So far, 2023 has been a record-breaking year for venture capital—but not in a good way.

Startup funding has seen a record slowdown this year, quarter, and now, according to new research, month. And the lag has been taking a toll on VC firms’ performance.

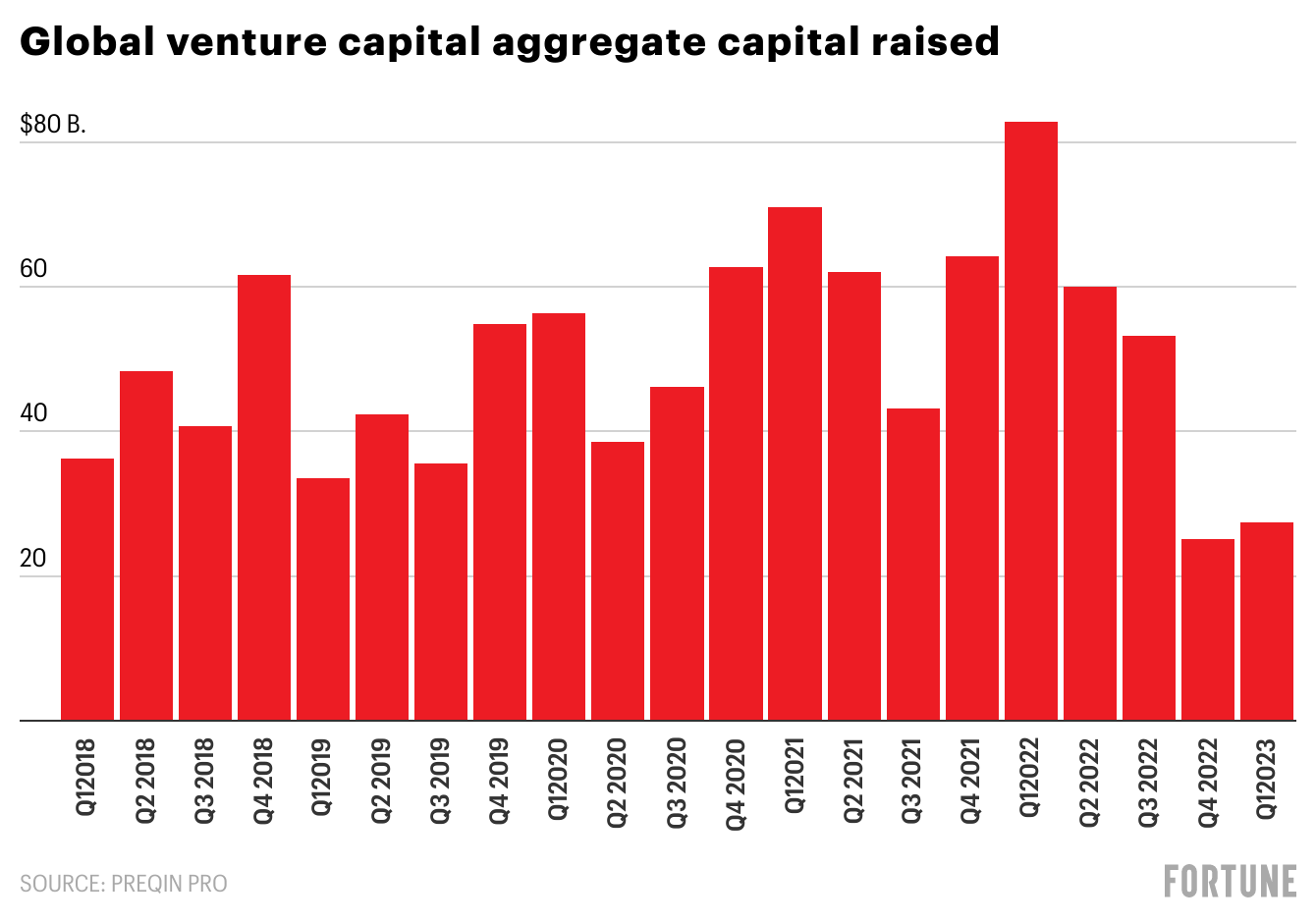

According to new research from Preqin, VC funding is not only down, but so are indicators of how firms are performing. Index return performance has dropped 10.4% in the expansion-stage quarter over quarter, and 5.9% in the early-stage in the fourth quarter of 2022. Year over year as of the last quarter of 2022, index returns were down 20% overall. “As capital flowing into venture capital slows, firms will need to consider whether capital reserves for follow-on investments are sufficient if fundraising cycles start to get drawn out, a reversal from what we have been seeing in the recent past,” says Angela Lai, vice president of research and insights at Preqin. Exit values, a standard metric of success for a startup, have been down across the board.

April has proven to be a particularly rough month as global funding declined 56% since last year, according to new data from Crunchbase. Late-stage funding has fallen the most at 62% in a year-over-year comparison, while early-stage funding declined to 48% and seed dropped by 50%.

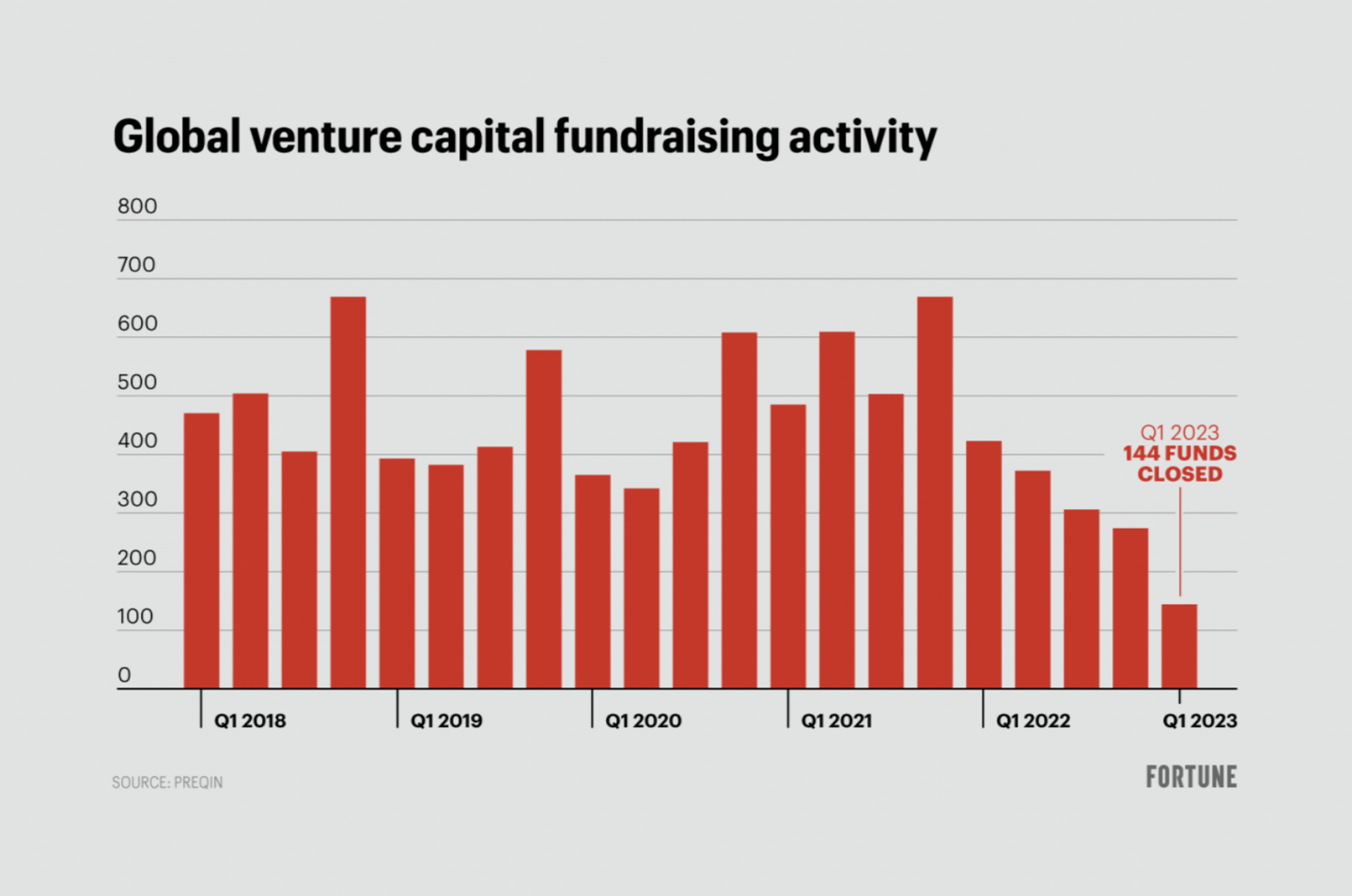

The volatile fundraising environment has impacted firms across the board but has been especially brutal for emerging managers with smaller funds. While the total number of funds closed dropped this quarter, the average fund size was larger and aggregate funding raised was slightly higher in the first quarter of 2023 compared to the last quarter of 2022, according to Preqin. During the first quarter of 2023, 144 funds closed, with only five funds making up half of the value of total fund closes. This means that smaller funds are receiving even proportionally less of the funding available as the market turns.

The failure of banks like Silicon Valley Bank, Signature, and most recently First Republic has also been detrimental to emerging, smaller funds. Monique Woodard, founder and managing director of Cake Ventures, which launched its first $17 million fund in January 2023, explained that she has historically seen the bigger banks as being less responsive and collaborative with newer funds. “Working with some of the larger banks has been a little bit more difficult for those of us with smaller font sizes,” she explained.

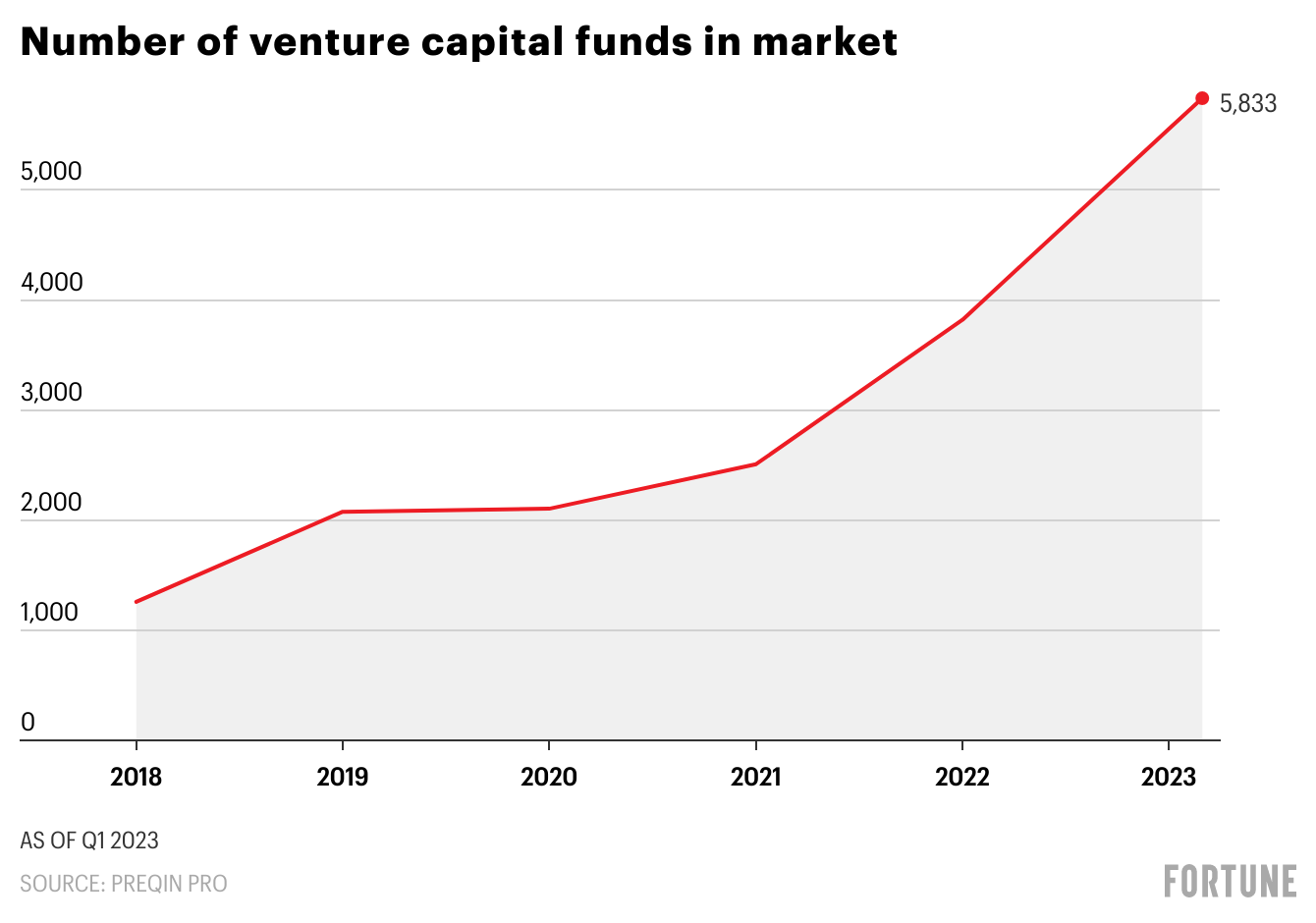

Yet a challenging environment hasn’t necessarily deterred new funds, surprisingly. The number of funds in the market is one metric that has shot up. The number of funds raising rounds increased by 5% over the first quarter. The most common stage for new funds was early stage given that the long incubation period for companies shields them from some of the impact of poor market conditions.

While the number of funds active is on the rise, deal activity continues to lag, bringing its fifth-consecutive quarter downturn even lower. Deal flow dropped the most in North America (53.1% decline in the first quarter of 2023) compared to Asia and Europe, which both saw deals decline overall by roughly 30%.

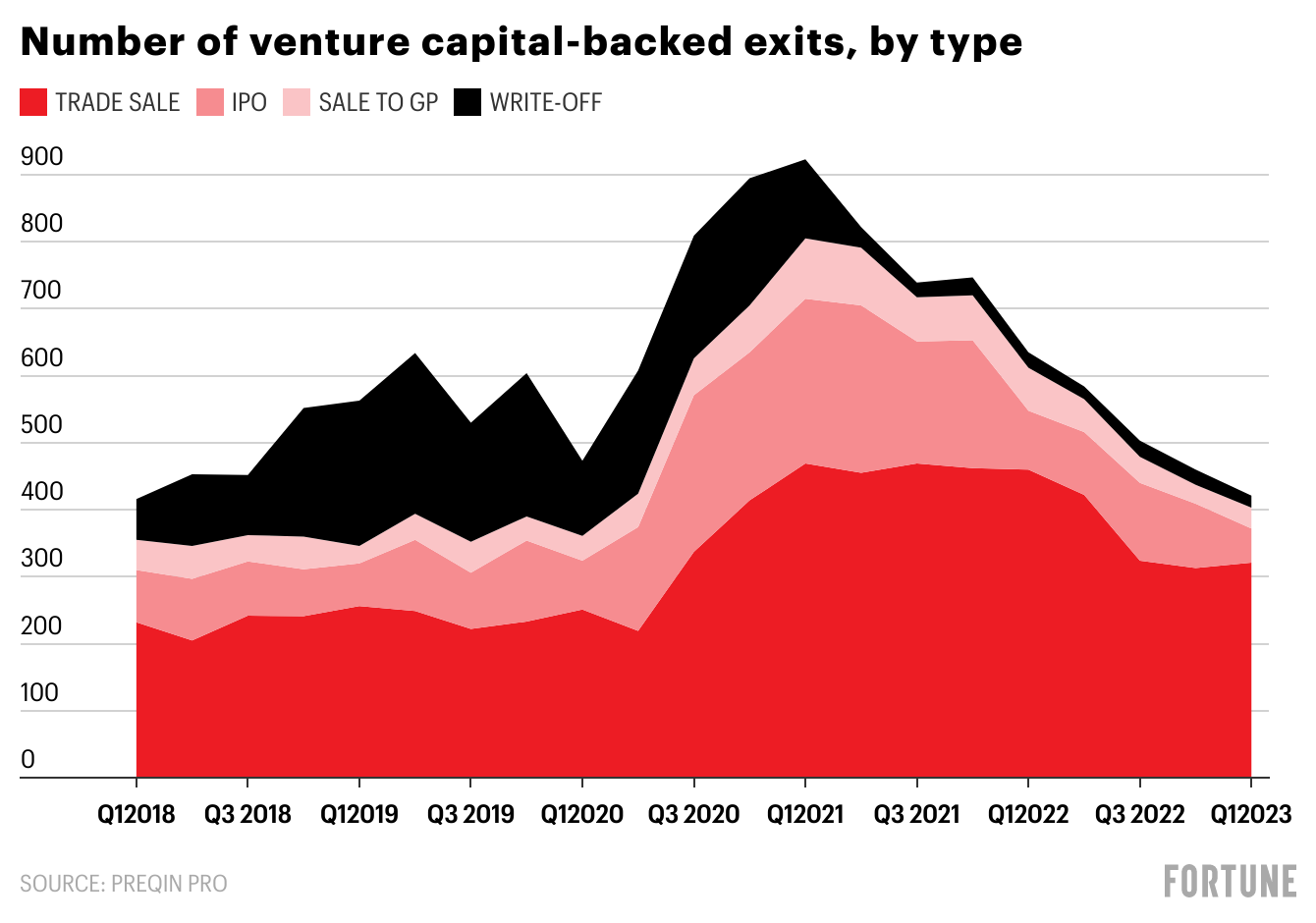

As avid Term Sheet readers already know, exit opportunities for venture-backed companies have become a rarity. Yet as the first quarter of 2023 came to a close, we can see how bad the carnage has been. Aggregate exit value has fallen by 48% quarter over quarter.

Is this as low as we can go? “We may be approaching the bottom of the market, although there is still the possibility of further downside before market conditions improve,” said Lai.

Big bucks for A.I.: One sector that has been able to pick up steam despite market conditions is artificial intelligence. Generative A.I. startup Cohere raised $250 million in new funding at a $2 billion valuation, according to the New York Times. The Toronto-based company was founded in 2019 by ex-Google researchers Aidan Gomez and Nick Frosst as well as Ivan Zhang. Investors in the Chat GPT rival include Salesforce, Nvidia, Inovia Capital, and Index Ventures.

See you tomorrow,

Lucy Brewster

Email: lucille.brewster@fortune.com

Submit a deal for the Term Sheet newsletter here.

Correction, May 3, 2023: The online version of this newsletter has been updated to show that Aplos acquired Raisely, a Melbourne, Australia-based nonprofit fundraising platform, not the other way around.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Magenta Medical, a Kadima, Israel-based heart pump developer, raised $55 million in funding. OrbiMed led the round and was joined by New Enterprise Associates, Pitango VC, and ALIVE.

- Foretellix, a Tel Aviv-based safety-driven verification and validation solutions provider for automated driving systems, raised $43 million in Series C funding. 83North led the round and was joined by Atrofin VC, NVIDIA, Woven Capital, MoreTech, Nationwide, Volvo, and Jump Capital.

- MayMaan Research, a Hollywood, Fla.-based internal combustion engine developer, raised $30 million in Series A funding from Wave Equity Partners.

- Uwill, a Natick, Mass.-based mental health and wellness solution for colleges and students, raised $30 million in Series A funding from Education Growth Partners.

- Kindbody, a New York-based fertility clinic network, raised $25 million from Morgan Health.

- LMS365, an Aarhus, Denmark-based learning management system, raised $20 million in Series A funding. Blue Cloud Ventures led the round and was joined by Kamet Capital.

- Pietra, a New York-based e-commerce infrastructure startup, raised $16 million in Series A extension funding. M13 led the round and was joined by Founders Fund, TQ Ventures, and Abstract Ventures.

- Thesis, a New York-based nootropics company, raised $8.4 million in Series A funding. Unilever Ventures, Redo Ventures, Alive VC, Break Trail, NBA athlete Kevin Love, and model Kate Bock invested in the round.

- NetRise, an Austin-based firmware security platform, raised $8 million in funding. Squadra Ventures led the round and was joined by Miramar Digital Ventures, Sorenson Ventures, and DNX Ventures.

- Aligned, a Tel Aviv-based B2B buyer-seller network developer, raised $5.8 million in seed funding co-led by Hetz Ventures and NFX.

- Instock, a San Carlos, Calif.-based e-commerce fulfillment company, raised $4 million in seed funding. One Way Ventures and Lux Capital co-led the round and were joined by Commerce VC.

- Coldspace, a Jakarta, Indonesia-based cold chain solutions provider, raised $3.8 million in seed funding. Intudo Ventures led the round and was joined by ASSA, Triputra Group, and MKA & ITS.

- OSavul, a Kyiv-based information security company, raised $1 million in funding from SMRK.

PRIVATE EQUITY

- Mubadala Investment Company agreed to acquire a minority stake in Brightspeed, a Charlotte, N.C.-based broadband and telecommunications services company, for $500 million.

- Bernhard Capital Partners agreed to acquire the Federal and Defense business of VSE Corporation, an Alexandria, Va.-based aftermarket distribution and repair servicesprovider for land, sea, and air transportation assets for government and commercial markets. Financial terms were not disclosed.

- Jones Fish Hatcheries & Distributors, backed by Fort Point Capital, acquired Wisconsin Lake & Pond Resource, an Eldorado, Wis.-based pond and lake management services provider. Financial terms were not disclosed.

- ServiceCore, backed by Mainsail Partners, acquired Docket, a Dayton, Ohio-based dumpster renting software platform. Financial terms were not disclosed.

OTHER

- PGIM agreed to acquire a majority stake in Deerpath Capital Management, a New York-based private credit and direct lending manager. Financial terms were not disclosed.

- Aplos, owned by ASG, acquired Raisely, a Melbourne, Australia-based nonprofit fundraising platform. Financial terms were not disclosed.

- RIA Advisory, a Coral Gables, Fla.-based revenue management solutions provider and Avance Investment Management portfolio company, and TMG Consulting, an Austin-based advisory and professional services firm, agreed to a merger. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- Pacific Avenue Capital Partners, a Los Angeles-based private equity firm, raised approximately $502 million for a fund focused on middle-market divestitures and carve-outs.

- Red Arts Capital, a Chicago-based investment firm, raised $270 million for a fund focused on middle-market supply chain companies.

- Energy Impact Partners, a New York-based investment firm, raised $111.9 million for a fund focused on diversity in clean energy.

PEOPLE

- Allied Industrial Partners, a Houston-based private equity firm, appointed Gerald Smith as managing director, Sabrina Gomez as chief of staff, and Tim Webb as director of portfolio operations. The firm also promoted Park Carrere to principal. Formerly, Smith was with CES Power, Gomez was with McNair Interests, and Webb was with Teal Systems.

- Innovation Endeavors, a Palo Alto-based venture capital firm, promoted Davis Treybig to partner.

- Macquarie Capital, the Sydney, Australia-based corporate advisory, capital markets, and investing arm of Macquarie Group, appointed John Pickhaver to head of infrastructure and energy capital for the Americas.