When the California State Teachers’ Retirement System makes any kind of change to its portfolio, people pay attention.

With more than $321 billion in assets under management, CalSTRS is one of America’s largest public pension plans and therefore one of the world’s most important limited partners, with approximately $50 billion in capital strewn across private funds and, naturally, some of the world’s most influential private companies.

CalSTRS’ core private equity portfolio is littered with all the usual suspects: TPG, New Enterprise Associates, Thoma Bravo, Blackstone, and, as of 2021, Tiger Global, to name a few. But 21 years ago, the pension plan also began setting aside a small portion of capital to back first-time fund managers. It has hired out that responsibility to three third-party partners over the years: HarbourVest, Muller & Monroe, and Invesco.

Now, CalSTRS says that one of those partners—Invesco—is getting out of this line of business, so it is bringing on Sapphire Partners, the $3.6 billion LP arm of enterprise software-focused VC Sapphire Ventures, to manage five funds and $1.4 billion in assets focused on emerging managers. With the change, CalSTRS will, for the first time, have a fund class solely focused on emerging venture capital investors. (Invesco declined to comment for this story.)

“Standardizing one group to focus on venture—because it’s so specialized from an emerging manager standpoint—made a lot of sense for us,” Rob Ross, a private equity portfolio manager at CalSTRS, told Term Sheet in an interview. He added: “We just haven’t been as specialized as we should be, given the nuances of venture capital.” Ross pointed out that, while Invesco did make investments in emerging VC, PE, and growth investor managers over their 18 years working together, this will be the first time emerging VC managers will be singled out.

Beezer Clarkson, who leads Sapphire’s fund investing business, says that Sapphire will invest CalSTRS’ capital exactly the same way it deploys its own. Sapphire Partners backs VCs raising one of their first three funds, targeting a 3x net return for Series A funds and a 5x net return for seed funds. While Sapphire will look at both specialists and generalists, Clarkson says it’s important that a GP can articulate why an entrepreneur would pick them as an investor, and why she should be interested as an LP.

“I think the authenticity of that answer is the differentiator,” Clarkson says.

CalSTRS is currently investing out of its fifth fund, a $250 million fund from 2021, and Ross estimated there is approximately $80 million from that fund left to deploy. (CalSTRS filed with the SEC for a sixth fund vehicle in order to shift management responsibilities to Sapphire, though Ross clarifies this is not a new fund and CalSTRS has not set aside any additional capital at this time.)

The change at the pension fund will likely be a welcome one for first-time managers, as fundraising has been pretty dire for those just getting their start. As I wrote about last month, emerging managers are on track to raise less than they have in a decade, based on data from the first four months of the year.

Part of that has to do with risk. Emerging managers, by definition, have fewer than three funds, meaning they don’t have much of a track record to show investors. “Only about 17% of funds make it to fund four,” Clarkson says, citing data from PitchBook. Not to mention, the current market uncertainty has made price discovery more difficult, and LPs are being choosier across all their GPs.

“I think all LPs are being more selective than they had been in the past,” Ross says.

At the same time, a high-risk bet on a first-timer can turn into an enormous return. Cambridge Associates reported in 2019 that 72% of the venture industry’s highest-performing funds were run by emerging managers. (This is the most recent metric. Cambridge Associates didn’t respond to my request for updated figures.)

“There’s no guarantee it’s going to work out well. And because there are so many emerging managers every year, the challenge of picking the ones that will continue is extraordinarily hard—and that’s probably the nugget of why most LPs don’t do this,” Clarkson says.

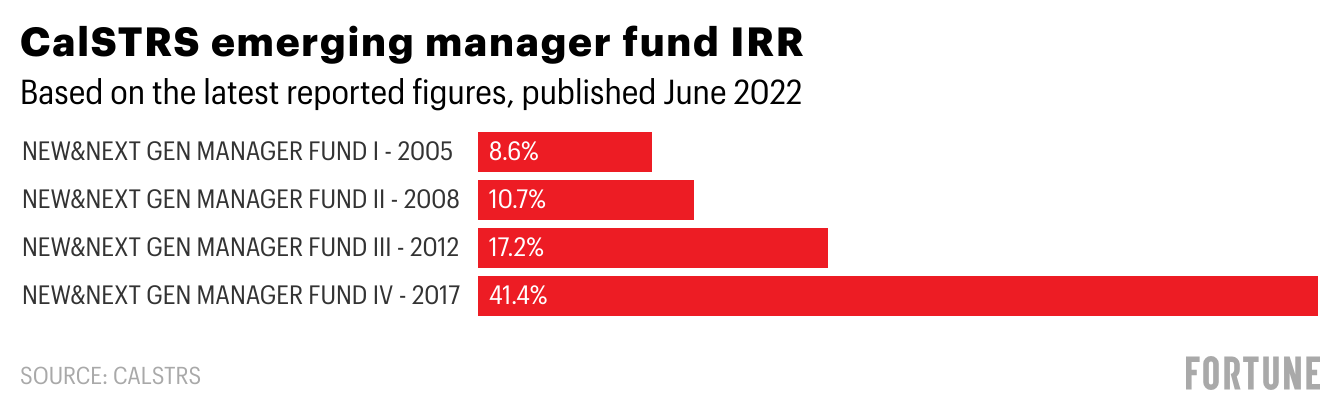

For CalSTRS, returns for this class of funds have been strong so far. Here’s a look (I didn’t include the 2021 fund because it didn’t have a long enough track record to judge it fairly):

As it’s become more and more competitive for LPs to get exposure to top-performing funds, it makes sense for large-scale limited partners to be building relationships with promising investors earlier on. And there’s nothing preventing a pension plan or institutional LP from outsourcing most of the work. Just earlier this year, one of California’s other major pension plans, CalPERS, had said it was now working with TPG and GCM Grosvenor to deploy $1 billion into emerging manager funds.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Enfabrica, a Mountain View, Calif.-based silicon and software company that provides the networking and chips for AI functions, raised $125 million in Series B funding. Atreides Management led the round and was joined by Sutter Hill Ventures, NVIDIA, IAG Capital Partners, Liberty Global Ventures, Valor Equity Partners, Infinitum Partners, and Alumni Ventures.

- Actio Biosciences, a San Diego, Calif.-based biotech company developing therapeutics for rare and common diseases, raised $55 million in Series A funding. Canaan and DROIA Ventures led the round and were joined by Deerfield Management, EcoR1, and Euclidean Capital.

- ELSA, a San Francisco-based machine learning and speech recognition technology for teaching English, raised $23 million in Series C funding. UOB Venture Management, UniPresident, Asia Growth Investment Fund and were joined by Gradient Ventures , Monk’s Hill Ventures, and Globant Ventures.

- Heliene, a Sault Sainte Marie, Canada-based solar panel manufacturer, raised $20 million in funding from Orion Infrastructure Capital, 2Shores Capital, Valta Energy, and Bullrock Reneweables.

- Treasury4, a Spokane, Wash.-based enterprise software platform that makes modern tools for treasury and finance practitioners, raised $20M in Series A funding. WestCap led the round and was joined by Cowles Company, Fortson VC, Voyager Capital, Kick-Start Seed Fund, and W.T.B. Financial Corporation.

- AMP, a Singapore-based platform that makes shipping and tracking tools for e-commerce merchants, raised $18.5 million in Series A funding from Jungle Ventures and Openspace Ventures.

- Zenity, a Tel Aviv, Israel-based security platform for applications with little to no code, raised $16.5 million in Series A funding. Intel Capital led the round and was joined by Vertex Ventures, Upwest, Gefen Capital, and B5.

- Buyandship, a Hong Kong-based international shipping and logistics provider, raised $10 million in Series B funding from Cool Japan Fund.

- N5, a Buenos Aires, Argentina.-based company whose software platform is aimed at modernizing existing technology of fintech companies, raised $9.5 million in funding from Illuminate Financial, Exor Ventures, Madrone Capital Partners, LTS Investments, and ArpexCapital.

- Vaxess Technologies, a Cambridge, Mass.-based life science company developing vaccine patches for self-application, raised $9 million in funding from RA Capital, The Engine, GHIC, Ulu Ventures, and others.

- DetraPel, a Boston, Mass.-based sustainable coatings manufacturer, raised $7.6 million in Series A funding. Material Impact led the round and was joined by INX International, Touchdown Ventures, FitzGate Ventures, Boro Capital, Icebook Investments, and others.

- Gable.ai, a Seattle, Wash.-based collaboration platform for software and data developers to build and manage data sets together, raised $7 million in seed funding. Zetta Venture Partners, Crane Venture Capital, and Essence Venture Capital led the round and were joined by angel investors The New Normal Fund, Monte Carlo, Hex, and others.

- Prewitt Ridge, a Los Angeles-based engineer automation software developer, raised $4.1 million in seed funding. Squadra Ventures led the round and was joined by Stage Venture Partners, Aurelia Foundry, Wonder Ventures, Haystack, Acequia, TechStars, GC&H, and angel investors.

- IMMIX, a London, U.K.-based crypto services provider and trading platform, raised $2.7 million in seed funding. MassMutual Ventures led the round and was joined by Ripple Ventures, among others.

- Science On Call, a tk-based AI-powered help desk for restaurants, raised $2.6 million in seed funding. York IE led the round and was joined by Bread & Butter Ventures, Relish Works Capital Investments, Groove Capital, Connetic Ventures, Redstick VC, and Phoenix Club.

PRIVATE EQUITY

- CenterOak Partners recapitalized Guardian Access Solutions, a Nashville, Tenn.-based that maintains, repairs, and installs exterior access control equipment. Financial terms were not disclosed.

- Impact.com, backed by Silversmith Capital Partners, acquired SaaSquatch, a Victoria, Canada-based provider of customer referral software for e-commerce companies. Financial terms were not disclosed.

- Imperial Dade, backed by Advent International, acquired Ralik, a Blainville, Canada-based paper goods, packaging, and janitorial supplies distributor. Financial terms were not disclosed.

- North Branch Capital acquired a majority stake in STARC Systems, a Brunswick, Maine-based designer and manufacturer of wall systems that help mitigate dust, abate sound, and block fire, among other things, for healthcare facilities and contractors. Financial terms were not disclosed.

- OneDigital Investment Advisors, a subsidiary of OneDigital, acquired Triad Financial Advisors, a Greensboro, N.C.-based wealth management firm. Financial terms were not disclosed.

OTHER

- Smurfit Kappa agreed to acquire WestRock, an Atlanta, Ga.-based packaging and consumer packaging manufacturer, for $11 billion.

- ICR acquired Consilium Strategic Communications, a London, U.K.-based healthcare communications and investor relations firm. Financial terms were not disclosed.

IPOS

- Birkenstock, a Linz am Rhein, Germany-based footwear brand, filed to go public in the U.S. L Catterton backs the company.

FUNDS + FUNDS OF FUNDS

- BV Investment Partners, a Boston, Mass.-based private equity firm, raised $1.75 billion for its 11th fund focused on tech, software, and IT services sectors.

PEOPLE

- Maverick Ventures, a San Francisco-based venture capital firm, hired Lexi Henkel as a principal. Formerly, Henkel was with TMRW Life Sciences.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.