Good morning. Lee Clifford here filling in for Sheryl while she takes a rare day off.

How did so many economists get the recession signals wrong?

It wasn’t so long ago that the world (as well as the media) was awash in recession predictions, stock market crash predictions, doomsayer narratives. Now here we are, with many investors and certainly CFOs feeling pleased but puzzled as the economy continues to bounce along.

Ryan Boyle, chief U.S. economist for Northern Trust, tackled the topic recently, highlighting widely followed “recession red flags” that turned out to be false flags. Boyle writes that economists “have developed a series of basic signals that can be harbingers of a downturn. Their track record was never perfect, but they have really failed us during the past two years.”

The three culprits?

GDP

Boyle writes that there were in fact two consecutive quarters of contraction in U.S. real GDP in the first half of 2022 which is the textbook definition of recession. However, “a broader evaluation of employment, industrial production, and spending painted a different picture,” according to Boyle. “Business cycle daters declined to declare a downturn, and their stance was justified when one of the negative GDP quarters was revised into positive territory.”

The yield curve

An inverted yield curve—where long-term rates fall below short-term rates—is a market watcher’s five-alarm fire, and every postwar recession has been preceded by one. But here, as Boyle writes, “the curve turned upside down in 2022, and the expansion is still going strong.” He adds that the “spread has remained positive since early September. Just this week, the 3M-10Y spread also returned to positive territory, without a recession yet.”

Temporary Help

“Falling levels of temporary help are also thought to be a bad omen,” Boyle writes. “When employers look to reduce headcount, they will usually start by cutting the temps and contractors…often followed by reduction of full-time employees. Temporary employment has been declining since early 2022, but a reduction in permanent employment has not followed.”

This indicates to him that “more people are taking temp jobs because they want to, not as a last resort.” He added to me via email that the “Sahm rule”—coined by economist Claudia Sahm, who found that if the unemployment rate gains 0.5% from its previous year’s low, a recession is imminent—was “triggered with July’s employment report, but then switched off in October as the unemployment rate stayed below July’s 4.3% reading. That’s not typical.” He explained that usually, “once employment starts rising, it keeps going upward. This appears to have been the Sahm Rule’s first false alarm.”

I asked Boyle with these signals having misfired, what he’s watching in the months ahead. His answer: any signs of distress in the labor market.

“Even as inflation and shortages made the economy feel distorted, consumers remained confident in their job prospects, and they kept spending,” he told me. Going forward, “I am most attuned to layoffs. We have seen very low levels of turnover as employers have held onto their workers.”

“Layoff announcements could turn the tide,” Boyle added. “Even workers who keep their jobs may become more cautious about spending, slowing down consumption.”

The recession watch conversation reminded me of a funny moment last year when I was interviewing economist Austan Goolsbee on stage at the University of Chicago. I had asked him what he saw coming in the year ahead. His answer amused me. “Why do people keep asking economists to predict the future?” he said. “We can’t even predict the past.”

The next CFO Daily will be in your inbox on Friday, Dec. 27. Happy Holidays.

Lee Clifford

Lee.Clifford@fortune.com

The following sections of CFO Daily were curated by Greg McKenna.

Leaderboard

Mike Hug will retire as CFO of Travel + Leisure Co. (NYSE: TNL) after more than 25 years at the company. A search for his replacement is underway and will include both internal and external candidates, the company said. Hug will continue to serve as CFO until the company finds a successor or June 1, whatever comes first. He’s served as CFO of the company since it was spun off from Wyndham Hotels & Resorts in 2018 and previously held the same role of the company’s timeshare business.

Clarence Philipneri was appointed CFO of Salute, a global data lifecycle services company, effective Jan. 6. He has previously served as global head of finance operations at commercial real estate giant Jones Lang LaSalle, where he was also the CFO of its Americas work dynamics division. He has also held various leadership roles at CBRE in the real estate company’s global data center solutions group.

Big Deal

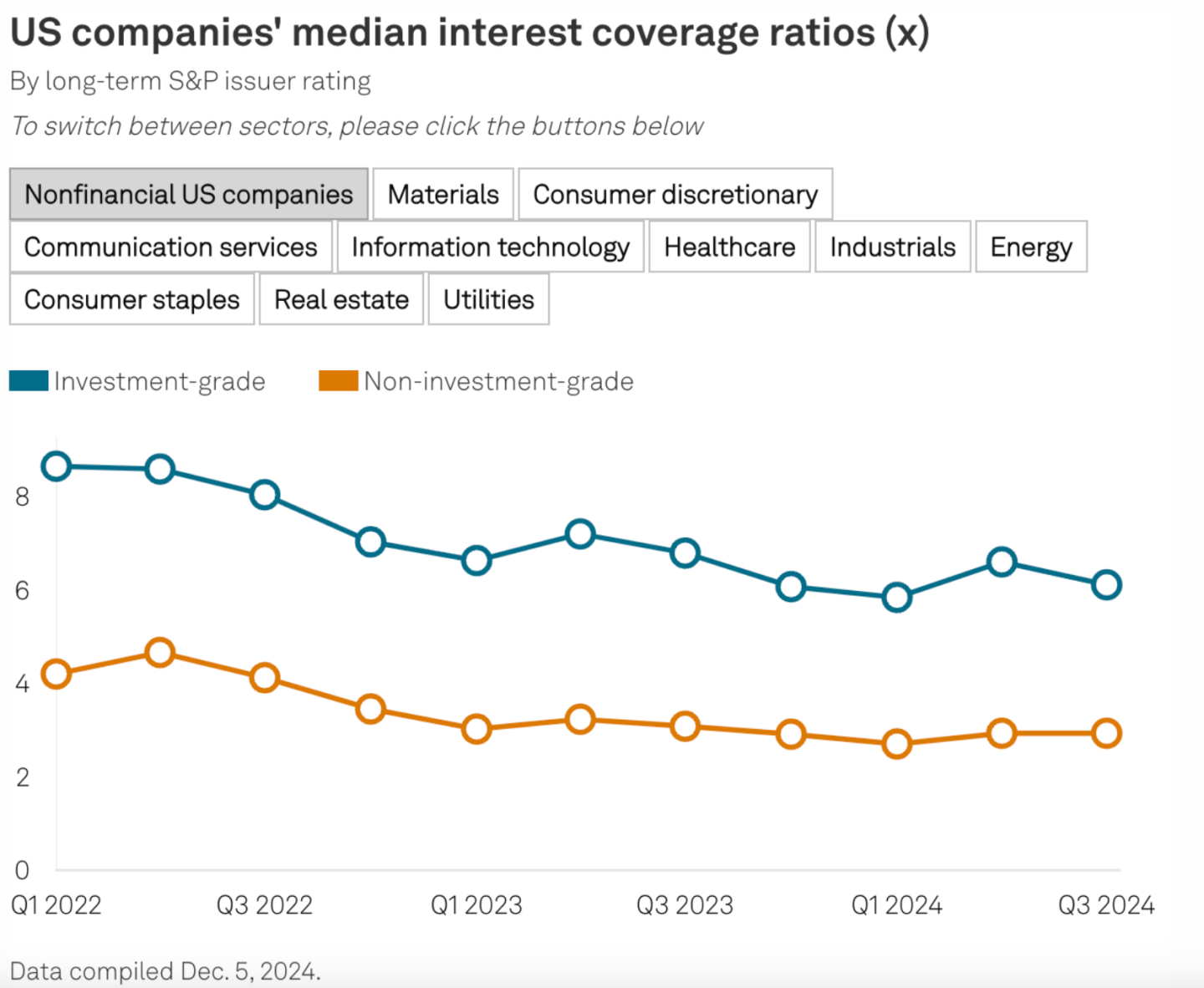

Despite three interest rate cuts from the Federal Reserve, beginning with a half-point reduction in September, companies are still contending with elevated borrowing costs. The strength of U.S. investment-grade corporate earnings relative to interest liabilities weakened in the third quarter, according to a new report from S&P Global Market Intelligence.

Earnings before interest and tax were able to cover debt-interest payments 6.12 times for the median U.S. nonfinancial investment-grade company in Q3, falling from 6.61 last quarter. Six of the 10 sectors tracked by S&P Global Ratings experienced a decline in the metric. The ratio for the energy sector dropped the most, plunging 31% to 5.12, while the real estate sector had the lowest median ratio at 2.56.

Going deeper

How can we upskill Gen Z as fast as we train AI? is a new report from EY. Those born between 1997 and 2007 will have long-term exposure to the impact of artificial intelligence in the workplace, but a new global survey conducted by the firm suggests Gen Z individuals may be overconfident about their ability to use and evaluate AI tools, underlining the need for policymakers, educators, and businesses to build consensus about increasing the AI literacy of future workers.

Overheard

“There’s the potential that if Amazon or AWS doesn’t innovate in AI at a faster speed, they are gonna stay behind in the market. For a lot of people in the industry when they think of AI, AWS is not gonna be the 1st, 2nd, or 3rd choice. They have a lot of ground to cover and I think that’s partly why it’s getting a lot of attention internally.”

Cate Ciccolone, a former senior security consultant at Amazon Web Services who left in the spring, told Fortune a month before former intern Matt Garman appeared at the cloud giant’s annual conference for the first time as CEO.