Whenever Principal Financial chief information officer Kathy Kay wants to tackle her company’s tech debt—the work required to upgrade, replace, and eliminate redundant and obsolete technology—the company’s chief financial officer always finds funding.

It all hinges on making a strong case for the extra spending.

“If you’re gonna say, ‘I just need to get rid of this tech debt because I want this new stuff,’ and you can’t articulate a business benefit, no CFO is going to fund that,” she says.

The 145-year-old insurance company has needed a lot of tech investment lately to tear down the walls between its many business units. Historically, customers would have to speak to multiple agents to get the help they needed for retirement services, benefits, and asset management. A retirement services agent, for example, had no way of knowing if the client was also an investments customer. Inevitably, many customers ended up frustrated.

To fix the problem, Principal ripped out the contact center tools and systems that it built to separately serve each division. In its place, the company developed new technology that gave all agents the same tools and access to customer information to make talking to clients easier.

The marketing department underwent a similar tech upgrade to give its staff more intel on how colleagues in other divisions had previously talked to customers. The plan included using Salesforce Marketing Cloud to better share information about the products Principal had already sold to customers or that they may want to add on, and how to steer conversations with clients based on their prior responses.

“If you are listening to your customers, it will drive how you should run and organize within your company,” says Kay. “It should drive your strategy and that would enable a CIO to think about the technology implications.”

As part of its tech overhaul, Principal must still shut down over 200 different applications, Kay says. Other systems can remain but will need to be upgraded.

When it comes to tech modernization, Principal first considers how it will fit with both the business and tech sides and will explore new solutions if what’s currently in place doesn’t align with where the company is evolving.

“You have a strategy that changes, but then you have technology that’s changing,” says Kay.

Estimates vary, but around 10% to 20% of tech budgets meant for new products are diverted to resolving the work and costs of dealing with their tech debt. Brian Woodring, chief technology officer at fintech Rocket Companies, says there are a few ways of thinking about tech debt. Is it a matter of managing all your legacy systems? Or perhaps avoiding negative outcomes, like when technology from a vendor no longer receives updates from the manufacturer. Or perhaps there’s a cost to operating a legacy system that’s no longer serving a purpose to the business.

“It’s the byproduct of delivering value that you don’t like, and you have to have a plan for managing it effectively,” says Woodring, who also serves as Rocket Mortgage’s CIO. “And that plan cannot be, ‘We’re going to take three years and do nothing but fix tech debt while the business is stagnant.’ That’s a very good way for the company to decide they need a new CIO.”

Addressing tech debt can cause some angst. One project Woodring oversaw was the replacement of an in-house, proprietary CRM with a hybrid solution that mixed some capabilities built by Rocket with some from Salesforce. “I’m not going to lie, it has been bumpy at times,” says Woodring, who acknowledged the older system was beloved by team members. But the pain was necessary because the prior system wasn’t built to evolve quickly enough to meet changing business needs.

When Ajay Sabhlok joined Rubrik in 2018, the data security firm started using a new software tool to come up with sales quotes for client orders. But because the tool was highly customized, employees were using the software in a lot of disparate ways. There were no standards in place for how the software should be used, no governance oversight to be sure those standards were met, and no clear documentation for how the tool was being used.

Two years dragged on and became four, turning a pile of tech debt into a mountain. “We were short of resources,” says Sabhlok, CIO and chief data officer at Rubrik since 2021. “We had to ignore the technical debt.”

Reflecting back, Sabhlock says the issue was a lack of governance around the software tool. Today, he has a review council in place to ask hard questions about the tech Rubrik is deploying. Tech debt is also a key topic in annual planning at Rubrik. “More recently, we started funding technical debt reduction,” says Sabhlock. “It has cost us a lot of money.”

John Kell

Send thoughts or suggestions to CIO Intelligence here.

NEWS PACKETS

AI gives freemium a try. OpenAI’s dominant hold on the global generative AI market is leading rivals large and small to offer their AI models for free, with more advanced offerings coming with a fee or paid subscription. For now, venture capital likes what it sees from these open-source AI startups, which scored $2.9 billion in venture-capital funding last year, up from $900 million in 2022, the Wall Street Journal reports citing PitchBook data. But as is often the case with freemium, turning a profit will be a challenge, especially when considering the initial costs to train their models can run into hundreds of millions of dollars.

Rivals try to chip away at Nvidia. Valued at over $2.3 trillion, Nvidia has become a Wall Street darling thanks to soaring demand for its chips by Google, Microsoft, and other makers of artificial intelligence. But Reuters reports that an alliance including Qualcomm, Google, Intel, and Samsung is angling to take on Nvidia by developing open-source software that would let AI developers make computer code that can run on any machine, rather than be locked into Nvidia’s ecosystem.

China’s risky bet on tech as economy savior. With China’s housing sector stuck in a downward spiral, the high-tech sector could give the nation a much-needed economic jolt. High tech could account for 19% of China's gross domestic product in 2026, according to Bloomberg, up from about 14.3% of GDP in 2023. But an escalating tech turf battle between Beijing and the U.S. and its allies could hurt China if restrictions are put in place on tech exports. Look no further than the high-profile example of an ongoing U.S. government threat to ban TikTok if its China-based owner doesn’t sell it.

ADOPTION CURVE

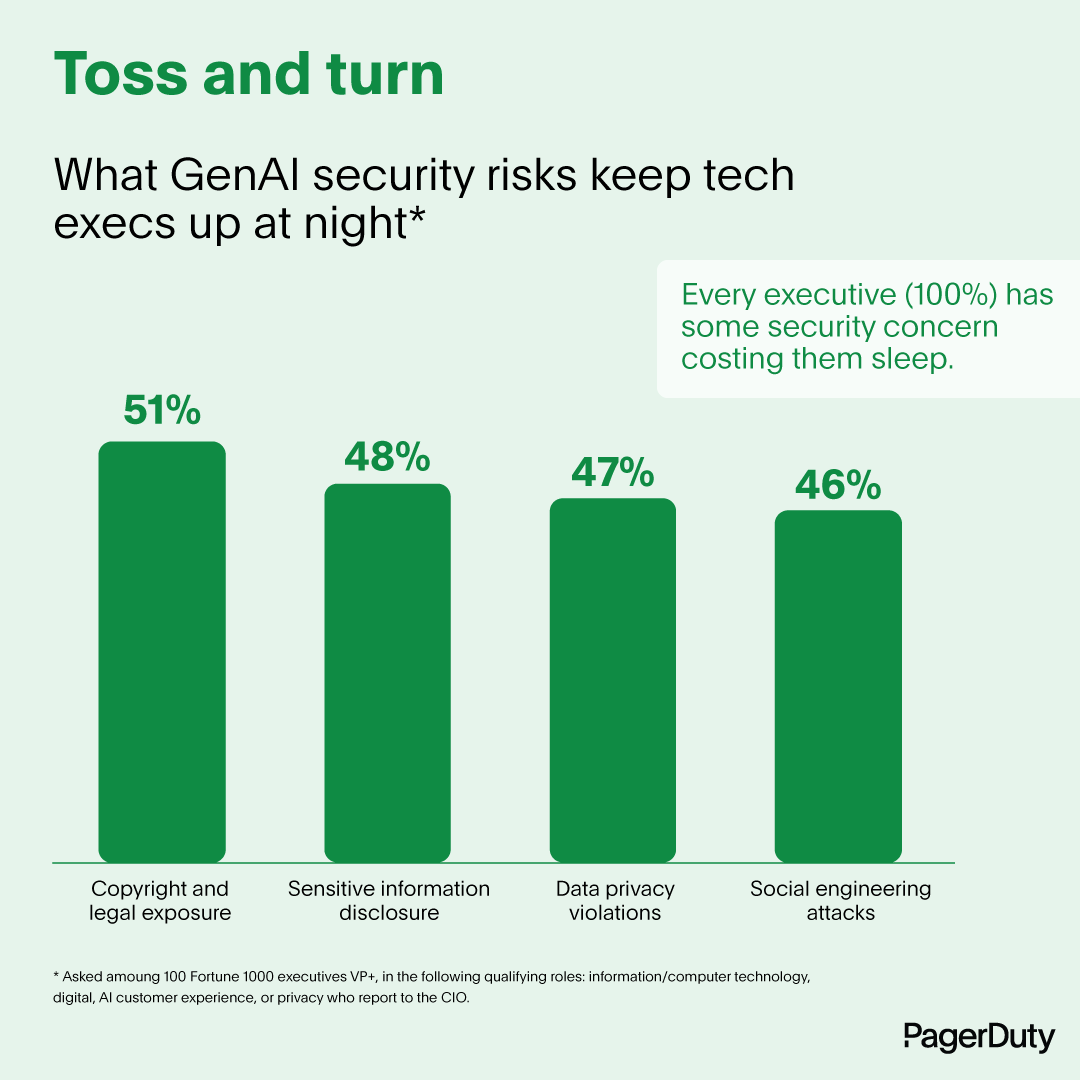

Wakefield Research surveyed 100 executives who report to a Fortune 1000 CIO and found that 100% expressed concerns about the security risks associated with generative AI. The top concern was copyright and legal exposure, followed by sensitive information disclosure and data privacy violations.

But they don't agree on how to handle the risks. Seventy-three percent believe generative AI requires a “moderate” amount of human involvement, the rest say only a low level is needed. Half believe they should only adopt the tech when the right guidelines are put in place, but nearly just as many (46%) worry they will fall behind if they don’t act fast regardless of parameters. And only 29% of companies have formal guidelines established versus 66% of leaders who say they are still setting up those policies.

JOBS RADAR

- Four Seasons announced the appointment of Sudhakar Veluru as its new executive vice president and chief information technology officer. Prior to joining luxury hotelier, Veluru was CTO at MGM Resorts International.

- UTA named Eric Iverson as CTO, joining the talent agency from Amazon MGM Studios. At UTA, Iverson will lead the agency’s technology strategy, including how AI can be used to benefit clients, reports the Hollywood Reporter.

- Leeward Renewable Energy appointed Nate Graham as chief technology officer. In the newly created role, Graham will be responsible for all aspects of the renewable energy company’s enterprise-wide IT operations, including architecture, development, and infrastructure.

- Code42 Software has named Dennis Dayman as chief information security officer. In the role, he will be responsible for leading global risk and compliance, security operations, incident response, and external and internal threat management and investigations.

- Supernal announced the appointment of David McBride as CTO, where he will lead the company’s technology strategy and vehicle development, reporting to CEO Jaiwon Shin.

- The Technology Advancement Center, a cybersecurity nonprofit, announced new leadership hires including Monty Mills as CIO and Greg Wessel as CTO. Mills spent 20 years in the U.S. Air Force, while Wessel previously worked for the National Security Agency.

- New Haven named Michael Simeone as the Connecticut city’s new CTO, after he most recently served as CIO for law firm Bendett & McHugh, P.C. Simeone takes over as CTO after hackers last June stole $5.9 million in city funds, though at least $4.7 million is expected to be recovered, New Haven Register reports.