It’s expected to be an active proxy season, but some major companies are more at risk for activist encounters than others.

Goldman Sachs analysts have conducted research that delves into better understanding how activist investors seek to create value through fundamental changes at a company. The new report examines 2,142 shareholder activism campaigns launched since 2006 with a corporate valuation demand against Russell 3000 companies.

The analysts found four financial variables representing potential sources of vulnerability that might prompt an activist attack: slower trailing sales growth; a lower trailing EV/sales multiple (lower valuation); a weaker trailing net margin; and trailing two-year underperformance (lower excess returns).

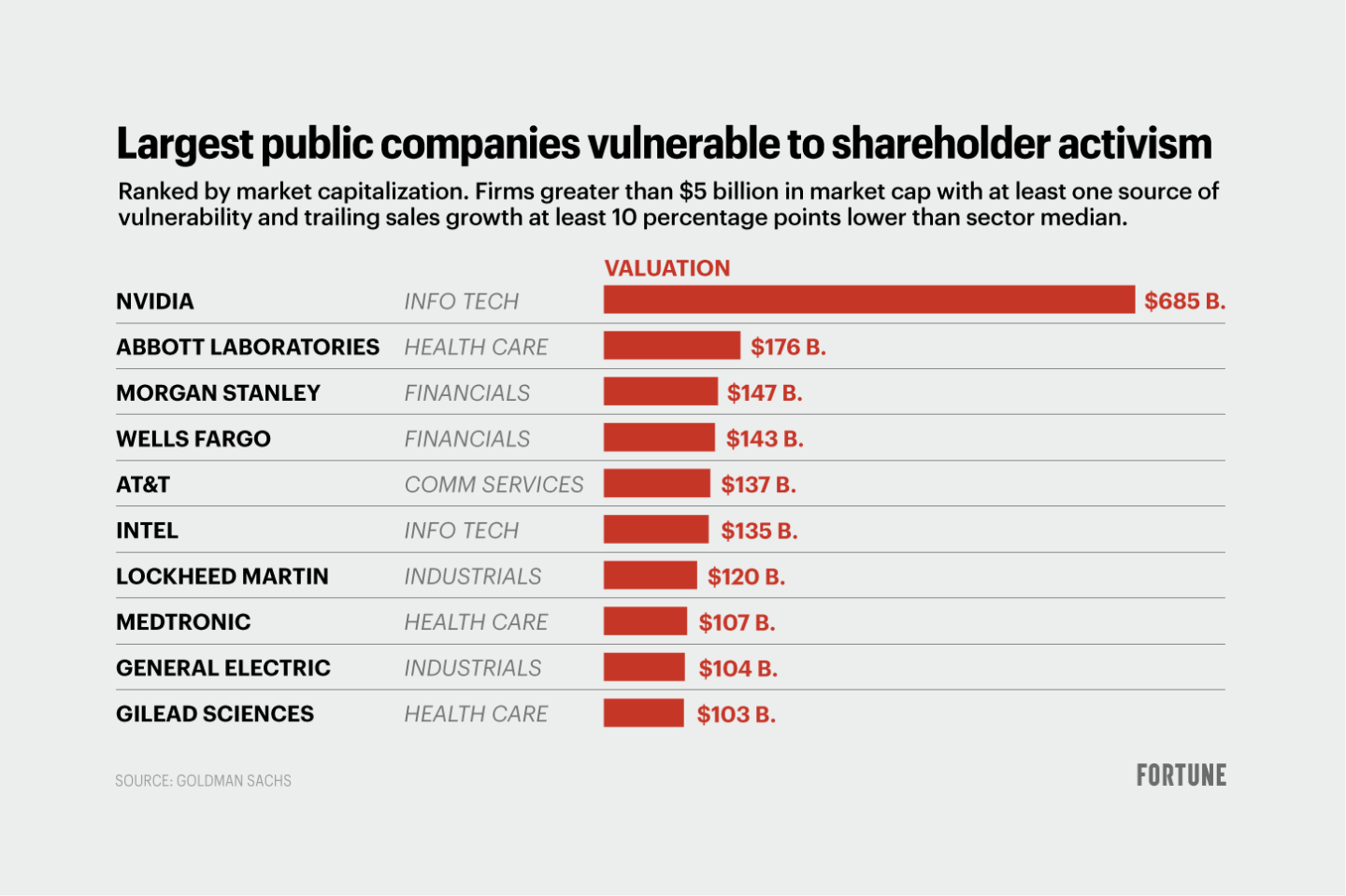

As a result, the report identifies 116 stocks in the Russell 3000 index that could be susceptible to an activist investor campaign. “These firms have a market cap greater than $5 billion; at least one source of vulnerability based on our model; and experienced at least 10 pp [percentage points] lower realized sales growth relative to its sector median during the trailing 12 months,” according to Goldman. “The median firm grew sales by –5% (vs. +10% for the Russell 3000 median), trades at 2.7x EV/sales (vs. 3.3x), has trailing net margins of 16% (vs. 14%), and has returned –1% during the last 2 years (vs. +7%).”

Below is a table of the companies, shown in five pages:

An additional key finding of the report: The top three most frequent demands of activist investor campaigns since 2006 have been for companies to separate their business (28%), review strategic alternatives (19%), and return cash to shareholders (12%). Specific demands such as realizing net asset value (NAV), creating a real estate investment trust (REIT), or changing investment strategy are less common, along with operational changes and a general discussion of strategy.

Investors launched 148 campaigns against 120 distinct public U.S. companies in 2022, a roughly 20% year-over-year increase, according to the analysts. Goldman analysts expect shareholder activism to remain popular this year as investors adapt to regulatory changes and the macro environment. In Q1 2023, activists launched 27 campaigns against 26 companies.