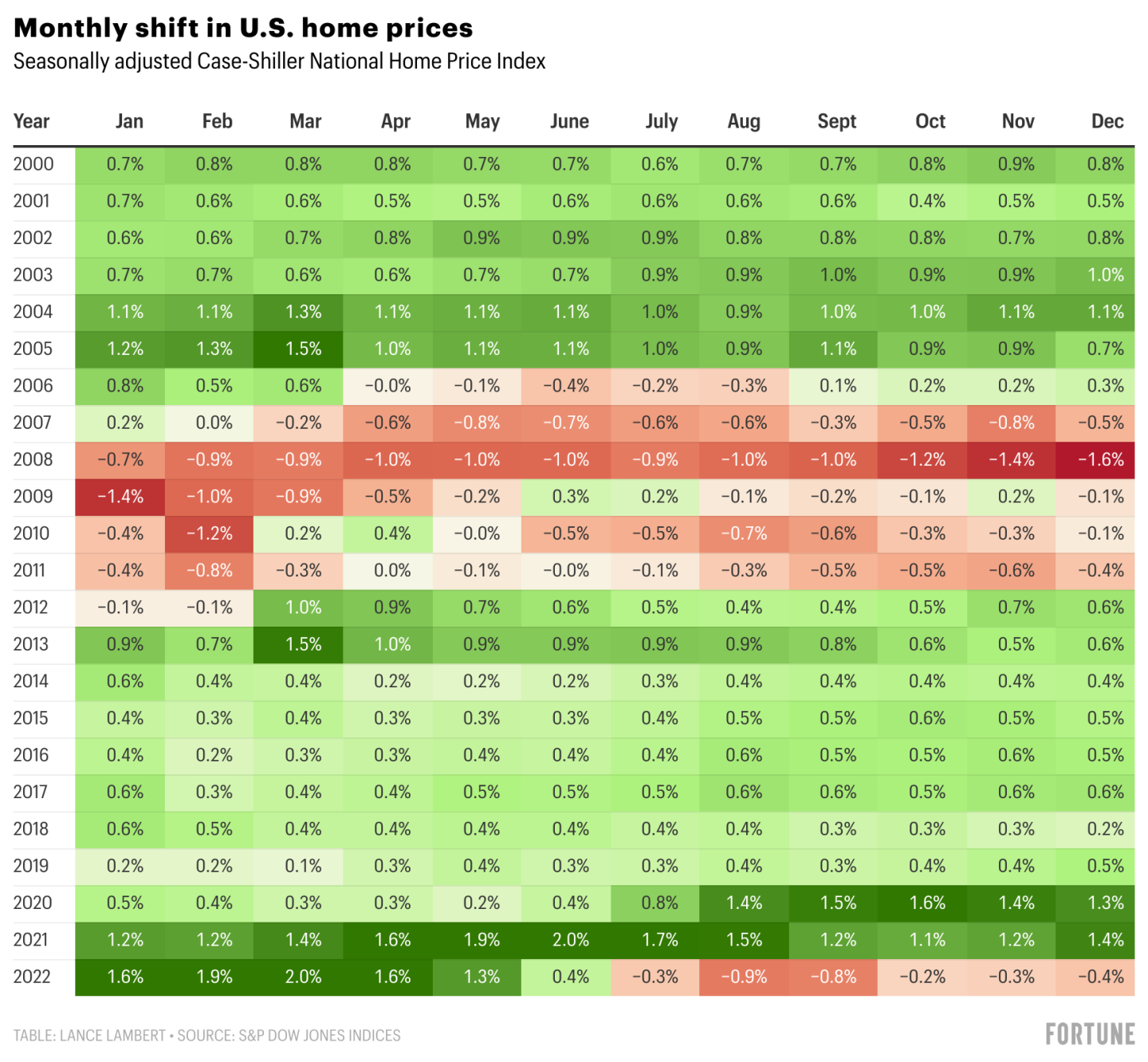

On Tuesday, we learned that U.S. home prices as measured by the seasonally adjusted Case-Shiller National Home Price Index fell for the sixth straight month in December. Since peaking in June, U.S. home prices have fallen 2.7% on a seasonally adjusted basis, and 4.4% without seasonal adjustment.

On one hand, that 2.7% drop in single-family house prices marks the second-biggest home price correction of the post–World War II era. On the other hand, through December, the Pandemic Housing Correction is a mild correction compared to the 26% peak-to-trough drop notched between 2007 and 2012.

The reason the U.S. housing market has slipped into correction mode is pretty straightforward: Affordability—or better put, the lack of affordability—has reached levels not seen since the housing bubble. That’ll happen since mortgage rates nearly tripled in 2022 just after U.S. home prices ran up 41% during the Pandemic Housing Boom.

Of course, this housing market correction is also by design.

Just as U.S. home prices were reaching their peak in June 2022, Fed Chair Jerome Powell told reporters that the red-hot U.S. housing market would be “reset” by spiking mortgage rates. Then in September, Powell went further, saying the “reset” meant that the U.S. housing market would travel through a “difficult [housing] correction.” In November, Powell went even further, saying that a “housing bubble” had formed during the pandemic.

“Coming out of the pandemic, [mortgage] rates were very low, people wanted to buy houses, they wanted to get out of the cities and buy houses in the suburbs because of COVID. So you really had a housing bubble, you had housing prices going up [at] very unsustainable levels and overheating and that kind of thing. So, now the housing market will go through the other side of that and hopefully come out in a better place between supply and demand,” Powell said in November.

To better understand the ongoing housing correction, let’s take a closer look at the latest Case-Shiller data.

For 124 consecutive months, from the bottom of the previous correction in February 2012 to the peak of the Pandemic Housing Boom in June 2022, the seasonally adjusted Case-Shiller National Home Price Index reported positive month-over-month home price growth. That has since been replaced by this new streak: six consecutive months of U.S. home price declines.

That said, this home price correction isn't one-size-fits-all. Some overheated Western housing markets, like San Francisco (down 12.7% since its 2022 peak) and Phoenix (down 9.4%) have experienced sharp corrections.

Meanwhile, places like New York (down 2.2% from its 2022 peak) and Chicago (down 1%) have barely dropped. Unlike overheated markets such as Phoenix, New York and Chicago didn't see local home prices become as detached from underlying fundamentals during the Pandemic Housing Boom. That's helping those markets better absorb the ongoing mortgage rate shock.

Between March 2020 and June 2022, U.S. home prices soared 41.2%. Through November, those total Pandemic Housing Boom gains have only slipped to 37.3%. That's a mild correction—not a full-blown housing crash.

Where do we head from here? It's hard to say. Firms like Zillow and CoreLogic think the home price correction will soon fizzle out. Meanwhile, firms like Fannie Mae and Moody's Analytics think we're headed for around a 10% peak-to-trough decline. (Through December, seasonally adjusted home prices have fallen 2.7% from the June 2022 peak while still finishing 2022 up 5.8%.)

Among the 20 major markets tracked by Case-Shiller, 12 markets saw home prices fall by less than 5% in the second half of 2022. That includes markets like Chicago (-1%) and New York (-2.2%). Meanwhile, eight markets saw local home prices fall by over 5% in the second half of 2022. That includes sharp drops in markets like Seattle (-15%), San Francisco (-12.7%), and Phoenix (-9.4%).

Between March 2020 and May 2022, the Case-Shiller Seattle Home Price Index jumped 55% from 266.6 to 414.0 However, the home price correction in the second half of 2022 saw that index slip to 351.7 as of December. That means San Francisco's total Pandemic Housing Boom gains have been reduced to 31.9%.

Want to stay updated on the U.S. housing market? Follow me on Twitter at @NewsLambert.