President Joe Biden said Monday that more than 30 million borrowers would see “life-changing” relief from his new plan to ease their student loan debt burdens, a fresh attempt by the Democratic president to follow through on a campaign pledge that could buoy his standing with younger voters.

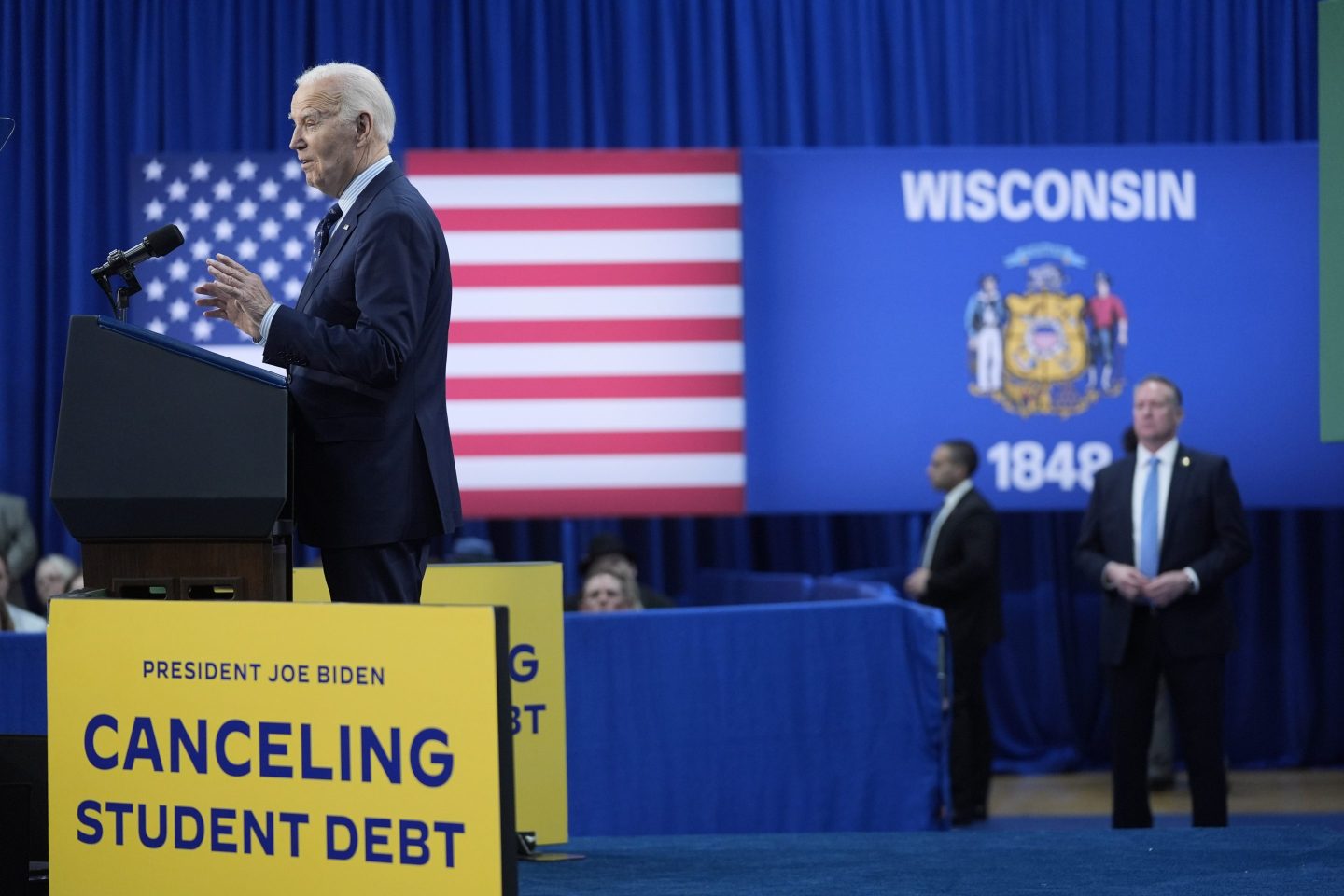

He detailed the initiative, which has been in the works for months, during a trip to Wisconsin, one of a handful of battleground states that could decide the outcome of Biden’s likely November rematch with Donald Trump, the presumptive Republican nominee.

Biden said he wanted to “give everybody a fair shot” and the “freedom to chase their dreams” as he lamented the rising cost of higher education.

“Even when they work hard and pay their student loans, their debt increases and not diminishes,” he said. “Too many people feel the strain and stress, wondering if they can get married, have their first child, start a family, because even if they get by, they still have this crushing, crushing debt.”

Biden’s trip, which included a stop at a Chicago fundraiser on the way back to Washington, comes a week after primary voting in Wisconsin highlighted political weaknesses for him as he prepares for the general election.

More than 48,000 Democratic voters chose “uninstructed” instead of Biden, more than double his narrow margin of victory in the state in 2020.

Trump also saw a significant number of defections during the state’s primary, with nearly 119,000 Republicans voting for someone other than him.

But Biden’s results, which echoed similar protest votes in states like Michigan and Minnesota, have rattled Democrats who are eager to solidify the coalition that catapulted him into the White House in the first place.

A critical fracture has been the Israel-Hamas war. Younger voters are more likely to disapprove of Biden’s enduring support for Israel’s military operation in Gaza, which has caused heavy casualties among Palestinian civilians.

Concerns about the war have spread throughout the Madison area, said Democratic Rep Mark Pocan, who represents the city. Pocan said he was “surprised to see the intensity on the issue” from all ages of voters, and he wanted Biden to be aware.

“I just want to make sure he knows that if we’re going to have a problem, that could be the problem in Wisconsin,” Pocan said.

Some young voters have been impatient with Biden’s attempts to wipe away student loan debt. The Supreme Court last year foiled his first attempt to forgive hundreds of billions of dollars in loans, a decision that Biden called a “mistake.”

Since then, the White House has pursued debt relief through other targeted initiatives, including those for public service workers and low-income borrowers. Administration officials said they have canceled $144 billion in student loans for almost 4 million Americans.

At the same time, the Department of Education has been working on a more expansive plan to replace Biden’s original effort. Monday’s announcement was an opportunity to energize young voters whose support Biden will need to defeat Trump in November.

Vice President Kamala Harris went to Pennsylvania, another battleground state, on Monday to promote debt relief in a meeting with city and school employees in Philadelphia.

“You shouldn’t have to make a decision whether you serve or be able to pay your bills,” she said.

Republicans said Biden’s plan shifts the financial burden of college tuition onto taxpayers who didn’t take out loans to attend school, and Kris Kobach, the Republican attorney general in Kansas, accused him of trying to twist the law “beyond recognition.”

The Job Creators Network, a conservative advocacy group that challenged Biden’s original plan, is considering legal action as well. The organization is backed by Bernie Marcus, a Republican donor who is also hosting a fundraiser for Trump in Atlanta on Wednesday. Trump described Biden’s debt relief initiative as an “election-enhancing money grab” two years ago.

Biden’s new plan would expand federal student loan relief to five new categories of borrowers through the Higher Education Act, which administration officials believe puts it on a stronger legal footing than the sweeping proposal that was killed by a 6-3 court majority last year.

The plan is smaller and more targeted than Biden’s original plan, which would have canceled up to $20,000 in loans for more than 40 million borrowers. The new plan would cancel some or all federal student loans for more than 30 million Americans, the White House said. The Education Department plans to issue a formal proposal in the coming months, with plans to start implementing parts of the plan as early as this fall.

The plan’s widest-reaching benefit would cancel up to $20,000 in interest for borrowers who have seen their balance grow beyond its original amount due to what Biden described as “runaway” interest. That part of the plan would forgive at least some unpaid interest for an estimated 25 million borrowers, with 23 million getting all their interest erased, according to the White House.

An additional 2 million borrowers would automatically have their loans canceled because they’re eligible but have not applied for other forgiveness programs, such as Public Service Loan Forgiveness.

Borrowers who have been repaying their undergraduate student loans for at least 20 years would be eligible to have any remaining debt canceled, along with those repaying graduate school loans for 25 years or more.

The plan would forgive debt for those who were in college programs deemed to have “low financial value.” It’s meant to help those who were in programs that ended up becoming ineligible to receive federal student aid or programs found to have cheated students.

A final category would cancel debt for borrowers facing financial hardship.