It’s been pretty easy to make money on stocks over the past decade. One can’t-miss strategy: You just buy the big names in tech. Repeat over and over again.

From February 2009 to last November, investors marveled as the value of the tech-heavy Nasdaq doubled, and doubled, and doubled again—and kept going—to soar from 1400 to 16,200. That to-the-moon trajectory made some sense—it coincided with a period of rock-bottom interest rates and easy-money Federal Reserve policy. The bulls saw this as a golden era of lower-for-longer interest rates, which gave rise to, among other things, the TINA (there is no alternative) stock-picking strategy, and the rise of YOLO (remember that?) retail traders.

All that must seem like a distant memory. The Nasdaq fell 5% yesterday, the worst performer of the major exchanges, and its worst one-day performance since last June. It’s now down 22.2% this year, firmly in a bear market.

Thursday’s wipeout—in total, global stocks took a $1.3 trillion hit yesterday, Bloomberg calculates—was felt across the board, with big-cap tech getting hit particularly hard. According to Deutsche Bank, the FANG+ Index tumbled 6.4% on Thursday. This morning, ahead of a big jobs report, Nasdaq futures were down a quarter of a percent at 4 a.m. ET.

In better days, FAANG of course was a handy acronym for the high-fliers of tech: Facebook (now Meta Platforms), Apple, Amazon, Netflix, and Google’s Alphabet. Add Microsoft, and you had the sextet of tech darlings that lifted retirement portfolios the world over.

Well, some big names on Wall Street think it’s time to dump that acronym—or at least rethink it—to find some value amid all the carnage.

In an investor note, Merrill Lynch and Bank of America Private Bank investment strategists Lauren J. Sanfilippo and Joseph P. Quinlan see us in a different investing epoch of war and high inflation and energy transformation—one that needs a new FAANG.

“In a matter of months,“ they wrote, “we have gone from a pandemic to Putin; infections to inflation; Big Data to Big Oil; zoom to zinc; masks to mascara; E-commerce to electric vehicles; jabs to javelins; swabs to sanctions; Webex to weddings; boosters to bombs; Non-fungible tokens (NFTs) to liquefied natural gas (LNG); Centers for Disease Control (CDC) to North Atlantic Treaty Organization (NATO); work-from-home to work-from-office; the cloud to cobalt; and lite assets to hard assets.”

They see a new murderers’ row of roll-off-your-tongue heavyweights. Out are Facebook, Apple, blah, blah, blah—known as FAANG 1.0. In are the new growth areas of Fuels, Aerospace & defense, Agriculture, Nuclear and renewables, and Gold and metals/minerals. Call it FAANG 2.0.

“This cohort is emblematic of a world undergoing profound change. A sampling of this change: energy security is now the top priority of most governments—just ask Poland and Bulgaria, cut off from Russian gas last week. Global defense spending topped $2 trillion for the first time in 2021 and is headed higher. World food prices are at record highs. Nuclear is poised for a comeback; Electric Vehicle demand continues to soar. Gold is now the preferred asset of central banks thanks to geopolitics, while resource/food nationalism is proliferating around the world, adding even more upside pressure to metal/mineral and food prices,” they explained.

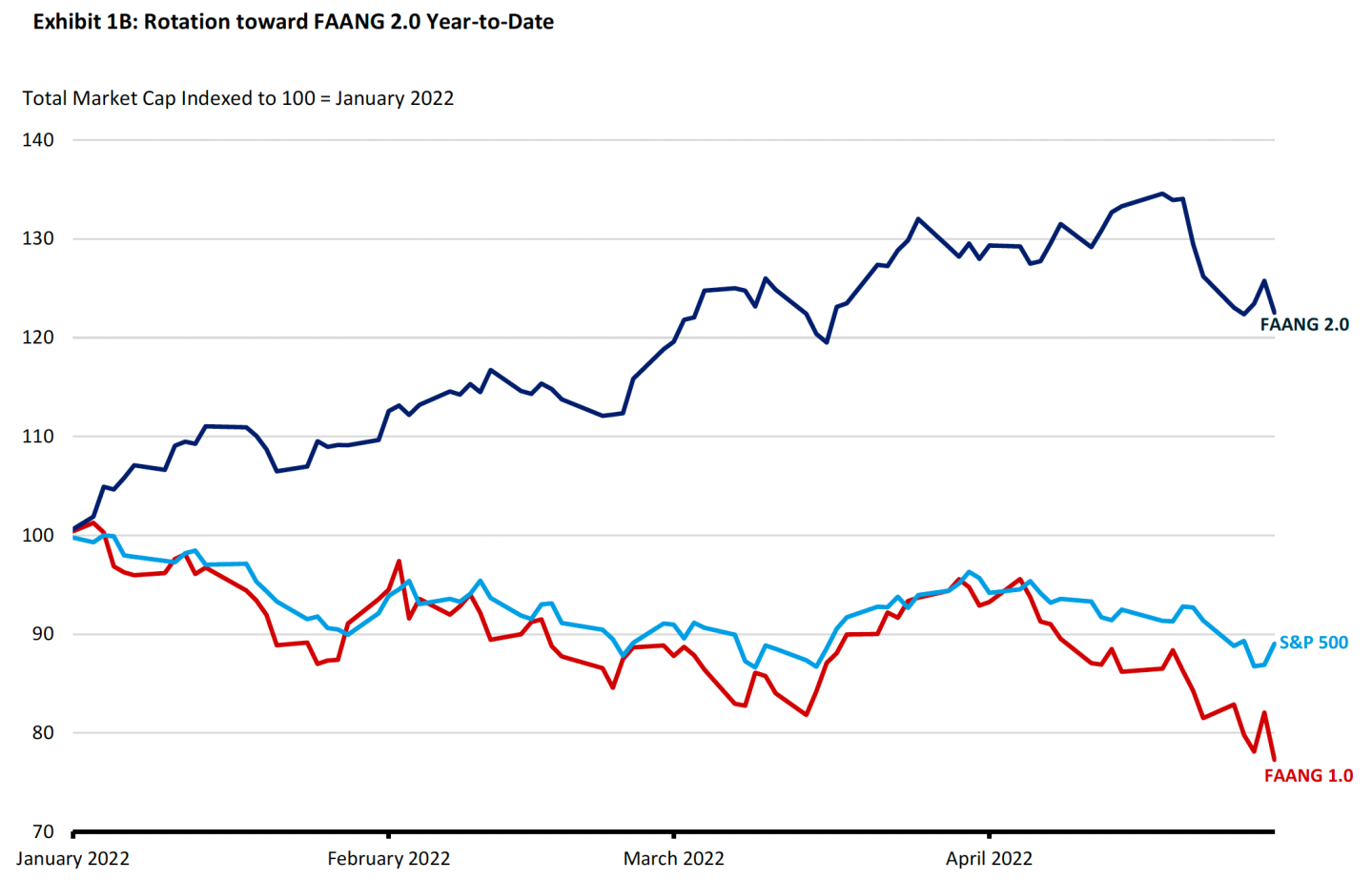

Sanfilippo and Quinlan first floated this FAANG 2.0 in February, and the diverging performance of the the two groups has only grown since then.

In the investor note, the duo don’t tip individual stocks, but you don’t have to dig to deep to find them. For example, food giant Archer-Daniels-Midland is up nearly 32% year to date, defense contractor Lockheed Martin is up 25% in the same period, and miner Rio Tinto (gold and uranium) is up 3% YTD.

Check out this Fortune must-read: “April was a brutal month for stocks. Here are 3 charts that lay out the carnage, and 1 that should give investors hope”