Happy Monday! Let’s start the week off on a dark note. It’s pretty easy to do these days—just take a peek at the public markets.

More specifically, let’s take a look at privately-backed companies that have gone public in the last two years. PitchBook recently put together indices that track venture-backed and PE-backed companies whose shares have been listed on the Nasdaq or New York Stock Exchange within the last 24 months, as well as an index of companies that have gone public via SPAC merger in the same time period. It offers a good indication of how you could expect companies nearing an exit on the public markets today to perform—and offers a bit of context to the performance of those that have recently done so.

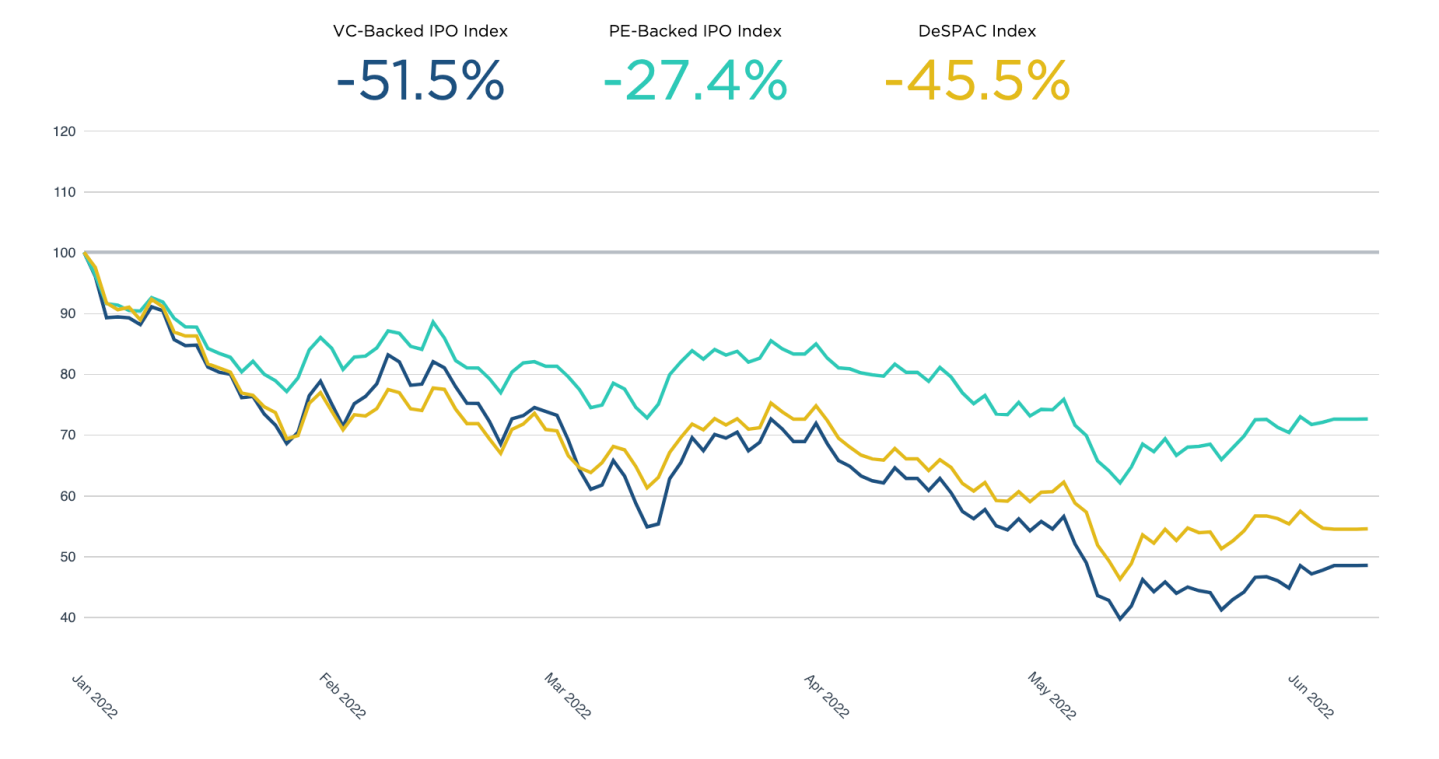

You guessed it: This year is not going well. Venture-backed companies are faring the worst. Year-to-date, shares of venture-backed companies that recently went public are collectively down more than 50% from January (For comparison purposes, the Nasdaq 100 Technology Sector index was down nearly 31% from the beginning of this year at market close on Friday). Here’s a look at the data, per PitchBook:

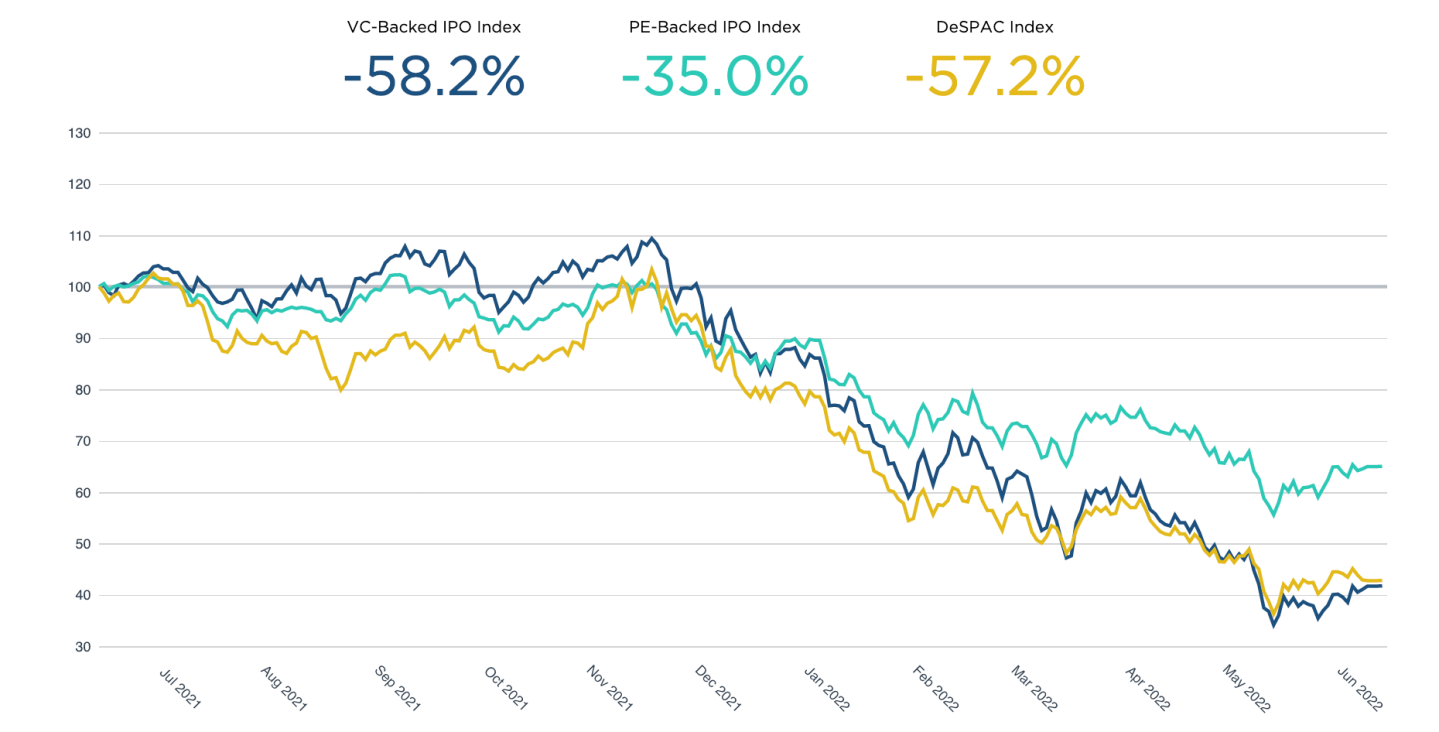

And, just for fun, here’s how bad it gets if you compare the performance of newly-minted public companies to that of the roaring 2021 market. Yelp!

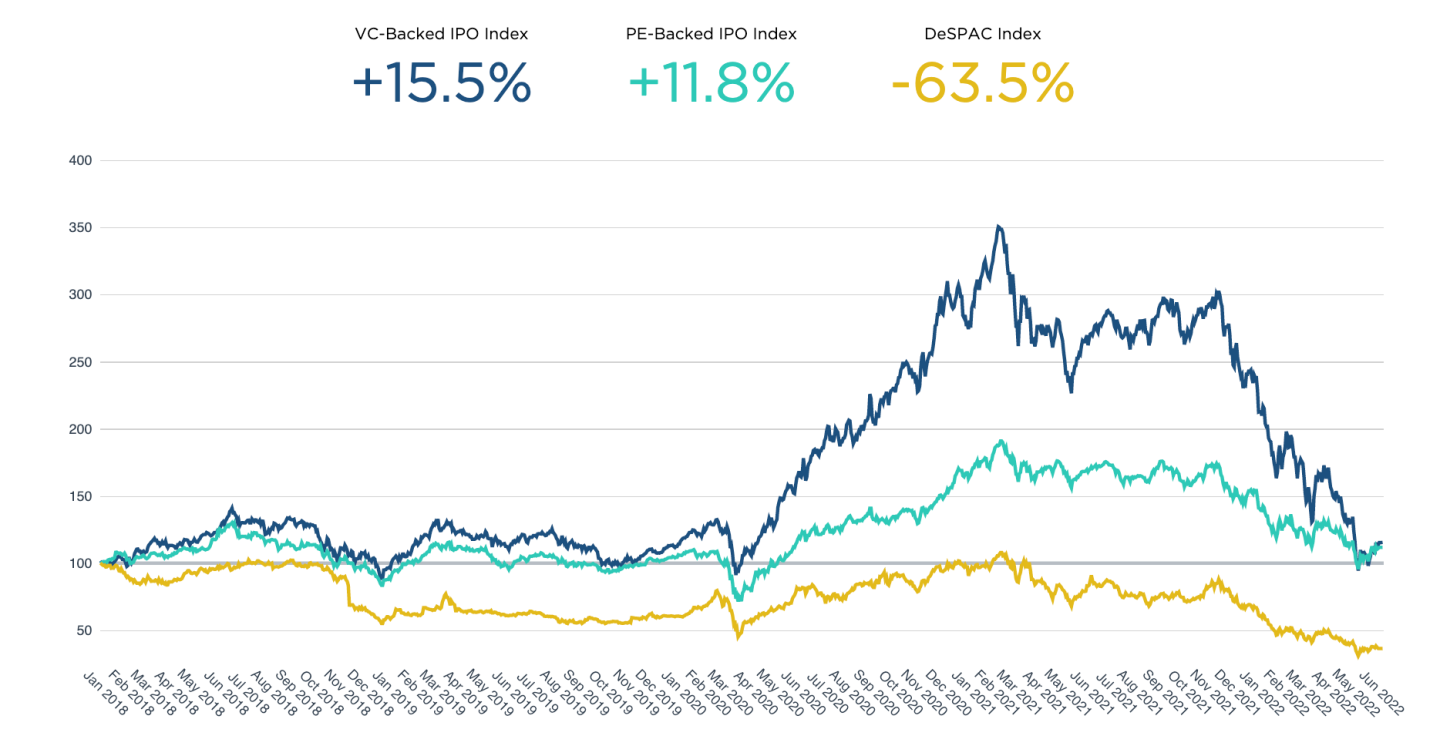

But I do like to leave things on a positive note. If you look back four years to 2018, both VC and PE-backed companies are up marginally, even if it’s not by a whole lot. SPACS—not so much:

You’re hired—psyche! Imagine declining five job opportunities to work at Coinbase—only to have the company renege via email. That’s what happened to Harish Rajanala, who was on vacation when he received an email with the subject line: “Update to your Coinbase offer.” Amid intense turbulence in the crypto markets, the public crypto exchange rescinded “a number of accepted offers” and extended its hiring freeze into the “foreseeable future,” writes my colleague Declan Harty. While it’s unclear just how many offers Coinbase ultimately pulled back it appears at least 300 people were impacted. You can read the full story here.

Jackson has the day off, and both I and the deals section are thrilled to have him back tomorrow. See you then,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

VENTURE DEALS

- Boulder Care, a Portland, Oreg.-based telehealth provider of medical treatment and long-term support for people overcoming substance use disorders, raised $37 million in Series B funding from investors including Qiming Venture Partners, Goodwater Capital, Laerdal Million Lives Fund, First Round Capital, Greycroft, Tusk Venture Partners, and Gaingels.

- Degron Therapeutics, a Shanghai-based biotechnology company developing a new class of small-molecule medicines, raised $22 million in Series A funding. Med-Fine Capital led the round and was joined by investors including Dyee Capital, Baidu Venture, NeuX Capital, CO-WIN Ventures, and Yuanbio Venture Capital.

- Luminai, a Pal Alto, Calif.-based workflow automation company formerly known as Digital Brain, raised $16 million in Series A funding. General Catalyst led the round and was joined by investors including Moxxie Ventures, Craft Ventures, YC Continuity, Underscore VC, and others.

- Atmos Labs, a Chicago-based play-and-earn (P&E) metaverse developer, raised $11 million in seed funding. Sfermion led the round and was joined by investors including Animoca Brands, Collab+Currency, FBG Capital, Alumni Ventures, RedBeard Ventures, DWeb3, LD Capital, and others.

- OKAPI: Orbits, an A.I.-based space traffic management platform, raised €5.5 million ($5.8 million) in seed funding. MunichRe Ventures led the round and was joined by investors including Dolby Family Ventures, Herius Capital, and APEX Ventures.

PRIVATE EQUITY

- Cornerstone OnDemand, backed by Clearlake Capital Group, agreed to acquire SumTotal, a Gainesville, Fa.-based learning and human capital management SaaS provider for customers in highly regulated and complex industries, from Skillsoft for $200 million.

- Blue Owl Capital’s hedge fund and private equity firm financing business, agreed to acquire a minority stake in Lead Edge Capital, a New York-based growth investment firm, per Bloomberg.

- Serent Capital acquired ManageAmerica, a property management software, payments, and utility billing provider for specialized housing. Financial terms were not disclosed.

- Trilon Group, backed by Alpine Investors, acquired CPH, a Sanford, Fla.-based architecture and engineering firm. Financial terms were not disclosed.

EXITS

- Howden Group agreed to acquire TigerRisk Partners, a Stamford, Conn.-based risk, capital, and strategic advisor to the global insurance and reinsurance industries, from Flexpoint Ford. Financial terms were not disclosed.

OTHER

- IXL Learning acquired Curiosity Media, an Arlington, Va.-based language learning services provider. Financial terms were not disclosed.

- Sykes Holiday Cottages acquired UKcaravans4hire, a U.K.-based static caravan rental website. Financial terms were not disclosed.

IPOS

- Bahrain’s sovereign wealth fund is weighing a listing of Aluminium Bahrain, a Kingdom of Bahrain-based aluminum smelter, in Saudi Arabia, per Bloomberg.

- Virgin Australia, the Australian airline of Virgin Group, is weighing going public in Sydney as early as 2023, per Bloomberg. Bain Capital owns the company.

SPAC

- Kacific Broadband Satellites, a Singapore-based high-speed internet access provider, is in talks to go public via a SPAC merger, per Bloomberg.

Correction: This newsletter has been updated to reflect that Dolby Family Ventures invested in OKAPI: Orbits, not Dolby Ventures.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.