Good morning.

As a CFO, making investments to bring real innovation to the marketplace can position the company for long-term growth. But when it comes to innovation in health care, like combating obesity, the implications can impact the lives of millions of people.

“It’s important to note that obesity is not just a number on a scale,” Anat Ashkenazi, EVP and CFO of Eli Lilly and Company tells me. “It has much broader health implications.” There are over 110 million patients in the U.S. alone with obesity, which is associated with over 200 health complications, Ashkenazi says.

Lilly (No. 142 on the Fortune 500), the Indianapolis-based pharmaceutical company, announced on Nov. 8 that Zepbound, a weight-loss drug, was approved by the U.S. Food and Drug Administration. The list price of Zepbound was set at $1,059.87 for all six doses. It is expected to be available in the U.S. by the end of the year.

“We priced it approximately 20% lower than the existing GLP-1 obesity medication on the market at the time of launch,” Ashkenazi says. “And this is the list price. It’s not what the patients actually pay.” If a patient is covered by commercial insurance, they may be eligible to pay as low as $25 for a 1-or 3-month supply. But if Zepbound is not covered, a patient has access to a Lilly assistance program and may be eligible to pay $550 for a 1-month prescription, approximately 50% lower than the list price.

“Running clinical trials for something like this is in the billions of dollars, and takes years to get there,” Ashkenazi explains. “On the one hand, you want to get the value for the innovation, and on the other hand, it’s important that patients can access the medication. We priced it so patients can access it.”

Lilly’s competitor Novo Nordisk A/S’s obesity medication Wegovy has a list price of about $1,349. Novo Nordisk’s Ozempic and Lilly’s Mounjaro are classified as type 2 diabetes drugs, and they have also led to weight loss among patients. A new data analysis finds that Mounjaro outperforms Ozempic.

This year, the demand for obesity drugs has accelerated. The global obesity market could reach $77 billion in 2030, up from a previous estimate of $54 billion, Mark Purcell, Morgan Stanley European Biopharmaceuticals analyst, stated in a recent research report. Due to the “rapid expansion” of reimbursements for obesity drugs, about 40 million people in the U.S. (out of roughly 110 million adults with obesity) have access to these medicines through their insurance plans, according to Morgan Stanley research.

Meanwhile, in a recent forecast, Evan David Seigerman, an analyst from BMO Capital Markets, predicted the global market for innovative weight-loss drugs to reach $100 billion by 2035. And the revenue for these medications could reach $70 billion in the U.S. alone.

‘Double down on innovation’

Ashkenazi, who joined Lilly in 2001, has been CFO of the company since 2021. She previously served as a CFO for several of the company’s global business areas. Her thoughts on strategy?

“We believe that the way to have a winning strategy, and you can see this by the success we’ve had, is to double down on innovation.” Lilly continued to invest in innovation during challenging times, she said.

Between 2010 and 2014, about 40% of the company’s revenue was exposed to patent expiry, she explains. “You can lose 90% of sales within a few months. And that’s not easy to go through. And what we said is, during that period, the one thing we’re going to invest in, and we’re not going to compromise on, is research and development.” Lilly has been launching new products every year since 2014, she says.

How does she define the CFO role? “It’s financial and strategic leadership coupled with people and organizational leadership,” Ashkenazi explains. “Whether an organization is going through tremendous success and growth, or challenging times, the CFO should anchor the organization back to its core mission and values and chart the course forward.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Lars Boesgaard was named CFO at PDS Biotechnology Corporation (Nasdaq: PDSB), a clinical-stage immunotherapy company, effective Dec. 4. Boesgaard succeeds Matthew Hill, who resigned as PDS Biotech’s CFO, effective Dec. 1, to pursue other professional endeavors. Boesgaard has had a career spanning more than 25 years in health care. Before joining PDS Biotech, he served as CFO of AM-Pharma B.V., and before that, CFO of Columbia Care. Boesgaard was also previously the VP and CFO of Roka Bioscience.

Daniel Hobbs was named EVP and CFO at Simmons First National Corporation (Nasdaq: SFNC), effective Dec. 4. He will report to Simmons president Jay Brogdon. Prior to Hobbs's arrival, Brogdon served as both president and CFO. Hobbs most recently served as EVP and head of finance at Regions Bank. During his 16-year tenure, Hobbs also served as CFO for the consumer bank and in a variety of other capacities with finance responsibilities.

Big deal

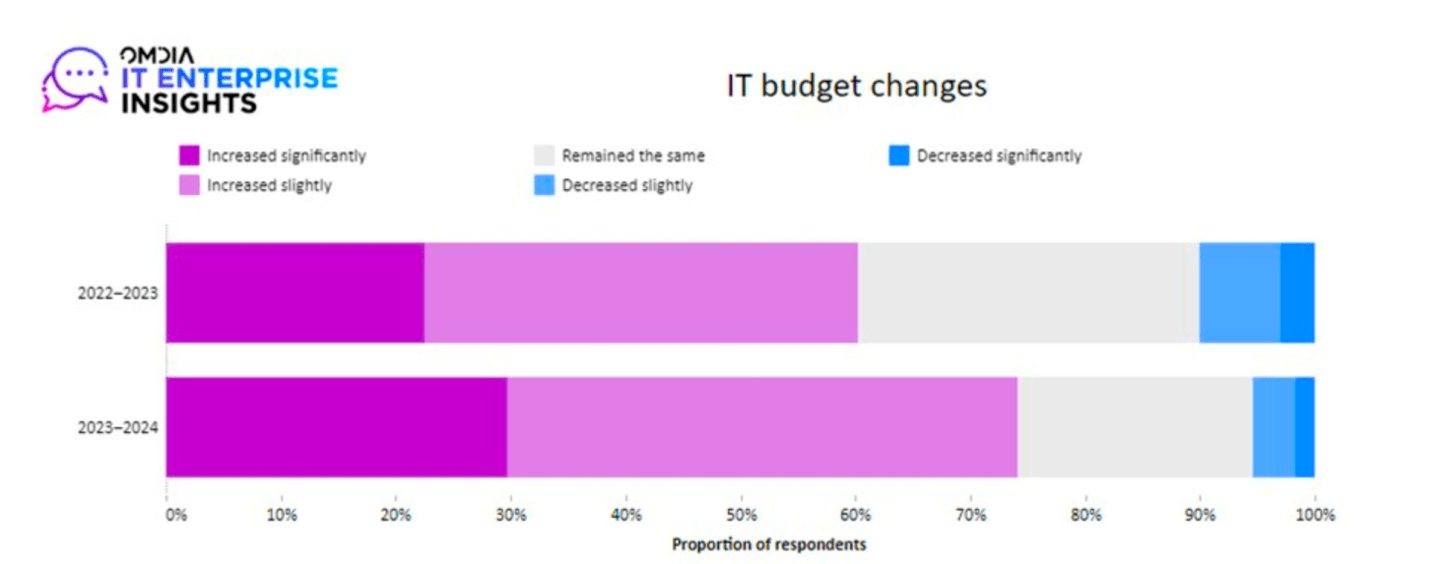

The 10th annual IT Enterprise Insights study released by Omdia, a technology research and advisory group, found that IT has become one of the main drivers of value to a company. Almost three-quarters (74%) of senior IT executives confirmed increases to their overall budget allocated to enterprise IT in 2023, compared to 62% in 2022. The top business priority is increasing operating efficiency, while the top IT priority is managing security, identity, and privacy.

“We are seeing a marked shift from Information and Communications Technology being seen predominantly as an engine that keeps the business running into becoming a key source of both creating additional value to an organization and attracting and keeping talent," Cem Nurkan, Enterprise Technology Research Director at Omdia, said in a statement.

The report findings are based on a survey of 6,500 senior IT executives on their organizations’ investment plans and priorities across 56 countries and 16 industry sectors.

Going deeper

Investing legend Charlie Munger, Warren Buffett’s chief lieutenant at Berkshire Hathaway, has died at 99, Berkshire Hathaway announced on Tuesday. "How Charlie Munger built the blueprint for Berkshire’s $785 billion empire and steered Warren Buffett away from ‘cigar-butt’ investing," is a new Fortune article that discusses how Munger was responsible for shaping much of Buffett’s thinking over the course of his career.

Overheard

"Talent scarcity will be endemic to the labor market in the years and decades ahead. There’s going to be more work to be done by fewer people. And it is not just the number of people: there will also be a mismatch in terms of the skills that people have versus the skills that companies need in the market. The need for specialization in the labor market is arguably greater than ever."

—Sander van’t Noordende is the CEO of Randstad, a recruitment agency, explains in a Fortune opinion piece that the labor market will stay tight as shifting demographics keep draining the talent pool.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.