Levi Strauss & Co. slumped after announcing it will cut as much as 15% of its corporate workforce to boost efficiency. The company also gave an outlook for 2024 sales and profit that fell short of Wall Street’s expectations.

Levi, which is prioritizing direct-to-consumer sales over wholesalers, said a new, multiyear “productivity initiative” will include cost-cutting and simplify some operations. The job cuts will cause restructuring charges of $110 million to $120 million in the first quarter, the company said in its earnings statement.

The shares fell as much as 5.9% in extended New York trading after the announcement. The stock is down 4.8% this year through Thursday’s close, outpacing the decline of the Nasdaq US Small Cap Index over the same period.

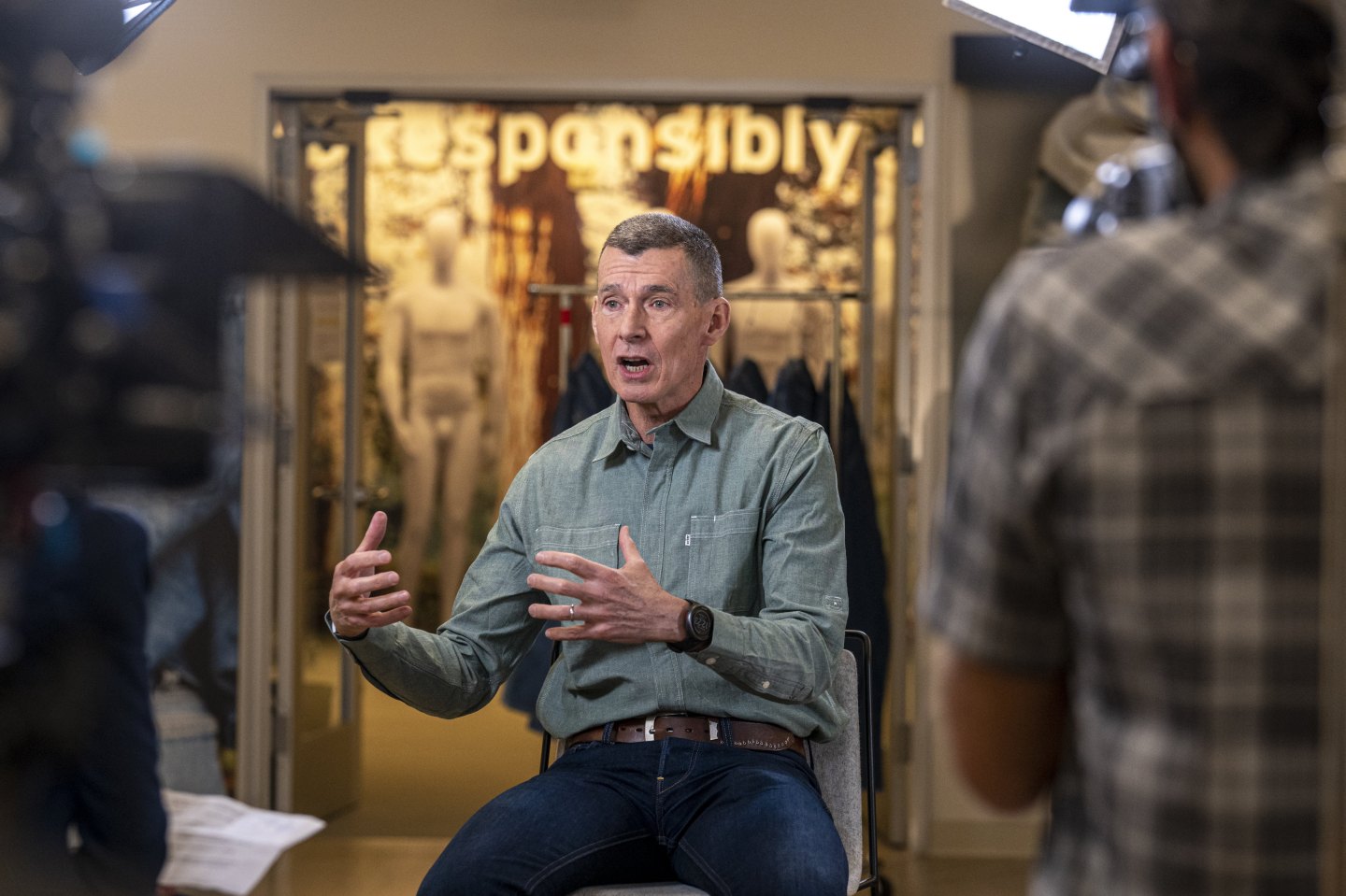

“We are creating a leaner and more agile company to support our future as a DTC retailer,” incoming Chief Executive Officer Michelle Gass said in an interview, referring to sales from Levi-owned stores and its website. She takes over from current CEO Chip Bergh on Jan. 29.

In fiscal 2024, Levi projects adjusted earnings per share of $1.15 to $1.25, below the average analyst estimate of $1.33. Net revenues are expected to rise as much as 3% from the prior year, also below Wall Street’s expectations.

Gass said the cautious outlook is the result of Levi “planning for uncertainty and volatility in the year ahead in our wholesale business.” Levi said the productivity initiative is expected to last two years and will generate net cost savings of $100 million in 2024 and fuel “long-term profitable growth.”

The company’s fiscal fourth-quarter earnings per share were slightly above the average analyst estimate. Revenue in the period, which ended Nov. 26, was just below below expectations.

Sales in the crucial holiday months of November and December were stronger than anticipated with a single-digit rise from the prior year, Chief Financial Officer Harmit Singh said.

Direct-to-consumer revenue, which makes up more than 40% of the overall business, rose 11% in the quarter. The company expects that division will generate 55% of sales in the next five to six years, Singh said.

Levi sees new products such as denim skirts, dresses and jackets bolstering the DTC business, Gass said. Sales of denim skirts and dresses rose more than 50% in the fourth quarter.

Wholesale revenue, which are sales generated by other retailers, fell 2% in the fourth quarter. That’s an improvement from the prior period, but still represents a drag on overall results. Gass said Levi is working on shifting its mix of wholesale partners and will look to rely less on off-price retailers, which generally sell at lower prices.

The company will also discontinue its Denizen brand, which is a wholesale brand sold at Target Corp.’s stores and a handful of other retailers. Gass said that Target was in agreement on the Denizen decision. Levi will continue to sell other products at the retailer.