Exxon Mobil Corp.’s ambitious plan to storm the world of energy trading is getting a skeptical reaction from seasoned market observers who say the oil giant could be a formidable foe — but only if it takes risks it hasn’t been willing to stomach before.

Exxon’s array of physical assets and huge balance sheet give it advantages over even the world’s top trading houses, who’ve reaped record profits since the pandemic. But its plans are all too familiar to traders who’ve seen it wade in and out of trading over the past five years, according to more than a dozen industry professionals.

How much risk Exxon takes, how much loss it tolerates, and how much it shells out for top talent — considerations rarely associated with the conservative oil giant — will be key to its success, they said.

Exxon has “the potential to be great, but realizing that potential is not an easy thing to do,” said Craig Pirrong, a professor of finance at the University of Houston. “It remains an open question how committed they will be. BP, Shell and Glencore and others have stuck with it through ups and downs. Exxon has not done that.”

The established trading houses rarely are threatened by upstarts. Glencore Plc, Trafigura Group and Vitol Group, as well as BP Plc and Shell Plc, have decades of experience navigating market volatility, and they’ve created internal systems and analytics that are hard to replicate. High market volatility and an array of actively traded derivatives contracts mean plenty of profits are available even if new entrants succeed.

But the global breadth of Exxon’s operations and access to market information — the key for any trader – is unparalleled. Exxon is also flush with the capital to back big trading positions after posting a record $59 billion in profit last year.

It’s a “big shift in strategy for Exxon,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management. “It should be a very natural extension of their ongoing business, but the competition is fierce.”

An Exxon spokeswoman didn’t have any comment beyond yesterday’s announcement.

Trading isn’t an entirely new business for Exxon. It made an initial, limited foray in 2018, when it hired consultants and scooped up personnel, including some high-profile traders, from established shops while setting up trading floors near Houston and in Leatherhead, a commuter town just outside London.

But the effort faltered in the pandemic, when Exxon posted losses while rivals captured significant returns.

Exxon’s latest expansion is gathering steam. The company has made a series of external hires in 2023, and last year marked its best trading performance on record. Exxon has also looked to centralize traders in London this year to attract and retain talent.

In an email to employees on Thursday, the company said it’s focusing on “ultimately delivering industry-leading trading results.” It didn’t mention hiring targets, how much capital it plans to deploy or strategic goals for the business.

Compensation will be key because the market for commodities trading talent is tight, with hedge funds in particular beefing up their presence. Traders’ pay is heavily weighted toward annual bonuses, which often grant them at least 10% of the money they make for their company. Exxon doesn’t pay annual cash bonuses to most of its employees and instead offers high base salaries and a generous pension.

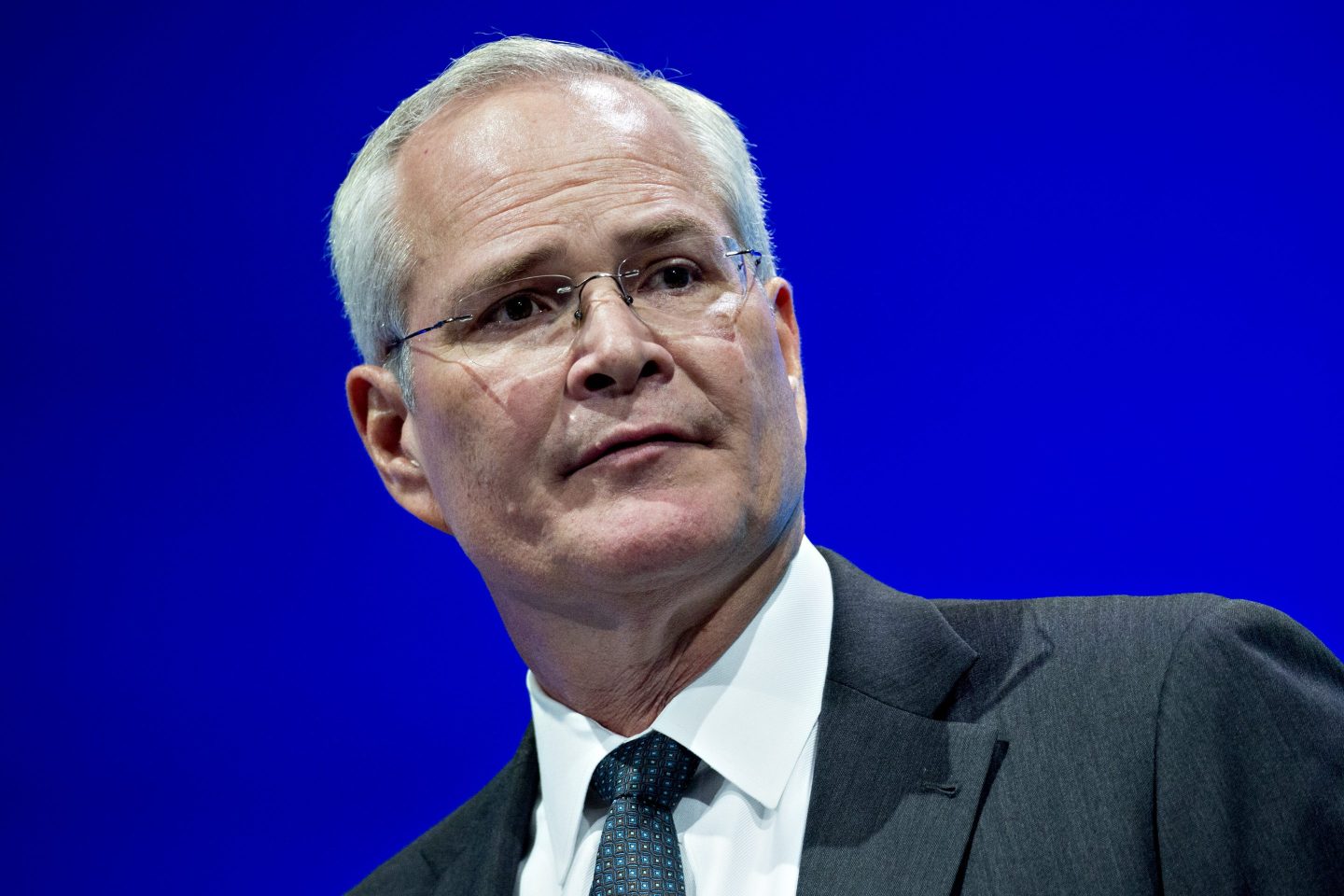

But Chief Executive Officer Darren Woods has showed he’s willing to depart from tradition. Last year, he expanded the number of employees eligible for restricted stock almost threefold and awarded US workers raises that outstripped inflation, on top of a one-time, mid-year increase.

Exxon’s approach to risk may be even more crucial. The oil giant is run by engineers who’ve focused on building or buying the lowest-cost assets and operating them efficiently, rather than betting on commodity prices. That has created a culture averse to taking price risk and with a low tolerance for failure.

Still, the scale of Exxon’s global operations give it unique visibility into almost every corner of the energy market, from pipeline flows in North America, to ship movements in the Middle East and refined-products demand in Asia.

Instantly understanding how prices will be affected by changes to physical flows, such as a refinery outage, can mean millions of dollars in gains. One trader joked that Exxon’s market intelligence is so vast that counterparties’ bets would amount to guesswork by comparison.

“You can’t beat the market unless you have some sort of edge,” Pirrong said. “Exxon has huge potential because of that global footprint. The challenge is making that information available to traders in a way they can trade profitably.”

–With assistance from Sheela Tobben

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.