Good morning. The CFO’s office plays a vital role in compliance with the U.S. Securities and Exchange Commission’s (SEC) mandate to standardize climate-risk disclosures. Under the rules, public companies are required to report climate risks that may have a material impact on business strategy, results of operation, or financial condition—for now at least. But under the incoming administration, many anticipate the SEC will rescind or decline to enforce these disclosure rules.

The current SEC Chair Gary Gensler, who introduced the climate disclosure mandates, will step down on Jan. 20. He is expected to be succeeded by President-elect Donald Trump’s nominee, Paul Atkins, who is a veteran regulator with a libertarian outlet, Fortune reported.

For more insight, I talked with Kristina Wyatt, deputy general counsel and chief sustainability officer at Persefoni, a climate management and carbon reporting platform for enterprises. Wyatt was formerly senior counsel for climate and ESG at the SEC.

“I think it’s probably more likely than not that the SEC will in some manner rescind the climate rules, potentially through the litigation process as part of the settlement,” she said. Atkins is “a very smart guy” and a “good person,” though his bent is more toward “concern about the cost to companies of regulation,” she said.

Several companies filed lawsuits against the SEC the day after the agency imposed its final climate disclosure rules in March. In response, the agency stayed the implementation of the rules. The SEC had previously received considerable pushback with more than 24,000 comment letters from companies leading up to this year’s announcement of the final rules.

Although the SEC rules have been stayed and their fate is uncertain, Persefoni’s business continues to increase, Wyatt said.

“We’re certainly seeing customers come in the door looking to be able to calculate their carbon emissions, and looking to be able to make disclosures related to their climate-related financial risks,” she said.

Even if there were no climate rules, companies are well aware that they need to consider the existing baseline SEC rules, like regulation S-X, which requires a public firm to disclose financial information, Wyatt explained. So if a company is spending a material amount of money on a climate-related issue, for example, they’d potentially need to report that.

Other reasons companies might not do an about-face when it comes to reporting on carbon emissions—customer, investor, and consumer demand, Wyatt said.

“Companies will come to us and say, ‘Well, we have some interest in calculating our emissions, but we really don’t want to do anything until there’s clear regulatory guidance in the form of SEC rules,” she explained. “And so many times, they end up coming back and they say, ‘Our biggest customer is asking us to report so that they can report.”

When the SEC adopted the final rules in March, it dropped the scope 3 reporting requirement—greenhouse gas emissions that are not produced by the company itself but among its value chain.

“But it hasn’t gone away because there are other different regulatory bodies that are pushing for it,” Wyatt said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Tani Girton, EVP, CFO, and principal accounting officer at Bank of Marin Bancorp (Nasdaq: BMRC), a wholly owned subsidiary of Bank of Marin, will retire effective Jan. 31. Dave Bonaccorso, who currently serves as the bank’s treasurer, has been named her successor. Bonaccorso will assume the CFO and principal accounting officer roles on Jan. 2. He joined Bank of Marin as treasurer in August 2023. Previously, Bonaccorso was the treasurer of Rabobank, N.A. and Mechanics Bank.

Ranojoy “RJ” Hazra was named CFO at HireRight, a provider of global background screening services and workforce solutions. Hazra joins HireRight with more than 15 years of executive leadership experience in the finance and technology sectors. His most recent role was SVP and CFO of the international division at Equifax. Before that, he spent several years in various leadership positions at General Electric.

Big Deal

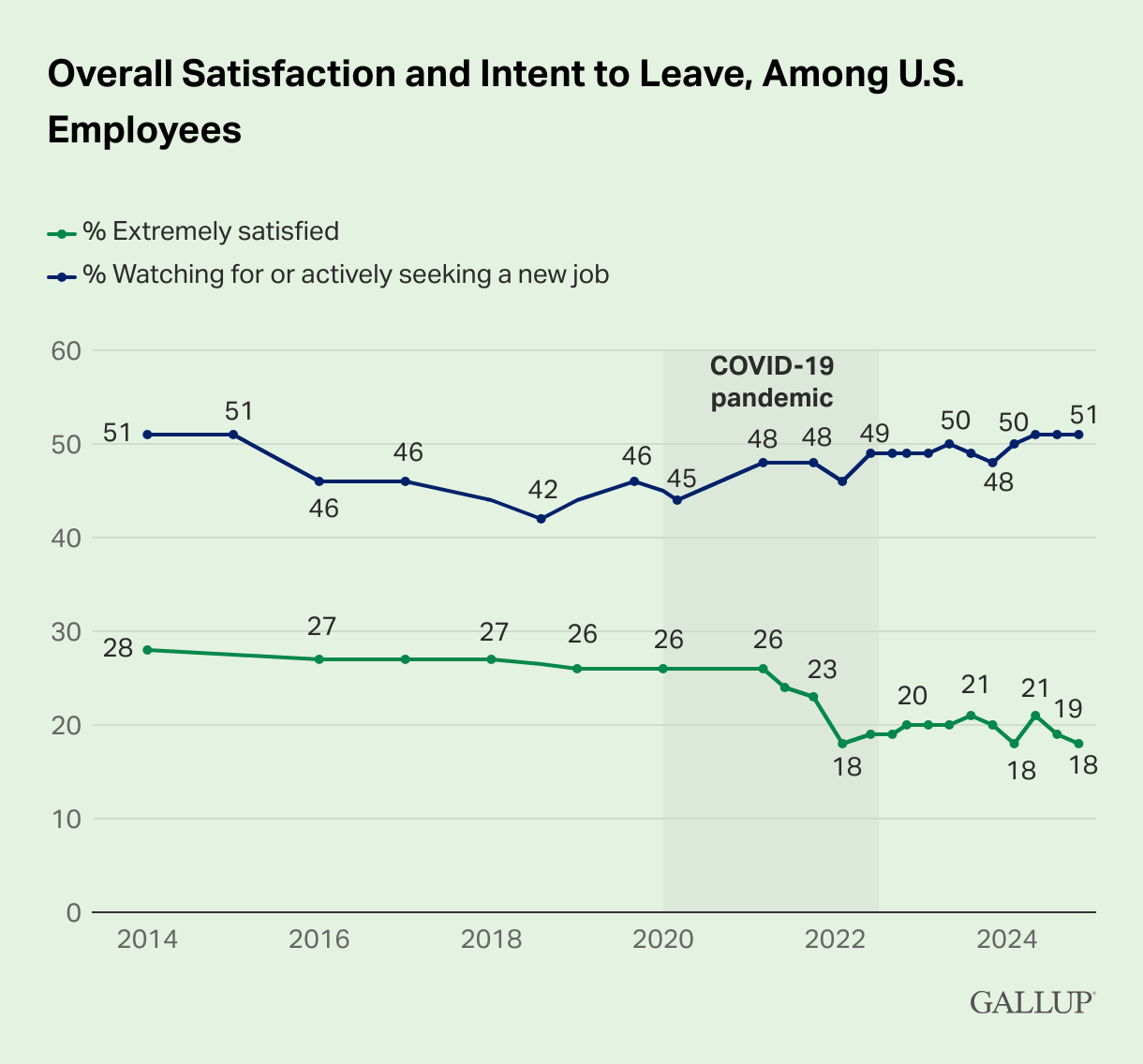

A new report by Gallup finds the rise of the “Great Detachment.” That means many frustrated employees are left feeling stuck with their discontent as they struggle to make the leap to a new employer in a cooling job market, according to Gallup. Currently, 51% of survey respondents are watching for or actively seeking a new job. Meanwhile, just 18% are extremely satisfied with their jobs.

While turnover numbers on average may have slowed, employee productivity concerns and future talent loss are hidden organizational risks, the report finds. The Great Detachment coincides with declines in two areas of employee engagement: clarity of expectations at work and feeling connected to the company’s mission and purpose, according to the report.

Going deeper

Wharton’s Future of Finance is a video series hosted by Wharton Finance Professor Itay Goldstein. In a recent episode, Goldstein is joined by Tobias Adrian, financial counselor and director of the International Monetary Fund, to discuss the regulatory challenges posed by the rapid adoption of artificial intelligence in finance.

Overheard

“I keep that to always remind me: If someone comes to you with an idea that seems small, but there’s a way to make the world just a little bit better, say yes. A lot of ideas won’t work, but the ones that do, those are really good.”

—Corning Inc. CEO Wendell Weeks explained to Fortune in an interview why he keeps in a frame in his office Thomas Edison’s $311.97 order for Corning Glass Works dated Nov. 17, 1880. The order was to produce the glass for a risky new invention of his: the lightbulb.