Good morning.

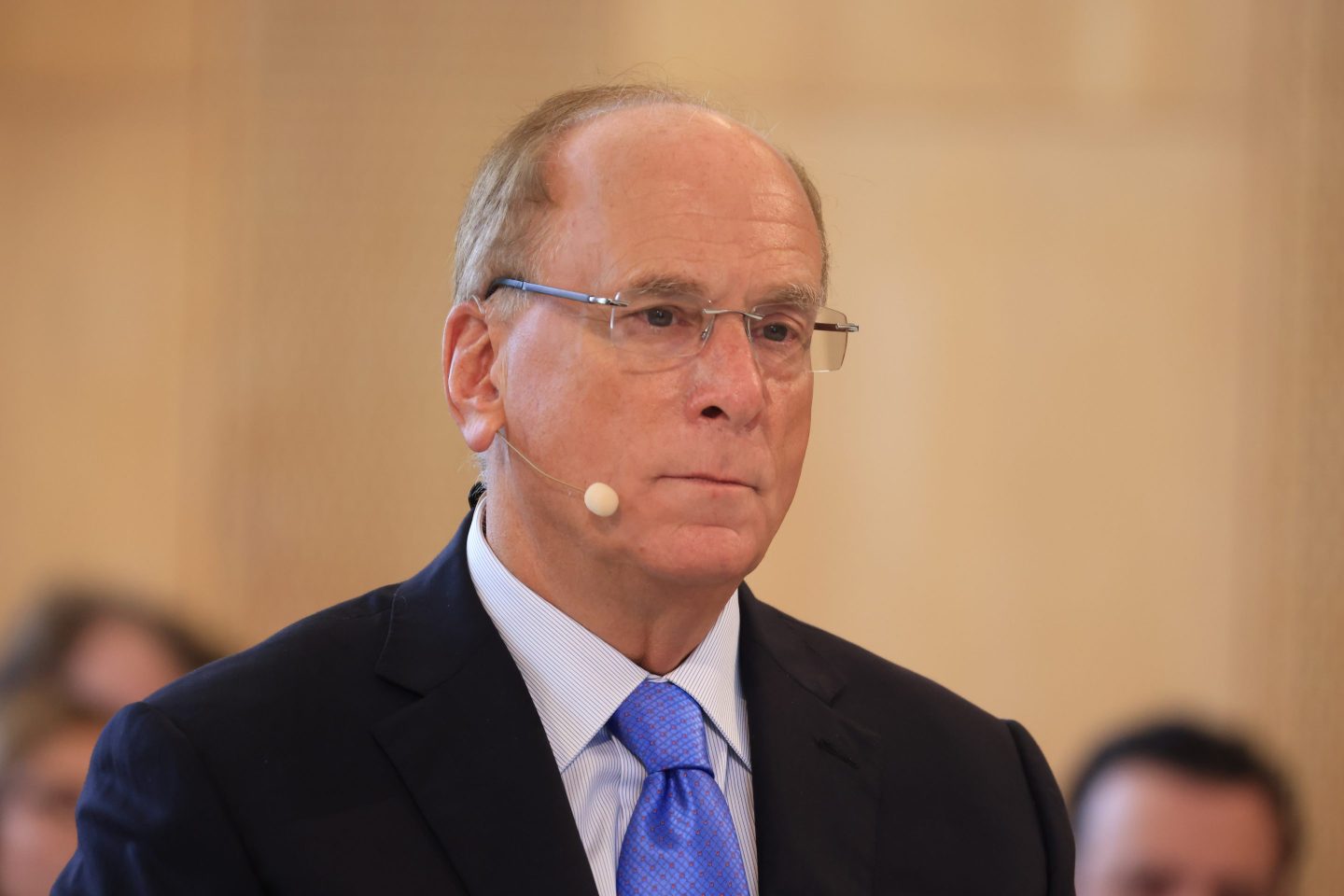

More detail out this morning on the corporate proxy season, courtesy of our friends at Diligent. The most surprising finding is how thoroughly the “Big 3” investors—BlackRock, Vanguard and State Street—turned against environmental and social shareholder proposals in the past year. In the U.S., BlackRock’s support for E&S proposals dropped from 41.3% in the 2020-21 season, to 23.7% in 2021-22, to a mere 8.7% in 2022-23. Vanguard’s drop was equally precipitous, from 29.6% to 12% to a tiny 3% in the past year. And State Street went from 43.7% to 28.6% to 21.2%. Clear signs of the backlash.

So much for E&S. On the G front, there is a somewhat different story: all three firms stayed strong in their support for “say on pay” advisory votes, with votes remaining over 90%. Diligent’s Josh Black, who published the report, writes that after a period of “upheaval” including “the rise of ESG funds, a pandemic, polarization surrounding the 2020 U.S. election, and social movements centered on diversity, equity and inclusion” the “relationship between companies and their shareholders has returned to normal.” You can read the full report here.

Not everyone thinks this so-called “return to normal” is a good thing. Also out this morning is our second in a series of reports from the Fortune CEO Initiative on how to resist the ESG backlash, written by Anton Vincent, president of Mars North America, and Cid Wilson, CEO of the Hispanic Association on Corporate Responsibility.

Separately, I spoke yesterday with Xerox CEO Steve Bandrowczak, who talked about his plan to reinvent the 117-year-old company. Bandrowczak has been in the top job for a little over a year and believes Xerox can use its existing relationships providing document services to small- and mid-size companies to expand into RPA (Robotic Process Automation) and AI services. “We can help companies solve enterprise challenges without enterprise resources,” he said, mentioning hospitals and law offices as examples. “The beauty of it is, when I talk to big companies like Dell and Microsoft and UiPath and Lenovo, they say: ‘We can’t reach those clients with these (RPA and AI) solutions. So let’s partner with you. You’ve already got feet on the street. You have service technicians and sales technicians. You are the perfect partner to go drive this for us.’”

Bandrowczak said that for the last 15 years, Xerox’s contracts for Managed Print Services have been “renewing down”—which means clients pay less for the same service. “For the first time, in the last three quarters, the renew rate has been higher. Why? Because we’re adding these products and services on top of it.”

Will it work? Reinvention is always hard work, but it starts with a plan.

More news below.

Alan Murray

@alansmurray

alan.murray@fortune.com

TOP NEWS

New AI orders

AI companies now must share their safety test results with the U.S. government under a new executive order from the Biden administration. The order adds legal teeth to earlier, voluntary commitments from major tech companies. Experts hailed the new rules as a smart approach to the new technology: “It’s really the first time where the government is ahead of things,” says Michael Santoro, a tech ethics professor at Santa Clara University. Fortune

Crashing valuation

X is now valuing itself at $19 billion, according to the platform’s employee equity compensation plan. It’s a steep drop from last October, when Elon Musk bought the social media platform—then named Twitter—in a deal valuing the platform at $44 billion. X is struggling with high debt payments and crashing advertiser revenue. Fortune

Super-commuters

The rise of remote work is creating a new kind of “super-commuter:” Professionals who work remotely in small towns, yet regularly travel–sometimes by plane–to visit company headquarters. The new phenomenon is likely to help small towns, as well as major cities, which can accommodate jet-setting employees and executives. Mid-sized cities, meanwhile, are likely to suffer as companies realize they no longer need regional offices. Insider

AROUND THE WATERCOOLER

CEO of Ozempic prescription startup Calibrate steps down as investors eye ‘rapid down-sizing’ of consumer business by Jessica Mathews

Airbnb cofounder Joe Gebbia raises $41 million for his startup building small, pre-fabricated houses that spun out of Airbnb in 2022 by Alexei Oreskovic

Can design save the world? A new ‘Burning Man’-like alliance of companies such as PepsiCo and Microsoft is giving it a shot by Nicholas Gordon

HSBC doubled its profits and is giving shareholders $3 billion in buybacks but the bank’s troubles haven’t ended just yet by Prarthana Prakash

Wellesley president Paula Johnson plots her college’s post-affirmative action future by Emma Hinchliffe and Joseph Abrams

This edition of CEO Daily was curated by Nicholas Gordon.

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.