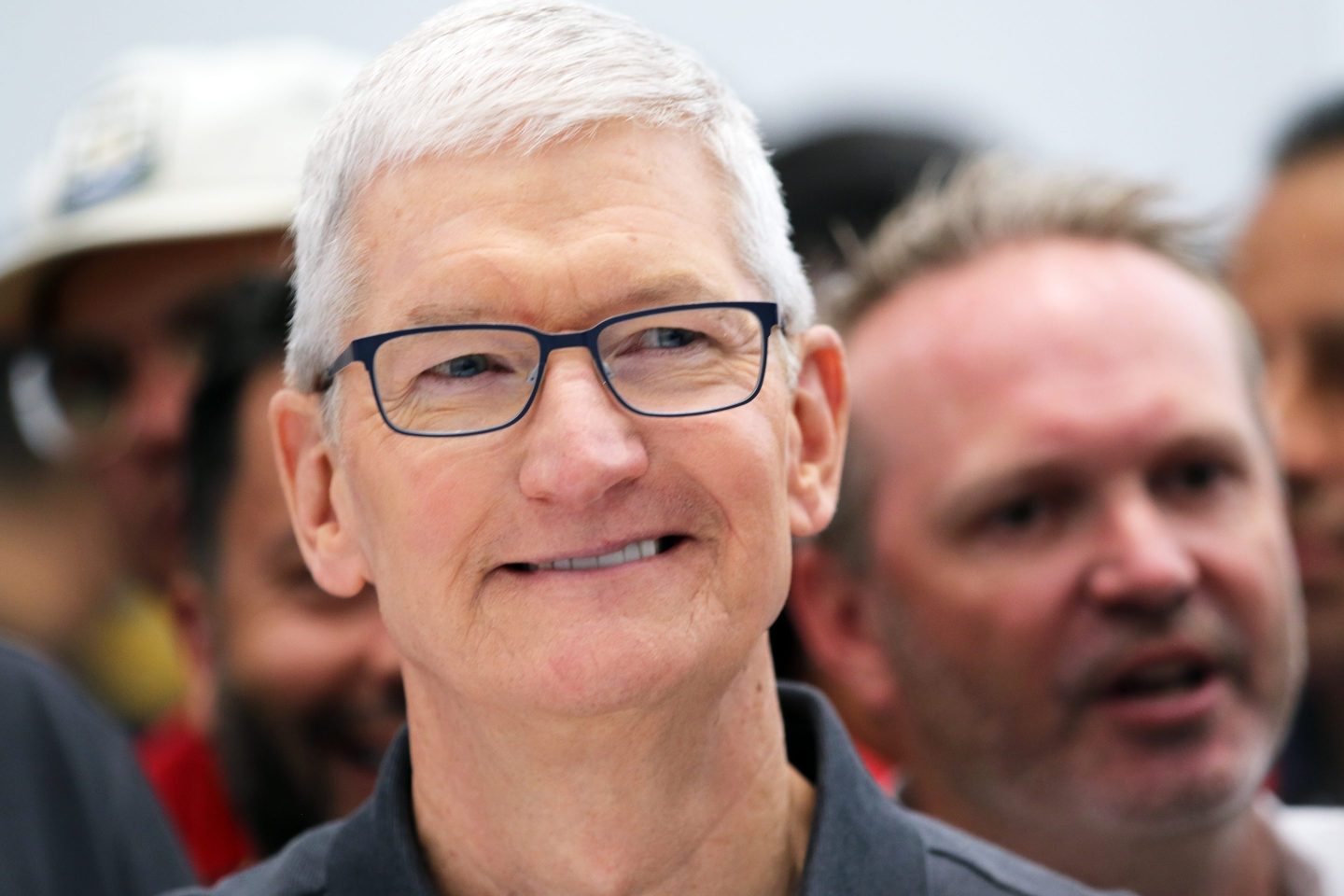

Tim Cook and other senior executives at Apple have recently cashed in tens of millions of dollars’ worth of the iPhone maker’s stock, not long after the company’s share price slipped from its summer highs.

According to an SEC filing from Oct. 3, viewed by Fortune, Apple CEO Cook sold 240,569 shares with a value of approximately $41.5 million.

The transaction, however, didn’t come without strings attached, as further SEC filings reveal proceeds from the sale of some 270,000 additional shares were withheld for tax reasons to cover the cost of the settlement.

The share sale is Cook’s largest in in two years, following a sale in August 2021 that netted him $335 million, according to Bloomberg calculations.

Cook isn’t the only one who had a multimillion-dollar payday this month. SEC filings seen by Fortune show Apple’s senior VP of retail, Deirdre O’Brien, sold 65,536 stocks on the same day as Cook—totaling a payout of just under $11.3 million; while Katherine Adams, general counsel at Apple, sold just under $11.4 million worth of stock.

The sale comes as Apple’s stock slipped from the dizzying highs of summer 2023, when share prices hit more than $195 per share. At the time of this writing, Apple’s share price sits around $173.

Apple did not immediately respond to Fortune’s request for comment.

Despite the stock’s slippage from its 2023 heights, Apple shareholders are likely still pleased with the company’s recent performance. The share price is up 39% for the year to date, and by approximately 210% in the past five years.

The company sits comfortably among the so-called Magnificent Seven—megacap tech stocks that also include Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla.

Why the payday?

The sale by Cook, O’Brien, and Adams doesn’t signify the same thing that a regular shareholder sale would.

All three of the senior executives are vesting a part of their compensation package, as opposed to simply offloading stock—a very common practice among Big Tech bosses.

The SEC filings show the trio are variously vesting performance-based restricted stock units, stock awards, and restricted stock units, which many companies use to compensate their senior staff in addition to a salary.

Cook, for example, is cashing in his performance-based stocks after requesting—and receiving—a 40% pay cut at the start of the year.

In January, an SEC filing revealed Cook took a $35 million pay cut from 2022 to 2023. Cook kept the same base salary—the $3 million it has been since 2016—but saw his equity award value decrease from $75 million to $40 million.

His annual cash incentive remained at $6 million.

Cook himself requested the change, the filing said, following a 64% shareholder approval of named executive compensation packages, which was down from 95% the year prior.

‘Magnificent Seven’ CEO pay

Compensation for tech titans varies wildly across the board—and can fluctuate massively from year to year.

Take Amazon CEO Andy Jassy: In a proxy statement released in April it was revealed that Jassy took home $1,298,723 in 2022. The total is made up of a salary of $317,500 and $981,223 in 401(k) payments and additional security costs.

The seven-figure sum indicates a more than 99% cut from the long-term compensation package outlined for Jassy the year before, when he was awarded $212 million in stock to be vested over 10 years.

Meanwhile over at Microsoft, chairman and CEO Satya Nadella received $54,946,310 in 2022. That’s up from $49,858,280 the year prior courtesy of an increase in stock awards.

His base salary of $2.5 million stayed the same, as it had in 2021 and 2020.

While Mark Zuckerberg notoriously is paid just $1 in salary, Meta’s proxy statement for 2023 revealed its founder and CEO also didn’t partake in the company’s bonus scheme.

Zuckerberg was not awarded any further equity in Meta “because [the business’s] compensation, nominating, and governance committee believed that his existing equity ownership position sufficiently continued to align his interests with those of our shareholders.”

However, Zuckerberg’s compensation for 2022 did come to more than $27 million, the statement added, as a result of Zuckerberg’s security program.

Sundar Pichai, CEO of Google’s parent company Alphabet, had another big year for stock awards in 2022.

The company’s proxy statement, released in April, show Pichai earned a total target award value of $210 million.

However, Alphabet highlights that Pichai’s equity rewards are updated on a triennial basis—i.e., once every three years—adding: “Sundar’s last equity award was granted in December 2019, and fully vested at the end of December 2022. In December 2022, the Compensation Committee granted a new equity award to Sundar to recognize his strong performance as our CEO.”