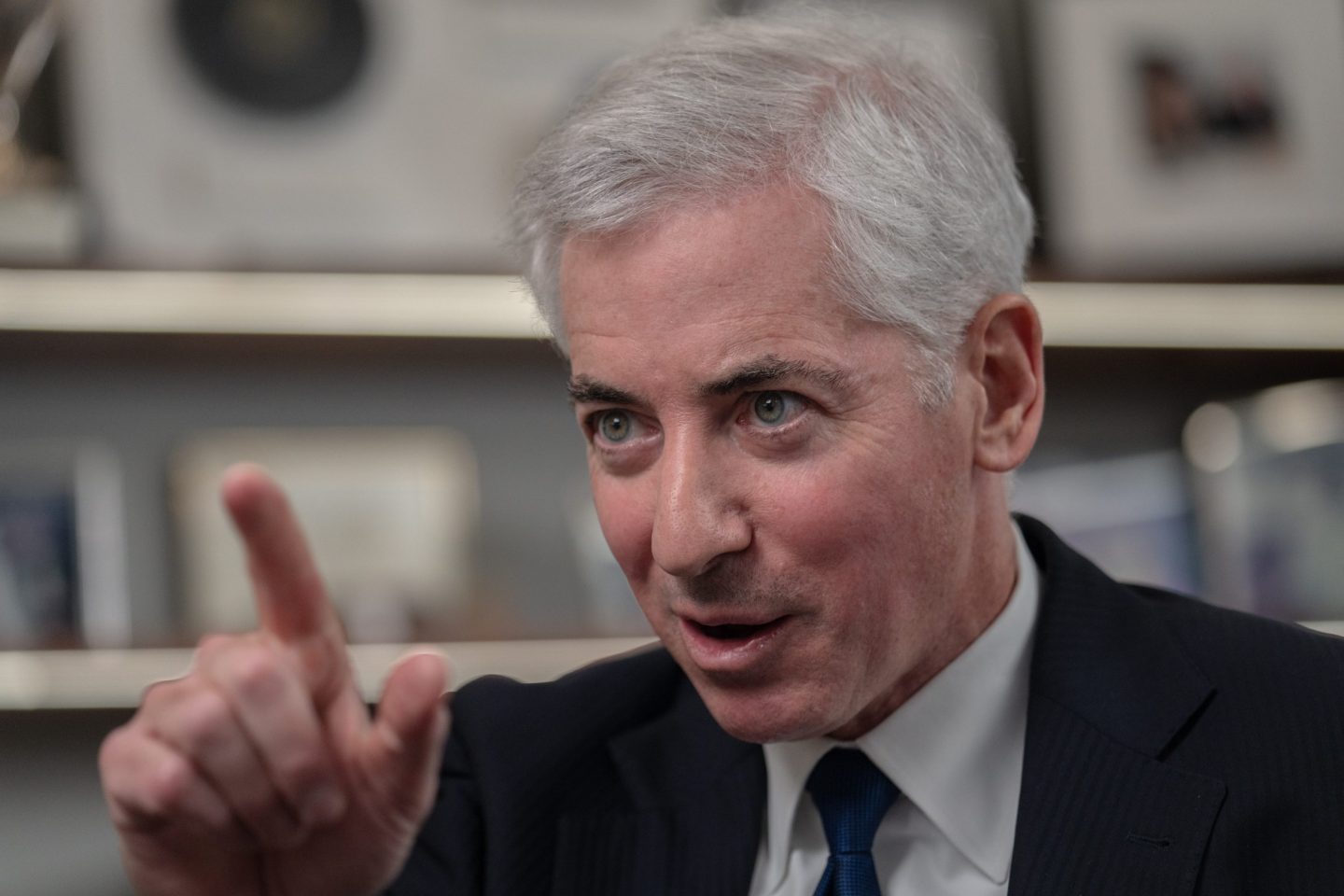

Bill Ackman scored a victory in his campaign against Harvard when the university’s president, Claudine Gay, stepped down on Monday following allegations she failed to properly respond to antisemitism on campus. Not one to rest, Ackman is now broadening his scope to take aim at Harvard’s overall approach, accusing the institution of falling prey to what he calls “a political advocacy movement” and “ideology” known as DEI that is anti-meritocratic to the core.

According to the billionaire hedge fund manager, the anti-semitism that he had previously accused Harvard of “was not the core of the problem” but merely “a troubling warning sign” of the real issue—an obsession with DEI, or diversity, equity and inclusion, that has grown into something entirely different from the three concepts embedded within the acronym, he said on X on Tuesday.

In the 4,000-word post, Ackman painted DEI as a “movement” that is antithetical to any merit-based program, including capitalism itself. Ackman’s missive appears to be the first mainstream criticism of DEI as “anti-capitalist,” and it widens the scope of a yearslong debate over DEI initiatives that has roiled the business community. Now, instead of DEI being part of a new way of looking at “stakeholder capitalism,” Ackman is accusing it of being an “ideology” harmful to the functioning of a capitalist economy.

“Under DEI’s ideology,” he wrote, “any policy, program, educational system, economic system, grading system, admission policy, (and even climate change due its disparate impact on geographies and the people that live there), etc. that leads to unequal outcomes among people of different skin colors is deemed racist.” By this standard, he continued, “Capitalism is racist, Advanced Placement exams are racist, IQ tests are racist, corporations are racist …” Zooming out in his analysis, he said the use of the lens of “oppression” means that any merit-based program, system, or organization “which has or generates outcomes for different races that are at variance with the proportion these different races represent in the population at large is by definition racist under DEI’s ideology.”

Ackman then accused diversity proponents of censoring dissenting views, akin to the Red Scare of the 1920s and 1950s, which culminated in Congressional hearings to root out suspected communist sympathizers in American industry. Except in Ackman’s telling, DEI proponents are in charge of the institutions and hold the power, while those who disagree with DEI principles “may find [themselves] unemployed, shunned by colleagues, cancelled, and/or [they] will otherwise put [their] career and acceptance in society at risk.”

“The techniques that DEI has used to squelch the opposition are found in the Red Scares and McCarthyism of decades past,” Ackman wrote. A few lines later he called DEI efforts a step “on the path to socialism” that is “inherently inconsistent with basic American values.”

If capitalism is racist, is DEI anti-capitalist?

Ackman’s screed is far from the first attack on DEI in recent years. Diversity initiatives have come under increasing fire from conservatives who claim that such efforts are racist toward white Americans, sometimes lumping them in with other liberal-sounding corporate programs, such as the emphasis on ESG (environmental, social and governance) investing. These programs are rebranded as “anti-white racism” or, in the case of ESG, as discrimination against fossil fuels.

That effort, which culminated in the Supreme Court’s ban on affirmative action in college admissions last year, has been brewing for years. Former President Donald Trump famously banned diversity and sensitivity training in a 2020 executive order, calling it a “malign ideology” akin to stereotyping. States including Florida and Texas have passed laws curtailing discussions of diversity in higher education. Last summer, Republican attorneys general put all Fortune 100 companies on notice about their corporate diversity programs, which observers believe are the next target of the conservative high court.

Versions of corporate diversity efforts have existed since the 1970s, when the federal government formally outlawed workplace discrimination based on sex, race, or national origin. But DEI as branding has truly flourished over the past decade, gaining steam after the 2020 murder of George Floyd and the social outcry for racial equity that it fueled. The late-2010s shift to a more holistic, gentler capitalism held that corporations should consider all of their stakeholders—employees, communities, and customers—in their actions.

“Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country,” the influential Business Roundtable wrote in 2019, in a statement detailing its members’ commitment to pay fair wages, embrace diversity, do business sustainably, and deal ethically with suppliers. It was a prominent rejection of the shareholder-primacy dogma of the previous four decades which held that a corporation’s only responsibility was to deliver profits to shareholders, a view that critics said verged on psychopathic.

The latest legal and cultural assault from the right, however, puts those goals in jeopardy. And companies are responding to the backlash: Six major corporations, including American Airlines, BlackRock, JPMorgan Chase, and Lowe’s, watered down statements committing to diversity policies, Reuters reported last month.

Ironically, for as much criticism as DEI initiatives are seeing from the conservative camp, they have also been criticized by liberals and leftists for being ineffective in closing racial gaps, perpetuating stereotypes, or even allowing companies a form of reputation laundering. In an extreme example of the latter, The Intercept reported on CoreCivic, the private prison company, touting its support for “principles of diversity, equity and inclusion.” Often, employees themselves are skeptical of these efforts, data shows: 75% of respondents to a Catalyst survey last year in Australia, Canada, the U.K. and U.S. said they believed their company’s racial equity policies were insincere.

Throughout all this, the fundamental problem DEI was ostensibly supposed to solve has remained stubbornly persistent. About one in six Americans is Black, but Black people make up only 4% of leadership at large companies, while the difference between what white and Black workers earn has, by some metrics, remained unchanged since the 1950s.