Good morning.

There has been some pushback on companies pursuing sustainability and ESG goals. But Mars Inc. is doubling down.

The home of well-known brands including M&M’s and Snickers, Mars is a global, family-owned business, with an expanding portfolio of veterinary health services like AniCura, and pet care products such as Whiskas and Pedigree. The company recently announced a $1 billion investment over the next three years to reduce emissions by 50% by 2030 to reach net zero by 2050.

Improving supply-chain traceability, scaling up climate-smart agriculture, and changing recipes and improving logistics are also on the agenda. Along with Scope 1 and 2 emissions, the company is highly focused on its Scope 3 emissions—those not produced by the company directly but from activities in its value chain—by setting five-year milestones to track its progress.

In operation for more than a century, Mars has more than 140,000 associates in over 70 markets worldwide. The company reached more than $47 billion in annual sales in 2022.

I sat down with Mars CFO Claus Aagaard to talk about the investment and how finance is playing a major role in sustainability efforts.

How does Mars plan to leverage this $1 billion investment?

The four biggest areas that we are dealing with are climate-smart agriculture, renewable energy, stopping deforestation, and then also working on logistics. Take renewables, for example, changing how we power our factories, how our boilers are running. We already have a significant part of our electricity in the U.S. and in Europe from wind farms and solar parks. I think we’re almost 60%, globally. We need to get that to 100%.

We are well down our road on Scope 1 and Scope 2 to get that to zero, but about 90% of our greenhouse gas emission is in our extended value chain. And through an initiative that we launched a couple of years ago, called Supplier Leadership on Climate Transition, we are working with some of our largest suppliers on also transitioning their electricity consumption to renewable electricity.

Thirty percent of our emissions come from raw material production in our value chain. So, by influencing the agricultural processes and stopping deforestation, we’ll reduce, we estimate, roughly 5 million metric tons of greenhouse gasses by 2030.

Our palm oil initiative is now deforestation free. And we have a commitment by the end of next year that our cocoa supply chain is also deforestation free.

CFOs are increasingly influencing ESG reporting. What’s your perspective?

I’m really keen to integrate this sustainability or climate agenda into the core of the business, and the way we’re driving it—starting from strategic priorities and strategic resource allocation. What is great now is that we have this roadmap to 2030, actually a little bit beyond. We’ve allocated the human and fiscal resources to it. And now we’re setting the system up to also track our progress.

I have set up a very small team, but growing, that is dealing with the external reporting side of the ESG. And in my FP&A team, here at an enterprise level, and working with our different lines of business, we have also dedicated resources and investment to develop tools that can support me in finance in the tracking but also business managers in the decision making. For instance, just as I have periodic and quarterly financial reporting, we now also have a good overview of our carbon emissions.

Is it fair to say Mars equally values financial performance and greenhouse gas performance?

We just commissioned a survey through Ipsos that found, on average, 69% of adults across the world’s seven largest economies say that companies like ours need to continue our efforts or even do more on climate change. Consumers are going to vote with their feet eventually. We also know from our own associate population that they want to work for a company that takes this seriously, particularly the next generation.

If you look at any competitive strategy, you need to follow the consumer and what your own associates are telling you that you need to be doing. That’s just going to make your business sustainable in the long term. We believe that by doing this the right way, that will give us a competitive advantage that will allow our business to continue to grow. We will also be leading on this journey. There’s going to be a relative cost advantage versus what this will cost for late entrants on this journey, as far as I can predict.

Is executive compensation tied to sustainability goals?

We have what we call the Mars Compass. These are shareholder-agreed objectives, which, yes, have some financial objectives. It has objectives around the quality of our portfolio from a growth standpoint, our reputation, around positive societal impact. So, for people like me, 40% of my variable remuneration is tied to climate actions and reputation.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Kristen Fries was promoted to EVP and CFO at First Resource Bank. Its holding company is First Resource Bancorp, Inc. (OTCQX: FRSB). Fries, who joined the company in 2014, was, most recently, SVP and controller.

Michael R. Leach is retiring from his role as SVP and CFO at Allient Inc. (Nasdaq: ALNT), a global engineering and manufacturing enterprise. Leach plans to retire at the end of April 2024 after a nearly nine-year career with the company.

Big deal

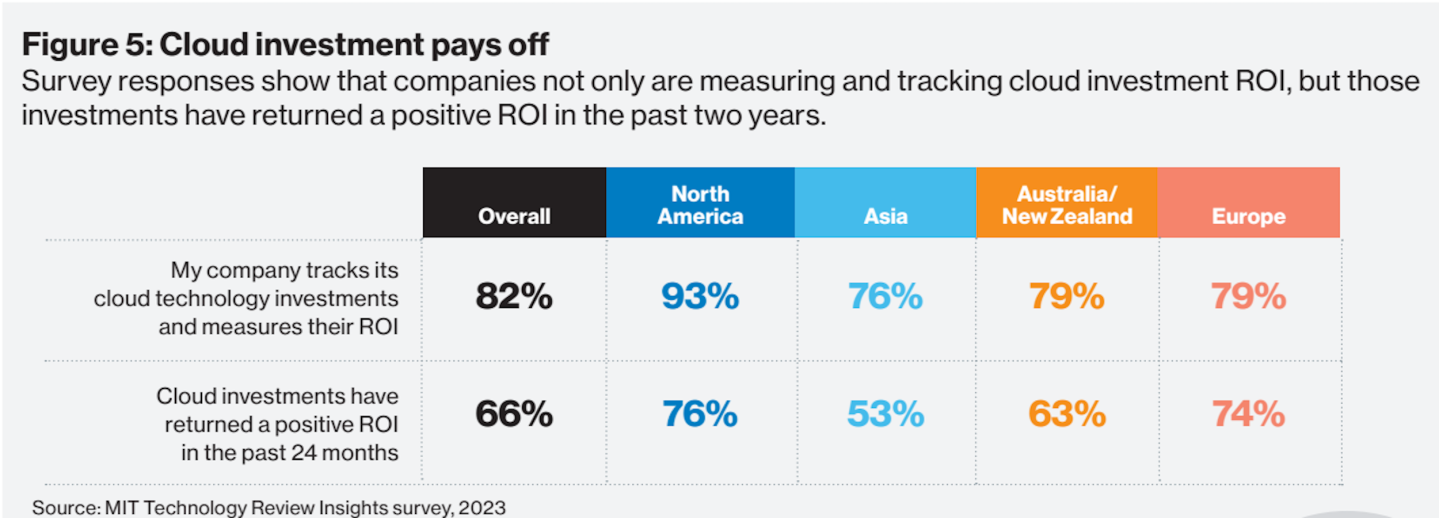

The "2023 Global Cloud Ecosystem," a new survey report by MIT Technology Review Insights, in partnership with Infosys Cobalt, finds cloud investment is becoming a mainstay for technology development and operational efficiency.

One of the key findings of the report is regarding return on investment (ROI). Overall, a majority of respondents (82%) say they measure the success of these cloud investments by determining ROI. At the same time, only (66%) report positive ROI in the last two years. Challenges remain for most firms mapping out cloud spending for business-line profitability. A higher percentage of respondents in North America (76%) and Europe (74%) report positive ROI in the past 24 months.

The findings are based on interviews with global experts on the cloud economy and a global survey of 400 C-suite executives. The respondents represent four regions (North America, Europe, Asia, and Australia and New Zealand), covering 12 industry sectors.

Courtesy of MIT

Going deeper

The United Nations' 2023 Emissions Gap Report released on Monday assesses countries' promises to tackle climate change compared with what is needed. This year's edition was released a week before the COP28 climate summit in Dubai that begins on Nov. 30. The world would need to cut emissions by 42% by 2030 in order to reach the limit adopted by members of the Paris climate agreement, which is 1.5 degrees Celsius (2.7 degrees Fahrenheit), according to the report.

"Change must come faster in the form of economy-wide, low-carbon development transformations, with a focus on energy transition," Inger Andersen, executive director, U.N. Environment Program, wrote in the report.

Overheard

"There is a clear disconnect between retailers’ capacity for reverse logistics and consumers’ expectations of quick and easy returns–and retailers are going to pay the price."

—Heather Hoover-Salomon, CEO of uShip, writes in a Fortune opinion piece titled, "Retailers are reversing generous returns policies which cost a staggering $817 billion last year–but consumers still expect easy returns as they plan their holiday shopping."

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.