Good morning.

A desire to travel the world from a young age, and “loving the fast-paced nature of being a consultant,” would lead Rema Serafi to a 27-year career at KPMG LLP. Next month, Serafi will become the first woman to hold the position of vice chair of tax at the U.S. audit, tax, and advisory firm.

Growing up, Serafi says she had two special role models: “My mom, a great doctor, along with my dad, who both emigrated to the U.S. from Syria.” And now the Barnard College grad is preparing to lead a team of more than 10,000 partners and professionals.

Serafi will succeed Greg Engel, who is retiring after four decades of service at KPMG. Serafi starts in the new position on Nov. 15, and will also serve as a member of the firm’s management committee.

“I’ve been in a role working alongside Greg for the past three and a half years to lead this group,” she says. Since 2020, Serafi has served as the national managing principal of tax. Before that, she led the economic and valuation services practice for five years and has served in tax roles both domestically and abroad.

‘Make sure that you are creating good experiences’

When Serafi joined KPMG, she recalls living in London for four months to work alongside the London and Frankfurt teams to get final deliverables for a client. As a young adult, that exposed her to the different nuances of managing your career internationally, including office hours, she says.

“I think the way we worked was a little bit different,” Serafi explains. “Some of us were fine working late into the night and some of us were fine coming into the office super early. New Yorkers like to get in real early, so that’s what we did.” Serafi recommends gaining international experience because “it falls into the theme of taking yourself out of your comfort zone,” she says.

Looking back on her tenure at KPMG, “There is no way I could have managed my career without mentors and sponsors,” Serafi says. Her network included professionals who were both inside and outside of the tax function across the firm, she says.

She offers a piece of networking advice: “Make sure that you are creating good experiences, leaving people feeling more positive than anything else in your interactions.”

“I was thinking about that a little bit earlier today because I was interviewing someone to join us as a senior recruit, and I really needed to recruit this person,” Serafi explains. In talking for some time, the two realized they previously worked together. “It really helped in that recruiting discussion that he had a good experience working with me 20 years ago,” Serafi says.

Changing the narrative

The long-held perception of tax professionals wearing a green eyeshade may be replaced by the image of a professional engaged with an AI chatbot.

“Tax is such an exciting profession to be in,” Serafi tells me. “As technology tools and generative AI tools continue to evolve, this is the place to be.” Exploring emerging technologies in the tax function is on her agenda.

“Our younger professionals are so interested in using technology to transform the way they work,” she says. KPMG announced in July a planned $2 billion investment in Microsoft Cloud and AI services over the next five years. An example? Microsoft Copilot will give KPMG professionals access to generative AI tools, Serafi explains. “It can summarize calls and meetings,” she says, “and help them to organize their thoughts in a faster, more efficient way.”

Looking ahead, there are several complex tax, legislative, and regulatory changes that chief tax officers, chief financial officers, and even CEOs are going to have at the top of mind, she says. One example is the new transparency requirements around ESG, Serafi says. And, another is Base Erosion and Profit Shifting (BEPS) 2.0: Pillar Two compliance, she says. “Pillar Two is a reality for our clients who have a global footprint,” she says. They’re thinking about how to use data for storytelling, she adds.

Serafi may be the first woman in her new role, but she seemingly won’t be the last.

“I think we need to continue to foster and push for an inclusive and diverse environment and that responsibility belongs to anybody who manages people,” she says. “We have to not only foster that, but reward it, and then hold those accountable who aren’t doing that. I’m really passionate about creating that culture and making it a part of our DNA.”

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Some notable moves this week

Liz O’Melia has resigned from her position of CFO at Dow Jones & Co., the parent of The Wall Street Journal, MarketWatch.com, and Barron’s, according to a Financial Times report. O’Melia joined the company in May 2022 and was previously CFO at S&P Ratings. Dow Jones has begun the search for a new CFO, according to reports.

Shawn Guertin, EVP, CFO and president of health services at CVS Health will be taking a leave of absence from his role due to unforeseen family health reasons, according to the company. Tom Cowhey, SVP of corporate finance at CVS Health, has been appointed interim CFO. And CEO of Oak Street Health, Mike Pykosz, has been named interim President of Health Services.

Jennifer Barnes was named CFO at Al. Neyer, a design-build developer. Barnes brings more than 25 years of experience to the role. Barnes will serve as a key contributor to the continued expansion of the company’s geographic footprint. Neyer’s project pipeline. A commercial real estate veteran, Barnes previously served as CFO at Viking Management Group.

Nicolette Turner was promoted to CFO at Headspace, a mental health and meditation app company. Turner was most recently SVP of finance. Since joining the company in 2020, she has mentored and advanced the careers of the tenured finance and accounting professionals at Headspace, while recruiting several other individuals. Turner played a key role in the negotiation of Headspace’s $3 billion merger with Ginger in 2021. Before Headspace, she held finance roles at Cardinal Health, Hillrom, McKinsey, and KPMG.

Alan Keifer was named interim CFO at Cactus, Inc. (NYSE: WHD), a provider of products for onshore unconventional oil and gas wells, effective Nov. 13. Stephen Tadlock, who currently serves as EVP and CFO at Cactus was promoted to CEO of the Spoolable Technologies segment. Tadlock will continue to serve as CFO of Cactus until Keifer begins his service. Keifer is a former VP, controller and chief accounting officer of Baker Hughes Inc., who has worked with Cactus since it went public in 2018.

Ilan Daskal was named EVP and CFO at Viavi Solutions Inc. (Nasdaq: VIAV) a provider of communications test and measurement and optical technologies, effective Nov. 7. Daskal joins Viavi from Bio-Rad Laboratories, Inc. where he has served as EVP and CFO since April 2019. Before that, he held CFO roles with multiple technology and engineering companies. Daskal was previously the EVP and CFO at International Rectifier Corporation, which was acquired by Infineon Technologies in 2015.

Virginie Boucinha was named CFO at DBV Technologies (Nasdaq: DBVT), a clinical-stage biopharmaceutical company, effective Nov. 6. Boucinha brings approximately 30 years of experience in the pharmaceutical industry. She most recently served as the group performance director for Pierre Fabre. Before that, Boucinha held various senior positions at Sanofi, including chief of staff to the Sanofi CEO, Global Transformation Office Head, and CFO for India and South Asia. Boucinha will be based at DBV’s headquarters in Montrouge, France.

Big deal

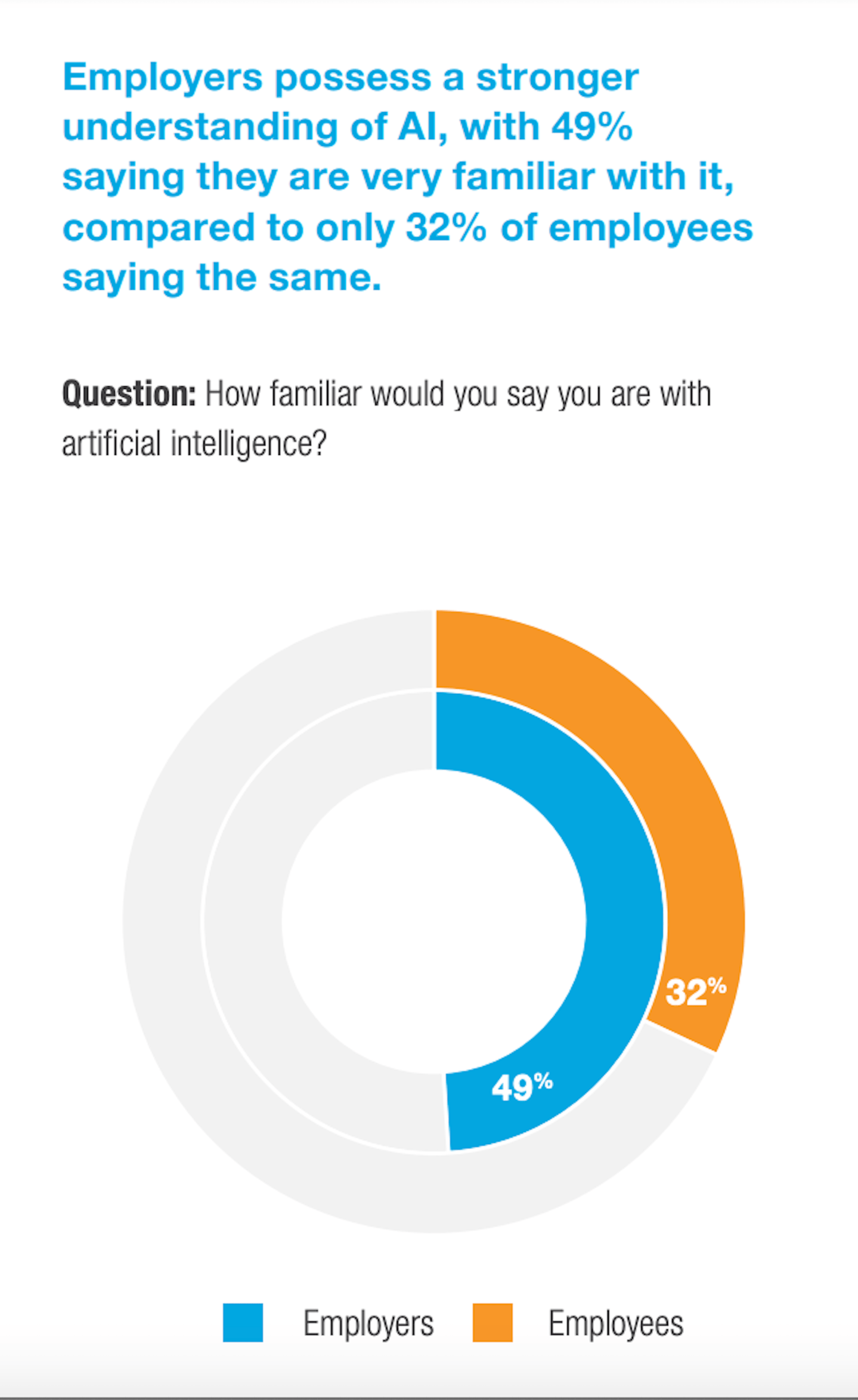

The 13th annual Aflac WorkForces Report tracks the state of the American workplace among employees and employers to find trends, attitudes, needs and experiences in health care and benefits administration. An interesting finding in the report pertains to AI usage. Generally speaking, employers are more engaged with AI than employees, and they see a role for AI in managing benefits, the survey found. However, employees are far less convinced of AI's potential role in benefits or enrollment management, according to the report.

Going deeper

Here are a few Fortune weekend reads:

"Tesla’s poor Q3 numbers show it’s not a tech juggernaut, but a struggling car company" by Shawn Tully

"It’s official: The housing market is turning millennials into their parents. A Fortune 500 economist says it’s a déja vù market that is replaying the 1980s" by Will Daniel and Sydney Lake

"Rolls-Royce CEO who once described the company as a ‘burning platform’ is planning to cut up to 2,500 white-collar jobs" by Prarthana Prakash

"If you habitually hit the snooze button on your alarm, new research says you may be mentally sharper for it" by Erin Prater

Overheard

"An ESG program must align with the business and its strategic drivers. Otherwise, claims of greenwashing and corporate waste may be legitimate. To find solid footing, drive value, and manage anti-ESG sentiment, an ESG program must be right-sized and integrated with the business."

—Jeff Levinson, chief ESG Officer, SVP and general counsel at NetScout Systems, and Ashley Walter, partner-in-charge, ESG, at Orrick, write in a Fortune opinion piece about a new framework that can help companies avoid box-checking exercises.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.