Good morning,

“Today was a big day. We were walking down the street towards the New York Stock Exchange. Our company color is blue, and we saw the big blue banner in front of the exchange and everyone just stopped. It was one of those kind of heart-pounding moments,” Ferguson CEO Kevin Murphy told me.

Ferguson PLC, (NYSE: FERG) a $23-billion company, is a distributor of plumbing and heating products. Yesterday, the company shifted its primary listing from the London Stock Exchange to the NYSE. Its stock price opened at $116.23 and closed at $120.75.

“A few years back, we started really focusing the group more towards North America,” Murphy says. “Ferguson Enterprises in the United States was always the biggest part of that group. Over a year ago, we divested our U.K. business, which was the last of our U.K. European assets, and became 100% sales and profits and executive management in the United States and Canada.”

The company has more than 30,000 employees globally. Ferguson brings 34,000 suppliers in 31 different countries together with over a million customers, Murphy says. The company brings product into the United States and Canada through over 1,600 locations, he says. I had a conversation with him about how Ferguson has navigated supply chain issues, its stake in the housing boom, and adjusting to inflation.

Q. The supply chain crunch has been an ongoing issue throughout the pandemic. How much have you invested in your own supply reserves? And did you begin this pre-pandemic?

Murphy: We did engage in this pre-pandemic. We saw this coming very early on. Ten percent of what we do historically is in commodities like copper tubing, PVC pipe, steel pipe, and cast-iron pipe. We saw that inflation really starting to come in during the fall of 2020. It’s also the time that we started to see supply chain issues really start to develop. We’re fortunate that we run a very financially strong company with a very conservative net debt to EBITDA position. So, we took the opportunity to use the balance sheet to really invest in inventory to make sure that we had the best local supply, breadth and depth, for our customer to satisfy their needs and keep their project on schedule. We invested an extra $1 billion-plus dollars in inventory.

(Our top 20 suppliers were delivering full and on-time orders at a rate of 30%.) This was about half the rate of what we normally see. But our supplier relationships, global sourcing operations and strong balance sheet allowed us to have more than 95% in-stock inventory at the local level for our customers where and when they needed it. We outpaced our over-market sales growth during the heart of the supply chain challenges.

Q. So, is it part of the job of a Ferguson associate to suggest to a customer an alternative product that’s more readily available?

Murphy: Yes. An associate would say, ‘We will get you X. But here’s the same style of product that will fit your project needs, and we can guarantee that this will be available.’ That type of relationship is what makes this company. We call it a three-legged stool: our suppliers, our associates, and our customers. And without all three legs of that stool, it all falls down.

How did you maintain your relationship with suppliers at the height of the pandemic?

Murphy: We have over 250 sourcing professionals out in sourcing offices around the globe. They’re doing site visits on the factory floor. And so that was a real benefit for us. Now, does that mean that we can travel from the United States to those offices? That has been a challenge because we like to spend time collaborating in groups. But it was especially challenging when you’re talking about the U.S. and China, the U.S. and Vietnam, or the U.S. and Taiwan.

Q. There’s a housing boom in the U.S. What percentage of your business would you say is tied to the U.S. residential housing market?

Murphy: About 56% of our business is residential. About 44% of our business is nonresidential. If you break that down, about 60% of our business is repair, remodel, replace, and 40% new construction. So, then if I get right down to your question, (of that 56%) about 20% of our business, overall, is residential new construction and 36% is residential repair, replace, and remodel.

Q. Has inflation put pressure on the business?

Murphy: It’s got its own challenges. Our people have worked incredibly hard with our customers, and our customer’s clients (the ultimate owner, builder, or developer) to pass along these price increases. We saw inflation as we exited our second quarter. Our inflation rate was in the high teens. But we’re able to pass along that price increase and be paid for the value that we’re providing in the marketplace, which is reflected by our gross margin. And we did not see a demonstrable demand erosion because of those price increases. We kept our eyes wide open on that. And we certainly were mindful of it. We hadn’t seen any real fall-off in demand either residential or from a nonresidential perspective and industrial or commercial.

Have a great weekend. See you on Monday.

Sheryl Estrada

sheryl.estrada@fortune.com

Upcoming events:

Join me for a LinkedIn Live event on May 16 at 12:30 p.m. ET where I will talk with Michele Tam, expert and associate partner at McKinsey & Company, about building the most effective team to support a CFO. You can register here.

The Emerging CFO: Sounding the Alarm: CFOs Tackle Inflation and Interest Rates, a virtual event, will take place on Tuesday, May 17 at 11 a.m. ET. Confirmed speakers include Nicole Carrillo, CAO at LoanDepot, Pascal Desroches, CFO at AT&T, and John Diez, CFO at Ryder. You can register here.

Big deal

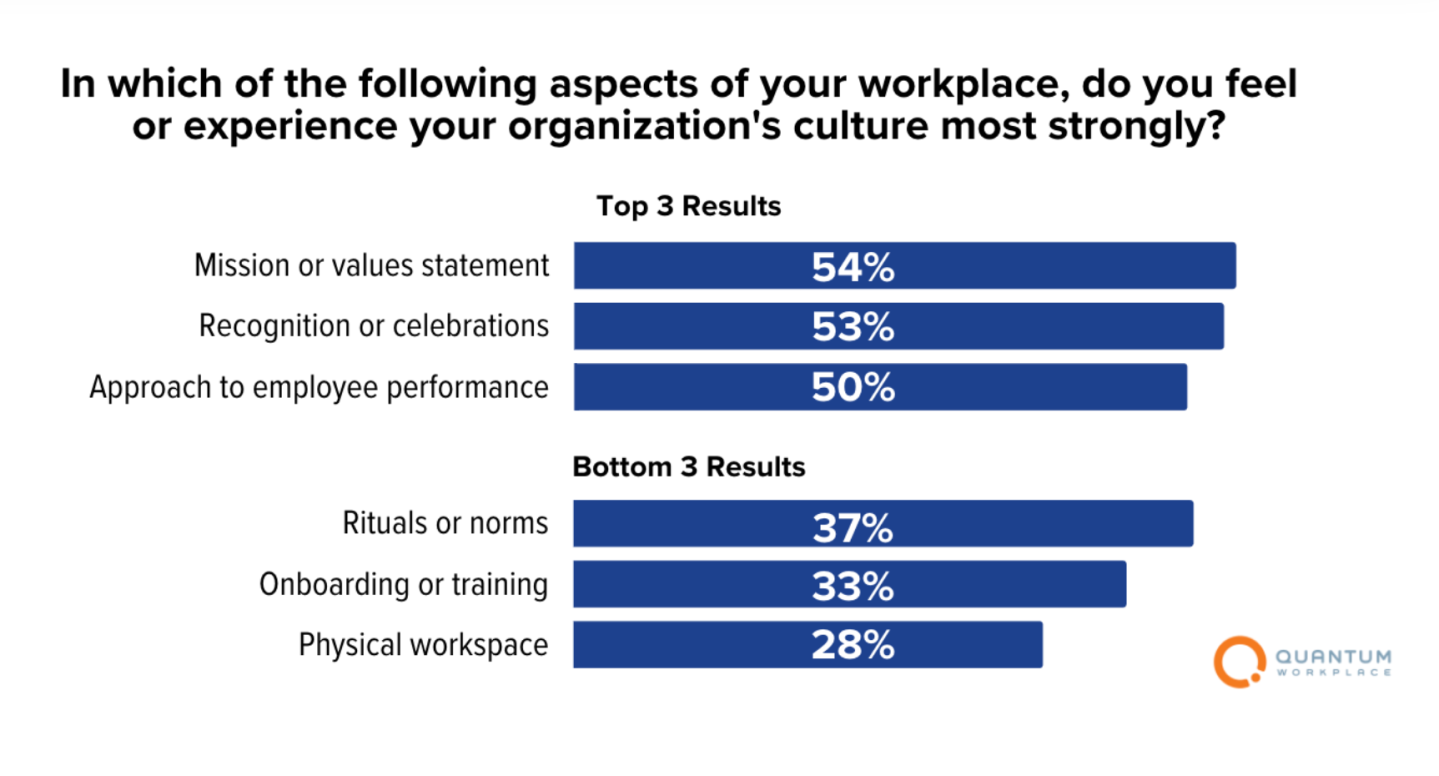

A research report by Quantum Workplace, Unpacking Organizational Culture in a New World of Work, provides a new perspective on the role of company culture. Respondents said they most experience company culture through mission statements(54%) and recognition (53%), according to the report.

Going deeper

In case you missed it, here’s what was featured in CFO Daily this week:

Moderna’s new CFO departs after the company discovers he’s under investigation

Chief’s first CFO is finally in the room where it happens

Companies adding a crypto 401(k) option can expect employees to cheer—and sue

Leaderboard

Some notable moves this week:

Eduardo Bezerra was named EVP and CFO at Perrigo Company plc (NYSE: PRGO), a provider of consumer self-care products, effective May 16. Bezerra will succeed Ray Silcock, who previously announced his intent to retire. Bezerra joins Perrigo from Fresh Del Monte Produce, Inc. (NYSE: FDP), where he served as SVP and CFO. He previously served in multiple finance, as well commercial and strategy positions at Monsanto Company for over 20 years.

Scott Calver was named CFO at Cargojet (TSX: CJT.UN). Calver most recently served as the CFO of Trimac Transportation. He comes to Cargojet with financial executive experience including capital markets and operational management in the transportation and logistics sector. Trimac, Calver also previously served as VP of finance for ICS Courier.

Elizabeth Castro Gulacsy will retire from her position as CFO of SeaWorld Entertainment, Inc. (NYSE: SEAS), a theme park and entertainment company, effective on Dec. 31 or upon the appointment of her successor, if earlier. Gulacsy had a nine-year tenure with the company. A recruiting firm will conduct a search to fill her position.

Drew Plisco was named CFO at ATP, an information services and software solutions provider for the aviation industry. Plisco brings 15 years of finance experience. Before joining ATP, he served as CFO of Holon Solutions and Infutor Data Solutions, as well as held other senior leadership positions at Sage Group plc, First Advantage, and SAP.

Kurt Van den Bosch was named CFO of Group Finance at Johnson & Johnson MedTech. Van den Bosch will be a member of the Global Finance Leadership Team, reporting directly to Joe Wolk, EVP and CFO for Johnson & Johnson. Most recently, Van den Bosch served as the Area VP of Mid-Sized Markets J&J MedTech EMEA. He joined Janssen Pharmaceuticals, Belgium, in 1990 as part of the finance team. Prior to joining J&J MedTech, he served as CFO for Janssen EMEA.

Vic Russo was named CFO at Reachdesk, a global data-driven gifting platform. Russo will oversee all financial aspects of the company and drive business development. Most Recently, Russo served as CFO of Electric AI and Savills Studley. Prior to that, he held multiple vice president positions at FieldAware, Buddy Media, and 247 Real Media.

Overheard

"Twitter deal temporarily on hold."

—Elon Musk tweeted on Friday that his $44 billion Twitter takeover has been temporarily put on hold as the company investigates how many of its users are fake accounts, as reported by Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.