Good morning, Peter Vanham here in Geneva, filling in for Alan.

It’s the chronicle of a death foretold: Germany, Europe’s largest economy, entered a recession yesterday. The recession was widely expected, but beneath its surface lies a major dilemma for the German economy: to “de-risk” or depend on China, that’s the question.

The question became acute because Germany’s engine sputtered partially due to faltering exports to China. German companies saw an 11.3% drop in their exports to the world’s second-largest economy so far, whereas most other European economies exported more. What happened?

Part of it can be brought back to conventional factors. Cars typically represent a large share of German exports, but Chinese consumers are increasingly buying Chinese brands, and government subsidies which pushed German car sales higher last year, ended.

Since a few months, though, there is another major factor, and it is one that represents a seismic shift: German politicians are steering their companies away from China.

The country’s political leaders won’t go as far as some in the U.S. have, pursuing a policy of “decoupling”. But Europe’s largest economy is increasingly aligning with the U.S., anyway.

“The U.S. and the European Union have converged on using the term ‘de-risking’ [from China], and Germany’s chancellor Olaf Scholz emphasized the term in his [G7] speech as well,” Costanze Stelzenmueller, director of the Center on the United States and Europe at Brookings told me.

A few months ago, leaked documents also indicated “Germany’s foreign ministry wants to take a tougher line on China and push companies to reduce their dependency on Beijing”, Politico reported.

It means German executives still depending on China, and wanting to expand their market share there, such as Siemens, are facing an uphill battle. “I will defend my market share, and if I can, I will expand it,” Siemens CEO Roland Busch told the Financial Times this week.

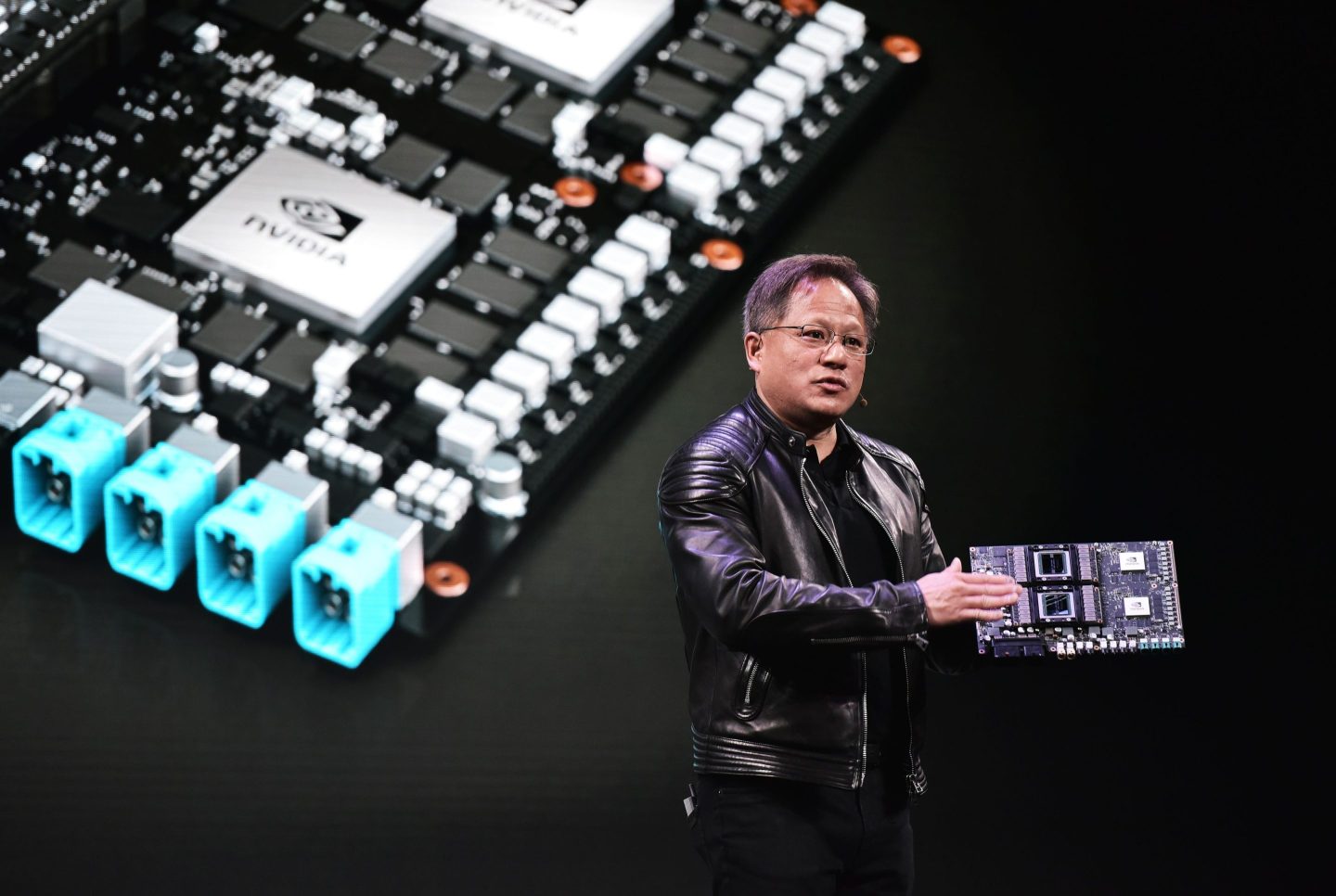

Back in the U.S., Nvidia chief Jensen Huang also warned about the consequences of the G7’s desire to de-risk from China. “There is no other China, there is only one China,” he said this week, warning of “enormous damage to American companies” if the trade in chips stopped.

But if exports falter, and the notion of “economic dependency” becomes a political problem on both sides of the Atlantic, it’s hard to see how this wouldn’t have any long-term effects.

CEO Daily is off on Monday for Memorial Day. We’ll see you back here Tuesday. More news below.

Peter Vanham

Executive Editor

peter.vanham@fortune.com

@petervanham

TOP NEWS

Debt ceiling deal

White House and Republican negotiators are reportedly edging toward a deal on raising the U.S. debt ceiling with just days to go until the country runs out of cash to pay its bills. The emerging agreement includes a two-year cap on federal spending, a 3% increase in defense spending and a measure to upgrade America’s electric grid so it can accommodate green energy. Details on the deal are still provisional, however, and a final accord has not been drawn up, despite the U.S. edging toward a potentially catastrophic default on its debts. Bloomberg

Nvidia soars

Nvidia shares gained more than $184 billion in a single session on Thursday, after the tech firm—which describes itself as a world leader in A.I. computing—forecast revenues growth of 52% in the third quarter thanks to a boom in demand for artificial intelligence. As Fortune’s Shawn Tully reports, Thursday’s rally puts Nvidia close to joining the elusive trillion-dollar market cap club, whose members include Apple, Alphabet and Amazon. But that doesn’t mean it’s not a risky stock, with one top analyst insisting the company is “priced for fantasy.” Fortune

Musk’s brain implants headed for human trials

Elon Musk’s brain implant firm Neuralink says it has been granted permission from the FDA to begin conducting human trials. The company initially struggled to win FDA approval after applying to the agency in early 2022 for permission to test on humans. Last year, it was reported that Neuralink was facing a federal investigation over welfare violations of animals involved in the company’s testing procedures—but Musk has said he’s so confident in the implants’ safety that he would feel comfortable with them being tested on his own children. Reuters

AROUND THE WATERCOOLER

Caroline Ellison: How a young math whiz with an appetite for risk became a major player in Sam Bankman-Fried’s corrupt crypto empire by Courtney Rubin

Microsoft’s $69 billion Activision Blizzard deal is an expensive slog and distraction — and CEO Satya Nadella knows he’d be nuts to walk away by Matt Weinberger

The $500 billion ‘Office real estate apocalypse’: Researchers find remote work’s effect even worse than expected by Alena Botros

‘I’ve never saved a dime’: Shark Tank’s Barbara Corcoran has spent her millions—including giving half of it away by Eleanor Pringle

Gen Z should never work from home if they want success—or love, NYU professor says by Chloe Taylor

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.