It’s been a rough start to the year, as venture capital funding hit a three-year low in the first quarter, while multiple bank collapses spread fears about the health of the financial sector. But private equity held up “better than expected,” says Tim Clarke, a senior private equity analyst for data provider PitchBook. The worry is, it could be downhill from here for the rest of the year.

“In my mind, there was a stress test, [and] PE passed it almost on every front, including fundraising, including deployment, which stabilized, and it also did five really big deals around that bank failure,” Clarke told me yesterday.

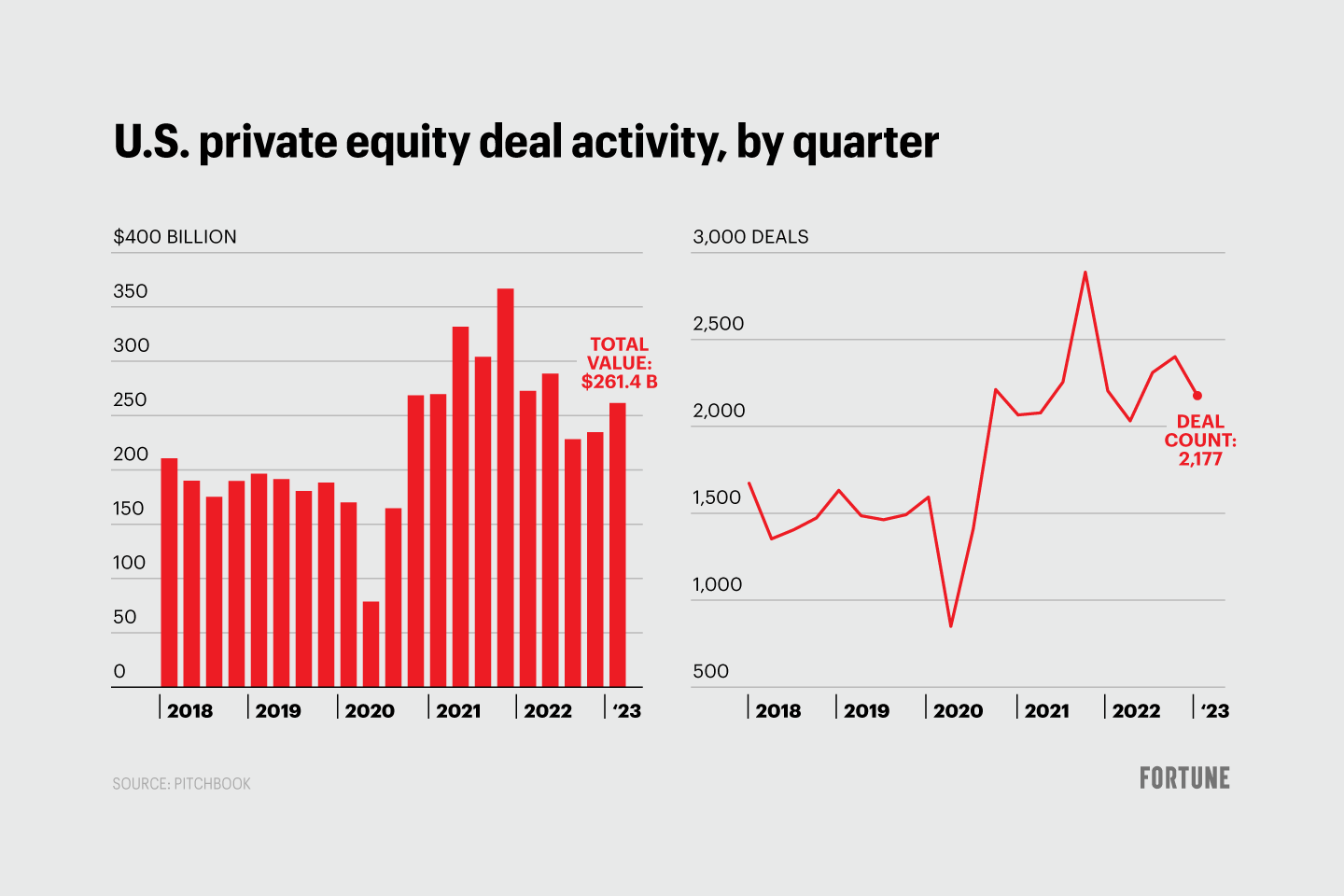

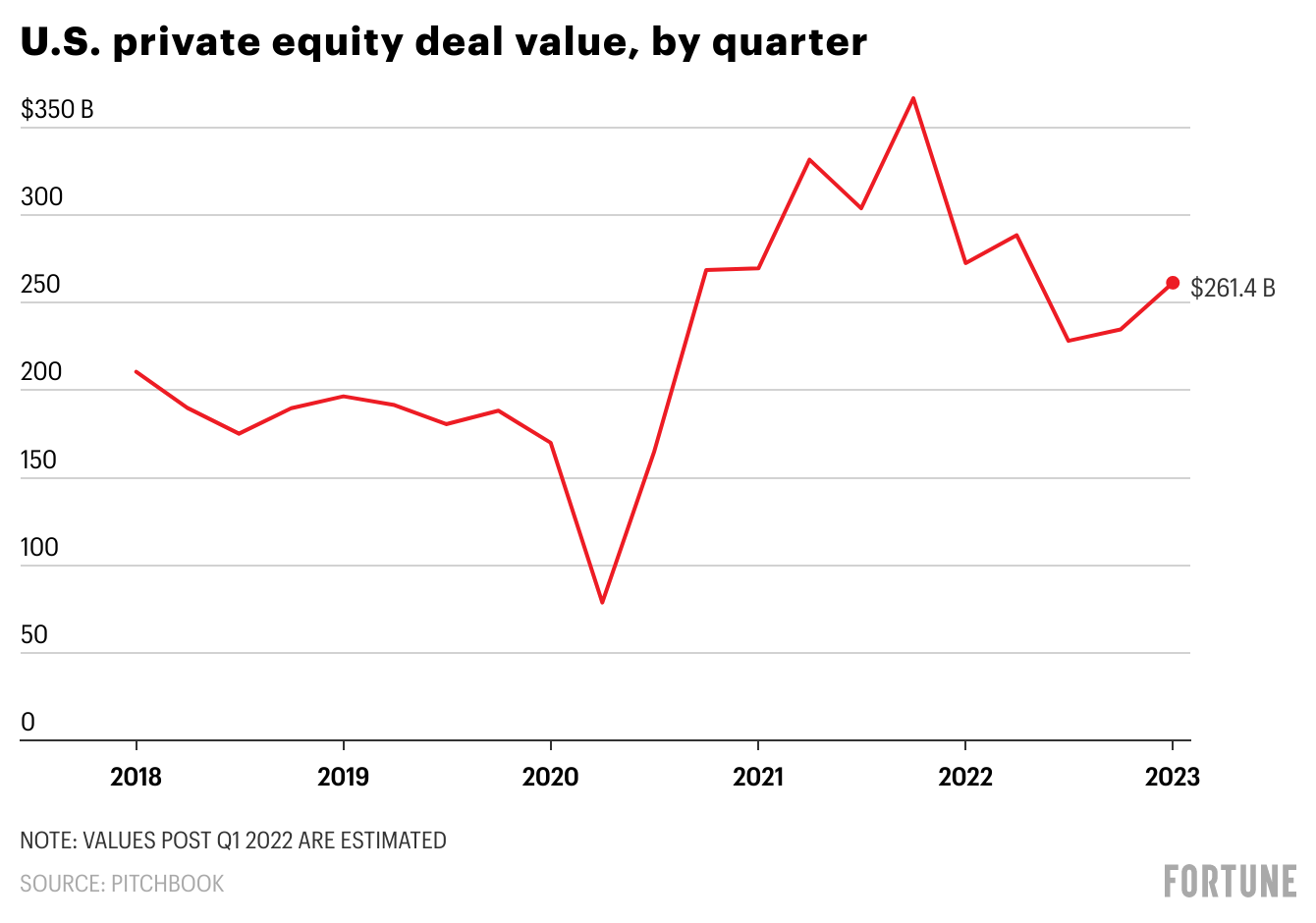

Per a new PitchBook report, though deal count dropped 9.3% (with over 2,100 deals), deal value rose 11.4%. Those numbers are, as the analysts write, “well above the pre-COVID-19 averages of roughly 1,400 deals and $180 billion in deal value,” but the trend is “still flat to down, and we have yet to make a definitive bottom.”

Perhaps ironically, Clarke believes the Silicon Valley Bank collapse (and the other bank troubles this past quarter) may have actually helped take some risk off the table for private equity for the rest of the year. Following the bank runs, “the entire shape of the [interest rate hike] expectations changed and people went from thinking about two or three more hikes to maybe one and done,” he notes. “So it actually helped the interest rate backdrop, which was the biggest threat” to PE.

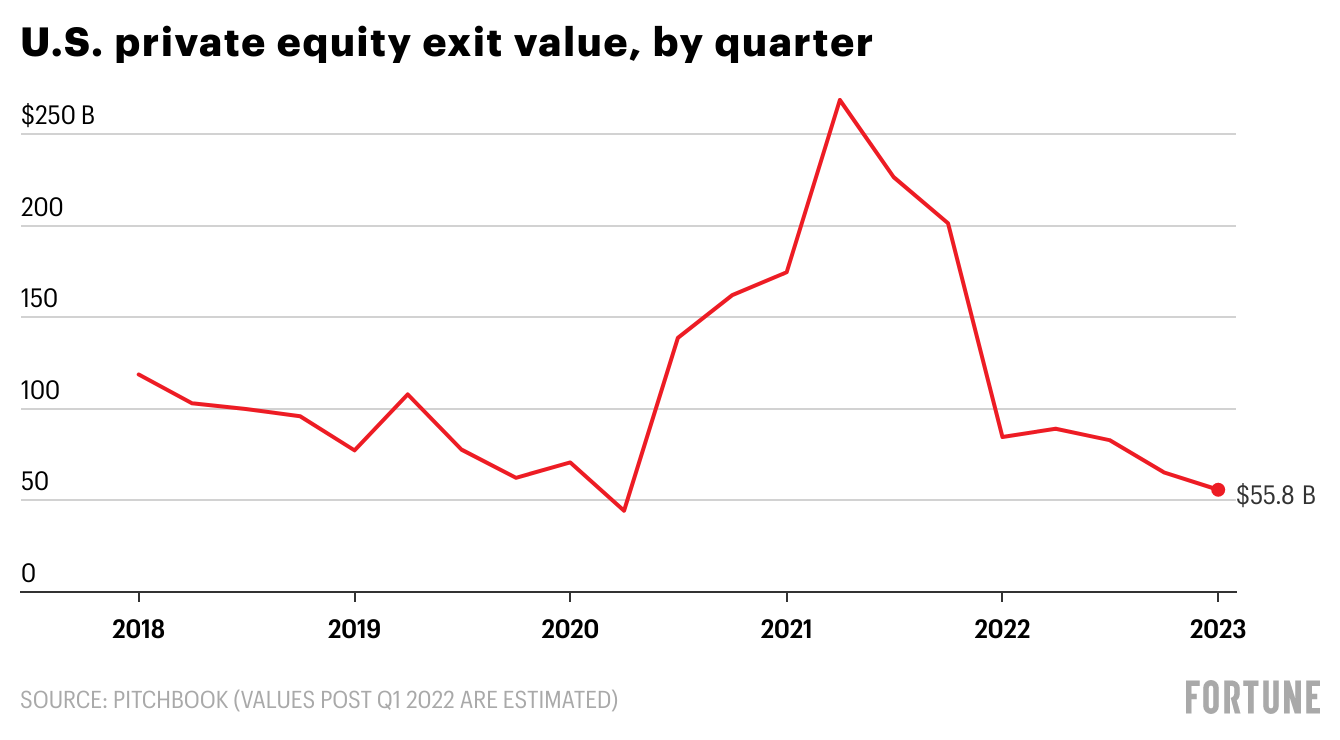

However, exits—when private equity investors cash in on their investment and return those funds to their limited partners—continue to fall as the IPO window remains shut and many private equity firms are hesitant to sell companies at low valuations. Per the PitchBook report, U.S. PE exit count and value both declined for the third consecutive quarter in Q1.

“The biggest worry is…you’re way down on exits,” says Clarke, and every quarter “is another quarter of very little cash flow coming back [to LPs].” He believes the industry “has to find a third avenue for creating liquidity—I mean, you either bring a company public, or you sell it to a larger player.” Clarke points out that public PE firms are talking about other strategies on their earnings calls, including the secondary market.

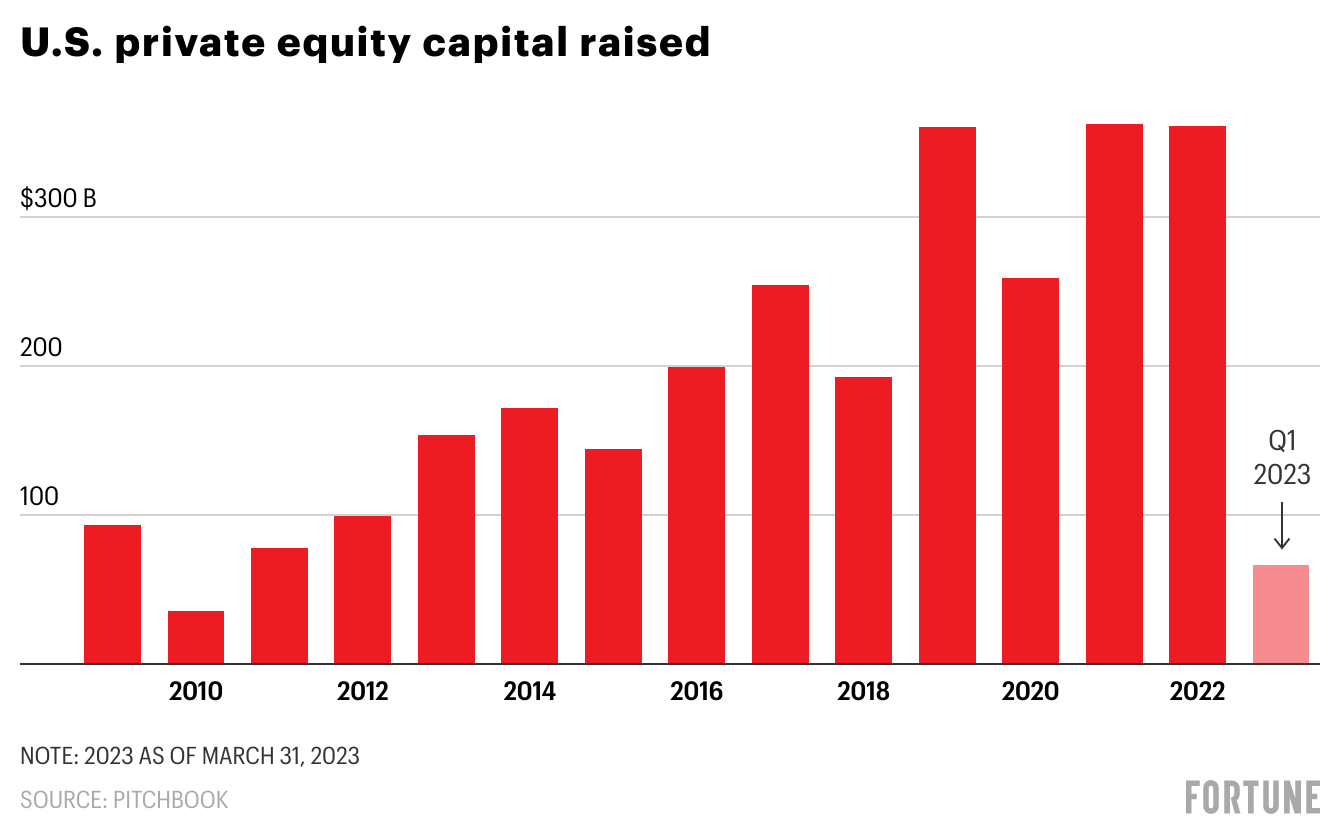

But Clarke says that the gap between net buying versus selling in PE has widened. “Eventually that feeds into fundraising and that feeds into performance if you don’t solve this. The risk is that this is the best quarter of the year, and fundraising starts stepping down from this point,” Clarke warns.

In other words, if PE firms can’t exit more of their investments and return cash back to their investors, who can then feed it back into the system, “they don’t have a lot of time before…that fundraising starts to shut down like it did on the venture capital side.”

So far in 2023, 73 funds raised $66.8 billion in capital through the end of March according to PitchBook. Clarke notes it was surprisingly “right in line—slightly above” Q1 of last year.

Overall, Clarke wagers that 2023 is shaping up to be a “subdued” year for fundraising, and likely a down year for dealmaking overall compared to 2022. But given how rocky the year has been so far in the private markets, “subdued” doesn’t sound so bad.

Taylor Swift does good due diligence, apparently: While lots of top VC firms were fooled by Sam Bankman-Fried and his crypto exchange FTX, apparently Taylor Swift was doing her due diligence for a potential celebrity sponsorship deal and asked whether FTX was selling unregistered securities before deciding to pass, per the attorney who’s heading up a class-action lawsuit against FTX and its celebrity spokespeople. I can’t imagine writing this sentence ever again, but if only VCs were as wary as Taylor Swift…

See you tomorrow,

Anne Sraders

Twitter: @AnneSraders

Email: anne.sraders@fortune.com

Submit a deal for the Term Sheet newsletter here.

Clarification: This newsletter has been updated to reflect Cruz was promoted to CEO of Angeles Private Investment Company, not hired.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- EquipmentShare, a Columbia, Mo.-based equipment and digital solutions provider for the construction industry, raised $290 million in funding. Funds affiliated with BDT Capital Partners led the round and was joined by RedBird Capital Partners, Tru Arrow Partners, Sound Ventures, and Brown Advisors.

- Noah Medical, a San Carlos, Calif.-based medical robotics company, raised $150 million in Series B funding. The Softbank Vision Fund and Prosperity7 Ventures co-led the round and were joined by Tiger Global, Hillhouse, Sequoia China, Shangbay Capital, Uphonest Capital, Sunmed Capital, Lyfe Capital, 1955 Capital, AME cloud ventures, and others.

- Halcyon, an Austin-based cyber resilience platform, raised $50 million in Series A funding. SYN Ventures led the round and was joined by Dell Technologies Capital, Corner Ventures, and others.

- Ditto, a San Francisco-based distributed data platform developer, raised $45 million in Series A funding. Acrew Capital led the round and was joined by U.S. Innovative Technology Fund, True Ventures, and Amity Ventures.

- Clerkie, a San Francisco-based financial automation platform, raised $33 million in Series A funding. Left Lane Capital led the round and was joined by Wellington Management Company, Flourish Ventures, Citi Ventures, CMFG Ventures, and Vestigo Ventures.

- 3D Glass Solutions, an Albuquerque, N.M.-based integrated passive solutions provider for radio frequency, photonic, and data centers, raised $30 million in Series C funding. Walden Catalyst Venture led the round and was joined by Intel Capital, Lockheed Martin Ventures, Applied Ventures, Cambium Capital, and Mesh Cooperative Ventures.

- GOALS, a Stockholm-based soccer-focused game studio, raised $20 million in Series A funding. Seven Seven Six led the round and was joined by Northzone, Moonfire, and Cassius.

- Lexion, a Seattle-based contract management and operations workflow platform, raised $20 million in Series B funding. Point72 Ventures led the round and was joined by Citi Ventures, Khosla Ventures, Madrona Venture Group, and Wilson Sonsini.

- Groundlight, a Seattle-based computer vision accessibility platform, raised $10 million in funding. Madrona, Greycroft Partners, and Founders Co-Op invested in the round.

- Motion, a Toronto-based analytics platform for creatives, raised $6 million in seed funding. Headline led the round and was joined by Sugar Capital, Abstract Ventures, and Habitat Partners.

- Wayland Additive, a Huddersfield, U.K.-based electron beam 3D printing manufacturer, raised £4.6 million ($5.73 million) in funding. Longwall Ventures, Parkwalk Advisors, ACF Investors, and Metrea Discovery invested in the round.

- Vinci Games, a San Francisco-based VR game studio, raised $5.1 million in seed funding. Makers Fund led the round and was joined by Y Combinator, Soma Capital, Pioneer Fund, Anorak Ventures, BonAngels, and Twitch cofounder Kevin Lin.

- TiiCKER, a Detroit-based shareholder loyalty and engagement platform, raised $5 million in seed funding co-led by Baysore Advisory Group, Red Cedar Ventures, and Flipturn Ventures.

- BrandLovrs, a São Paulo-based influencer marketing platform, raised $2 million in seed funding. Canary led the round and was joined by TheVentureCity.

- Coinflow Labs, a Chicago-based Web3 payment stack provider, raised $1.45 million in pre-seed funding. Jump Crypto and Reciprocal Ventures co-led the round and were joined by CMT Digital, Digital Currency Group, Gumi Cryptos, Builder Capital, Prompt Ventures, Blocktech Ventures, and other angels.

PRIVATE EQUITY

- CES Power, backed by Allied Industrial Partners, acquired Echo Technologies Services, an Atlanta-based telecommunications company. Financial terms were not disclosed.

EXITS

- Lignetics Group acquired Fiber By-Products, a White Pigeon, Mich.-based recycler and wood pellet manufacturer, from Beringea. Financial terms were not disclosed.

OTHER

- Akamai Technologies agreed to acquire Neosec, a Palo Alto-based API detection and response platform. Financial terms were not disclosed.

- Ascent Solar acquired the manufacturing assets of Flisom, a Zurich-based thin-film solar manufacturer. Financial terms were not disclosed.

- XFactor.io acquired DecisionLink, a Plano, Texas-based customer value management solutions provider. Financial terms were not disclosed.

IPOS

- SeatGeek, a New York-based ticketing platform, confidentially filed for an initial public offering, according to The Information.

SPAC

- Sunergy Renewables, a New Port Richey, Fla.-based residential solar and energy efficiency solutions provider, agreed to go public via a merger with ESGEN Acquisition Corp., a SPAC. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- Congruent Ventures, a San Francisco-based venture capital firm, raised $304 million for a fund focused on climate investments.

PEOPLE

- Angeles Investments, a Santa Monica, Calif.-based investment firm, promoted Derrick Cruz to CEO of Angeles Private Investment Company.

- Elsewhere Partners, an Austin-based venture capital firm, Rita Selvaggi as an operating partner. Formerly, she was with ActivTrak.

- Hayfin Capital Management, a London-based alternative asset management firm, hired Steve Bringardner as head of consultant relations. Formerly, he was with BlackRock.

- Piva Capital, a San Francisco-based venture capital firm, has hired Adam Lasics as a partner of strategy and operations and promoted Roxanne Tully to principal. Formerly, Lasics was with GE Ventures.

Correction, May 8, 2023: The online version of this newsletter has been updated to reflect that EquipmentShare is based in Columbia, Mo. not Columbus, Mo.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.