Good morning,

Some major companies aren’t waiting until the passage of the U.S. Securities and Exchange Commission’s proposed climate-risk disclosure rule to add the right finance talent for ESG reporting. They’re creating new roles.

Regarding ESG (environmental, social, and governance), I conducted a job search on LinkedIn under “ESG finance” and “ESG controller” to see what I would find. Citi, one of the largest banks in the U.S., is seeking an ESG disclosures controller—a new role in the company’s finance/controller function. The person would be “responsible for oversight of ESG-related disclosures in our financial and reporting processes for Citi’s SEC filings, as well as information contained in Citi’s publicly available ESG reports,” according to the LinkedIn post. A master’s degree or a CPA is preferred. Meanwhile, Cisco Systems has several openings for an ESG finance leader to report to the ESG controller.

The role of ESG controller is different from sustainability officers because ESG controllers can bring the “experience and diligence that the company has developed around financial information to non-financial disclosures,” according to a recent report by Wes Bricker, PwC vice chair and U.S. Trust Solutions co-leader.

The SEC’s proposal would require public companies to disclose greenhouse gas emissions (Scope 1, 2, and 3), along with a financial statement portion that addresses the impact of climate-related risks and opportunities.

“There are steps leaders can take to better prepare for the new climate change disclosure requirements—and establishing an ESG controller should be at the top of the list,” according to Bricker.

I wondered if a focus on recruiting for an ESG controller role is beginning to develop at companies of all sizes. So I asked executive recruiting leaders.

“I would say that organization complexity and sector determine if CEOs dedicate specific ESG teams, or if the responsibilities span finance, legal, and HR,” says Molly Gonzales, an SVP and head of the CFO Practice at Raines International. “Small to midsize organizations are adding resources in the junior to mid-level finance functions to assist in reporting.”

What Gonzales, a former CFO, has seen is “larger corporations—especially those with big environmental and emissions footprints—are forming teams under a chief sustainability title,” she says. “The companies on the forefront are those who have made public statements on time to achieve net zero, and now they’re staffing up to figure out how to measure their current business and a plan to achieve their goals.”

Jaimee Eddington, a partner in the Dallas office of Heidrick & Struggles and regional leader of the Americas, says she hasn’t received a huge number of search requests yet for an ESG controller. But SEC regulations, which keep changing, “are putting a lot of pressure on disclosure now—and of course, CFOs and controllers are the experts,” Eddington says. “Integrated reporting is already in Europe and coming to the U.S.—where SEC reports will carry both financial and ESG measures,” she explains. “ESG is also more likely now to be embedded in the audit committee of the board,” she says.

I’ve previously talked with experts about the rise in CFOs with MBAs as opposed to those with CPAs. But if positions like ESG controller begin to pick up steam, a CPA’s relevance in the CFO’s organization would only increase. Barbara M. Porco, a CPA, and clinical professor, and associate dean of graduate studies in the Gabelli School of Business at Fordham University, says she’s preparing her students for such opportunities.

From freshman year through MBA programs, ESG literacy is infused into the curriculum, Porco says. “You’re creating not only an awareness of ESG through the SDGs [sustainable development goals], but you tie it in at the end with ESG reporting and disclosures, and suddenly now, you know what—accounting might be interesting,” she explains. “Students may begin to think: ‘So you mean to tell me that if I go into the accounting profession, I need to understand environmental and social issues?” she says.

And that “resonates with students because now it’s something that talks to their own personal goals,” Porco says. A potential driver in creating the next generation of CPAs is “bringing in the ESG space and talking about this in terms of risk and opportunity management,” she says.

Whether spearheaded by a CFO or a controller, there’s no doubt the future of finance will include involvement in ESG reporting.

Quick note: I’ve heard from some readers who wanted recommendations for books on leadership. Is there a book that deeply resonated with you on your career journey? Let me know. I’ll compile a list and share it.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Sign up here to receive CFO Daily weekday mornings in your inbox.

Big deal

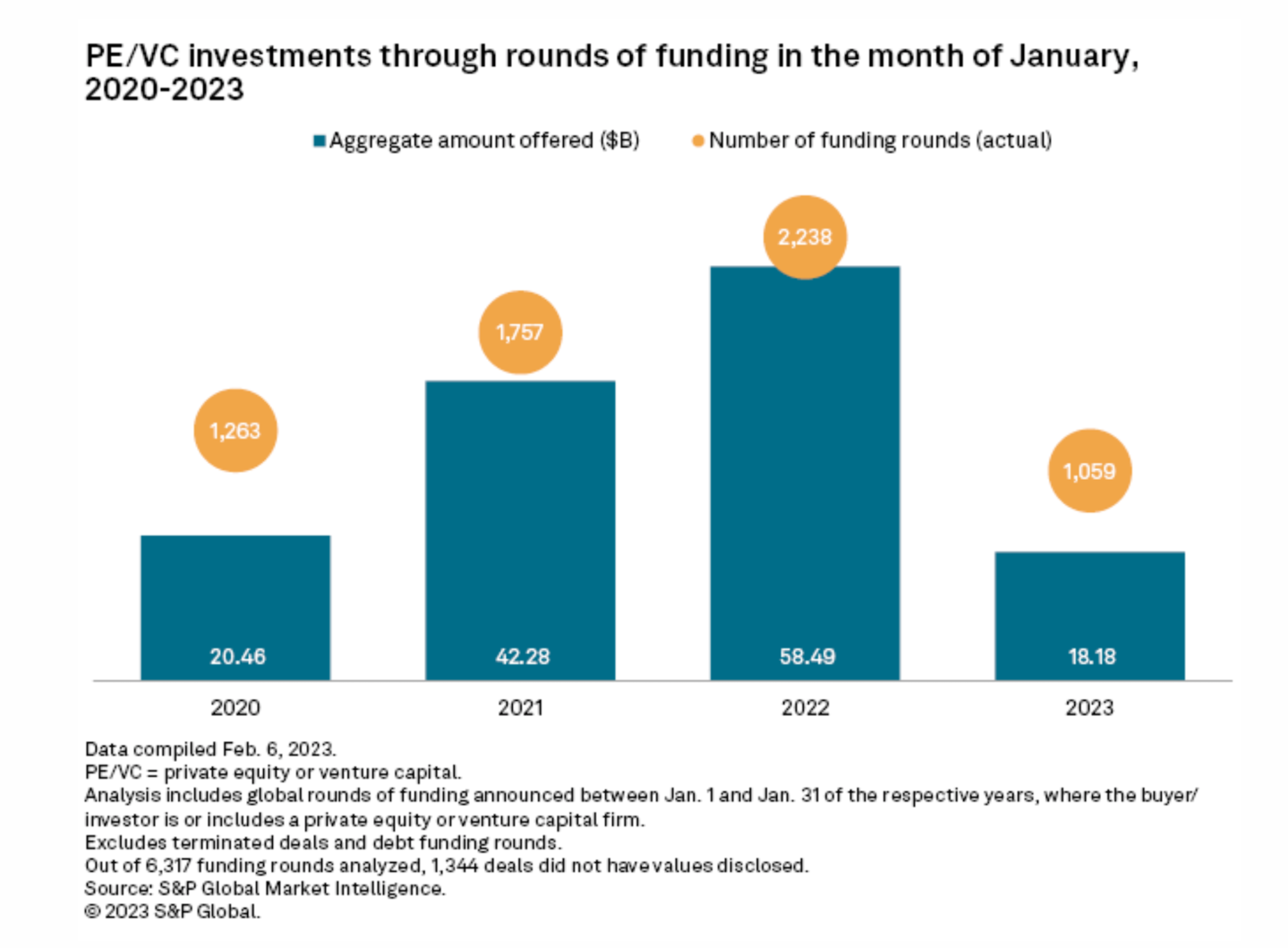

The number of funding rounds with global venture capital participation was down in January 2023 (52.6%) to 1,059 rounds, from 2,238 rounds in January 2022, according to new S&P Global Market Intelligence data. Global venture capital investment fell 68.9% year over year in January to $18.18 billion from $58.49 billion. PhonePe Private Ltd., a digital payment applications developer, raised the largest funding round in January with a transaction value of $1 billion, S&P Global Market found.

Going deeper

"Why Capital Investment in Equipment Doesn’t Hurt Employment," a report in Wharton's business journal, discusses a new study coauthored by Wharton’s Daniel G. Garrett. The research on tax incentives at U.S. firms between 1997 and 2011 finds that giving businesses tax breaks for investment in new equipment doesn’t lead them to replace workers with machines.

Leaderboard

Philip Garton was named CFO at VulcanForms, an MIT-born company that builds and operates advanced digital manufacturing infrastructure. Garton is a finance executive with more than three decades of experience at global organizations. He was previously the CFO of Shoals Technologies Group. Garton served as CFO at several other private equity-backed companies, including but not limited to Springs Window Fashions, JM Swank, Lincoln Industrial Corporation, and Purdy Brush. In addition, he has led finance for major international divisions of Honeywell and Vallourec SA.

Doug Barnett was named CFO at Magnit, an integrated workforce management (IWM) platform provider. Barnett has spent more than 20 years in executive roles within the tech and software sectors. Most recently, he was the EVP and CFO at the Sabre Corporation. Before that, he also served as EVP-CFO of Informatica and TriZetto Corporation, as well as CFO of UGS.

Overheard

"Unlike many other business leaders and chief executives, I’ve always been a night owl."

—Marco Frigatti, SVP at Guinness World Records, was among the more than a dozen night owl executives who shared with Fortune how they’re making their sleep patterns work with their high-flying careers.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.