At the end of last week, I was putting together some charts based on some new third-quarter valuation data PitchBook released last week.

And I have to say I was a bit shocked. After all, numbers can sound rather dramatic. But it’s something else entirely when you can see it visualized. Look for yourself at the incredible decline in median growth-stage valuations over the last two years:

That is a nosedive if I’ve ever seen one. But as of now, the valuations still aren’t lower than they were four years ago: They’ve simply come back down to earth.

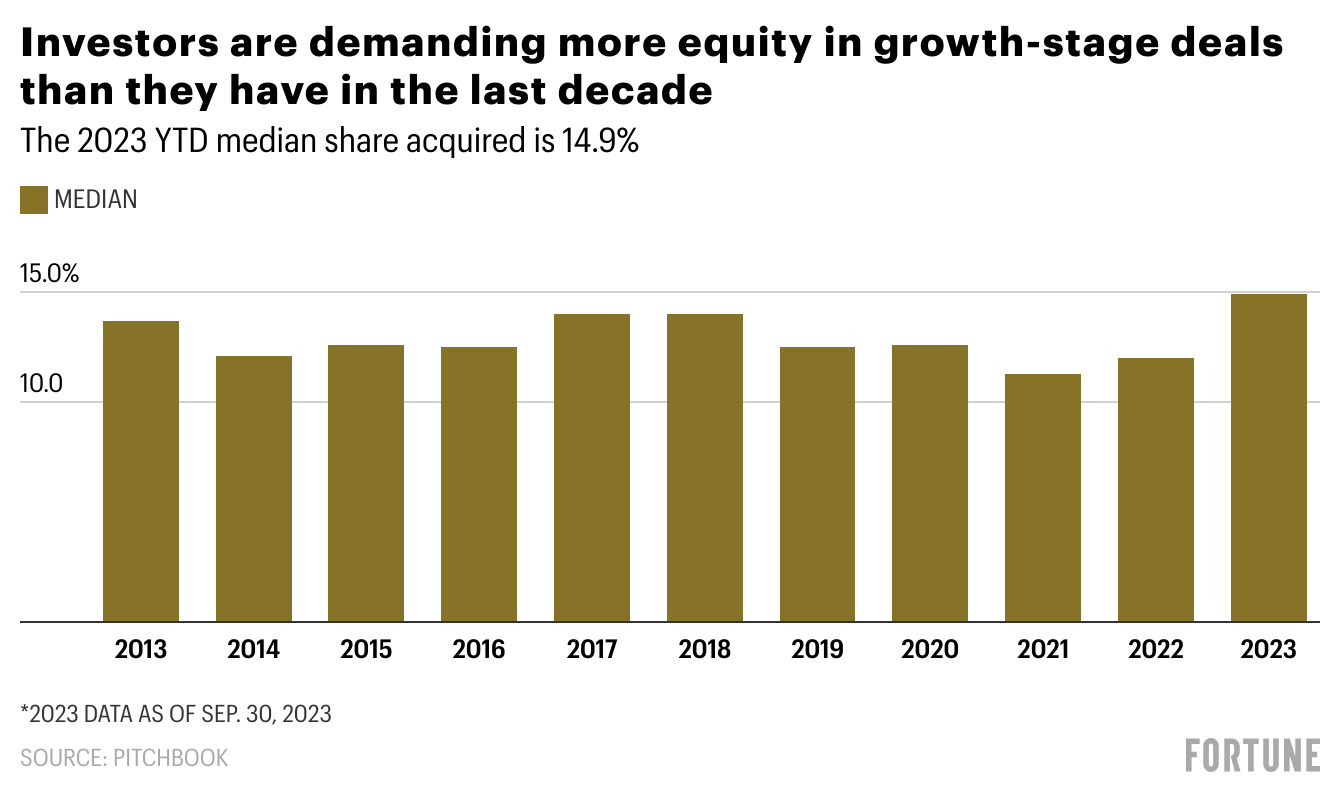

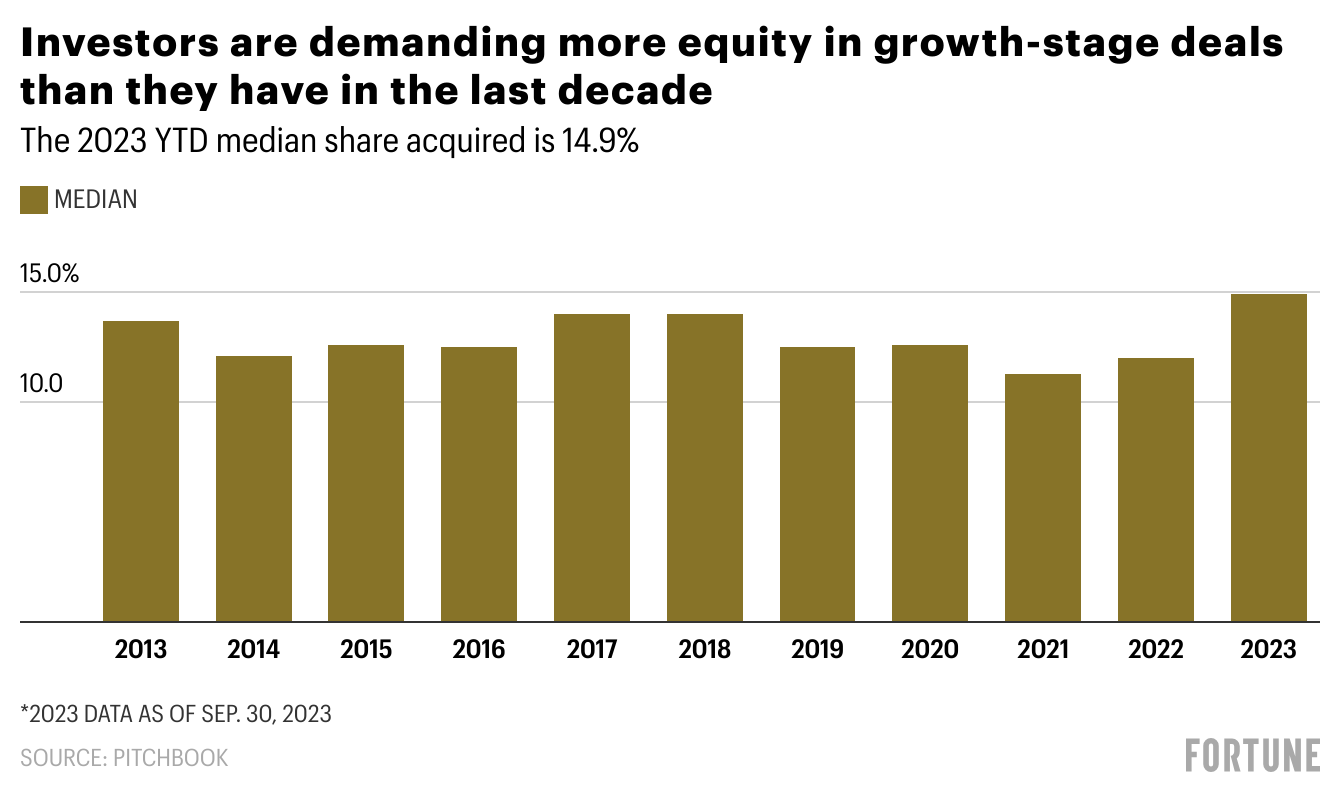

As investors have regained the upper hand in the negotiations with late-stage companies, they are also taking larger equity stakes in the companies they are backing. See below:

But what’s interesting is that we’re really not seeing some of these swinging market conditions across the whole ecosystem. Both pre-seed and seed valuations are actually up in 2023 (as of Sep. 30 data), compared to last year, according to PitchBook. And the size of seed deals are actually hitting record highs right now:

What do you think? Sound in line with your own experience? Drop me a note below, if you like.

Have a good day!

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Divergent Technologies, a Los Angeles-based developer of digital end-to-end industrial manufacturing systems, raised $230 million in Series D funding. Hexagon AB led the round and was joined by others.

- VectorY Therapeutics, an Amsterdam, Netherlands-based biotech company developing antibody therapies to treat neurodegenerative diseases, raised €129 million ($138 million) in Series A funding. Forbion and EQT Life Sciences led the round and were joined by MRL Ventures Fund and others.

- Imprint, a New York City-based provider of co-branded credit cards, raised $75 million in Series B funding. Ribbit Capital led the round and was joined by Thrive Capital, Kleiner Perkins, Lachy Groom, and Moore Specialty Credit.

- Otovo, an Oslo, Norway-based solar and battery storage marketplace, raised €40 million ($42.8 million) in funding. Å Energy, Axel Johnson Group, and Nysnø led the round and were joined by OBOS BBL.

- etaily, a Metro Manila, Philippines-based platform designed to build, manage, and grow ecommerce shops, raised $17.8 million in Series A funding. SKS Capital and Pavilion Capital led the round and were joined by others.

- Refine Intelligence, a New York City and Ness Ziona, Israel-based AI-powered monitor of money laundering, check fraud, and other scams for banks, raised $13 million in seed funding. Glilot Capital Partners and Fin Capital led the round and was joined by SYN Ventures, Valley Ventures, and others.

- Dotwork, a Georgetown, Texas-based software platform designed to provide unstructured data, key metrics, and software stacks for strategy management, raised $12 million in Series A funding from Jim Crane, Tim Arnoult, Hunter Nelson, Steve Elliott.

- Solvimon, a Utrecht, Netherlands-based pricing and billing platform for companies, raised €9 million ($9.6 million) in seed funding from Northzone and others.

- Shekel Mobility, a Lagos, Nigeria-based marketplace for finding, financing, and selling cars for auto dealerships, raised $7 million in funding. Ventures Platform and MaC Venture Capital led the round and were joined by Y Combinator, Rebel Fund, Unpopular Ventures, Maiora Capital, and others.

- Augmentus, a Singapore-based developer of intelligent and no-code robotics software solutions, raised $5 million in Series A funding. Sierra Ventures led the round and was joined by existing investor Cocoon Capital.

- BrightGo, a San Francisco-based janitorial software company, raised $3 million in seed funding from Costanoa Ventures and Index Ventures.

- OMORPHO, a Portland, Ore.-based retailer of micro-weighted training gear, raised $3 million in seed funding. KB Partners and Thirty-5 Capital led the round and were joined by others.

- CoverSelf, a San Francisco-based healthcare claims and payment accuracy platform, raised $8.2 million in seed funding. BEENEXT and 3one4 Capital led the round and were joined by others.

PRIVATE EQUITY

- Celonis, backed by Blackstone, acquired Symbioworld GmbH, an Aschheim, Germany-based provider of business process and quality management software. Financial terms were not disclosed.

- Greater Sum Ventures acquired a majority stake in Utility Associates, a Decatur, Ga.-based provider of communications technology and services for frontline professions. Financial terms were not disclosed.

- Kaltroco acquired a minority stake in the Dave Cantin Group, a New York City-based provider of financial, transactional, and advisory services to retail automotive groups and their owners. Financial terms were not disclosed.

- Norwest acquired a minority stake in Aesthetic Partners, a Miami, Fla.-based practice management provider for medical aesthetic and plastic surgery practices. Financial terms were not disclosed.

- Tourtellot, backed by Encore Consumer Capital, acquired Ryeco, a Philadelphia, Penn.-based distributor of fruits and vegetables. Financial terms were not disclosed.

EXITS

- General Atlantic agreed to acquire a majority stake in Joe & the Juice, a Copenhagen, Denmark-based juice, coffee, and sandwiches chain, from Valedo Partners. Financial terms were not disclosed.

IPOS

- UL Solutions, a Northbrook, Ill.-based provider of product testing, inspection, and certification services to the energy, industrial automation, consumer electronics, and other markets, filed to go public. The company posted $2.6 billion in revenue for the year ending September 30th, 2023. UL Standards & Engagement backs the company.

PEOPLE

- AnaCap, a London, U.K.-based private equity firm, promoted Victoria Brown and Graeme Chaffe to partners.

- ArcLight Capital Partners, a Boston, Mass.-based private equity investment firm, hired Andrew L. Ott as a senior adviser. Formerly, he was with PJM Interconnection.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. Sign up for free.