When Miami-based 777 Partners agreed to buy the Premier League soccer club Everton in September, the deal was considered a lifeline for the loss-making legacy team. But the private investment firm’s dealings soon came under scrutiny, setting off a cascade of lawsuits and allegations.

Now, one of 777’s lenders is accusing the firm and its primary backer of running a nine-figure fraud scheme for years “in a seemingly never-ending cycle of ‘robbing Peter to pay Paul.’”

In a lawsuit filed Friday in New York federal court, asset management company Leadenhall Capital Partners and its life insurance arm said they provided 777 with more than $600 million in funds. Leadenhall alleged that roughly $350 million that 777 had pledged as collateral for the loan either did not exist, were not in 777’s control, or had already been promised to other lenders.

The lawsuit named a number of 777 companies as defendants, and called out 777 cofounders Josh Wander and Steve Pasko, claiming they were “operating a giant shell game at best, and an outright Ponzi scheme at worst.”

The firm “takes money in from investors and lenders and shuffles it around to various money-losing alter egos in the enterprise to disguise their true financial condition,” Leadenhall’s filing continued.

Leadenhall’s complaint is the latest in a series of scandals involving the Miami-based firm. 777 Partners declined Fortune’s request for comment; Everton FC did not respond to a request for comment.

Who’s behind 777?

In addition to their role as cofounders of 777, LinkedIn lists Wander and Pasko as the respective founder and CEO of SuttonPark Capital, a “wholesale aggregator and servicer of structured settlements.” Wander graduated from the University of Florida in 2003, according to his LinkedIn profile. He has served as director of acquisitions at Structured Asset Funding and president at First Sustainable LLC—two companies with little online presence.

Pasko has over 30 years of experience in financial services, according to SuttonPark’s website, and has held managing director positions at Natixis Capital Markets and Bankers Trust. 777 began in 2015 following a management buyout from PennantPark, according to the company.

In the filing, Leadenhall said it discovered that all of 777’s assets were already pledged to A-CAP, a New York-based insurance group holding company and “the Wizard of Oz behind the 777 Partners’ curtain.” A-CAP, led by chairman and CEO Kenneth King, managed $4.9 billion in assets as of December 2021, according to its website.

“A-CAP, similar to Leadenhall Capital, serves as a lender to 777—there are no ownership ties,” an A-CAP representative told The New York Times. “The key distinction lies in the fact that A-CAP holds senior rights to collateral associated with 777.”

A-CAP did not respond to Fortune’s request for comment.

No wins for Everton

Liverpool-based Everton, established in 1878, joined the ranks of billionaire-owned Premier League teams when British-Iranian businessman Farhad Moshiri became its majority shareholder in February 2016.

But the club has struggled both on both league standings and balance sheets in recent years—it reported an $112.5 million loss for the 2022-2023 season—almost double from the previous year.

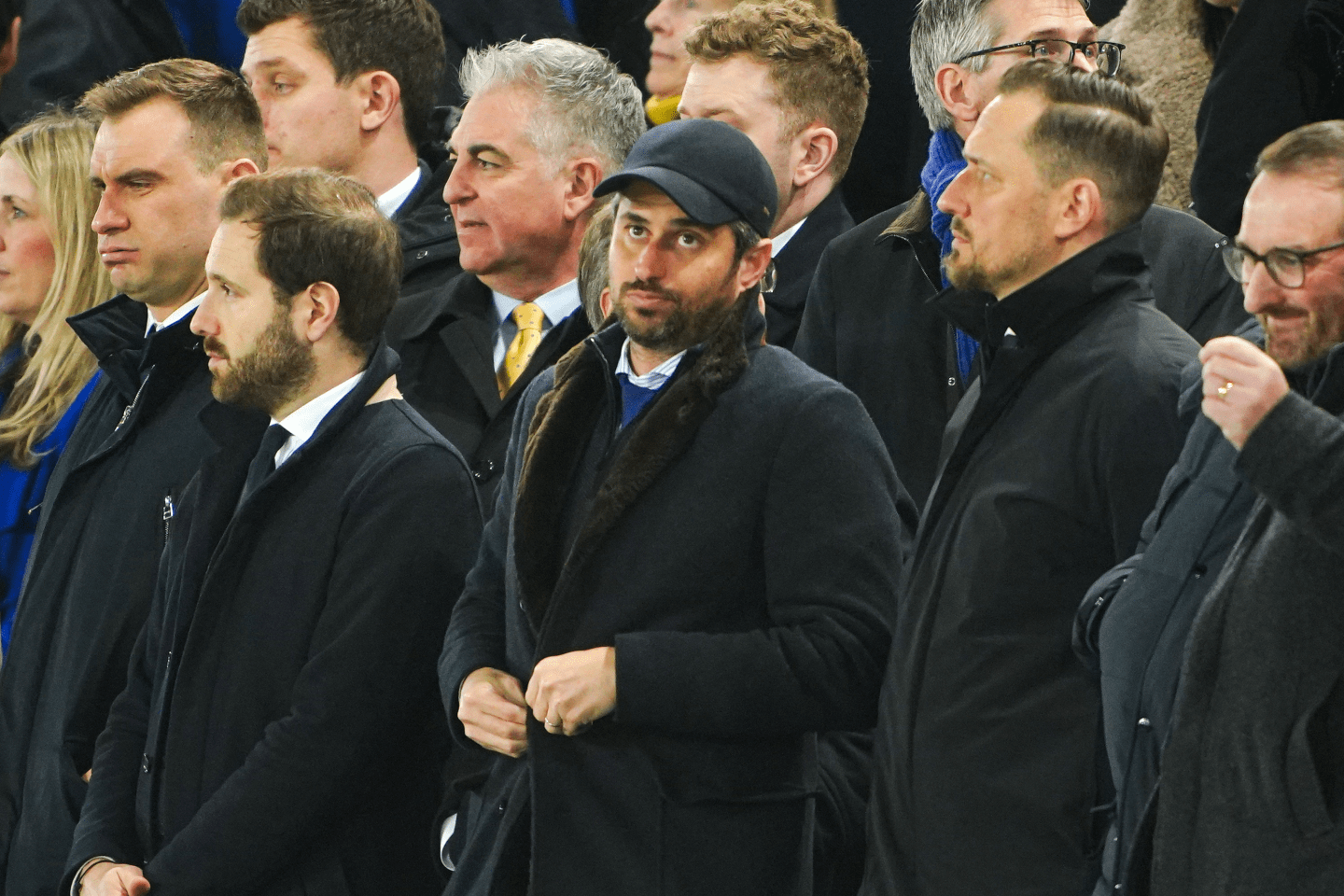

777 Partners agreed to buy Everton in September 2023 by purchasing Moshiri’s 94.1% stake in a deal reportedly worth more than $685 million. The deal was approved by the U.K.’s Financial Conduct Authority and the Football Association—but not by the Premier League.

In March, the league asked 777 to provide proof that it had the funds required to purchase Moshiri’s stake, complete the building of a new stadium, and meet operating costs. 777 did not publicly respond to the league’s request. Last week, Everton called in restructuring and insolvency advisors while looking for alternative financing, according to The Guardian.

Amid fan protests against 777 and its owners, the Everton Shareholders’ Association issued a statement Tuesday slamming the football club and Moshiri, calling the takeover a “farce.”

“In the absence of the Premier League making a timely decision we insist that the Everton Board, and Farhad Moshiri in particular, stop this damaging process now and recognise that 777 Partners are not at this time fit-and-proper prospective owners of Everton Football Club,” the association said in the statement.

Soccer, airlines, and … reinsurance?

On its website, 777 Partners describes itself as an “alternative investment platform that helps bold entrepreneurs transform visions into enduring value.” It owns or has stakes in sports teams, airlines, and fintech companies—but several of 777’s portfolio companies have accused it of unpaid debts.

Leadenhall’s complaint states that 777 and its affiliates have been named in “no less than sixteen lawsuits generally concerning unpaid debts and collectively demanding more than $130 million.”

The alleged debts transcend continents: In March, executives at Vasco da Gama, a Brazilian soccer team owned by 777, accused the firm of delaying payments and causing problems for the team. On Monday, Belgian club Standard de Liège called for the seizure of 777’s assets in the country, alleging that it was behind on players’ salaries.

777 is also a shareholder in two low-cost airlines—Flair in Canada, and Bonza in Australia. Flair owed $1.8 million to aircraft lessors as of January. Bonza entered voluntary administration on April 30, and lawyers now allege that Bonza owes money to 60,000 customers and hundreds of staff.

While Leadenhall claims 777 was funded by a “never-ending cycle” of borrowing, a Semafor report from November suggests the source of its funds could lie in Bermuda, where 777’s reinsurance unit is based. According to Semafor, 777 used consumer funds from its reinsurance arm, 777 Re, to fund its soccer and airline investments. It also used customers’ cash to invest $22 million into 777 Partners itself.

Credit rating agency AM Best downgraded 777 Re in February, citing its “very weak” balance sheet, “as well as its marginal operating performance, very limited business profile and weak enterprise risk management.” As U.S. regulators turn their gaze onto offshore reinsurance companies, the 777 scandal could ripple across not only the sports world—but the insurance industry as well.