Beneath the very public collapse of Adidas AG’s multibillion-dollar sneaker deal with Ye is a private legal battle over a $100 million-a-year marketing fund.

The fund, from which Adidas claims the rapper diverted $75 million, has come to the fore as the two sides trade accusations behind closed doors over the partnership that imploded last year, sending the German apparel maker reeling.

Details of the dispute, which is being conducted through an arbitrator, had been closely guarded until they were accidentally revealed in a related hearing in May, when the parties’ lawyers discussed them in open court. Bits and pieces of the conflict have also been seeping out in legal filings, including one in which Adidas alleges that the hiphop artist formerly known as Kanye West and his fashion brand Yeezy LLC “mishandled virtually all of the marketing funds” — including by deploying them for unauthorized purposes.

“There is nobody in the courtroom, your honor, other than the parties and their counsel,” Mark Goodman, an attorney for Adidas, told US District Judge Valerie Caproni at the hearing in Manhattan as he prepared to talk about information submitted under seal.

“That’s fine,” Caproni said, according to a transcript of the hearing. “Be aware it’s possible a reporter could walk in at any time.”

And then one did. The lawyers, who didn’t notice, went on to discuss the previously undisclosed marketing fund that Adidas executives had put in place.

‘Economic Rubble’

Adidas claims that last year it paid $50 million into a Yeezy bank account in Wyoming, where the rapper/designer used to live, and $25 million into Yeezy’s JPMorgan Chase account in New York, all to be put in a special pot for marketing. Instead, it alleges, the money was immediately transferred into a separate, general account where it was commingled with other Yeezy funds, in violation of their agreement.

Adidas is locked in secret arbitration with Ye and three of his companies claiming he single-handedly reduced the promising venture to “economic rubble.” It is pursuing an accounting of the funds and a return of the $75 million, minus any amount Yeezy can show was used for valid marketing purposes, as well as unspecified monetary damages.

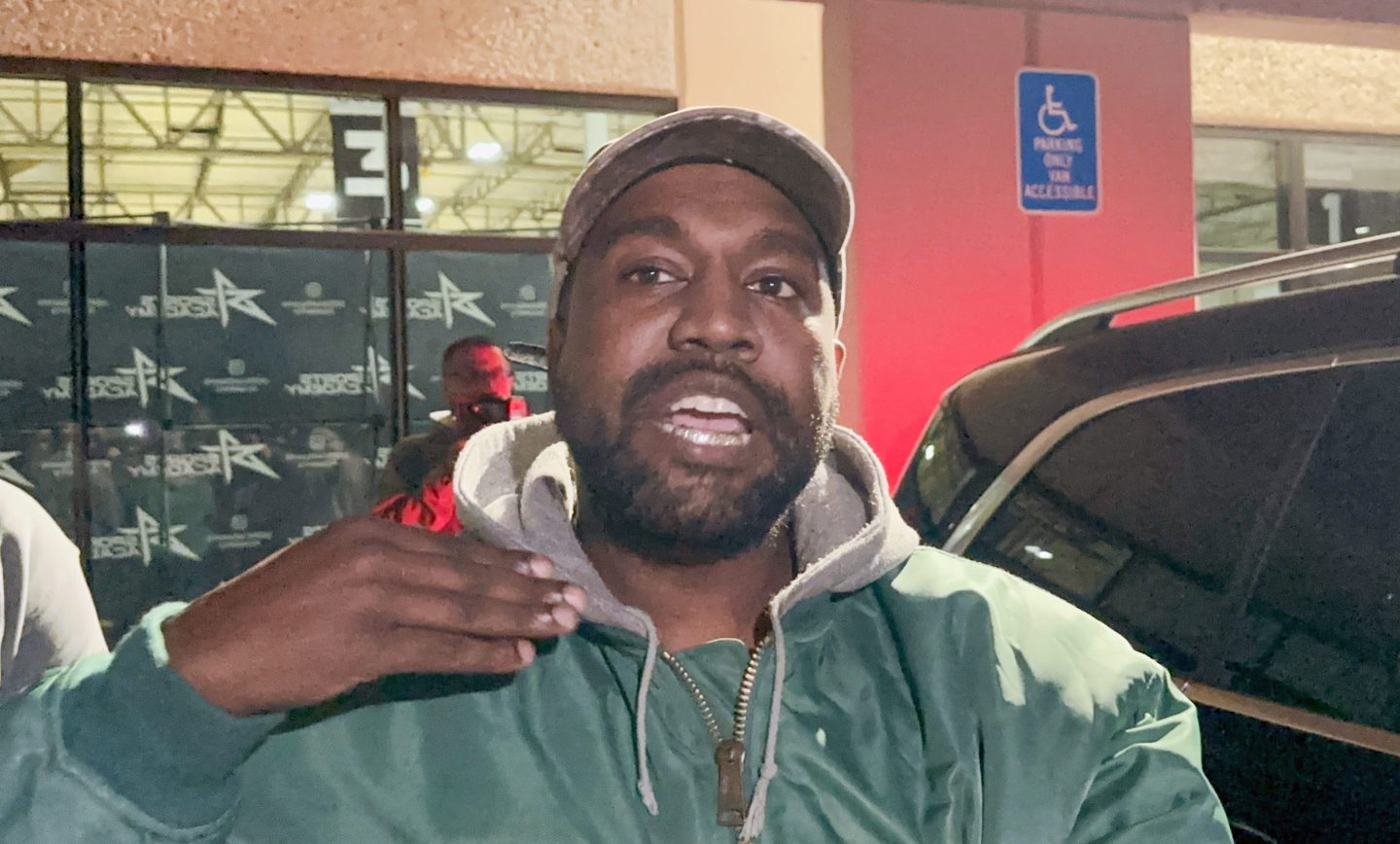

Ye has said the designer shoe is on the other foot.

“No one should be held in that position where people can steal from them and say we’re just paying you to shut up,” he said in an interview with Bloomberg in September shortly after firing off a series of Instagram posts hammering Adidas executives, and just before the deal went kerflooey. “That destroys innovation. That destroys creativity. That’s what destroyed Nikola Tesla.”

A heavily redacted copy of Ye’s arbitration counterclaims includes the accusation that Adidas copied Ye’s designs to make its own lower-priced shoes. Adidas claims it owns all of the Yeezy shoe designs, which Ye has publicly said are his.

The dispute became public when Adidas went to federal court in New York to try to freeze the $75 million to prevent Ye from dissipating it or moving it out of reach.

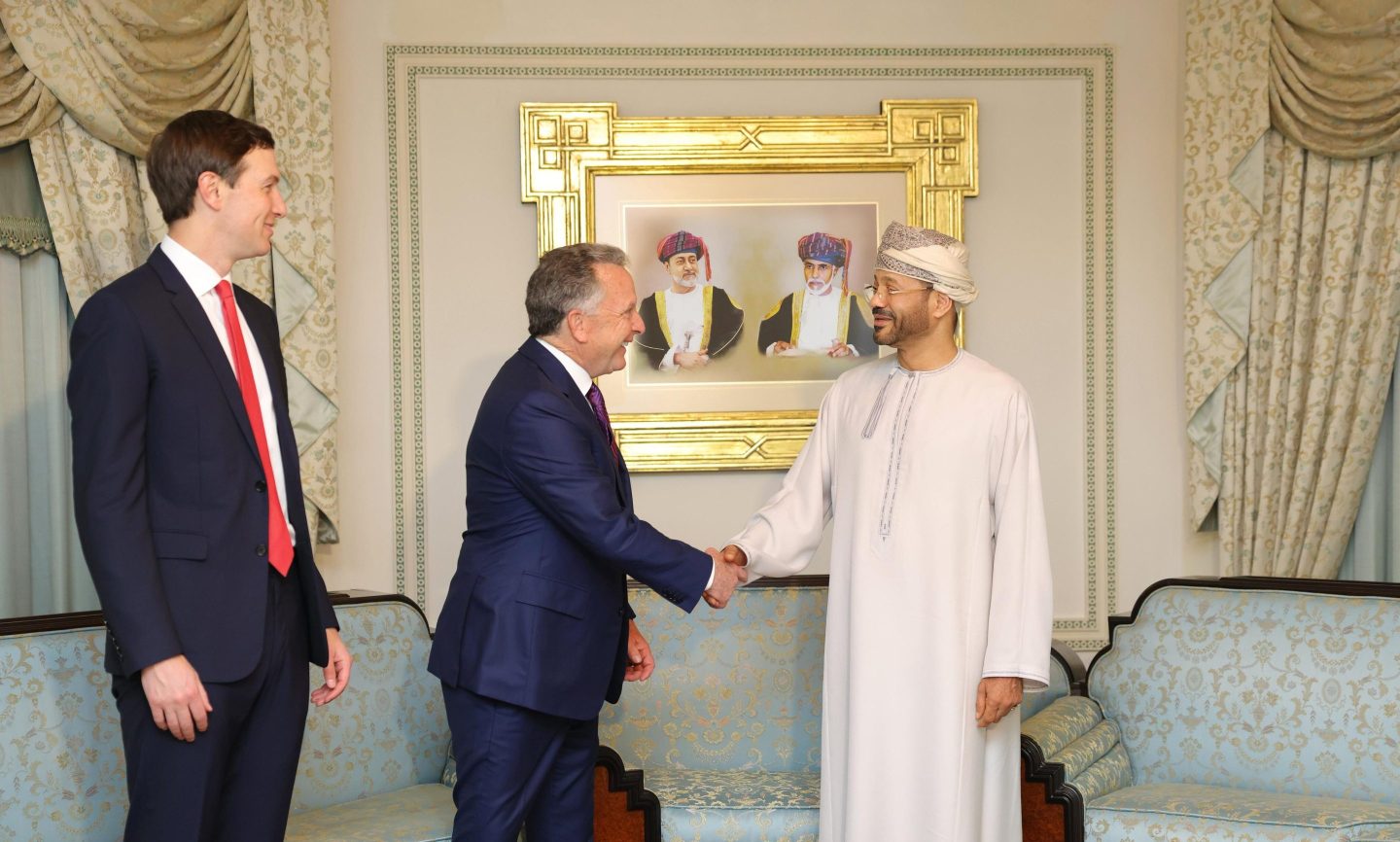

William H. Taft V, a lawyer for Adidas, declined to comment on the dispute. A lawyer for Ye didn’t respond to a request for comment.

Deal’s Implosion

The partnership fell apart in October after Ye chastised the executives and went on a series of antisemitic rants. Since then, it’s been nine months of operational and legal headaches for the German sportswear company. The breakup blew a hole in Adidas’s finances.

The company is now trying to recoup some revenue by selling $1.3 billion in leftover Yeezys, while donating some proceeds to charity. Even so, it found itself facing what could be its first operational loss since the early 1990s.

To make matters worse, shareholders filed a suit against Adidas in Oregon in April, alleging that former management failed to disclose issues between the company and Ye, and asking to represent a larger class of investors.

The contract between Adidas and Ye is contained in a 53-page licensing and endorsement agreement signed in May 2016, as well as in a series of amendments, letter agreements and payment confirmations that later became part of the deal. It includes confidentiality provisions intended to keep secret the details of the agreement and the Yeezy business. One requires Ye’s company to return any unused, or misused, marketing funds received from Adidas in the previous year, according to the shoe maker.

Under the terms of their deal, Ye’s business collected royalties from every pair of shoes sold, making up the bulk of his payouts, which surpassed $200 million in 2020, according to a cash flow document prepared by UBS and reviewed by Bloomberg News. On top of that, he received a marketing fee to promote the shoes — $51 million that year, or about 3% of net sales, according to the document.

It’s unclear exactly what the marketing money was used for. Ye has said that in 2019 he took out funds for marketing Yeezy to use on Sunday Service, his gospel choir tour that played shows at Coachella, Howard University, in Jamaica and at his homes in California and Wyoming. He said it cost about $50 million.

Based on the in-court disclosures, Caproni later ordered both sides to uncover previously blacked-out information related to the marketing payments from more than 450 pages of court filings in the case. She denied Adidas the freeze. The dispute is now back in private arbitration.