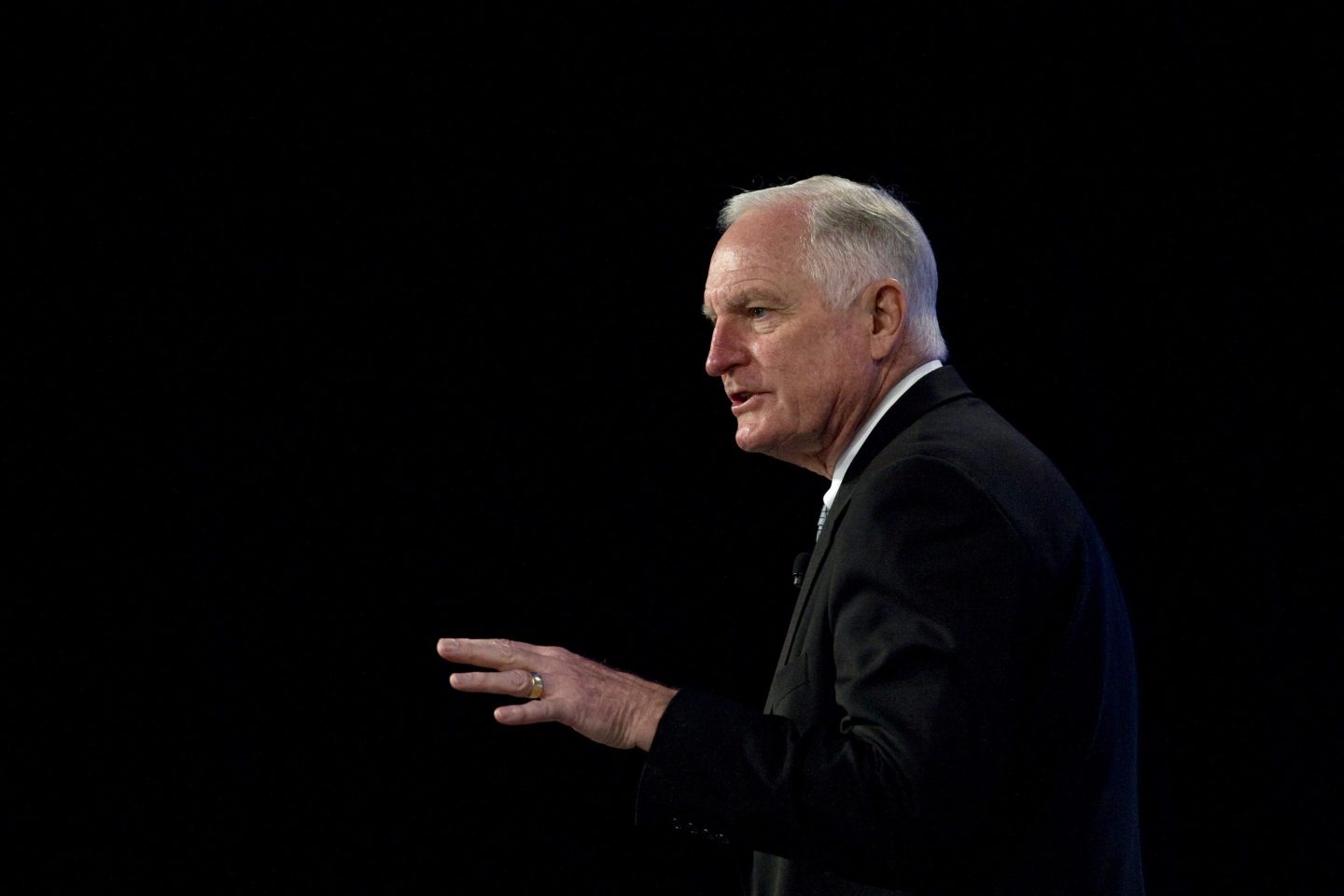

I ran Intel with 100,000-plus employees, and I think I know the challenges if Intel were to be split up. If we want semiconductor manufacturing leadership in the U.S., then build on the current resurgence of Intel, don’t tear it apart. The conversation should be who the next CEO should be to build on Pat Gelsinger’s accomplishments over the last few years. Currently the company is being run by a CFO and a product manager. The challenge for Intel is to get someone who understands the business of making chips, not someone who spends their time splitting the company into two pieces. Along the way, you might also worry about the Intel board. They bear ultimate responsibility for what has happened to Intel over the last decade.

Yes, I have an emotional attachment to intel, but I know what the team can do if properly led. It disappoints me that they lost their leadership position. However, it disappoints me more to see people who ignore the intricacies of the semiconductor industry and proclaim simplistic solutions. It takes years to develop a new semiconductor manufacturing technology and ramp it into volume production. Intel is about to regain its leadership in this area, and the dumbest idea around is to stall that from happening by slicing the company into pieces.

The moment you announce you are splitting up Intel you’ll lose the momentum and resources you need to succeed. In my opinion, a far better move might be to fire the Intel board and rehire Pat Gelsinger to finish the job he has aptly handled over the past few years.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.