There may be a heatwave rolling through the U.S., but it’s still not a hot time to fundraise. And the bottom of this sinking market could still be six months ahead of us.

The early numbers are in and venture dealmaking in Q2 was “tepid,” according to PitchBook senior venture analyst Kyle Stanford—and it “seems pretty precarious,” he told me.

Let’s break it down.

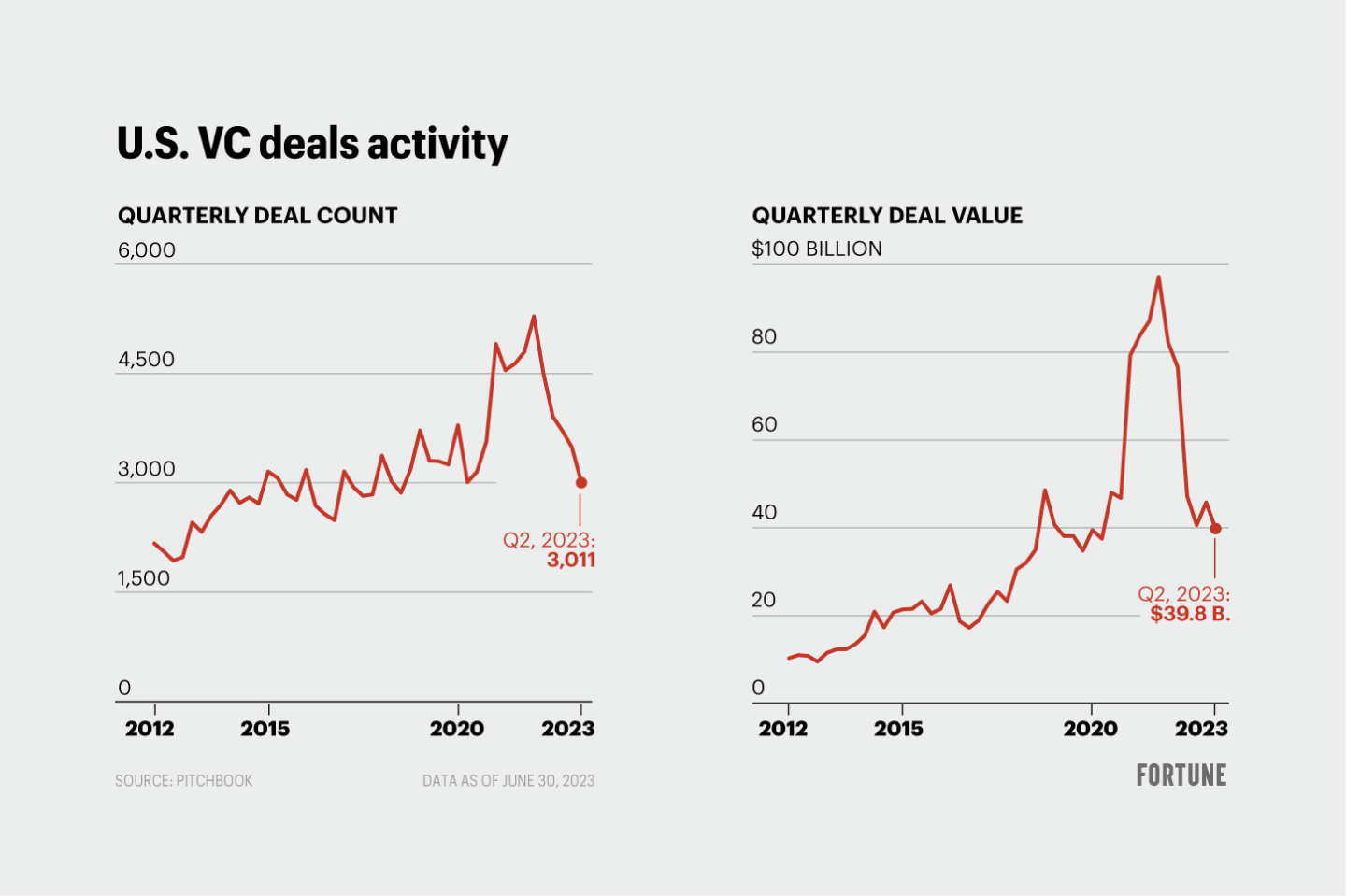

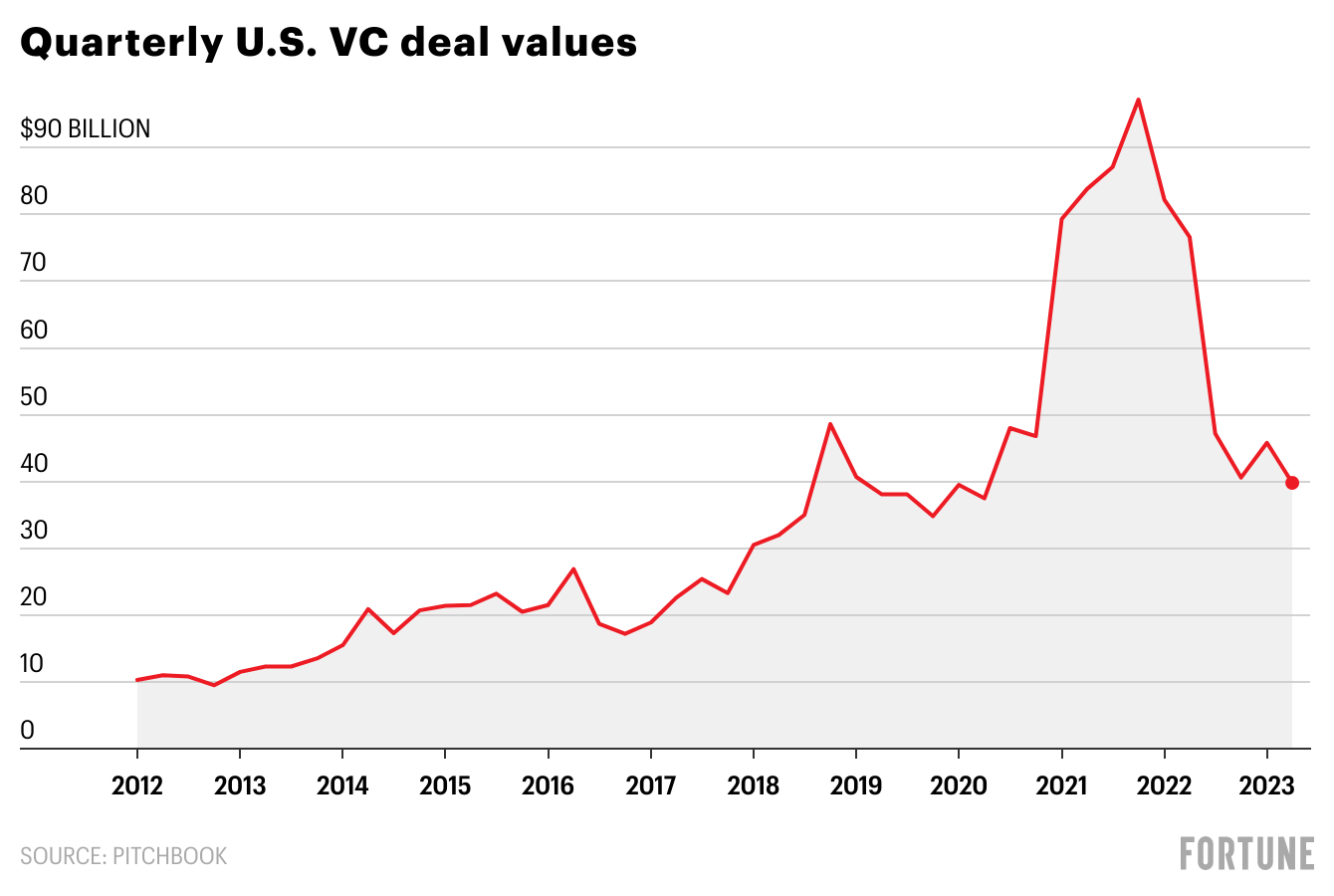

VC-backed companies in the U.S. raised $39.8 billion in the second quarter, a 48% drop year over year and a 13% decrease from last quarter, according to new PitchBook data.

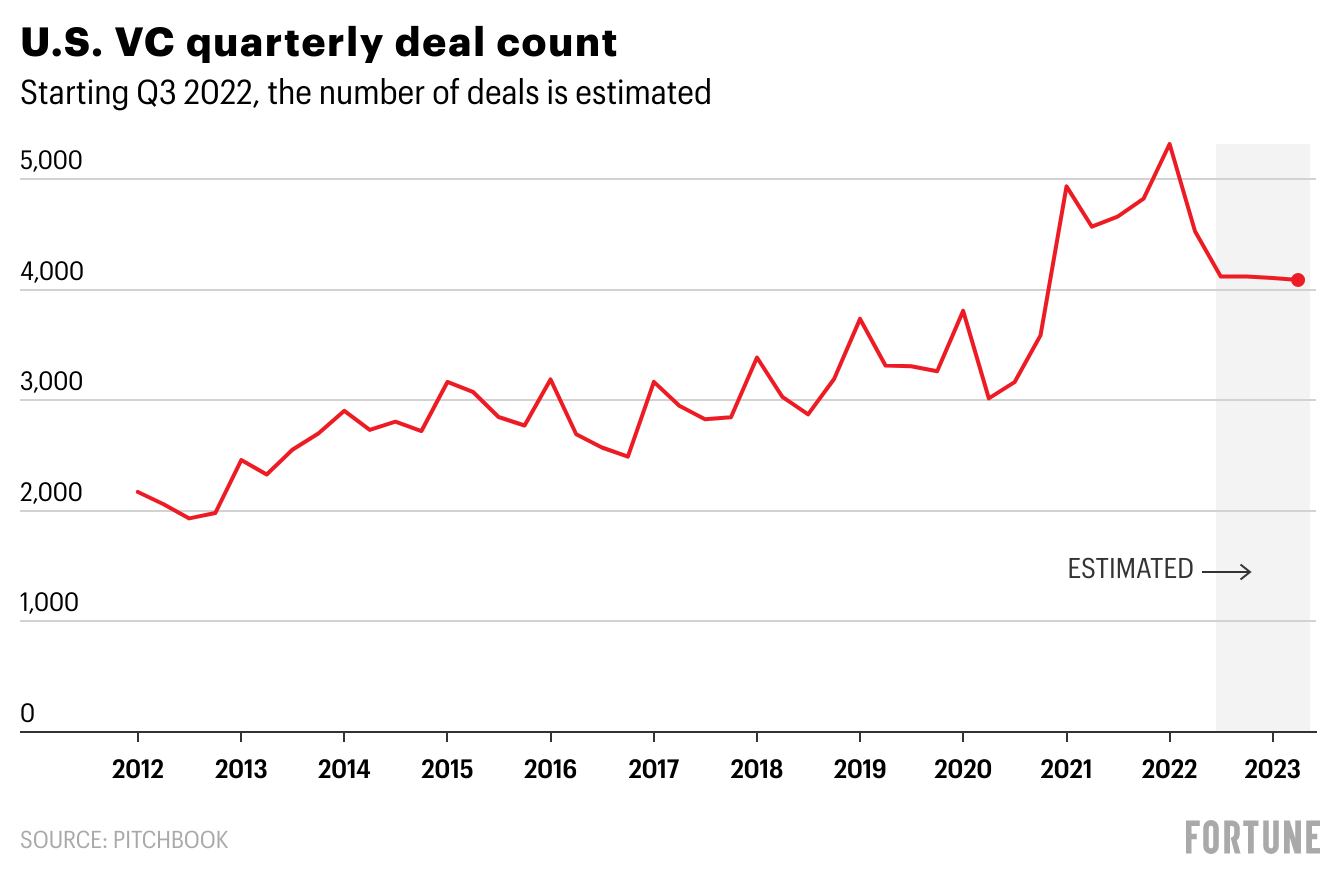

Deal count, meanwhile, continued to slump, down about 14% from Q1 at 3,011 deals. PitchBook’s estimated deal count for the second quarter puts that number a bit higher, at 4,088, which shows a plateau forming over recent quarters. (The estimate is due to a lag in reporting and finding deals, PitchBook says.) “It has stabilized from the deal count perspective,” notes Stanford, and it’s “still above pre-2021 figures.”

But “the next six months are probably the bigger story than just Q2,” he believes.

The big backdrop here is that there are some 50,000 VC-backed companies out there in the U.S., about half of which have raised funds since the end of 2021, Stanford says. Those companies that have held out will likely need to tap the market again in the near future to stay afloat or boost their funding. We’re already seeing more down rounds, and Stanford expects that to continue in the next couple of quarters.

“I think Q4 or Q1 next year is when we’re really gonna see…the bottom of the market. That is if everything stays the same: inflation continues coming down, interest rates plateau or hopefully start to come down,” Stanford predicts.

With that abundance of startups in need of cash, he believes investors are going to be more picky with funding their strongest companies. “That’s where a lot of the further decline is going to come from: ‘Alright, what do we do with this huge number of companies?…How do we get companies acquired or IPO or exited in some way [so] that we can kind of recycle money back to LPs?’”

Of course, the big caveat is if the IPO market opens in the coming months, we may see things turn around. Cack Wilhelm, general partner at IVP, says there’s “excitement” among investors over the “perception of public markets opening up and great companies raising again,” she told me.

But for now, we wait.

See you in the mountains…As Jessica mentioned yesterday, we’ll both be in Utah next week for the Fortune Brainstorm Tech conference. Shoot me a note or say hi if you’ll be around!

Have a great weekend,

Anne Sraders

Twitter:@AnneSraders

Email: anne.sraders@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- CADDi, a Chicago-based procurement solutions provider for the manufacturing industry, raised $89 million in Series C funding co-led by Globis Capital Partners, DCM, Global Brain, World Innovation Lab, JAFCO Group, Minerva Growth Partners, and others.

- Clair, a New York-based on-demand pay provider, raised $25 million in funding. Thrive Capital led the round and was joined by Upfront Ventures and Kairos.

- Numarics, a Zurich-based digital accounting solution company, raised €10.2 million ($11.1 million) in seed funding. UBS Next and FiveT Fintech co-led the round and were joined by Wingman Ventures and Seed X.

- ChipFlow, a Sheffield, U.K.-based open-source semiconductor chip design platform, raised $1.5 million in pre-seed funding. Fontinalis Partners led the round and was joined by Fuel Ventures, InMotion Ventures, APX, and others.

- Distil.ai, an Exeter, U.K.-based customer data platform, raised an additional £1.1 million ($1.4 million) in funding led by Mercia Ventures.

PRIVATE EQUITY

- GTCR agreed to acquire a majority stake in Worldpay, a Jacksonville, Fla.-based payment processing solutions provider, from FIS. GTCR will acquire 55% of Worldpay and FIS will retain the remaining 45%. The deal is valued at $18.5 billion.

- LBK Capital acquired U.S. Triestina Calcio 1918, a Trieste, Italy-based soccer club. Financial terms were not disclosed.

- Man Group agreed to acquire a majority stake in Varagon Capital Partners, a New York-based middle-market private credit manager. Financial terms were not disclosed.

OTHER

- DigitalOcean acquired Paperspace, a New York-based A.I. and machine learning infrastructure startup, for $111 million.

- Avenue Z acquired Bevel, a New York-based communications consultancy, for $75 million, according to Bloomberg.

FUNDS + FUNDS OF FUNDS

- The Raine Group, a New York-based investment firm, raised $760 million for a fund to invest in growth-stage technology, media, and telecom companies with a focus on sports, media, entertainment, and gaming.

- Insight Partners, a New York-based venture capital firm, raised$118 million for a fund focused on diverse-led, early-stage funds investments.

PEOPLE

- Makena Capital Management, a Menlo Park, Calif.-based investment firm, hired Anne Marie Fleurbaaij as managing director, cohead of marketable investments. Formerly, she was with University of Cambridge Investments.

- Norwest Venture Partners, a Palo Alto-based venture capital firm, hired David Rudnitsky as CRO operating executive and principal. Formerly, Rudnitsky was with Yext and Salesforce.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.