Good morning. Fortune Senior Correspondent Shawn Tully here.

Public company CFOs live by their stock prices—and die by them too. So it’s no surprise that plenty of finance chiefs are watching the markets with bated breath these days. After all, in just 18 trading days in September the S&P 500 has dropped some 5.3%.

But I believe the worst is still to come.

As I recently wrote in Fortune, an analysis of stock market valuations compared to historical norms using Robert Shiller’s famed CAPE metric suggests we’re looking at a market that has a lot further to fall. As I wrote:

The real 10-year rate equals the yield on 10-year TIPS, or treasury inflation protected securities. The recent jump in the long bond has driven the TIPS rate to 2.37%, the highest number in 20 years, excluding a brief explosion in the Great Financial Crisis. TIPS offers folks and funds a return of 2.37% points over projected inflation, on totally safe bonds. That’s a lot of competition for stocks, which are anything but safe, and seldom riskier than right now.

Of course, investors demand a premium over the risk-free real rate to choose equities, given their careening course, over the safety of Treasuries. Typically, that spread—known as the equity risk premium, or ERP—averages around 3.5 points. So the best estimate of the return investors expect from stocks going forward is 5.9%, which is the 3.5% ERP plus the real yield of 2.37%, plus inflation.

To get a 5.9% real return, a basket of stocks must pay you $5.90 for every $100 you invest. That’s a P/E of roughly 17, which, by the way, is around the S&P average over the past 150 years, though it’s been much higher in past decade of Fed-engineered super-low rates.

A multiple of 17 times our “normalized” earnings estimate of $160 gives an S&P of 2,720. That’s 43% lower than the level on September 26.

To be sure, a 40% drop may not be in our future. But a big decline is certainly feasible, because that’s what the hard math implies.

You can read the full analysis here.

Shawn Tully

shawn.tully@fortune.com

Leaderboard

Some notable moves this week:

Prashanth Mahendra-Rajah was named CFO of Uber Technologies, Inc. (NYSE: UBER), effective Nov. 13. Mahendra-Rajah is currently CFO of Analog Devices (ADI). Before joining ADI, he was CFO of WABCO Holdings Inc. Mahendra-Rajah previously served as Division CFO and in other financial leadership roles at Applied Materials, Visa, and United Technologies.

Tiffany Sy was named CFO and treasurer at Industrial Logistics Properties Trust (Nasdaq: ILPT), effective Oct. 1. Most recently, Sy was CFO and treasurer of Tremont Realty Capital and Seven Hills Realty Trust. She has served in finance and accounting leadership roles at The RMR Group. Before joining RMR, Sy held leadership positions in accounting at AlerisLife Inc. and Bank Rhode Island.

Patrick Edwards was promoted to SVP, CFO, secretary and treasurer at Shoe Carnival, Inc.(Nasdaq: SCVL), a retailer of footwear and accessories, effective Sept. 25. Edwards has served as the company’s chief accounting officer and secretary since 2021, and VP and controller since he joined the company in 2019.

Tony Querciagrossa was named CFO at Pinstripes, Inc., a dining and entertainment brand. Querciagrossa most recently was president of Columbus Industries, Inc. He was previously president of Purafil Inc. and before that group CFO of Filtration Group’s Indoor Air Quality businesses.

Joshua B. Warren was named CFO at Envestnet, Inc. (NYSE: ENV), a provider of integrated technology, data and wealth solutions, on Nov. 15. Warren will succeed Peter H. D'Arrigo, who has served as CFO since 2008. Warren most recently served as managing director and global head of business strategy for iShares and Index Investments for BlackRock.

Big deal

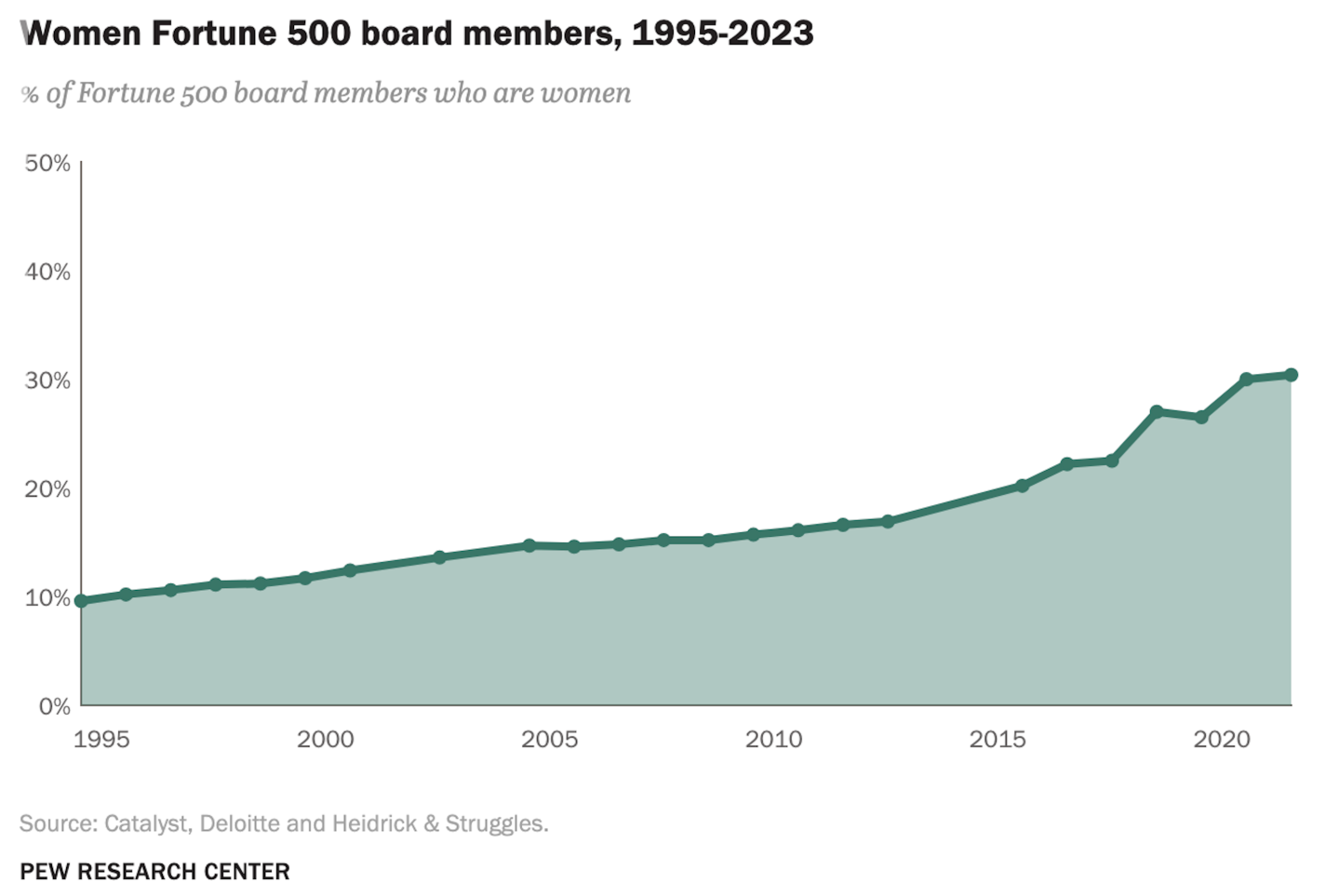

A new Pew Research Center report provides data on women leaders in politics and corporate America. One of the key findings is the share of women sitting on the boards of Fortune 500 companies has been gradually increasing for decades, from 9.6% in 1995 to 30.4% in 2022, according to the report.

Going deeper

Here are a few Fortune weekend reads:

"The economist who’s been predicting a recession for 18 months says the ‘litmus test’ is finally here, especially with oil headed toward $100 a barrel" by Will Daniel

"GitHub CEO: ‘Wall Street relies on software that was developed under Eisenhower. Here’s how AI can prevent the next financial crisis’" by Thomas Dohmke

"How to get out of the drama triangle—the toxic dynamic fueling worker burnout" by Neha Sangwan

Overheard

“Extreme frugality is required. Every expense at the company must be scrutinized under a microscope and all waste eliminated. The company has no use for delegators and money wasters. I expect everyone to treat company money like their own and lead by example.”

—GameStop CEO Ryan Cohen, just hours after being named chief executive, sent out a memo to employees on Thursday regarding the steps he will take to make sure the struggling video game retailer survives, CNBC reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.