Amazon is learning what most legacy media companies already knew: Showbiz is tough.

The e-commerce giant is cutting hundreds of employees from its streaming and movie divisious, according to an internal memo seen by Fortune. The cuts will affect Amazon MGM Studios, Prime Video, and the streaming service Twitch, an independent subsidiary that’s still unprofitable nine years on from its acquisition.

This is the second year in a row that the company is launching the new year with job cuts. Last year, Amazon had two rounds of layoffs that slashed a total of 27,000 jobs across the company, including in HR, its AWS cloud computing unit, and advertising business.

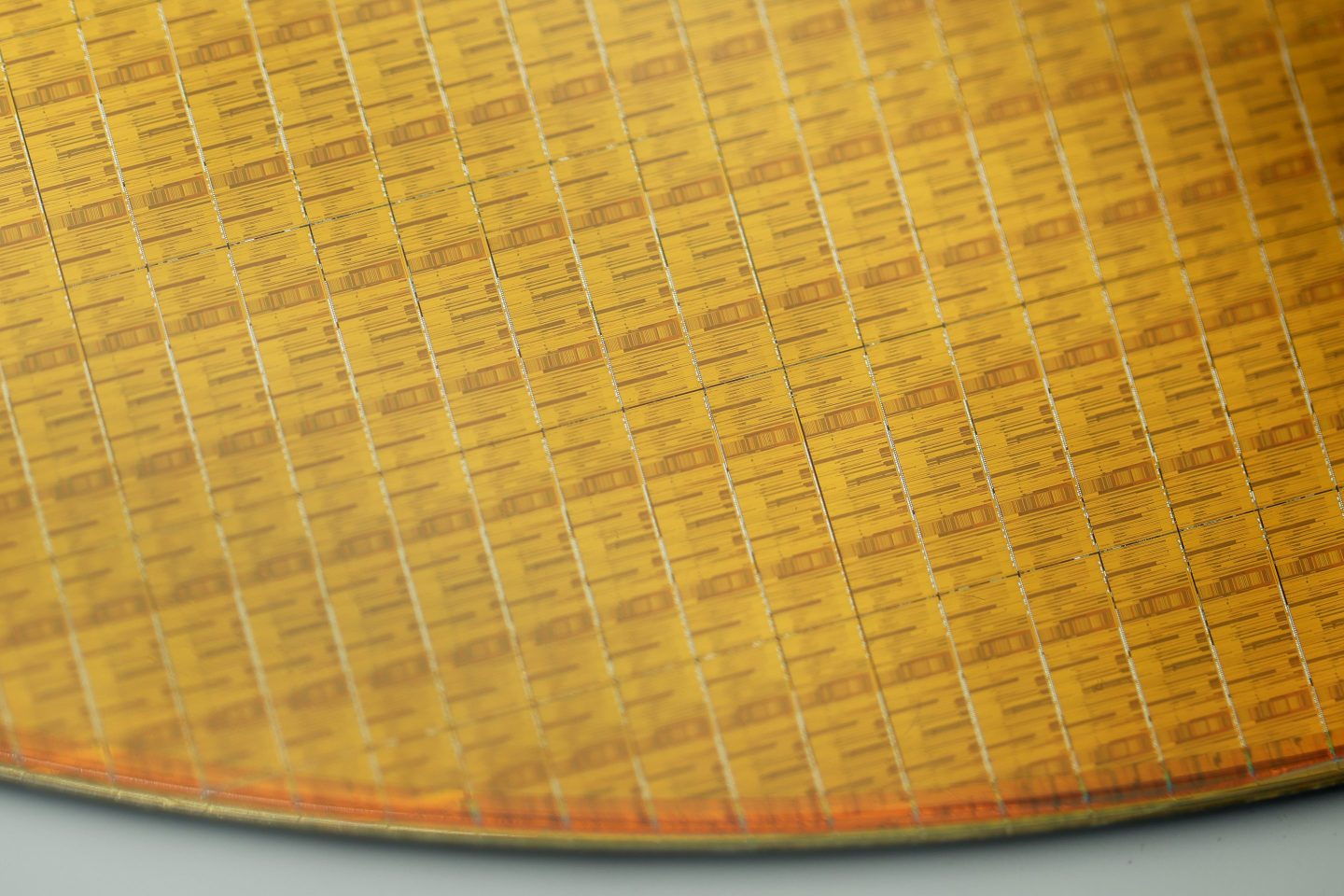

This batch of changes at Amazon come as companies across the streaming industry are reckoning with the difficulty of a business that has, so far, proven to have limited profits and high expenses. Amazon spent big money to bolster its content library, including an $8.5 billion deal to acquire the Hollywood studio MGM in 2022, and an 11-year, $11 billion broadcasting deal with the NFL that gives Amazon exclusive rights to broadcast Thursday Night Football.

Across the media landscape, companies are rethinking the strategy for their streaming services, which had previously prioritized gaining subscribers at all costs. Now, with borrowing costs high and inflation-strapped consumers being more choosy about entertainment, Amazon and its peers are looking to trim down costs and become more selective in the content they make and distribute, all while considering new sources of revenue. Some have introduced ads, emboldened by industry leader Netflix, which once swore it would never have advertising, but added it in 2022. Amazon itself will introduce ads to Prime video shows at the end of the month. Others, like Warner Bros. Discovery and NBCUniversal, have taken to licensing out content that had previously been exclusive to their own streaming services in exchange for some much-needed cash.

Amazon, like many of the legacy media companies who also operate streaming services—Disney, Warner Bros. Discovery, and Paramount—is realizing it can’t continue to spend endlessly on streaming, a business which has proved difficult to scale profitably for all except Netflix.

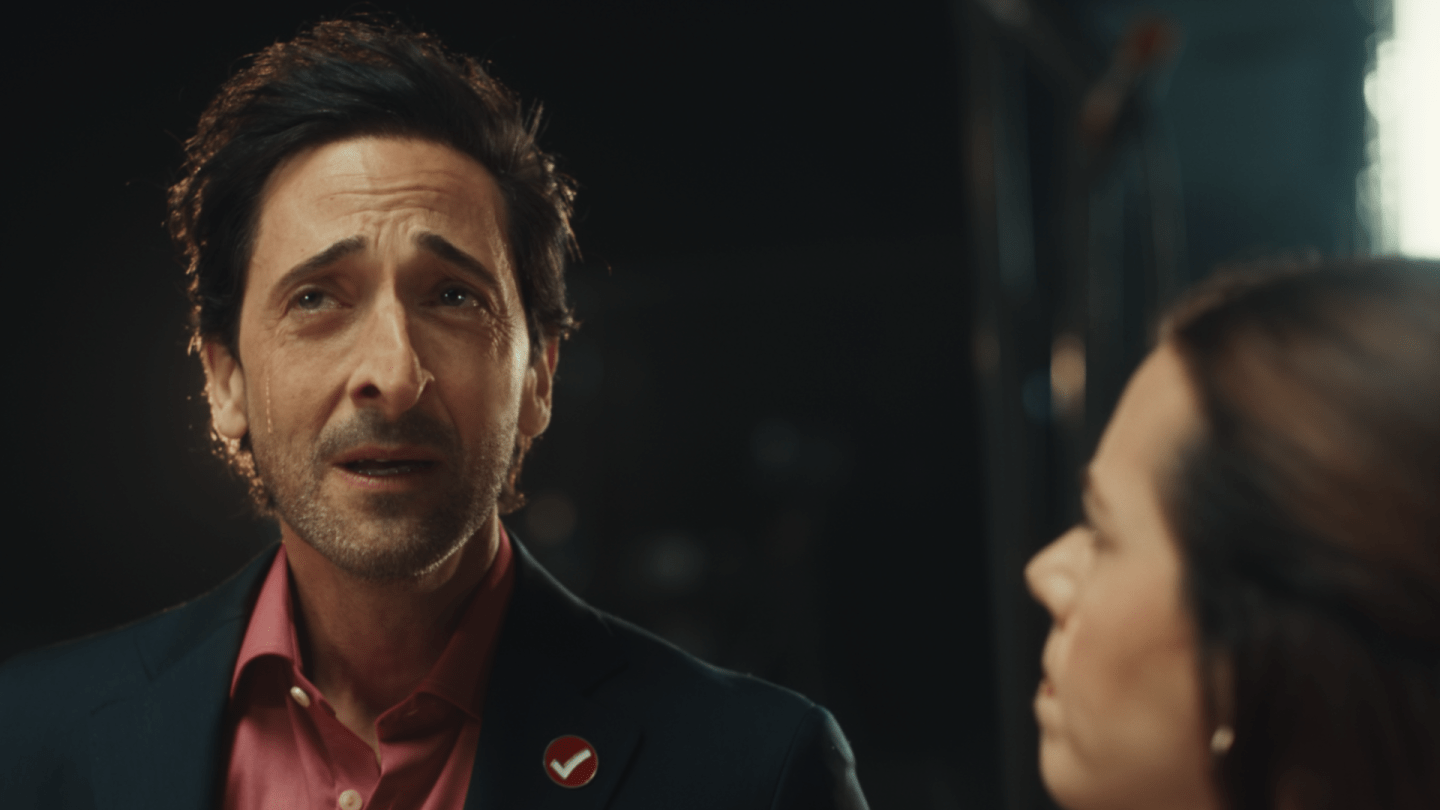

In announcing the layoffs, Amazon signaled it is cutting headcount to spend on content. “We’ve identified opportunities to reduce or discontinue investments in certain areas while increasing our investment and focus on content and product initiatives that deliver the most impact,” senior vice president of Prime Video and Amazon MGM Studios Mike Hopkins told employees in a message on Wednesday seen by Fortune.

Amazon spent $16.6 billion on content in 2022, behind only Netflix and Disney. The costs include Amazon’s NFL contract and a very pricey Lord of the Rings show, which reportedly cost $465 million for a single season. (Full-year figures for last year’s content spend aren’t available because Amazon hasn’t reported its 2023 earnings yet.)

Other media companies have opted to cut their content spending this year, with Disney slashing its content spending for fiscal 2024 by $2 billion. In recent public statements Disney CEO Bob Iger said the company made too many movies and shows for its streaming service, often at the expense of quality. “In our zeal to basically grow our content significantly to serve mostly our streaming offerings, we ended up taxing our people, in terms of their time and their focus, way beyond where they had been,” Iger told attendees at the Sun Valley Conference in November. Disney reported a $512 million loss on its streaming business in the third quarter of 2023.

Amazon CEO Andy Jassy in the past spoke optimistically of Prime Video, telling CNBC in June he was “very bullish” about the business. Jassy said it was both a strong business on its own and had a positive halo effect on the company’s core e-commerce business.

Prime Video was originally launched as a glorified marketing tool for the free shipping subscription Amazon Prime. “What we find is that customers who watch a movie that they love, they buy more Tide,” former CEO of Amazon’s worldwide consumer business Jeff Wilke told Vox in 2019. “They shop more, they’re more likely to renew their Prime subscription, they’re more likely to convert a free trial into a monthly or annual Prime subscription.”

But just a few weeks after Jassy sang Prime Video’s praises on CNBC, Bloomberg reported he was closely examining the finances of Amazon’s studio division. Despite its big budgets and buzzy programming, it can be difficult to truly gauge the success of Amazon’s entertainment business because it does not report separate financial results for the division. Secrecy aside, advertising executives are certain Amazon’s upcoming introduction of ads will be a “tornado” that upsets the streaming industry, as it is set to become the largest ad-supported streamer overnight.