Forecasts for U.S. home prices suddenly look a lot different compared to just a month ago, according to Freddie Mac’s latest outlook.

Prices will increase only 0.5% in 2024 and 2025, the mortgage giant said Thursday. That’s down sharply from its forecast in March, when it predicted home prices would rise 2.5% in 2024 and 2.1% 2025. The view for 2024 has suffered especially compared to the start of the year, when prices were seen rising 2.8%.

To be sure, a less aggressive trajectory for home-price gains sounds like good news for prospective buyers. But when combined with still-limited inventory and higher-for-longer rates, the overall picture isn’t a major improvement.

“While housing demand is solid due to a large share of millennial first-time homebuyers looking to buy homes, they are challenged by high mortgage rates and a lack of homes available for sale,” Freddie Mac said in its April statement. “We expect these challenges to persist in 2024 mainly in the absence of significant rate cuts, which will keep the rate-lock effect in place and keep total home sales volume below 5 million in 2024.”

With the economic landscape holding steady, the main difference over the past month is in the rates outlook and when the Federal Reserve may start easing.

A string of hotter-than-expected inflation readings to start the year gradually eroded hopes that Fed rate cuts would be imminent. That sent U.S. bond yields and mortgage rates steadily higher.

Then, on Tuesday, Fed Chair Jerome Powell confirmed Wall Street’s fears by saying that because of the robust labor market and remaining progress required on inflation, rates would stay where they are “for as long as needed.”

Treasury yields climbed even higher, with the 10-year rate topping 4.6%, sending other borrowing costs up too. The 30-year fixed rate mortgage surged past 7% for the first time this year, according to Freddie Mac’s reading on Thursday.

Those developments over the past month appeared to be the major catalyst for Freddie Mac’s big downgrade in its housing market outlook.

In March, it predicted Fed rate cuts could begin as soon as the summer, with mortgage rates staying above 6.5% through the second quarter then drifting lower in the latter half of the year. While inventory would still be tight, “more first-time homebuyers continue to flood the housing market” and push home prices up.

Those predictions have been removed from April’s outlook. Instead, Freddie Mac said the Fed is now in “wait and see” mode before it starts easing, and refrained from offering more specific guidance on rates. “We therefore expect mortgage rates to remain elevated for longer.”

The new forecast comes as high home prices and mortgage rates have kept many Americans away from ownership. The cost of owning a home is officially the highest on record, Redfin said recently.

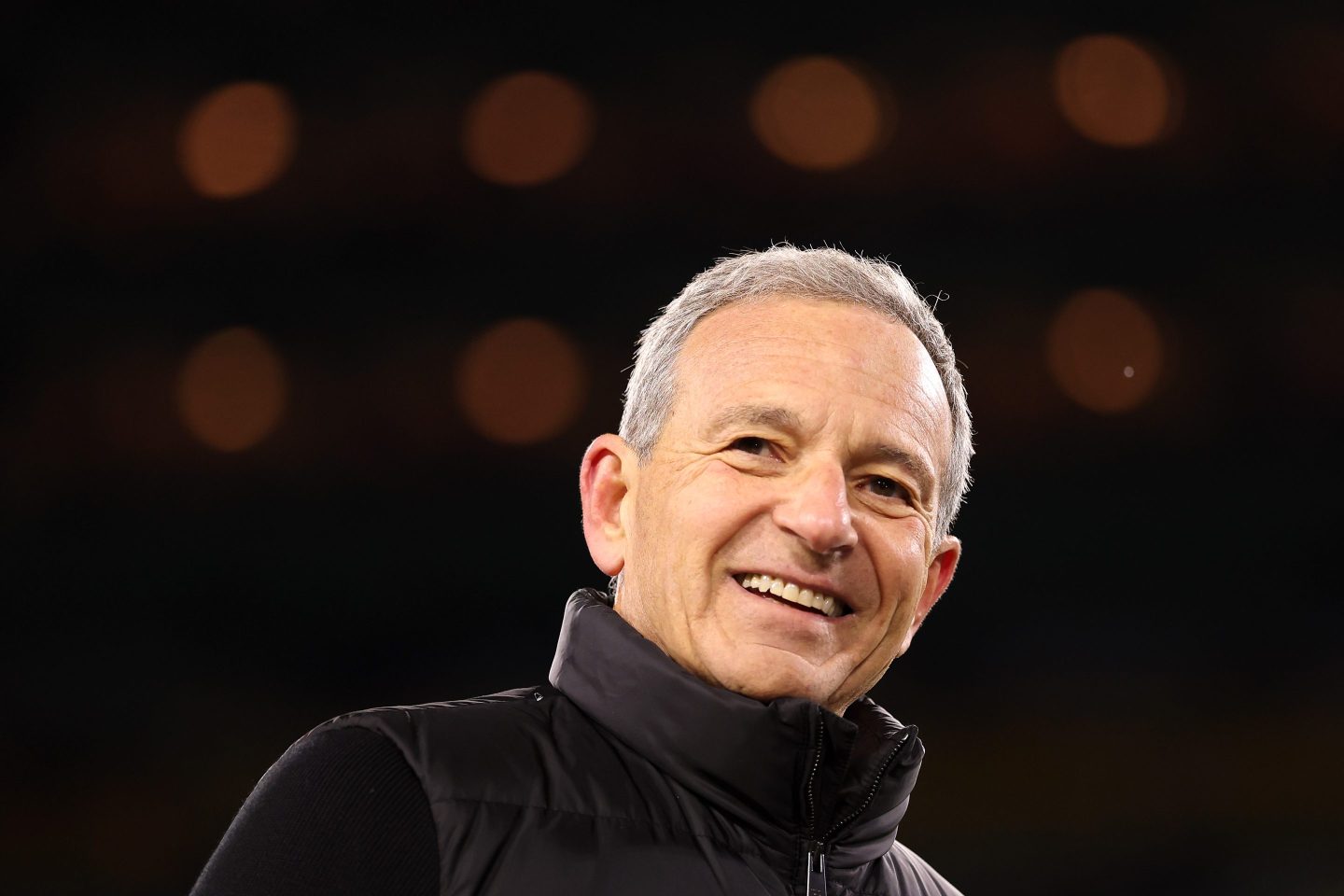

Redfin CEO Glenn Kelman said would-be buyers who held out last year are tired of waiting, as millennials who delayed starting a family can only wait so long. He said he’s never seen anything like it, calling it the “worst situation” for the housing market.

“Housing is in this recession, and the rest of the economy is booming,” Kelman said.