Good morning.

Companies are increasingly looking more at the overall skill sets of CFO candidates rather than whether those individuals have sector-specific experience, according to experts. One example? Ravi Thanawala.

Papa John’s International (Nasdaq: PZZA), one of the largest pizza delivery companies with more than 5,700 restaurants in approximately 50 countries and territories, announced on Monday that Thanawala will join as CFO on July 24. Thanawala is currently CFO for Nike North America, the retail giant’s largest division, which reported fiscal year 2022 revenue of approximately $18 billion.

Thanawala began his tenure at Nike North America almost seven years ago and took over as CFO in 2020. He previously served as the global VP and CFO of the Converse brand, and the global VP of retail excellence. Before Nike, he served as CFO at ANN Inc., the parent company of Ann Taylor, LOFT, and Lou & Grey. On his LinkedIn page, it shows his career began at Balenciaga as a wholesale intern.

A lack of food industry-specific experience certainly didn’t deter Papa John’s from pursuing Thanawala, who brings with him “a combination of strategic financial leadership experience, operational acumen, and international expertise,” CEO and President Rob Lynch said in a company statement. “Ravi’s proven track record of leading companies with diversified business models and robust e-commerce platforms will be key to enabling our continued growth through both our corporate-owned and franchisee-led restaurants.”

‘More transferable’

I asked executive recruiting experts what they’re seeing regarding more companies choosing CFOs from different sectors.

“CFO candidates have always been open and willing to explore new industries,” says Shawn Cole, executive recruiter and president of Cowen Partners, an executive search firm. “It was the companies that had reservations. And to a certain degree, CFO skill sets are becoming more transferable with technology adaptation, standardized ERPs, and FP&A. However, not all experience is transferable, and you have to find common ground between industries, service delivery, business size, and complexity.”

This trend, Cole continued, also “speaks to two things: a lack of qualified candidates with industry experience, and looking outside their industry for best practices in an uncertain economy/business environment.” He added: “There are only so many quick-service restaurants for Papa John’s to pull CFOs from, and it’s only natural for them to look outside the industry for transferable skill sets.”

“In general,” says Jenna Fisher, managing director and head of the CFO practice at the global firm Russell Reynolds Associates, “I see a correlation between the size of a company and agnosticism around industry. Broadly speaking, bigger companies have the luxury of having lots of people on the bench and lots of people with endemic knowledge about the industry at the company already. What tends to be the more salient data point—for larger companies in particular—is the functional skill set that a CFO brings to the table.”

That said, there are notable exceptions like “biotech and financial services, in particular, that have a very unique alphabet soup that is distinct to those industries, and they tend to be less fungible from an industry standpoint,” Fisher added.

So why did Thanawala choose Papa John’s? A company spokesperson said Thanawala wasn’t available for an interview. But in the announcement, he said Papa John’s has a “people-first culture, differentiated brand, and innovative mindset,” and “vast whitespace available for development in the U.S. and internationally.” Chris Collins, who served as the interim principal financial and accounting officer and finance team leader since March, will resume his role as VP of Tax and Treasury. Collins took on the interim role after Ann Gugino resigned as CFO in March.

Ultimately, Fisher tells me, the fact more companies are considering CFO candidates without industry-specific experience is “also somewhat correlated to what we’ve seen in terms of a lot of first-time CFOs getting the nod: It’s enabling this kind of next-gen talent to emerge.”

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

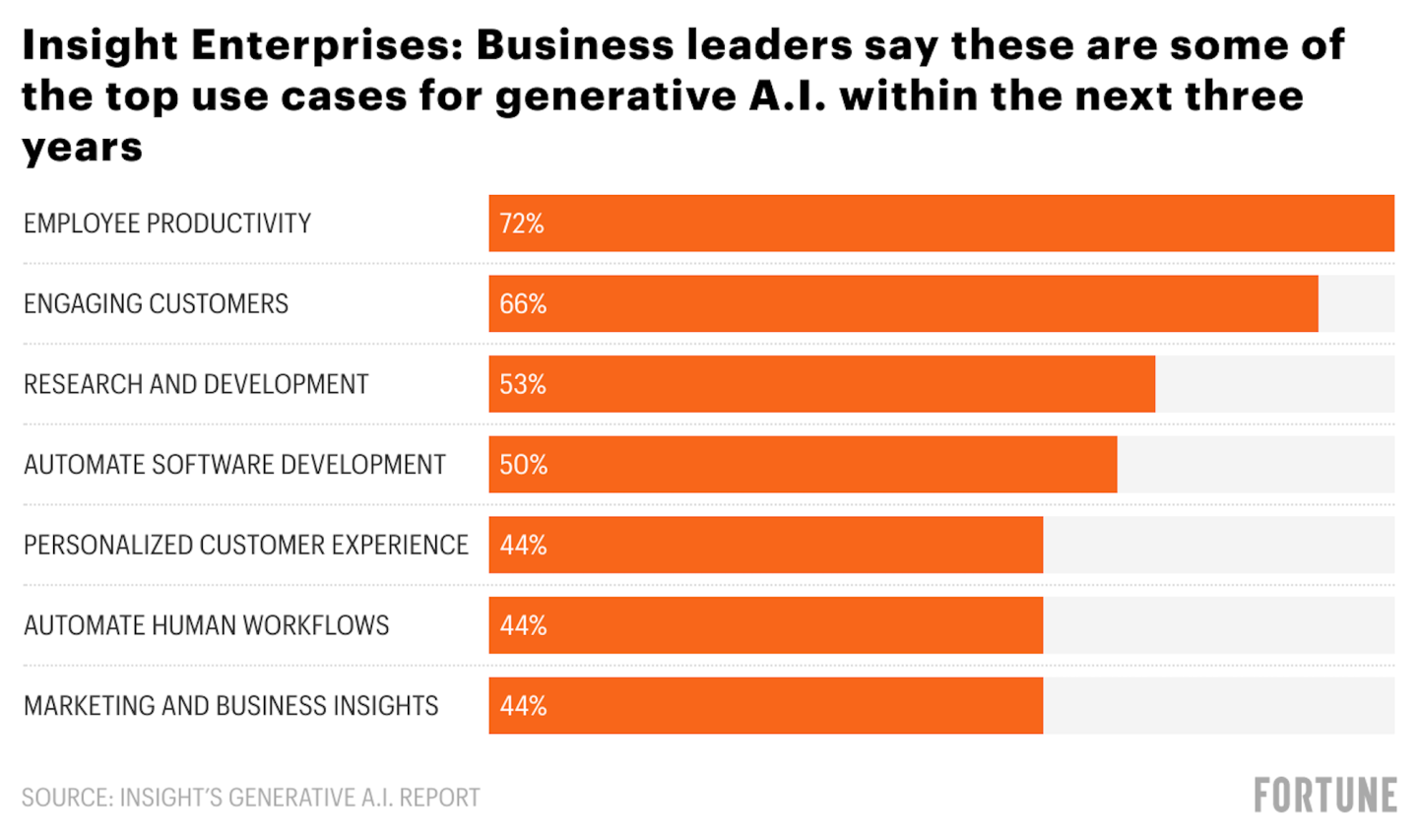

The Harris Poll, on behalf of Insight Enterprises (Nasdaq: NSIT), conducted a survey of 405 U.S. director-level or above professionals at companies with 1,000 or more employees on how they're thinking about and exploring generative A.I. technologies. Within the next three years, most business leaders surveyed expect to adopt generative A.I. to make employees more productive (72%) and enhance customer service (66%), according to the report. About half expect the technology to assist with research and development as well as automate software development or testing. Other use cases include surfacing market insights, personalizing customer experience, and automating software development and human workflows. The survey also found that 81% of respondents say their company already has established or implemented policies and strategies around generative A.I. or is currently in the process of doing so.

Going deeper

The third quarterly Fortune @ Work Playbook was released on Monday by Fortune's leadership team. The collection of articles examines how HR leaders at top companies are navigating the use of generative A.I. in the workplace.

Leaderboard

Lea Daniels Knight was named EVP and CFO at Integra LifeSciences Holdings Corporation (Nasdaq: IART), effective June 28. Most recently, Knight served as the EVP of business finance for Booz Allen Hamilton. Before that, she worked at Johnson & Johnson for 18 years, assuming finance roles with increasing responsibility, including as CFO of Johnson & Johnson’s North American pharmaceuticals business. She started her career in public accounting at Arthur Andersen LLP where she spent nine years managing audit engagements and helped to stand up the firm’s health care consulting and M&A practices for the Philadelphia office.

Michael (“Mike”) Hynes was named CFO at Noodles & Company (Nasdaq: NDLS), effective July 24. Hynes brings nearly 25 years of finance and accounting experience to Noodles & Company. He held several roles in finance and accounting since he joined Ruth’s Hospitality Group in 2008. Most recently, he spent three years as VP of finance and accounting for Ruth’s Chris, a fine-dining steakhouse. Before joining Ruth’s Chris, Hynes held managerial positions in several accounting firms, including RSM and Deloitte, where he started his career in 1998.

Overheard

"Despite the overwhelming evidence that flexible hybrid work is more productive than forced in-office work for the same roles, top executives are stubbornly herding employees back to the office like lost sheep, expecting productivity to miraculously improve. This, my friends, is the very definition of insanity."

—Gleb Tsipursky, the CEO of the future-of-work consultancy Disaster Avoidance Experts, writes in a Fortune opinion piece on the forced return to office

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.