When potential first-time homebuyers consider making the transition to homeownership, they often evaluate whether it makes more financial sense to keep renting or to buy.

Given today’s changing housing market, that decision is more complex. According to the Zillow Observed Rent Index, rent prices were up 9.6% in October compared with one year ago, down from the 17% peak earlier this year, but still well above traditional norms.

Meanwhile, in the purchase market, annual house prices grew by 13% compared with one year ago, according to the preliminary October First American Data & Analytics house price index.

While annual house price growth nationally has decelerated from the peak of nearly 21% in March, mortgage rates have more than doubled compared with last year, significantly impacting affordability.

The shifting housing market conditions and uncertain outlook create a challenging puzzle for those potential first-time homebuyers considering whether to rent or buy.

Breaking down the cost to own

It’s important to closely examine the monthly cost of renting or owning. The cost to rent is relatively straightforward: It’s the amount of rent paid by the tenant every month. The cost of owning, on the other hand, is more complicated and includes taxes, repairs, homeowner’s insurance, and the monthly mortgage principal and interest payment.

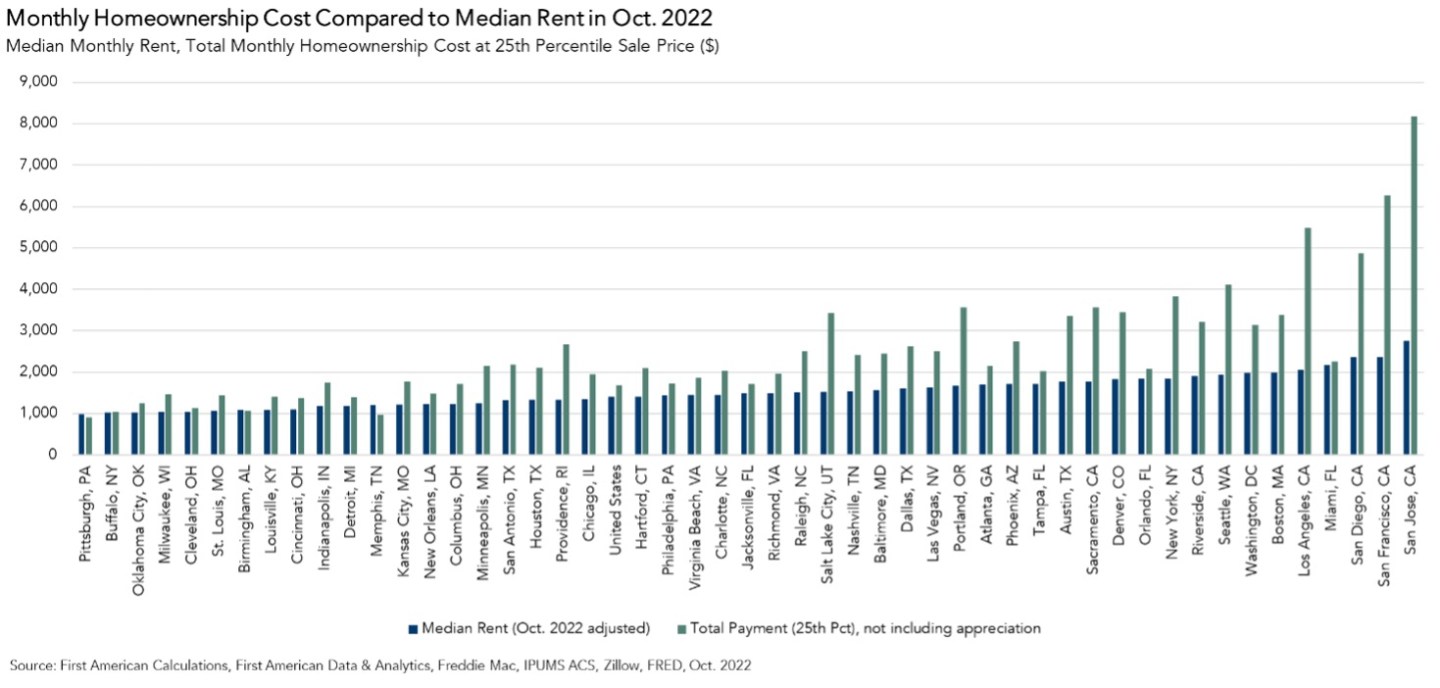

Consider a hypothetical first-time homebuyer taking out the average 30-year, fixed-rate mortgage in October of just over 6.9%, with a 5% down payment on a home at the 25th-percentile sale price. We’re using the 25th percentile because first-time homebuyers are much more likely to buy a less expensive home.

After accounting for the total monthly homeownership cost and comparing it with the median rent by market, it was better to rent than to own for potential first-time homebuyers in 47 of the 50 top U.S. markets. The three exceptions were Birmingham, Memphis, and Pittsburgh.

However, this calculation leaves out the main financial benefit of owning over renting: the accumulation of equity.

The wealth-generating effect of homeownership

For first-time homebuyers, finding the money for a down payment is typically the primary barrier to homeownership. However, once the home is purchased, appreciation helps build equity in the home—a significant benefit that renting doesn’t offer.

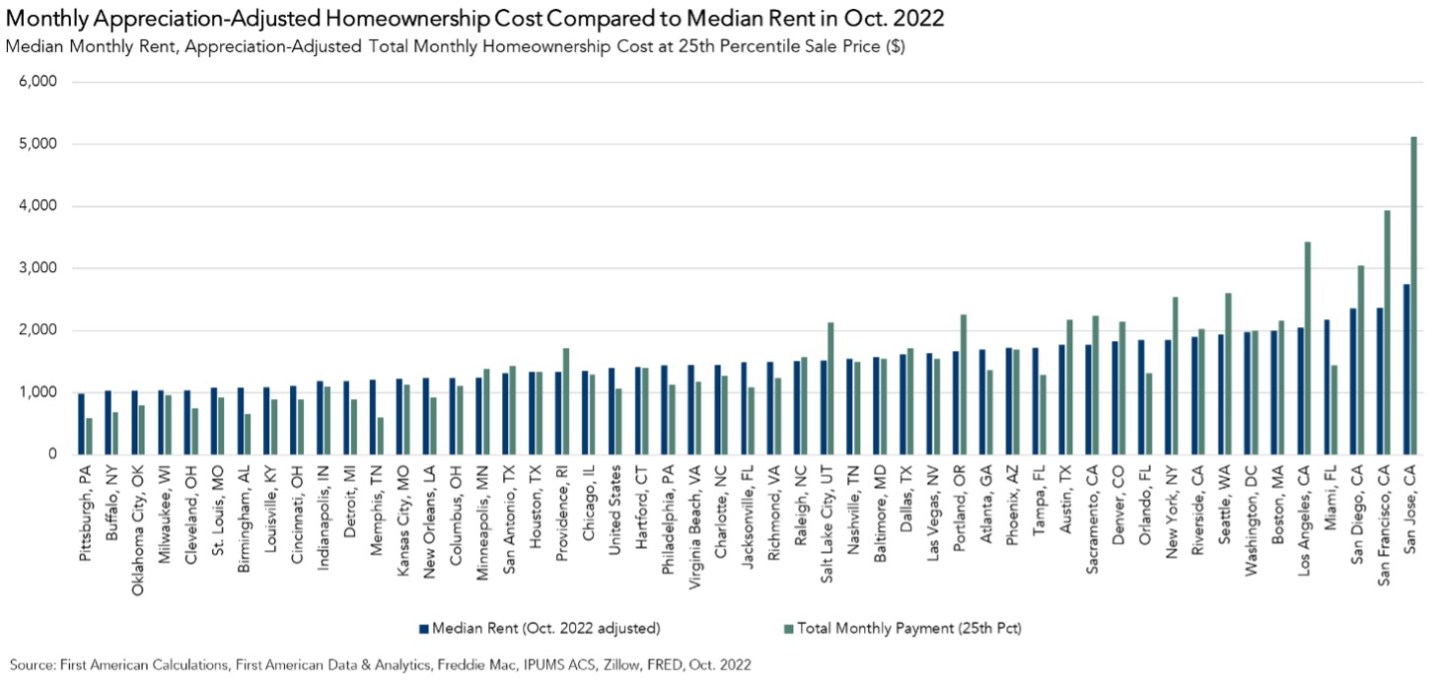

The rebalancing of the housing market makes it difficult to project what the pace of appreciation will be across the top 50 markets. However, the average historical annual rate of house price appreciation between 1988 and 2019 was 3.8%. When accounting for this conservative appreciation benefit in our rent-versus-own analysis, it was cheaper to rent in only 20 of the top markets. The graph below compares, by market, the cost of renting with the cost of owning adjusted for the average annual pace of house price appreciation.

If the first-time homebuyer put a 5% down payment on a $205,000 home (the 25th-percentile home price) with a mortgage rate of 6.9%, the homebuyer would pay roughly $1,283 monthly in principal and interest, plus an estimated $662 in taxes, repairs, private mortgage insurance, and homeowner’s insurance costs. That brings the homebuyer’s total monthly cost of ownership to $1,945.

Accounting for the national historical pace of appreciation, 3.8%, equates to an equity benefit of approximately $651 each month, reducing the total monthly cost to $1,294. Compared with the median monthly cost of rent in Chicago, $1,356, it makes slightly more financial sense to buy rather than rent once adjusted for appreciation.

Will the rent-versus-own dynamic change?

The future of mortgage rates is uncertain, but if they move higher that will mean higher monthly payments for the same loan amount. House price appreciation will vary dramatically by market in the year to come, but further moderation is likely. Nonetheless, this analysis demonstrates that the long-term wealth-building effect of home equity remains a powerful factor in the homeownership decision.

Odeta Kushi is the deputy chief economist at First American. This article is not intended as investment advice.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

More must-read commentary published by Fortune:

- Elon Musk knows what he’s doing. Here’s the real value he sees in Twitter

- California Gov. Newsom: ‘Ideological attacks on ESG investing defy the free market—and taxpayers are losing out. Here’s why we consistently beat Republican-led states in nearly every economic category’

- It’s not the jobs, stupid

- In a post-Trump world, the GOP needs to go back to sound principles on free enterprise, small government, and legal immigration

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today's executives—and how they can best navigate those challenges. Subscribe here.