Good morning.

Meet the 74 women who are CFOs at the biggest companies in Europe.

The inaugural edition of the Fortune 500 Europe list launched this morning. The European companies are ranked by revenue, and the list features businesses from 24 different countries. Together, the 500 companies brought in revenue of $13.94 trillion in their most recent fiscal year.

The No. 1 place is held by British energy giant Shell with revenue of $386.2 billion. Sinead Gorman, who earned a spot for the first time on Fortune’s Most Powerful Women list this year, joined the company in 1999 and became CFO in 2022. With oil and gas prices soaring, Shell more than doubled its profit to $39.9 billion in 2022, surpassing its previous annual record of $28.4 billion reached in 2008. In 2022, of the $25 billion Shell put aside for capital improvements, it invested $12.5 billion into its oil business, while allocating $4.3 billion to low-carbon energy projects.

Other finance chiefs at companies in the Fortune 500 Europe top 10 include:

Jutta Dönges, CFO at Uniper (No. 3), a state-owned energy company based in Düsseldorf, Germany. In March, Dönges began her tenure as chief financial officer, joining the management board and leaving Uniper’s supervisory board, which she joined in December 2022.

Katherine Thomson, interim CFO at BP (No. 6) was appointed to the role in September. BP named Murray Auchincloss, the company’s CFO since July 2020, interim CEO. Thomson is the first woman in the interim CFO role at the company. She has worked at BP for 19 years, previously holding several senior financial roles, including group treasurer, and head of group tax.

Natalie Knight, CFO at Stellantis (No. 7) began her role at the company in July. Before Stellantis, Knight was the CFO at Delhaize. She also held several senior finance positions during her 17 years at adidas AG in Germany and the U.S.

Here’s the complete list of the 74 women who are leading finance at the biggest companies in Europe. You can view the Fortune 500 Europe list here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

R. Alan Hall, EVP, CFO, and secretary at BL Harbert International, will retire at the end of 2023. Hall has been the CFO of the company since its formation in January 2000. Before 2000, he served as CFO of Bill Harbert International Construction, Inc. and controller of the Joint Venture Office of Harbert International, Inc. Hall has served with a Harbert family company for over 32 years.

Craig Henderson was named SVP and CFO at PGT Innovations, Inc. (NYSE: PGTI), a national brand in garage door industries. Henderson has over 20 years of experience in finance leadership. Before joining PGT Innovations, he served in multiple financial leadership positions with Trex Company, Inc., including director of financial planning and analysis, business development, and treasurer.

Big deal

Deloitte Private's 2023 Mid-market technology trends report is based on a survey of mid-market private company executives from organizations with annual revenues ranging from $250 million to more than $1 billion. More than half (53%) of respondents said their organizations are spending above 5% of revenue on technology in 2023, up from the 2019 peak of 43%, and a recovery from only 20% mid-pandemic in 2021.

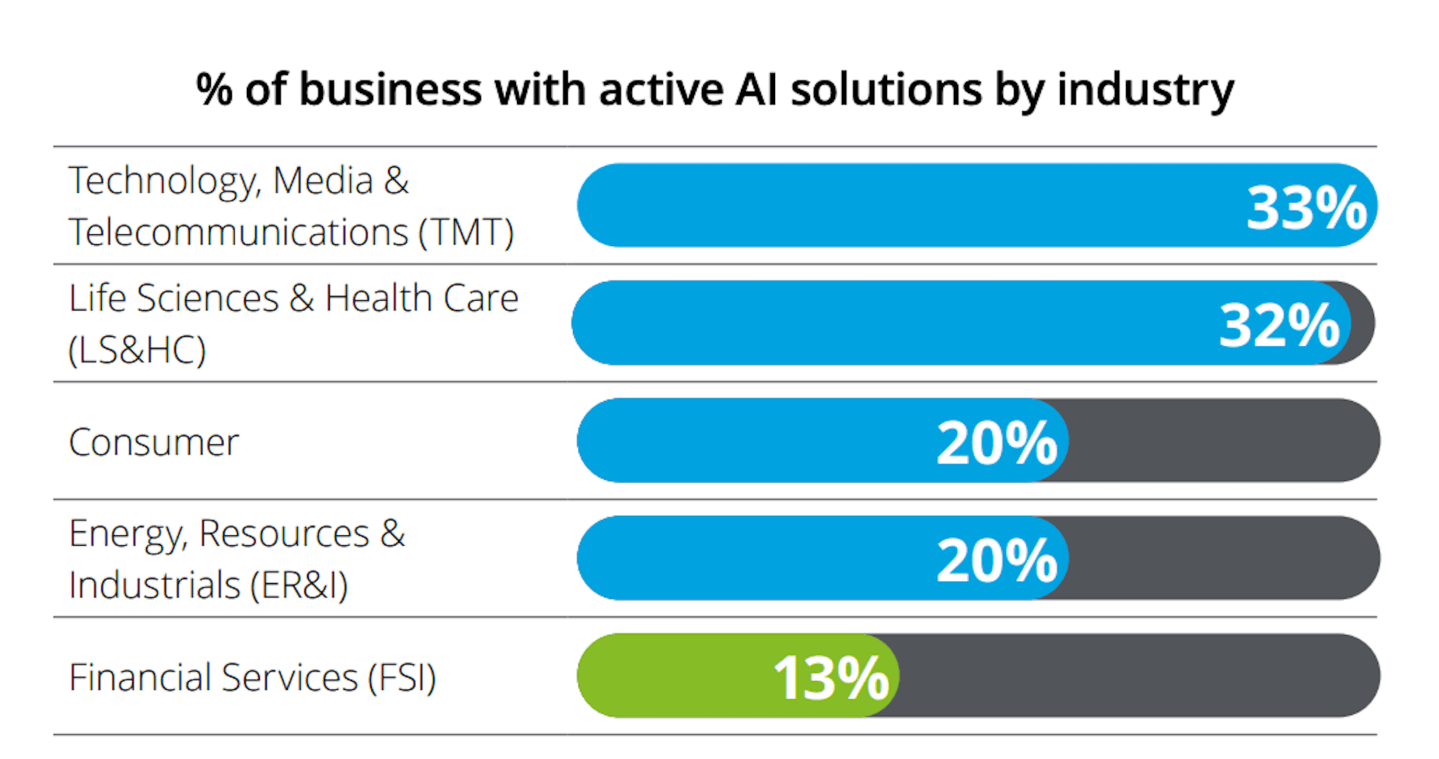

The report also takes a look at where mid-market companies are on the AI adoption curve. Forty-one percent of respondents report they're exploring AI; 30% are piloting AI solutions; and 25% report having active AI applications. Among industries, technology, media, and telecommunications, and life sciences and health care, are the most likely businesses to have active AI solutions. Meanwhile, companies in financial services and insurance are the least likely to be active in this area.

Going deeper

In the third quarter of 2023, total household debt for Americans rose by 1.3 percent to reach $17.29 trillion, according to the Federal Reserve Bank of New York's latest quarterly report on household debt and credit.

The research also found that mortgage balances increased to $12.14 trillion, credit card balances to $1.08 trillion, and student loan balances to $1.6 trillion. Meanwhile, auto loan balances increased to $1.6 trillion, continuing the upward trajectory seen since 2011, according to the report.

Overheard

“Workers might be working harder so they cannot be laid off; the era of ‘do nothing, the boss can’t fire me’ is over.”

—Professor Jeremy Siegel, emeritus professor of finance at the Wharton School of the University of Pennsylvania, wrote in his weekly commentary on Wisdom Tree. Siegel also wrote: "I think a continued growth of productivity, that also comes from recent artificial intelligence applications, can offset the softening of demand and help us avoid a recession and support the profit outlook."

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.