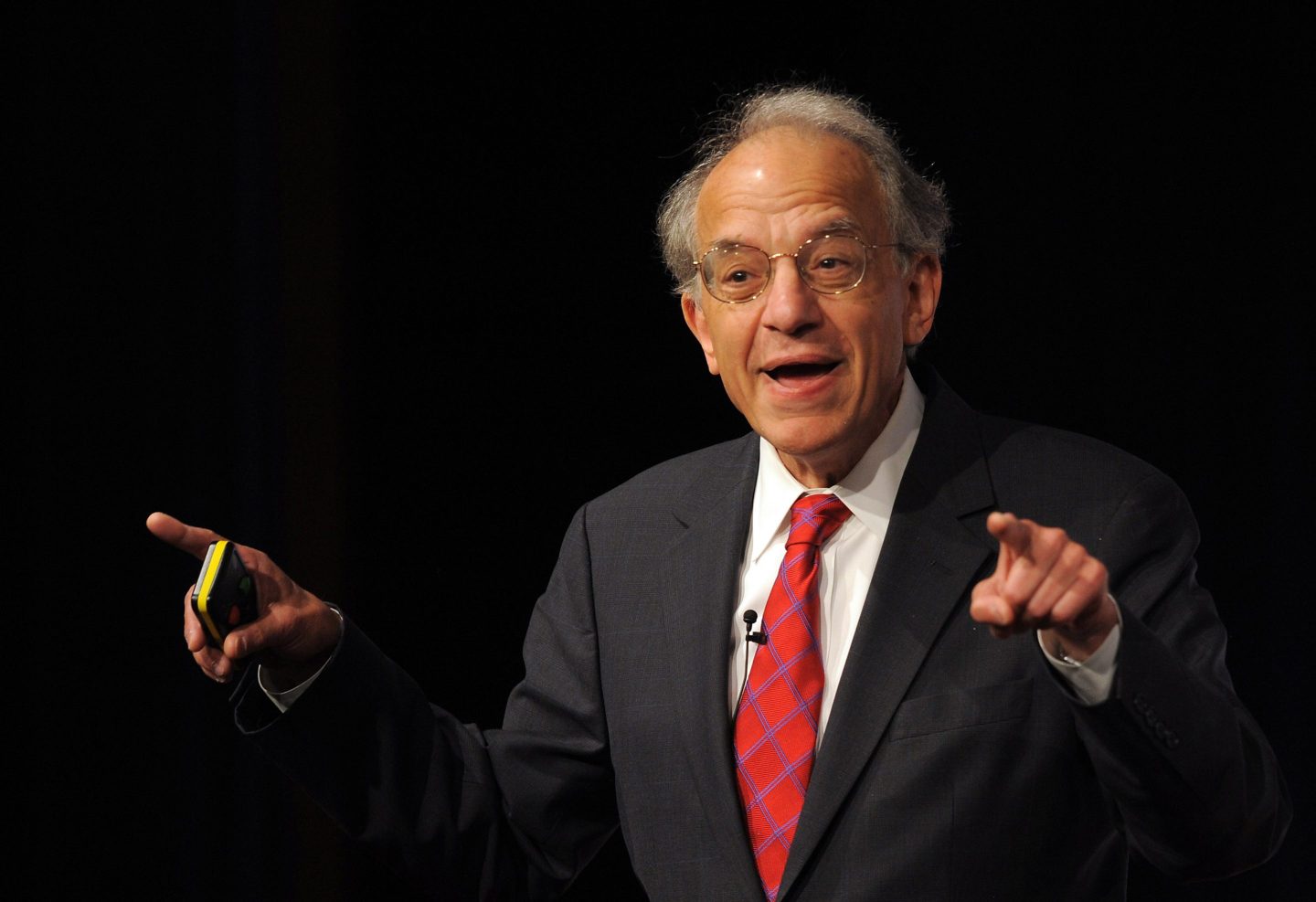

The sentiment on Wall Street may have dropped from outright optimism to something a little more realistic, but Wharton professor Jeremy Siegel remains hopeful that pockets of activity in the U.S. economy will keep it on the path away from recession.

The emeritus professor of finance at the University of Pennsylvania wrote this week that while data around jobless claims this week is “slightly concerning”—claims hit a 10-month high at 242,000—inflation is showing signs for the better.

As consumer spending continues to lose heat, the Consumer Price Index remained unexpectedly unchanged in May, offsetting fears about rising living costs putting pressure on inflation as the Fed wrangles to bring the number to 2%. All items on the index rose 3.3% for the 12 months ending in May, indicating Fed chairman Jerome Powell still has a significant—and perhaps painful—way to go yet.

The signals coming out of the U.S. economy paint a mixed picture—and Wall’s Street response reflects that, Siegel added in his weekly commentary for financial behemoth Wisdom Tree.

FOMO boost

However, the market remains boosted by one all-important behavior: fear of missing out, or FOMO. Despite speculation that artificial intelligence may be a market bubble soon to burst, shares in key players like GPU maker Nvidia continue to rocket to all-time highs.

Not wanting to miss out on even greater potential returns, investors are continuing to pile into the technology. As Siegel, who is senior economist to Wisdom Tree, writes: “The stock market’s response is mixed, with significant performance in sectors driven by artificial intelligence (AI) and tech innovations, notably NVIDIA, which has continued to capture the investor’s imagination.”

He later adds: “The market is navigating through a complex set of economic indicators. We believe investors should remain vigilant and diversified in their investment approaches, particularly considering the narrow focus of recent market rallies around specific tech stocks, which may not be sustainable in the long.

“FOMO still rules the market for AI-related stocks.”

Whether or not the FOMO will be justified remains to be seen. Nvidia stock is up 172% at the time of writing for this year alone, while the Roundhill Magnificent Seven—which offers equal weighting across stock market giants Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—is up 51% over the past year.

While the likes of famed investor Jeremy Grantham—the cofounder of investment giant GMO—are concerned AI is a bubble, or indeed a “bubble within a bubble,” investors remain largely bullish on the technology.

At Goldman Sachs’s Asset Management Investment Forum held in London last month, investors were asked if AI was a game changer or hype. The vast majority, 76%, believed it was a game changer while just 24% believed it was hype.

The bigger picture

While AI stocks are outperforming their small-cap peers, Siegel says a further boost will come when the Fed begin cutting rates.

He explains: “Although there’s a palpable concern about a potential slowdown or even a recession, I remain optimistic that we’re not on that path yet. Small caps and some of the value sectors need the Fed to start cutting rates to begin a more meaningful uptrend in these stocks.

“Looking ahead, while there was a lot of discussion on the Fed’s dot plot, the Federal Open Market Committee (FOMC) members have no idea what their policy will be as they are totally data dependent. Fed cuts are contingent on continued positive inflation trajectories that I expect to materialize.”

According to Minneapolis Federal Reserve President Neel Kashkari, Wall Street could be holding out until the end of the year for such a move. Speaking to CBS’s Face The Nation, Kashkari said Bank of America’s call that the one cut this year will come in December was “reasonable.”

He added: “We need to see more evidence to convince us that inflation is well on [its] way back down to 2%.”