Good morning. Do you find yourself snacking more? It’s a consumer behavior that keeps growing, according to Mondelēz International.

“It is something that is resilient,” said Luca Zaramella, EVP and CFO of the global purveyor of brands such as Oreo, Ritz, LU, Clif Bar, and Tate’s Bake Shop biscuits. “In terms of behavior, our categories in the midst of even the toughest crisis, they usually do well.”

Back in 2018, Mondelēz launched a growth strategy betting big on snacking—reshaping its portfolio to generate 90% of revenue through its core categories of chocolate, biscuits, and baked snacks. Today, about 80% of the portfolio grows through those core categories in both emerging markets and developed markets like North America, with the remaining 20% coming from other segments, including gum, candy, and prepared meals, Zaramella told me.

On Jan. 30, Mondelēz (Nasdaq: MDLZ) released Q4 and full-year 2023 earnings, the latter of which included a net revenue gain of 14.4% to $36.02 billion, which was driven both by organic growth and acquisitions such as those of Clif Bar and Ricolino. Adjusted growth profit, year over year, rose more than $2.4 billion, and some $3.7 billion was returned to shareholders.

All of this comes following months of boycotts and pressure from shareholders to exit Russia. Mondelēz, according to Reuters, has stopped advertising in Russia but maintains a strong presence there, unlike other global brands—McDonald’s and Starbucks among them—that fled after the February 2022 invasion of Ukraine.

“We have decided to stay, for now, because we believe we have an obligation towards around 3,000 employees that we have in the country,” Zaramella told me. “We have been applying a scaled down approach to the country, making it more self-sufficient, and trying to limit investments as much as possible.” That includes stopping all imports into Russia, Zaramella said. The company has reopened its two manufacturing plants in Ukraine, and also continues to support Ukraine and its people through $15 million in humanitarian relief, he said.

‘We sell brands’

The company has been investing in talent, infrastructure—including “state-of-the-art facilities”—digital technologies, and marketing, explained Zaramella, who added that when investing for growth, he observes several key metrics. “In order of importance: gross profit, market share volume, revenue, EBITDA, and cash flow.” Gross profit dollars is the most important P&L variable, he added, as it allows reinvestment protection in a virtual cycle.

“We have been investing quite a bit in terms of creating stronger ties with our consumer,” he said. “Last year alone, our advertising and consumer marketing budget went up by more than 20%. We don’t sell products, we sell brands.”

And those brands span a variety of demographics.

“Oreo is a product that appeals to 5-years-olds, but it is equally relevant to people of my age or even people that are older than me,” Zaramella explained. “Keeping a brand relevant is very critical.”

Mondelēz’s 2024 Super Bowl commercial for Oreo, its first ad for the cookie since 2013, includes Kris Jenner, which takes her back to before the reality TV show Keeping up with the Kardashians aired. (This year, 30-second Super Bowl ads sold for about $7 million.)

“I’m maybe not the regular CFO you might be thinking of that cuts costs left and right because I always say there is no free lunch,” he told me. “But I also talk to our chief marketing officer, and I tell him that when we make these types of investments, I need to make sure the investment is money well spent.”

And for Zaramella, what counts as money well spent when he’s choosing his own snack? Although partial to Cadbury chocolates, he said, “That’s an area where I’m loyal to Mondelēz, but I’m not loyal to just one product.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Christina Chiu, EVP, COO, and CFO at Empire State Realty Trust, Inc. (NYSE: ESRT) has been promoted to president. Stephen V. Horn, SVP, chief accounting officer has been promoted to EVP, CFO and chief accounting officer.

Jatin Rajput was named CFO at MPOWER Financing, a fintech firm. Rajput will step down from MPOWER's board and will be replaced by Rob Partlow, the company's previous CFO, who is retiring from full-time work and will join the board of directors. Most recently, Rajput was CFO of Deskera, a B2B SaaS platform, and founded Ad-In Ventures. Before that Rajput was a managing director at Deutsche Bank for 12 years.

Big deal

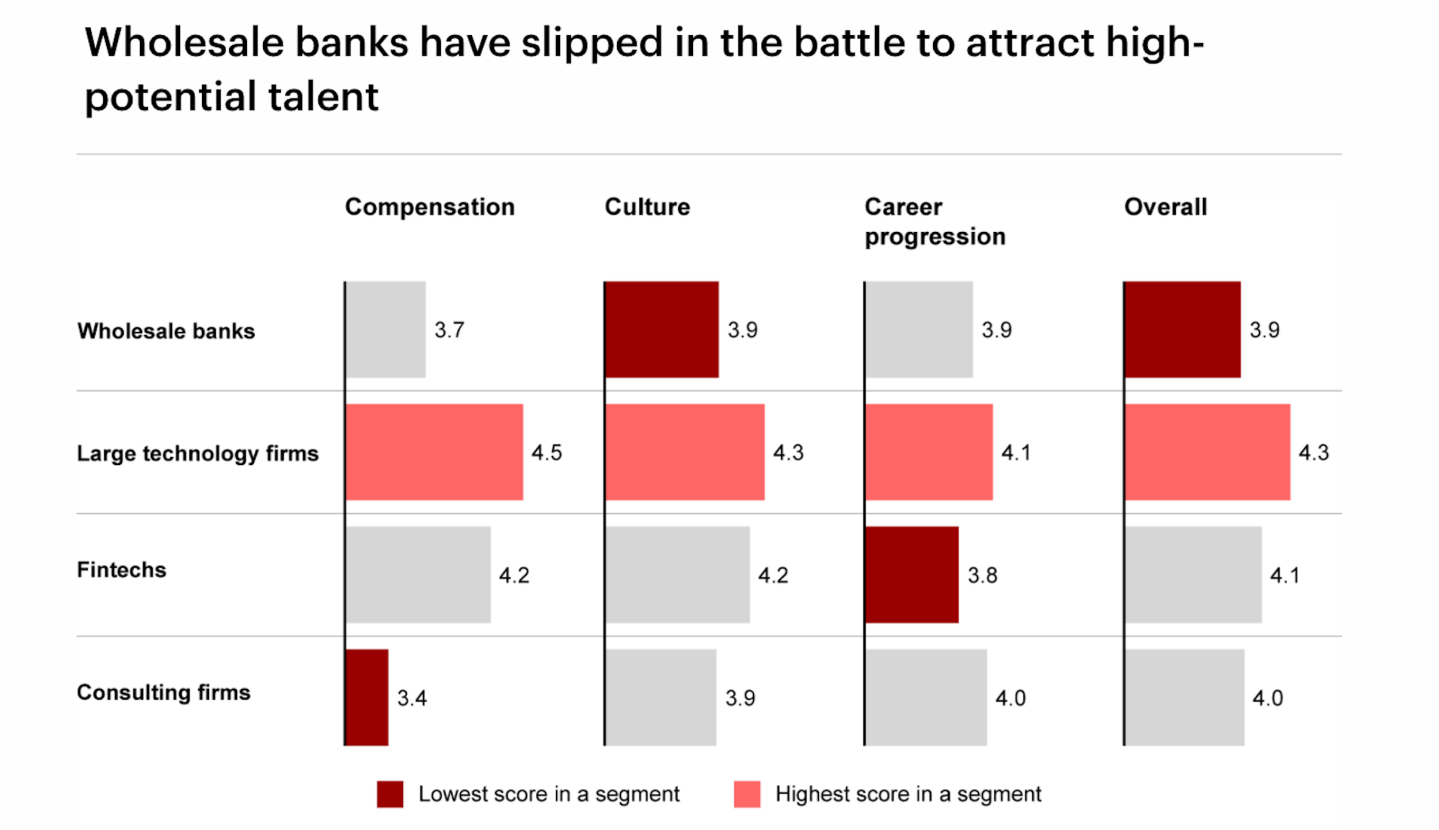

Five Themes That Will Fundamentally Change Wholesale Banking, a new report by Bain & Company, explores how slower growth raises new challenges around technology, talent, and environmental issues. A key finding is that wholesale banks (the banking business that deals with large corporate and other business customers) are losing their position for high-potential talent, "as the appeal of monetary compensation gets diluted relative to culture and career progression," according to the report.

Wholesale banks received the lowest overall score for compensation, culture, and career progression. Large technology firms received the highest overall score. Employees and recruits increasingly want a hybrid home-and-office work model, including purposeful work with learning opportunities.

Another finding is that 76% of executives interviewed said that their existing technology organization does not deliver value for money for their institution. Regarding leveraging new sources of growth and revenues, Bain's report highlights opportunities including climate-related financing and carbon markets and leveraging fast-moving advances in generative AI.

Courtesy of Bain & Company

Going deeper

"How Early Adopters of Gen AI Are Gaining Efficiencies," a new article in Wharton's business journal, shares insight from a recent Wharton conference where experts discussed how enterprises are seeing gains from generative AI in productivity and strategic planning.

Overheard

“If candidates don’t have follow-up questions that they’ve pulled through from the interview or if they just say ‘I’ve had all of my questions answered,’ that’s a red flag.”

—Jenn Bouchard, Meta’s former global head of talent, and current chief people and administration officer at the creative agency Figure 8, told Fortune in an interview. Bouchard, who has worked in talent acquisition for more than 15 years, learned that the absence of questions from candidates is generally a sign of “disinterest” in the job they’re applying for.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.