- Warren Buffett’s Berkshire Hathaway saw its stockpile of cash continue to swell, amid questions about what he plans to do with all that money. But in his annual letter to the conglomerate’s shareholders, he reaffirmed his desire to invest in businesses, rather than hold onto cash.

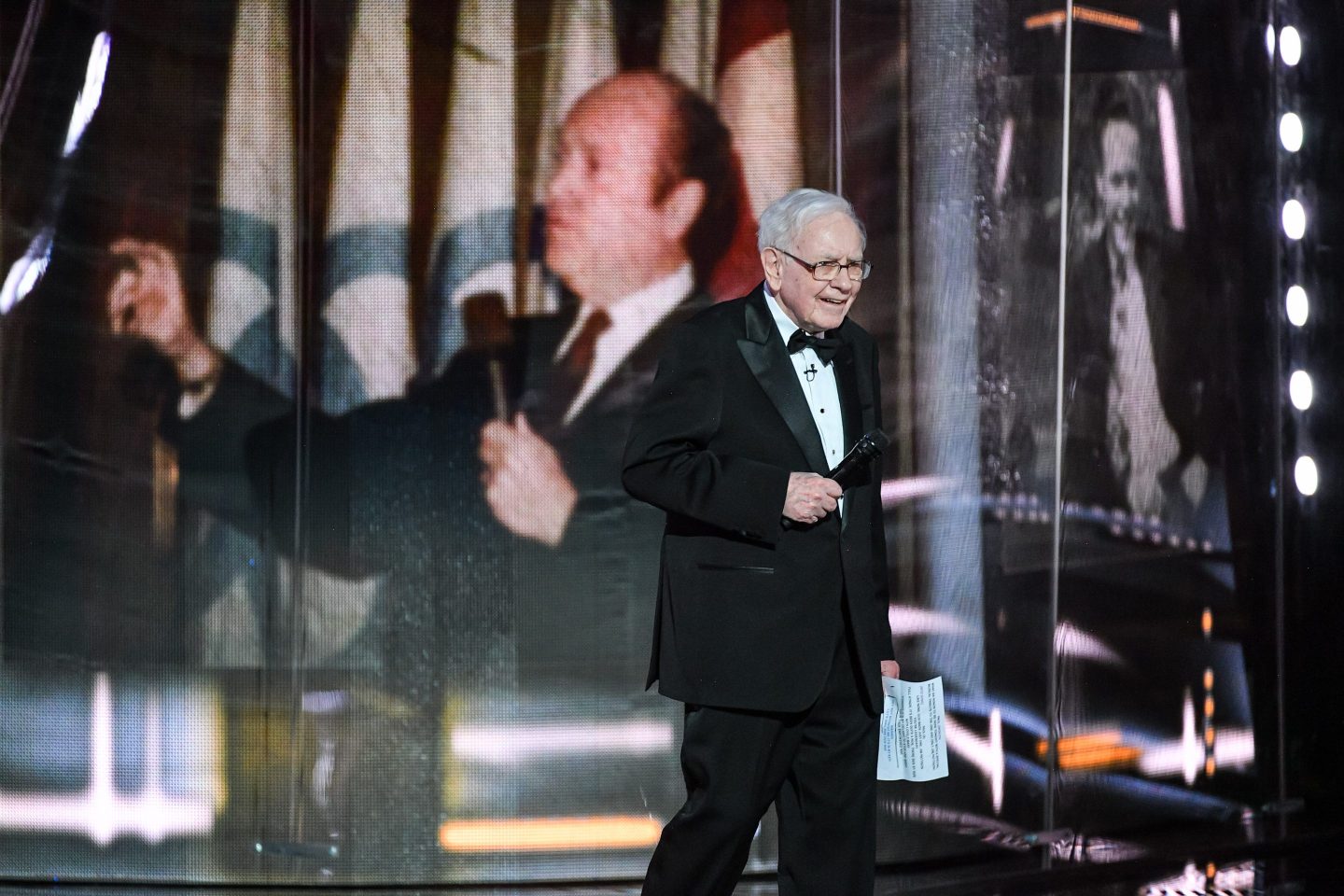

Berkshire Hathaway Chairman and CEO Warren Buffett reaffirmed his commitment to investing Saturday, even as his conglomerate continued accumulating cash reserves.

Berkshire’s cash pile hit $334.2 billion at the end of the fourth quarter, nearly double from $167.6 billion a year ago. That’s after Buffett has been a net seller over the last eight quarters, trimming his stakes in Apple, Bank of America, and Citigroup. The size of Berkshire’s stock portfolio has shrunk to $272 billion from $354 billion a year ago.

Meanwhile, Berkshire’s other equity holdings include subsidiaries like Geico, BNSF, Dairy Queen, and See’s Candy. But Buffett hasn’t used its cash in a major takeover deal in a while as the famously value-conscious investor has balked at high valuations in recent years.

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” Buffett wrote in his annual letter to shareholders. “That preference won’t change.”

Anticipation rose leading up to the latest letter, as investors speculated why the 94-year-old “Oracle of Omaha” had been stacking up cash reserves.

Prior to the dotcom bubble burst nearly 25 years ago, Buffett famously stayed on the sidelines instead of investing in high-flying tech stocks and let his cash pile grow, similar to what’s seen with Berkshire today.

On Saturday, he refrained from offering a prediction about the current market landscape but vowed that Berkshire’s investing stance hasn’t changed.

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities — mostly American equities although many of these will have international operations of significance,” Buffett wrote. “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good business, whether controlled or only partially owned.”

He added that Berkshire doesn’t have plans to offer a dividend, while noting thatthe security of cash is uncertain and “can see its value evaporate.”

“Fixed bonds provide no protection against runaway currency,” Buffett said.

Buffett said businesses are like people with goals they want to pursue, adding that they “will usually find a way to cope with monetary instability,” if there is a demand for goods and services.

“So, too, with personal skills,” he said. “Lacking such assets as athletic excellence, a wonderful voice, medical or legal skills or, for that matter, any special talents, I have had to rely on equities throughout my life. In effect, I have depended on the success of American businesses and I will continue to do so.”