Good morning. I would argue that most people like a comeback story. Fortune’s latest feature offers a good one in the form of Nike’s new CEO, Elliott Hill, a boomerang executive, who thinks he can pull off an epic turnaround.

“Nike is broken. Can this man fix it?” is the title of the feature written by Devin Gordon. It’s an in-depth and fascinating profile of Nike’s fearless and well-liked leader and offers insight into the company’s future plans. Four years after his retirement from the sneaker giant, Hill returned on Oct. 14, 2024, taking on the role of president and chief executive. Previously at Nike for 32 years, he held leadership positions such as president of its consumer and marketplace business units, and running commercial and marketing operations for the Nike and Jordan brands.

But Hill’s return comes after a lackluster year, to put it lightly. “Nike has become one of the world’s most lucrative companies, dominating the sneaker market and boasting a valuation north of $105 billion,” Gordon writes. “But there’s also no sugarcoating the reality that 2024 was arguably Nike’s worst year in its vaunted six-decade history.

Sales declined year over year for the last three quarters, across all geographies. Share prices plunged 20% in a single day, following a grisly June earnings call, annihilating $28 billion in shareholder value. “By the end of the year, Nike stock was down nearly 60% from its November 2021 high,” Gordon writes.

Layoffs of some 750 employees took place in July, including 32 vice presidents, 112 senior directors, and 174 directors. “Under Hill’s predecessor, John Donahoe, the bleeding had seeped beyond the spreadsheet,” Gordon writes. Employee morale across the campus was tanking.

However, company veterans rejoiced on social media when Hill was appointed CEO.

“There’s evolutionary innovation—you’re making tweaks to materials, foam construction, how you laced the shoe, the outsole pattern, et cetera,” Hill told Gordon. “And then there’s revolutionary innovation: groundbreaking, jaw-dropping, what-the-hell-did-Nike-just-do? innovation. You’ve got to do both.”

‘The right person to guide Nike’

During a Dec. 19 earnings call, his first as CEO, Hill offered a high-level observation: “We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision.”

Hill’s strategic partner is CFO Matthew Friend. “Matt and I have made it clear that we’re repositioning the business to get back to driving a pull market for Nike,” he said.

“If you look over history, we’ve consistently been a double-digit margin company,” Friend, CFO since 2020 and with the company for more than 15 years, said on the call. “When I think of the actions that we’re taking in the marketplace today, there are a number of opportunities as we look forward.”

There are a lot of people pulling for Hill’s success, including the most famous name on Nike’s payroll—Michael Jordan. “I’m a huge fan of Elliott,” Jordan wrote in an email to Gordon. “He’s exactly the right person to guide Nike right now.”

To learn more about Hill’s “irrational love” for Nike since he began there as an intern, and his plans to get the retailer back on the front foot, you can read the full article here.

Sheryl Estrada

sheryl.estrada@fortune.com

The following sections of CFO Daily were curated by Greg McKenna.

Leaderboard

Alexander Cram was appointed CFO of Nordhealth (OB: NORDH), a health care software company based in Norway, effective Feb. 3. He will replace Mari Laine, who is departing via mutual agreement. Cram arrives from Superside, a marketing services company, where he also served as CFO.

Harish Shantharam was appointed CFO of ALX Oncology Holdings (Nasdaq: ALXO), a clinical-stage biopharmaceutical company, effective Jan. 21. He will replace interim CFO Shelly Pinto, who will remain the company’s SVP of finance and chief accounting officer. Shantharam has over 20 years of financial leadership in the sector. He previously served as CFO at CymaBay Therapeutics, where he helped guide the company through its $4.3 billion acquisition by Gilead Sciences. Shantharam had worked at Gilead earlier in his career, eventually ascending to the role of VP and head of global commercial finance.

Big Deal

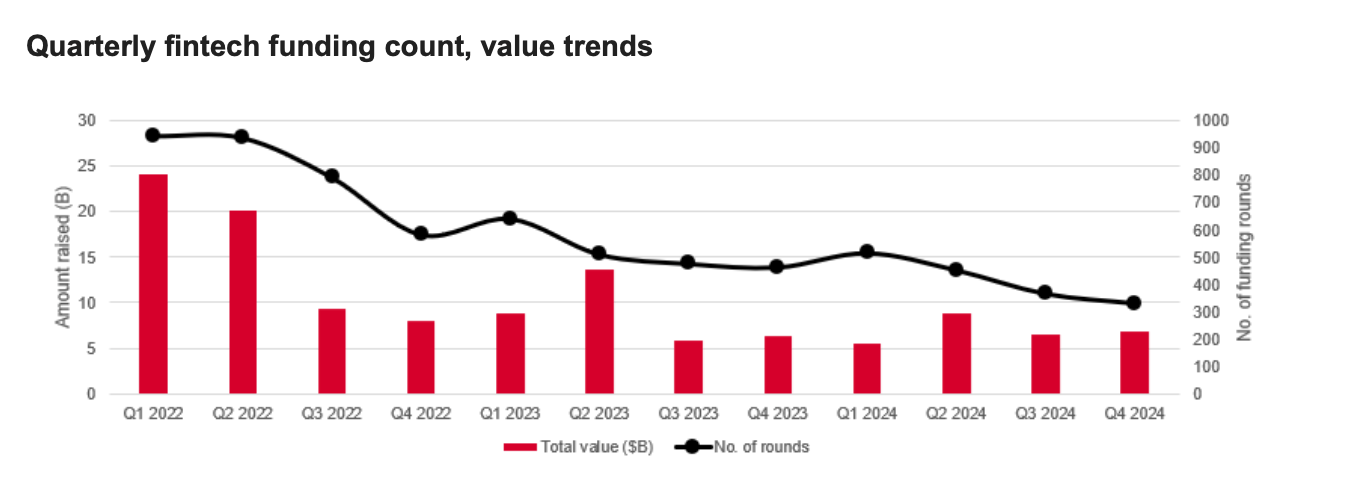

The amount of funding raised by fintech startups fell 20% to $28 billion in 2024, according to a recent report from S&P Global Market Intelligence. An uptick in megadeals worth over $100 million in the second half of the year, however, points to signs of increased optimism heading into 2025. Many of the largest funding rounds involved capital-intensive business models like digital lending, attracting private equity firms, hedge funds, and traditional financial institutions rather than just venture capitalists from Silicon Valley.

Funding declined markedly in the U.S., however, dropping 40% from $17 billion to $10 billion. Money raised in the U.K. surged 46% to $4 billion, while India, Singapore, and Brazil were the only other markets to exceed the $1 billion mark.

“A pipeline of high-profile fintech IPOs could inject much-needed liquidity into the ecosystem, sparking a renewed cycle of funding activity,” said Sampath Sharma Nariyanuri, a senior fintech research analyst at S&P Global Market Intelligence. “As venture capital firms reassess their portfolios, we anticipate a shift toward underserved segments and regions, positioning fintech sectors and geographies that underperformed in 2024 for a comeback.”

Going deeper

“Meet the man picked to succeed Warren Buffett,” is a new feature from Fortune’s Shawn Tully. Greg Abel, who oversees all of Berkshire Hathaway’s non-insurance businesses, is set to eventually lead the greatest wealth-building machine Wall Street has ever seen. Friends say he boasts a folksy, super-likeable personality similar to Buffett (minus the showmanship), and he has won over the Oracle of Omaha by showing the same knack for building trust, spotting deals, and skirting big risks.

Overheard

“I think this will be the most important project of this era.”

—Sam Altman, CEO of OpenAI, said at the White House during the announcement of Stargate, a joint venture formed by OpenAI, Oracle, and Softbank that includes a planned $500 billion build-out of AI data centers in the U.S.