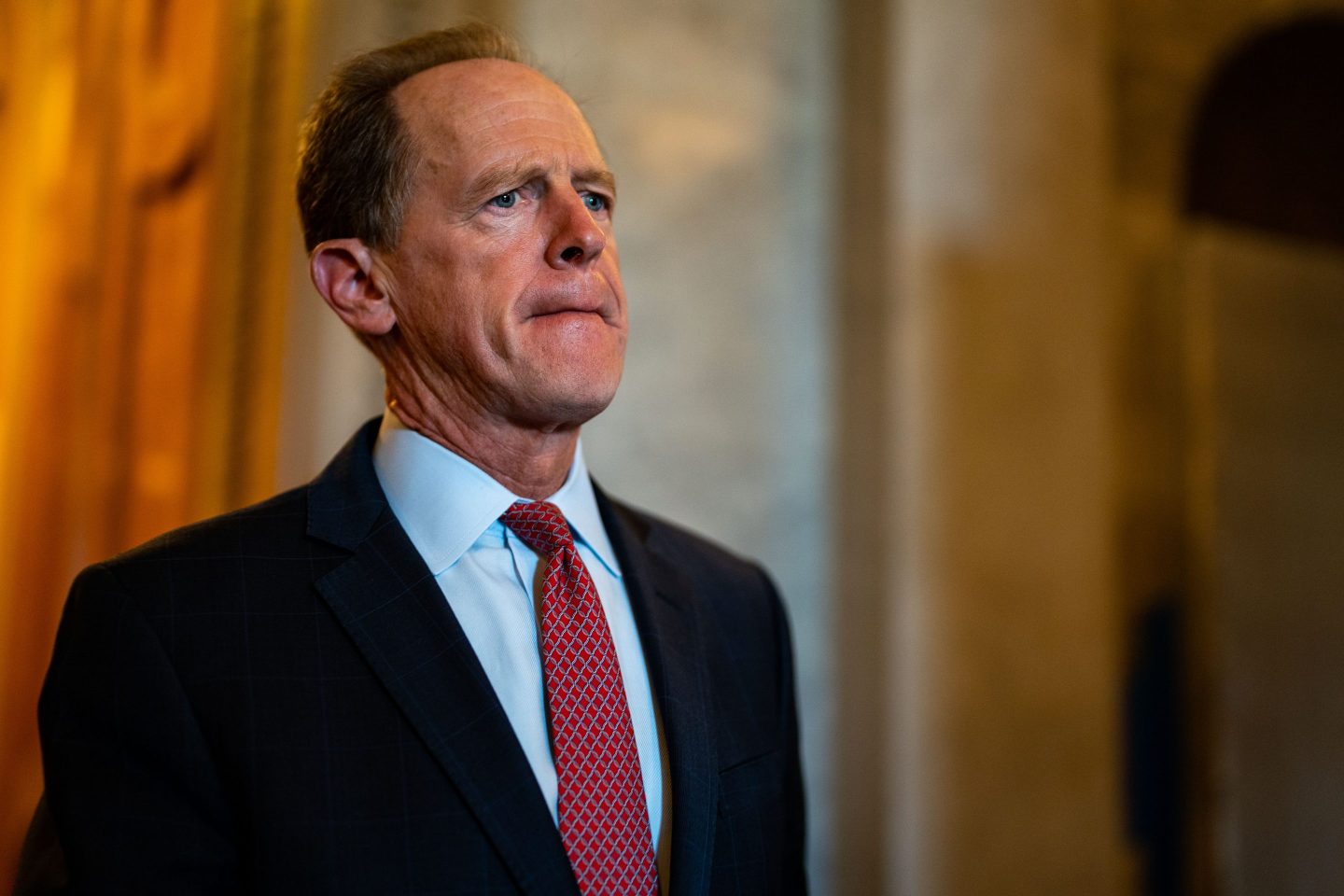

Earlier this fall, Senator Pat Toomey, a ranking member of the U.S. Senate Banking Committee, sent letters to ESG ratings agencies asking for clarity and transparency around the way we score companies. These letters arrived as state treasurers across the U.S. started pulling assets from asset managers with strong ESG commitments, criticizing them for prioritizing ESG concerns over shareholder returns.

Despite the politicization of ESG, Sen. Toomey is right: We do need more transparency in sustainability ratings. Transparency is a force for good: The rapid growth of ESG investing in recent years has in large part been a result of greater availability of non-financial corporate data. We now have access to more information on companies than ever before. And there is a long-established link between positive non-financial corporate performance and better returns.

However, Sen. Toomey is missing a key part of the problem: To achieve greater transparency in ESG, we also need clearer frameworks, more consistent reporting from companies, and collaboration and conversation between corporates and investors. ESG is not going anywhere, but we’re in a pivotal moment of understanding and opportunity.

Today, ESG reporting is largely non-mandatory in the U.S., which means companies decide what to disclose and have different ways and formats of releasing data. Legally, publicly traded U.S. companies are required to publish their financial data, but there is no such requirement for ESG information. That makes ESG reporting haphazard, with ESG raters parsing this data through their own, often opaque, methodologies to produce ratings.

That means the data we’re looking at is largely unorganized and expressed in different “languages” or frameworks with different indicators. If companies aren’t measuring in the same format or even the same measurement markers, how can ratings agencies interpret the data properly? And how can investors make meaningful decisions on where they allocate trillions in people’s savings and pensions?

In his letter, Sen. Toomey asks for “qualitative standards.” However, the word “qualitative” is part of the problem: We need quantitative standards. We need a framework for measuring ESG that avoids subjectivity and provides a space for companies to own and engage with their scores. We need clear guardrails for the U.S. market, so that companies are tracking towards similar goals. And investors need tools to make choices about what non-financial data they integrate in investment decisions, not biased ratings that judge or pre-determine the outcome.

Lastly, we need collaboration between investors and companies alike. Just as people can call credit agencies to dispute their scores, companies and investors should have open conversations about sustainability measures. With the use of data, investors can make informed decisions and move ahead with confidence.

Senator Toomey is starting a vital conversation on his way out of the Senate: less than 15% of global consumers even know what ESG means. From “woke investing” to “greenwashing,” ESG is lumped in with terms that steer away from ESG’s intention.

Capital markets are capable of rapid change. If the market believes in cutting down on risk, it will happen. And the financial benefits of ESG integration is supported by ever-growing evidence. Our own research, published this year, found that stock funds outperformed across global markets over the last five years when weighted towards companies with positive ESG scores.

When businesses and investors can see their data and understand it, they can make better decisions and find returns. It is our mission to remove the opacity around ESG in the market, and let data speak for itself.

Daniel Klier, Ph.D., is the CEO of ESG Book.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

More must-read commentary published by Fortune:

- Elon Musk knows what he’s doing. Here’s the real value he sees in Twitter

- California Gov. Newsom: ‘Ideological attacks on ESG investing defy the free market—and taxpayers are losing out. Here’s why we consistently beat Republican-led states in nearly every economic category’

- It’s not the jobs, stupid

- In a post-Trump world, the GOP needs to go back to sound principles on free enterprise, small government, and legal immigration