Economists have been chanting warnings of the sticky inflation theory for most of 2023.

Now, a notable scholar known as the “money doctor” is challenging the idea that “sticky” inflation could make the Federal Reserve’s job of ensuring price stability and maximum employment for Americans a serious challenge.

“Forget all the propaganda we’re hearing — that the chairman of the Federal Reserve has a tough problem, that this is going to be a long fight, things are sticky and so forth. Things aren’t sticky,” Steve Hanke, a professor of applied economics at Johns Hopkins University, told CNBC Thursday. “I think the inflation story is history.”

Becoming the money doctor

Hanke earned his “money doctor” moniker after spending decades advising heads of state and finance ministers on economic policy. He served on President Reagan’s Council of Economic Advisers in the 80’s, and helped Indonesian President Suharto tackle the fallout from the Asian Financial Crisis in the 90’s. He’s currently consulting with aides to the Argentinian libertarian party candidate Javier Milei on the best ways to combat the nation’s rampant inflation.

The professor is a proponent of monetarism, an economic theory that holds that changes in the money supply are the main driver of inflation. With the money supply in the U.S. contracting over the past year, he believes inflation is no longer an issue. That doesn’t mean consumer prices are set to fall (that would be deflation), but it does signal the end of the era of surging rent, food, and energy prices.

“The fact that the money supply has been contracting on a year-over-year basis by 4% in the United States. We haven’t seen that since 1938,” Hanke said. “It’s all about money, so the [falling inflation] numbers don’t surprise me.”

Hanke went on to rebuke the press and his economist peers for focusing on “non-monetary causes of inflation”—like supply chain issues or rising corporate profit margins—on Thursday. “This is utter rubbish,” he said, noting that he just finished a study, set to be published in September, which shows a one-to-one relationship between changes in the money supply and changes in inflation.

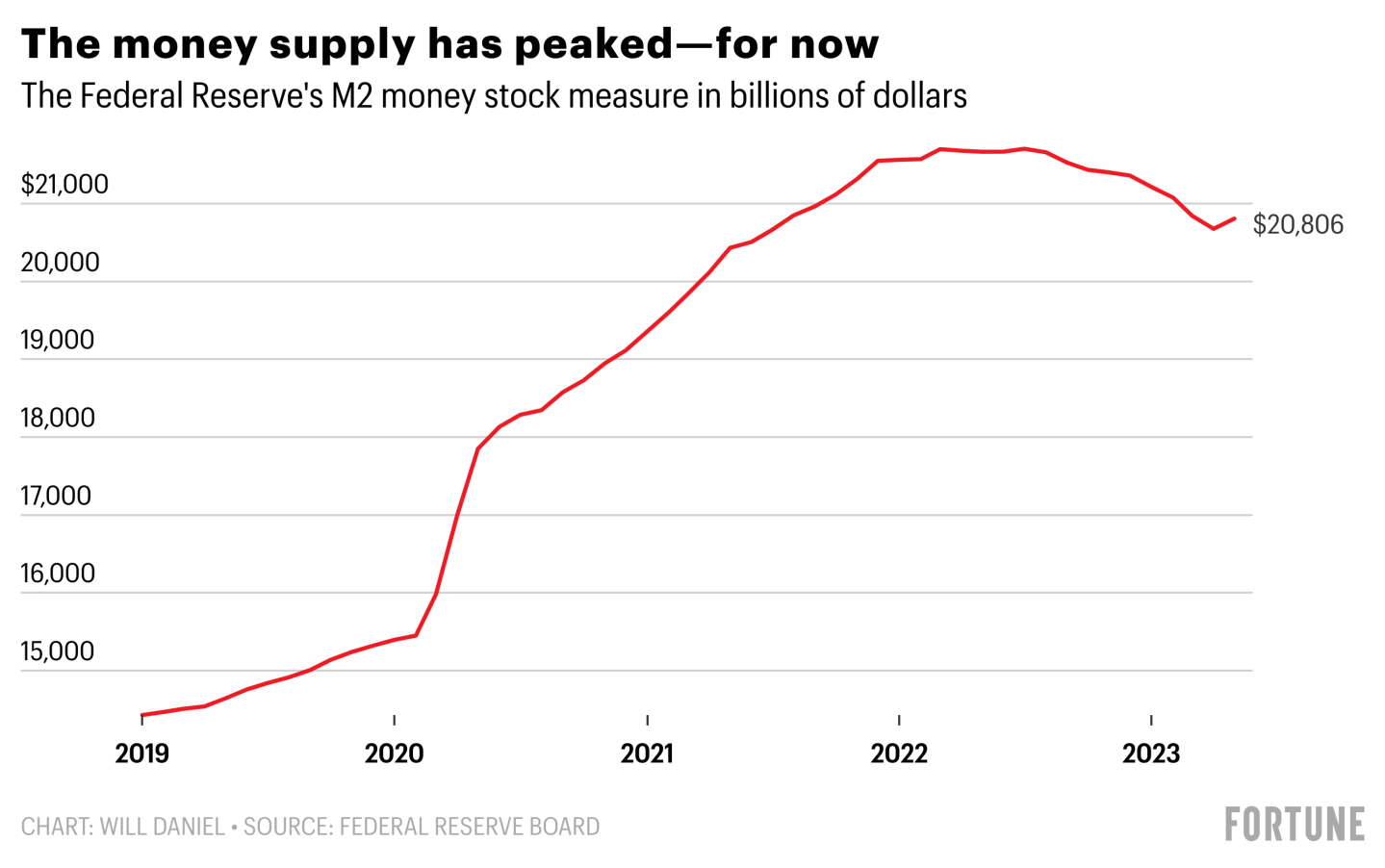

To Hanke’s point, the Federal Reserve’s M2 measure, which tracks the money stock in the U.S. economy, surged over 40% between February 2020 when the pandemic began and its peak in March of last year. During that period, year-over-year inflation jumped from 2.3% to 8.5%.

Then, between last July and this May, the money supply dropped nearly 5%. And year-over-year inflation again followed suit, falling from 8.5% to just 4%.

Evidence from wholesale prices

If the Fed continues to shrink the money supply, Hanke said inflation will hit the “2% range pretty fast,” pointing to falling wholesale prices as evidence for his theory. The producer price index (PPI), which measures wholesale prices for goods and services producers, rose just 0.1% from a year ago in June, the Bureau of Labor Statistics reported Thursday. That’s down from a peak of 11.5% in April of 2022.

Hanke noted that in 2021, when inflation was rising, the producer price index led the consumer price index higher, while core inflation, which excludes volatile energy and food prices, lagged behind. “Now, we’ve turned the thing around and the producer price indexes are falling like a stone….The consumer price index, it’s falling pretty much like a stone. And the core is lagging way behind,” he said, noting that “we’ll see all of that come down” if the Fed keeps shrinking M2.

Hanke isn’t alone in his more positive view of inflation. Jeffrey Roach, chief economist at LPL Financial, told Fortune that the latest PPI data was “another positive report for investors desperate to see inflation dissipate.”

“The decline in wholesale prices, especially for transporting freight, foreshadows a slowdown in both economic activity and a further deceleration in consumer prices throughout the balance of 2023,” he added.

While economist’s inflation predictions varied widely at the start of 2023, and their track record forecasting recessions hasn’t been the best over the past few years, it may make sense to pay attention to Hanke. In February, he predicted inflation would fall throughout 2023 to a range between 2% and 5%. Then, Hanke explained: “About two months ago I did an interview in Fortune Magazine, with Shawn Tully, and I said I think it’ll probably be at the lower end of that range. And it’s looking like it will be.”

If Hanke is right, the real issue for the U.S. economy in 2023 won’t be inflation, it will be growth.